Wellness products company Nature’s Sunshine (NASDAQ: NATR) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 3.8% year on year to $114.8 million. The company’s full-year revenue guidance of $467.5 million at the midpoint came in 2% above analysts’ estimates. Its non-GAAP profit of $0.35 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Nature's Sunshine? Find out by accessing our full research report, it’s free.

Nature's Sunshine (NATR) Q2 CY2025 Highlights:

- Revenue: $114.8 million vs analyst estimates of $112.3 million (3.8% year-on-year growth, 2.2% beat)

- Adjusted EPS: $0.35 vs analyst estimates of $0.16 (significant beat)

- Adjusted EBITDA: $11.27 million vs analyst estimates of $9.84 million (9.8% margin, 14.5% beat)

- The company lifted its revenue guidance for the full year to $467.5 million at the midpoint from $457.5 million, a 2.2% increase

- EBITDA guidance for the full year is $43 million at the midpoint, above analyst estimates of $42.36 million

- Operating Margin: 3.7%, down from 5.1% in the same quarter last year

- Free Cash Flow was $2.99 million, up from -$2.05 million in the same quarter last year

- Market Capitalization: $266.1 million

“We delivered another strong quarter, with net sales of $115 million and adjusted EBITDA of $11 million, up 4% and 8%, respectively, year-over-year,” said Terrence Moorehead, CEO of Nature’s Sunshine.

Company Overview

Started on a kitchen table in Utah, Nature’s Sunshine (NASDAQ: NATR) manufactures and sells nutritional and personal care products.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $460.8 million in revenue over the past 12 months, Nature's Sunshine is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

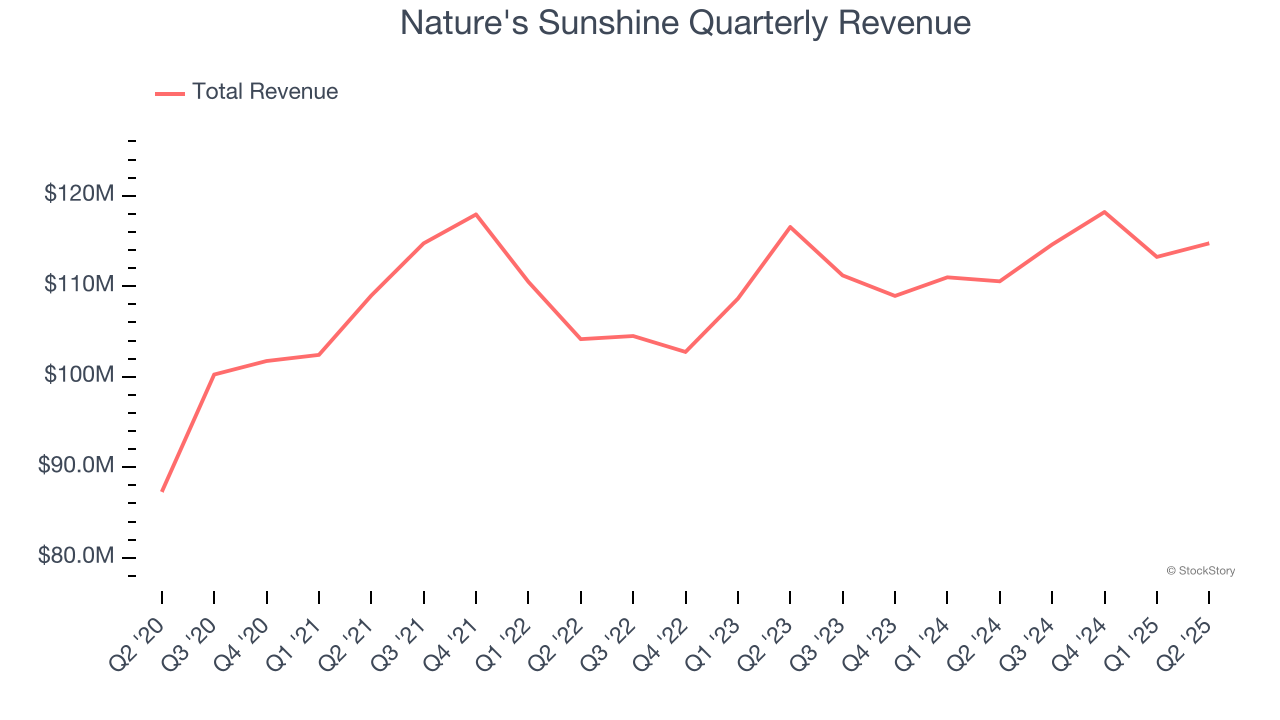

As you can see below, Nature's Sunshine struggled to increase demand as its $460.8 million of sales for the trailing 12 months was close to its revenue three years ago. This shows demand was soft, a tough starting point for our analysis.

