Biotech company Biogen (NASDAQ: BIIB) beat Wall Street’s revenue expectations in Q2 CY2025, with sales up 7.3% year on year to $2.65 billion. Its non-GAAP profit of $5.47 per share was 41.3% above analysts’ consensus estimates.

Is now the time to buy Biogen? Find out by accessing our full research report, it’s free.

Biogen (BIIB) Q2 CY2025 Highlights:

- Revenue: $2.65 billion vs analyst estimates of $2.33 billion (7.3% year-on-year growth, 13.8% beat)

- Adjusted EPS: $5.47 vs analyst estimates of $3.87 (41.3% beat)

- Management raised its full-year Adjusted EPS guidance to $15.75 at the midpoint, a 5% increase

- Operating Margin: 28.1%, down from 31.8% in the same quarter last year

- Free Cash Flow Margin: 9.9%, down from 24% in the same quarter last year

- Market Capitalization: $18.56 billion

Company Overview

Founded in 1978 and pioneering treatments for some of medicine's most complex challenges, Biogen (NASDAQ: BIIB) develops and markets therapies for neurological conditions, including multiple sclerosis, Alzheimer's disease, spinal muscular atrophy, and rare diseases.

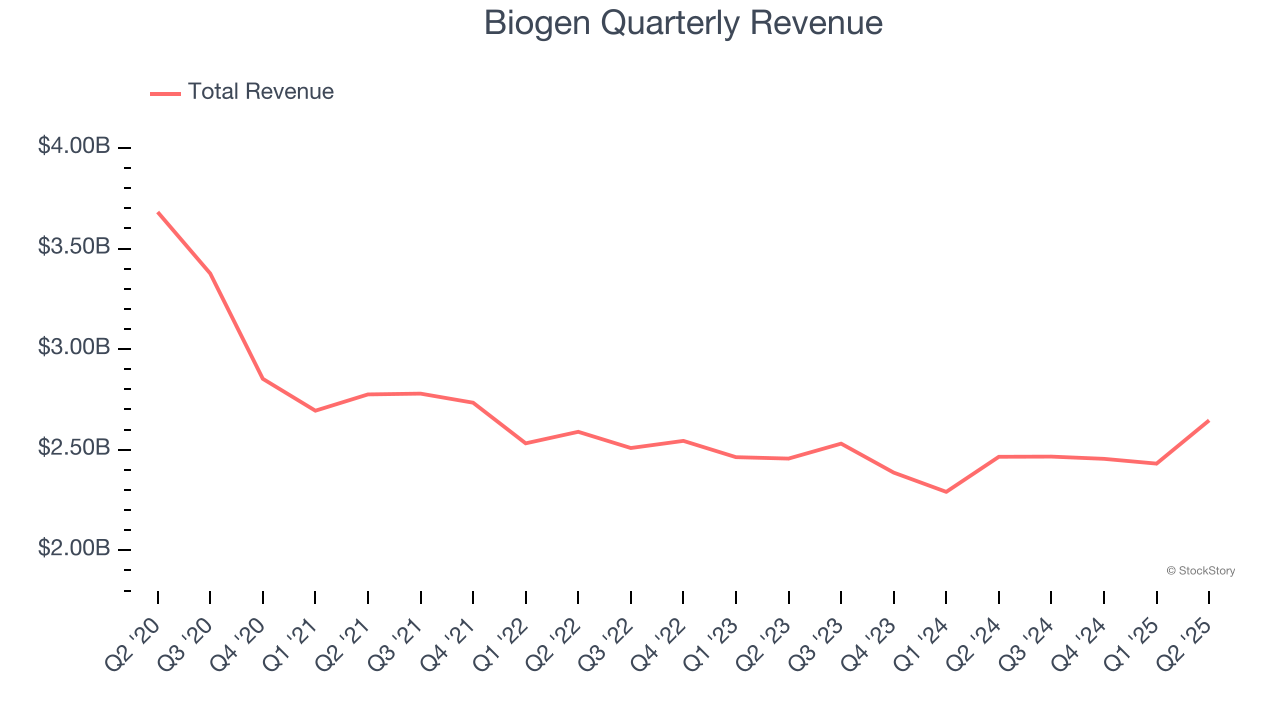

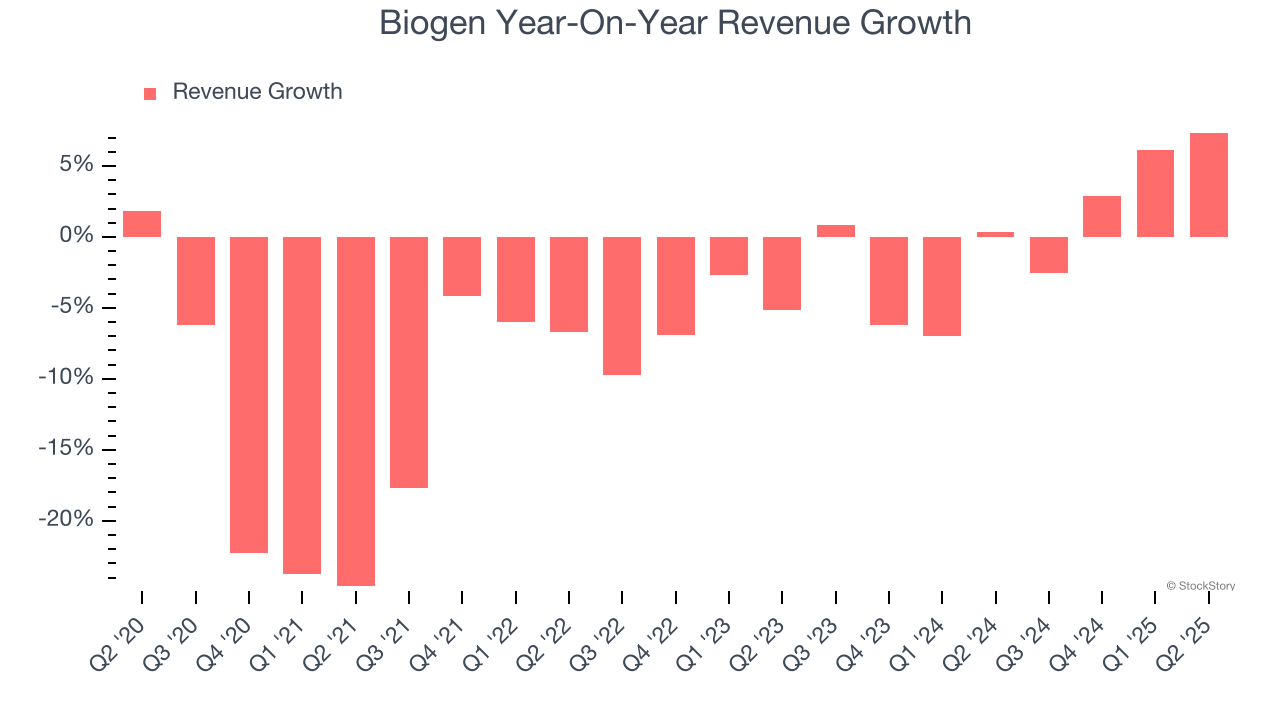

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Biogen’s demand was weak over the last five years as its sales fell at a 7.2% annual rate. This was below our standards and is a sign of poor business quality.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Biogen’s revenue over the last two years was flat, sugggesting its demand was weak but stabilized after its initial drop.

This quarter, Biogen reported year-on-year revenue growth of 7.3%, and its $2.65 billion of revenue exceeded Wall Street’s estimates by 13.8%.

Looking ahead, sell-side analysts expect revenue to decline by 9.3% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

