E-commerce software platform provider BigCommerce (NASDAQ: BIGC) announced better-than-expected revenue in Q2 CY2025, with sales up 3.2% year on year to $84.43 million. The company expects next quarter’s revenue to be around $86 million, close to analysts’ estimates. Its non-GAAP profit of $0.04 per share was in line with analysts’ consensus estimates.

Is now the time to buy BigCommerce? Find out by accessing our full research report, it’s free.

BigCommerce (BIGC) Q2 CY2025 Highlights:

- Revenue: $84.43 million vs analyst estimates of $83.32 million (3.2% year-on-year growth, 1.3% beat)

- Adjusted EPS: $0.04 vs analyst estimates of $0.04 (in line)

- Adjusted Operating Income: $4.78 million vs analyst estimates of $3.23 million (5.7% margin, 47.9% beat)

- The company reconfirmed its revenue guidance for the full year of $343.1 million at the midpoint

- Operating Margin: -8%, up from -16.5% in the same quarter last year

- Free Cash Flow was $11.91 million, up from -$2.87 million in the previous quarter

- Annual Recurring Revenue: $354.6 million at quarter end, up 2.5% year on year

- Market Capitalization: $382.9 million

“The second quarter was a defining period for our company, and today we mark an important milestone as we reintroduce ourselves as Commerce,” said Travis Hess, CEO of Commerce.

Company Overview

Founded in Sydney, Australia in 2009 by Mitchell Harper and Eddie Machaalani, BigCommerce (NASDAQ: BIGC) provides software for businesses to easily create online stores.

Revenue Growth

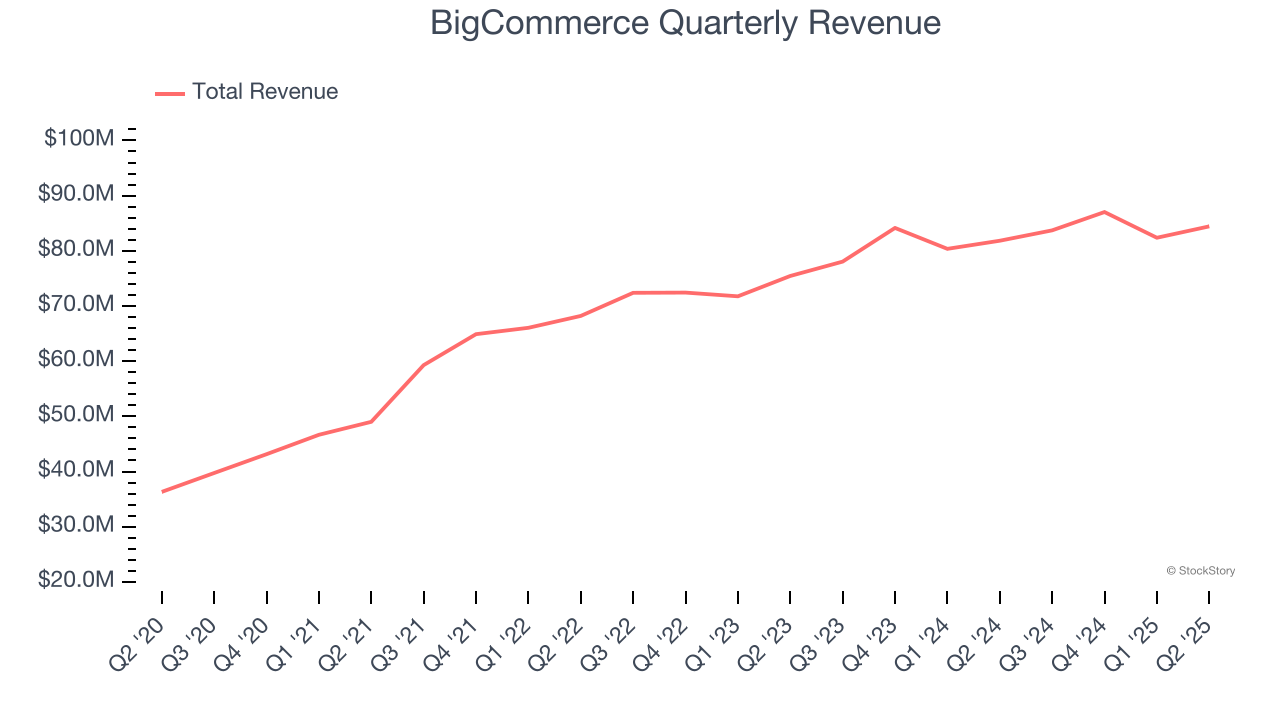

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, BigCommerce’s 9.3% annualized revenue growth over the last three years was sluggish. This fell short of our benchmark for the software sector and is a poor baseline for our analysis.