This quarter, Nature's Sunshine reported modest year-on-year revenue growth of 3.8% but beat Wall Street’s estimates by 2.2%.

Looking ahead, sell-side analysts expect revenue to grow 1.1% over the next 12 months, similar to its three-year rate. This projection is underwhelming and suggests its newer products will not catalyze better top-line performance yet.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

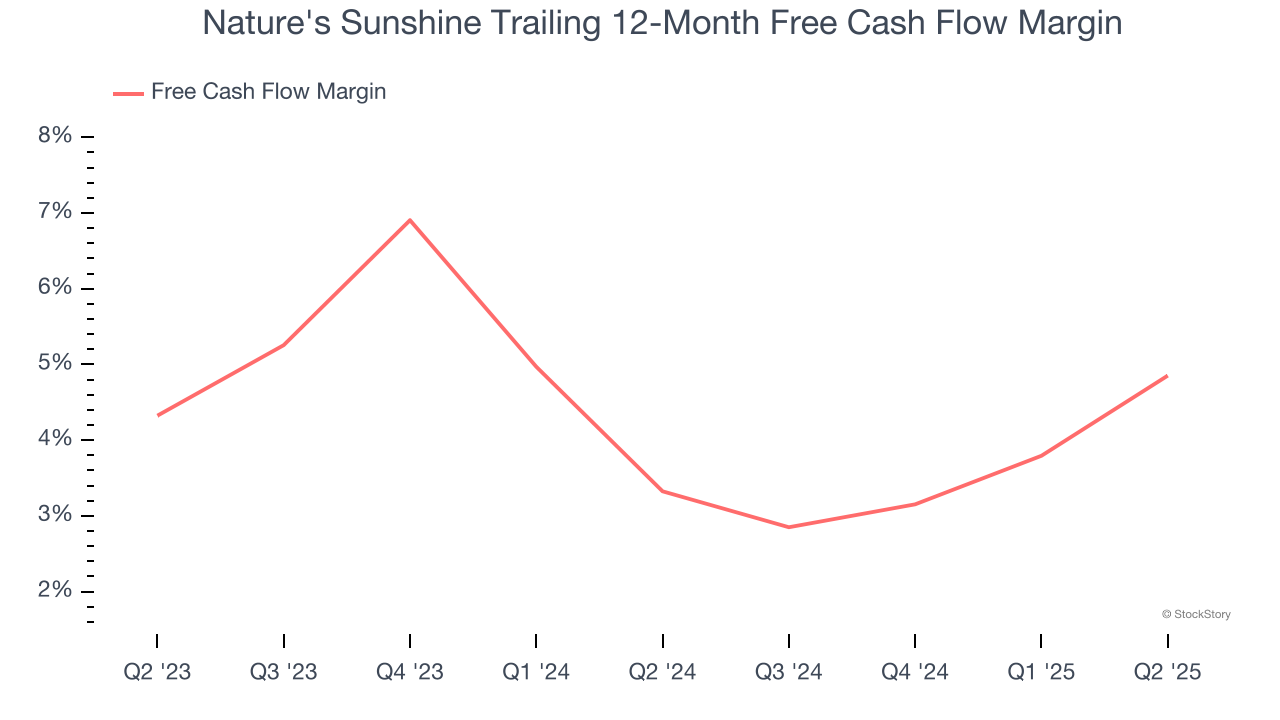

Nature's Sunshine has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.1%, subpar for a consumer staples business.

Taking a step back, an encouraging sign is that Nature's Sunshine’s margin expanded by 1.5 percentage points over the last year. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Nature's Sunshine’s free cash flow clocked in at $2.99 million in Q2, equivalent to a 2.6% margin. Its cash flow turned positive after being negative in the same quarter last year, building on its favorable historical trend.

Key Takeaways from Nature's Sunshine’s Q2 Results

We were impressed by how significantly Nature's Sunshine blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock remained flat at $14.01 immediately following the results.

Nature's Sunshine had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.