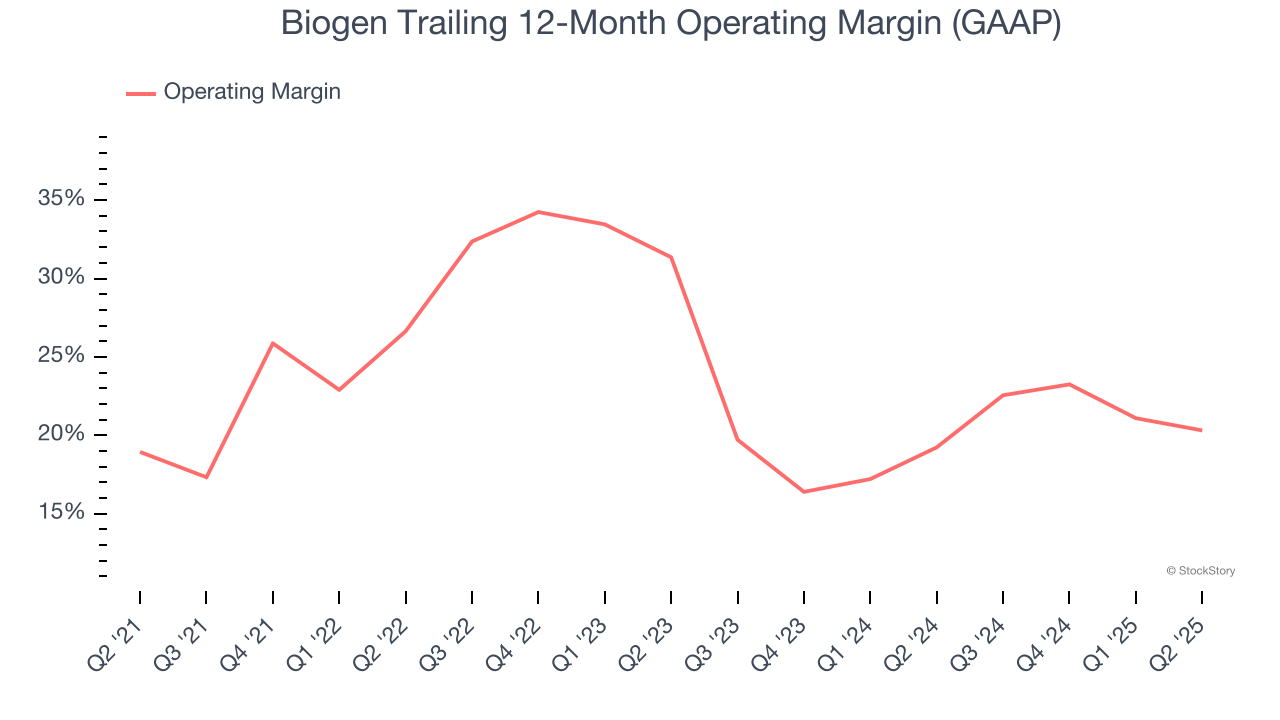

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Biogen has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 23.2%.

Looking at the trend in its profitability, Biogen’s operating margin rose by 1.4 percentage points over the last five years. Zooming into its more recent performance, however, we can see the company’s margin has decreased by 11 percentage points on a two-year basis. If Biogen wants to pass our bar, it must prove it can expand its profitability consistently.

This quarter, Biogen generated an operating margin profit margin of 28.1%, down 3.7 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

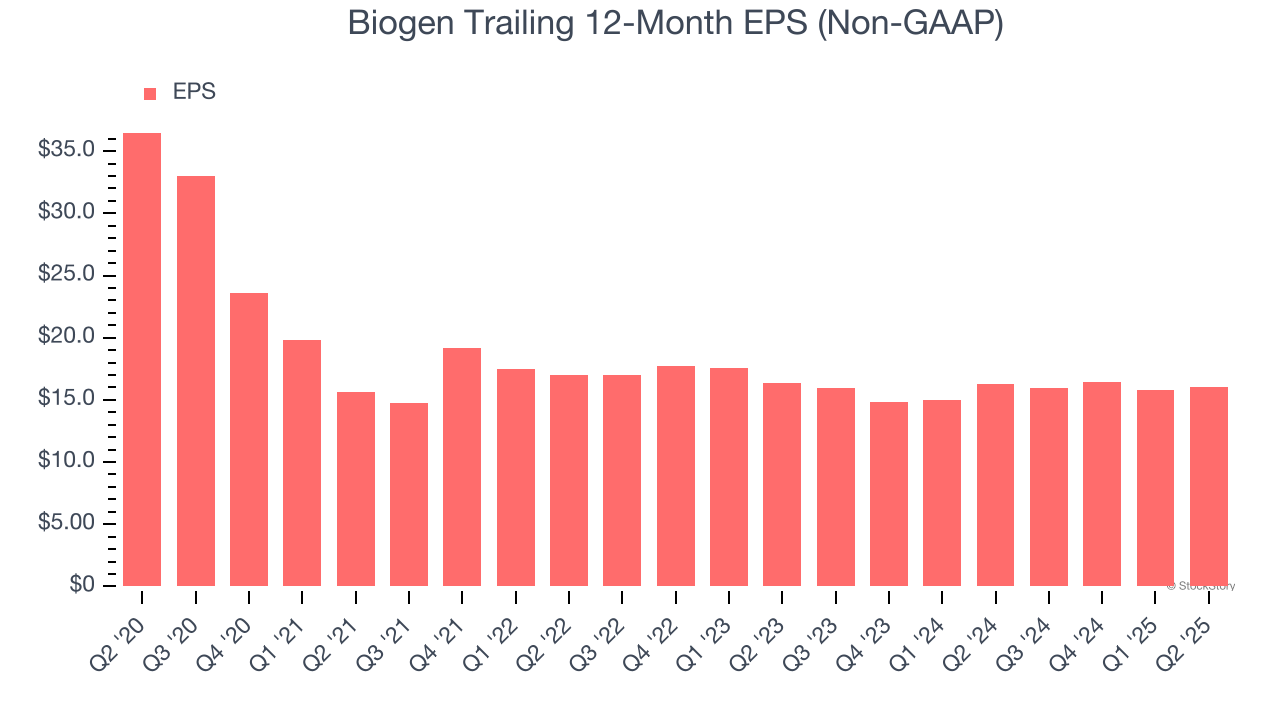

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Biogen, its EPS declined by 15.2% annually over the last five years, more than its revenue. We can see the difference stemmed from higher interest expenses or taxes as the company actually improved its operating margin and repurchased its shares during this time.

In Q2, Biogen reported adjusted EPS at $5.47, up from $5.29 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Biogen’s full-year EPS of $16.00 to shrink by 4.7%.

Key Takeaways from Biogen’s Q2 Results

We were impressed by how significantly Biogen blew past analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 4.4% to $132.50 immediately after reporting.

Biogen put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.