This quarter, BigCommerce reported modest year-on-year revenue growth of 3.2% but beat Wall Street’s estimates by 1.3%. Company management is currently guiding for a 2.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.1% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and suggests its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Annual Recurring Revenue

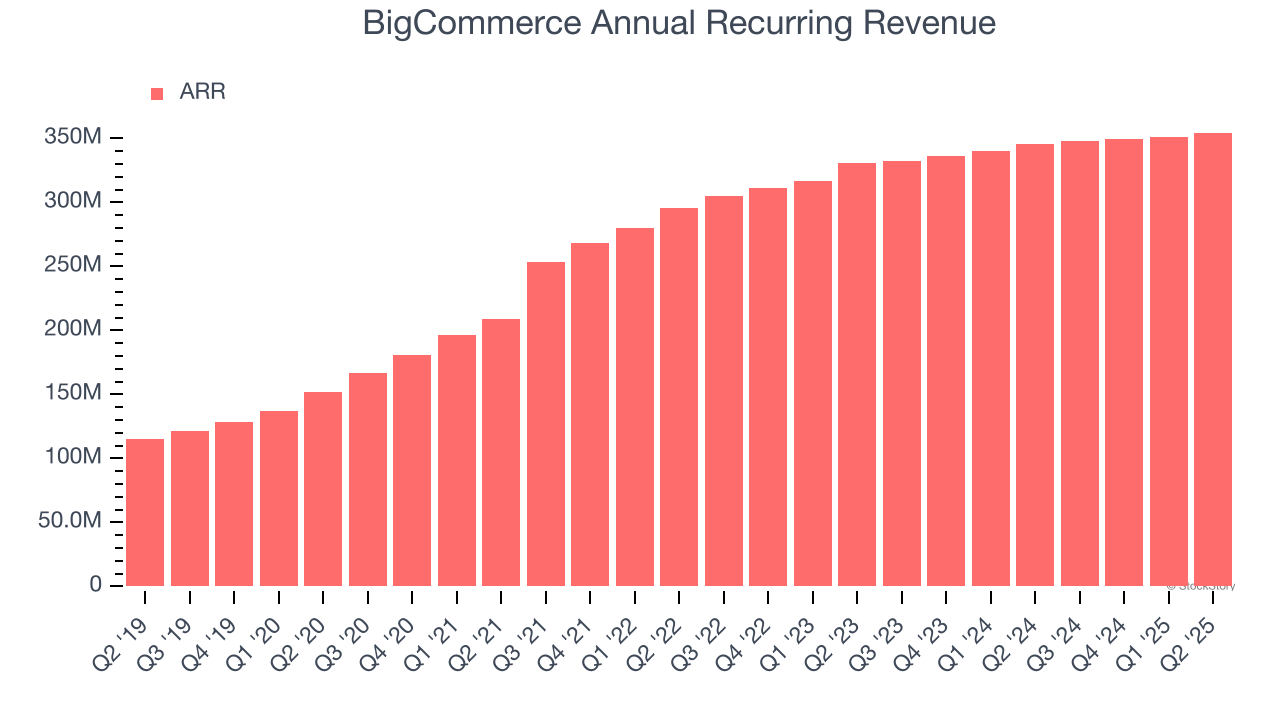

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

BigCommerce’s ARR came in at $354.6 million in Q2, and over the last four quarters, its growth was underwhelming as it averaged 3.6% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in securing longer-term commitments.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

BigCommerce is quite efficient at acquiring new customers, and its CAC payback period checked in at 35.6 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

Key Takeaways from BigCommerce’s Q2 Results

We were impressed by how significantly BigCommerce blew past analysts’ revenue and adjusted operating income expectations this quarter. Overall, this print had some key positives. The stock traded up 5.9% to $5.05 immediately after reporting.

Is BigCommerce an attractive investment opportunity at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.