Packaged foods company Kellanova (NYSE: K) met Wall Street’s revenue expectations in Q2 CY2025, but sales were flat year on year at $3.20 billion. Its non-GAAP profit of $0.94 per share was 5.4% below analysts’ consensus estimates.

Is now the time to buy Kellanova? Find out by accessing our full research report, it’s free.

Kellanova (K) Q2 CY2025 Highlights:

- Revenue: $3.20 billion vs analyst estimates of $3.19 billion (flat year on year, in line)

- Adjusted EPS: $0.94 vs analyst expectations of $0.99 (5.4% miss)

- Adjusted EBITDA: $507 million vs analyst estimates of $590.9 million (15.8% margin, 14.2% miss)

- Operating Margin: 13.7%, down from 15.4% in the same quarter last year

- Free Cash Flow Margin: 0.7%, down from 7.3% in the same quarter last year

- Organic Revenue was flat year on year (4% in the same quarter last year)

- Sales Volumes rose 3.2% year on year (-4% in the same quarter last year)

- Market Capitalization: $27.69 billion

Company Overview

With Corn Flakes as its first and most iconic product, Kellanova (NYSE: K) is a packaged foods company that is dominant in the cereal and snack categories.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $12.64 billion in revenue over the past 12 months, Kellanova is one of the larger consumer staples companies and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because it’s harder to find incremental growth when your existing brands have penetrated most of the market. To accelerate sales, Kellanova likely needs to optimize its pricing or lean into new products and international expansion.

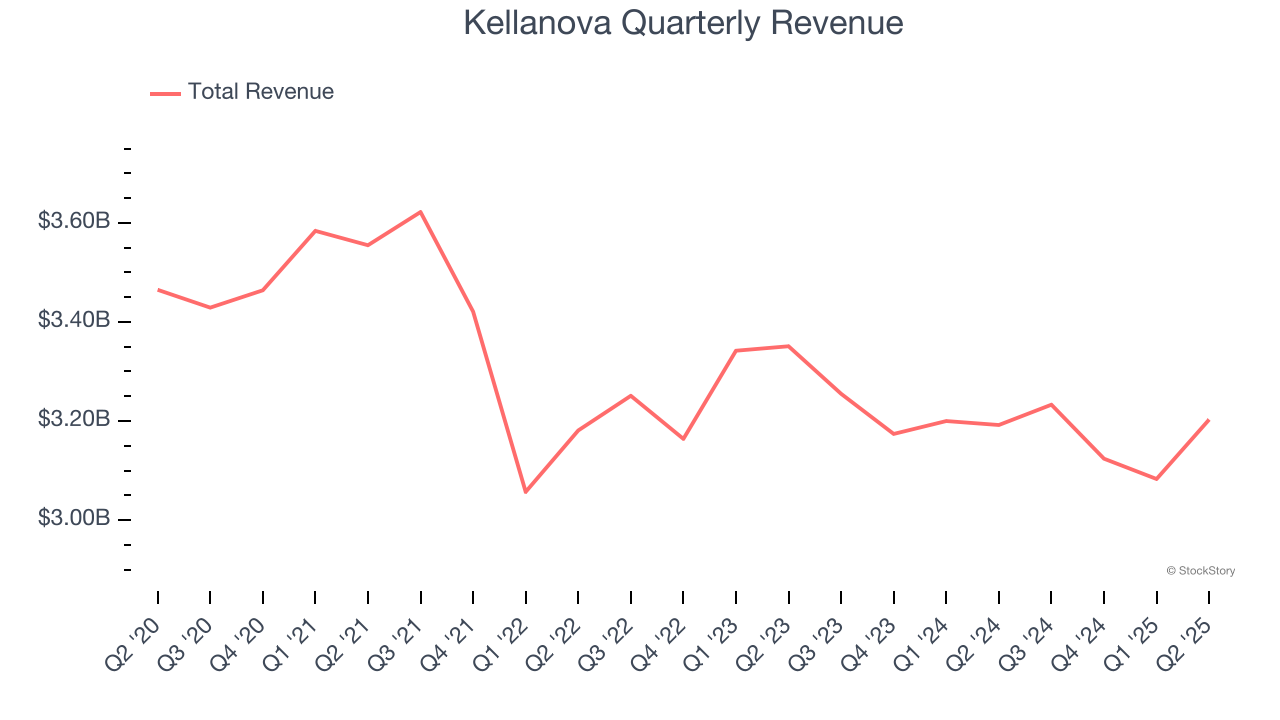

As you can see below, Kellanova’s demand was weak over the last three years. Its sales fell by 1.6% annually as consumers bought less of its products.

This quarter, Kellanova’s $3.20 billion of revenue was flat year on year and in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.3% over the next 12 months. Although this projection suggests its newer products will catalyze better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

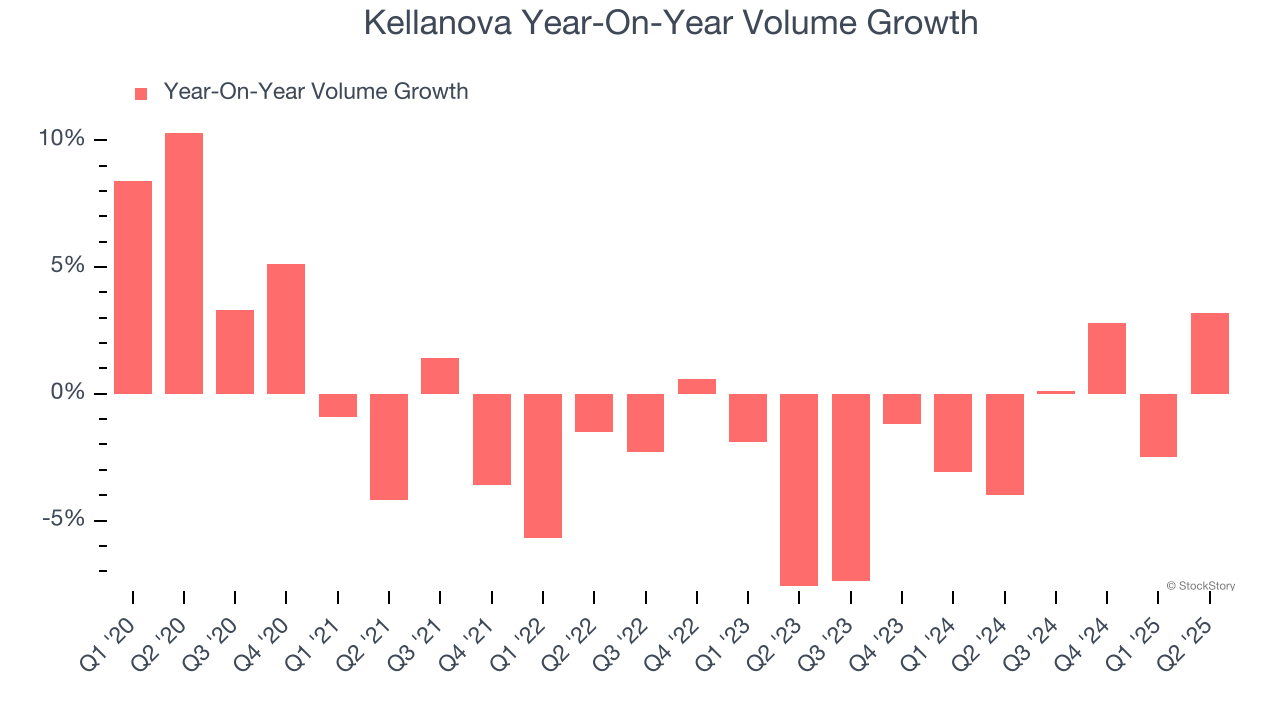

To analyze whether Kellanova generated its growth from changes in price or volume, we can compare its volume growth to its organic revenue growth, which excludes non-fundamental impacts on company financials like mergers and currency fluctuations.

Over the last two years, Kellanova’s average quarterly sales volumes have shrunk by 1.5%. This decrease isn’t ideal as the quantity demanded for consumer staples products is typically stable. Luckily, Kellanova was able to offset fewer customers purchasing its products by charging higher prices, enabling it to generate 4.3% average organic revenue growth. We hope the company can grow its volumes soon, however, as consistent price increases (on top of inflation) aren’t sustainable over the long term unless the business is really really special.

In Kellanova’s Q2 2025, sales volumes jumped 3.2% year on year. This result was a well-appreciated turnaround from its historical levels, showing the company is heading in the right direction.

Key Takeaways from Kellanova’s Q2 Results

We struggled to find many positives in these results as its gross margin, EBITDA, and EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $79.94 immediately after reporting.

So should you invest in Kellanova right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.