Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at DoubleVerify (NYSE: DV) and the best and worst performers in the advertising software industry.

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

The 7 advertising software stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 4.8% while next quarter’s revenue guidance was 1.4% below.

Luckily, advertising software stocks have performed well with share prices up 14.1% on average since the latest earnings results.

DoubleVerify (NYSE: DV)

When Oren Netzer saw a digital ad for US-based Target while sitting in his Tel Aviv apartment, he knew there was an unsolved problem, so he started DoubleVerify (NYSE: DV), a provider of advertising solutions to businesses that helps with ad verification, fraud prevention, and brand safety.

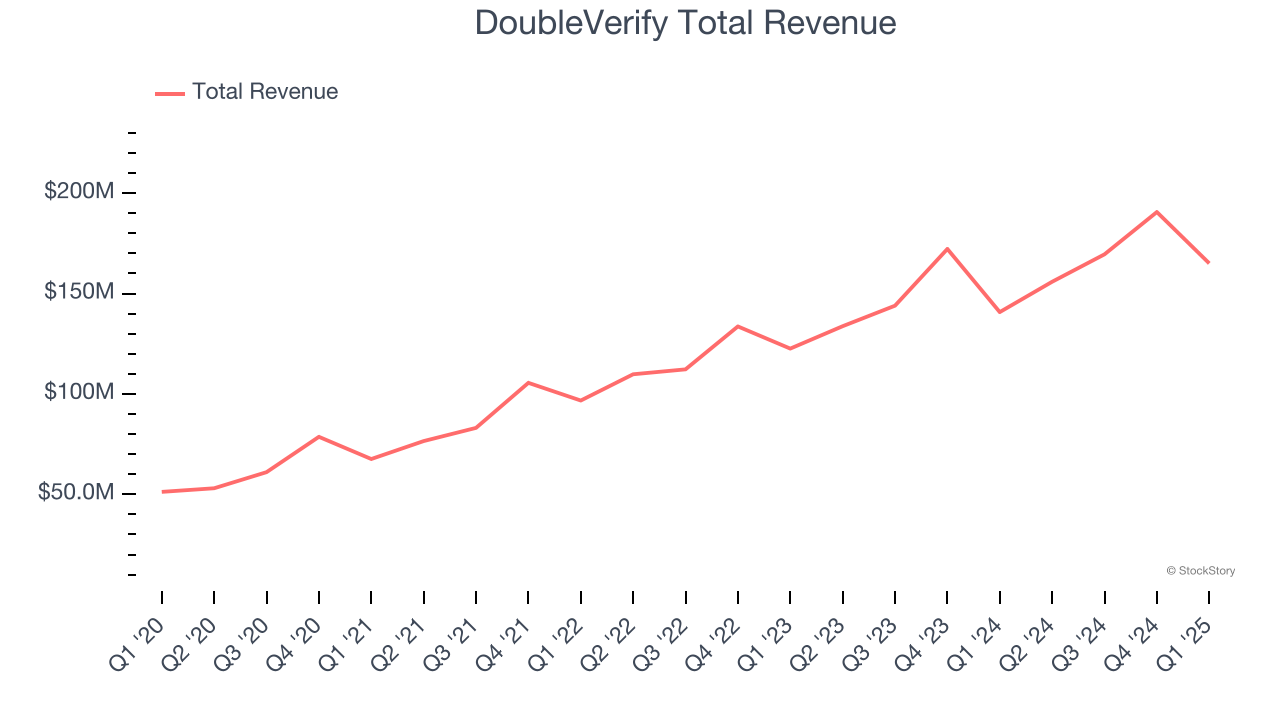

DoubleVerify reported revenues of $165.1 million, up 17.2% year on year. This print exceeded analysts’ expectations by 7.8%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and EBITDA guidance for next quarter slightly topping analysts’ expectations.

“DoubleVerify is off to a strong start in 2025, with first-quarter revenue and adjusted EBITDA meaningfully ahead of expectations,” said Mark Zagorski, CEO of DoubleVerify.

DoubleVerify pulled off the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 9.3% since reporting and currently trades at $15.41.

Is now the time to buy DoubleVerify? Access our full analysis of the earnings results here, it’s free.

Best Q1: The Trade Desk (NASDAQ: TTD)

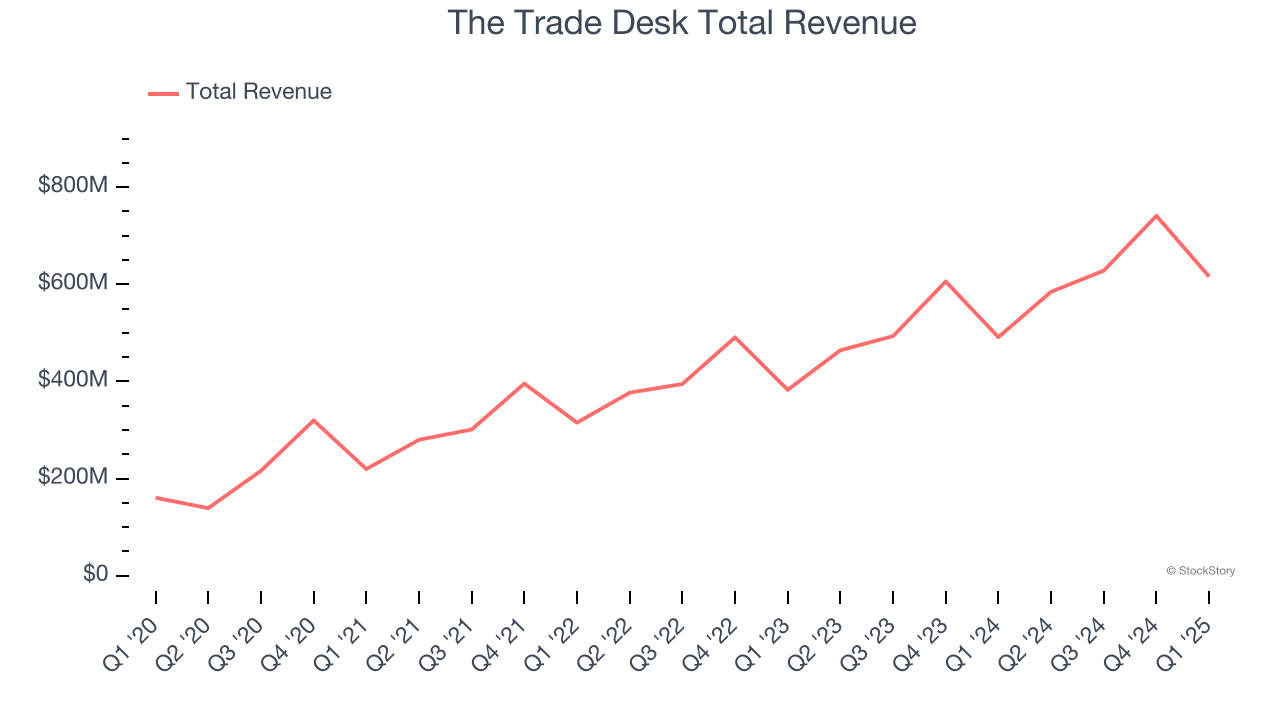

Founded by former Microsoft engineers Jeff Green and Dave Pickles, The Trade Desk (NASDAQ: TTD) offers cloud-based software that uses data to help advertisers better plan, place, and target their online ads.

The Trade Desk reported revenues of $616 million, up 25.4% year on year, outperforming analysts’ expectations by 7%. The business had a very strong quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ billings estimates.

The market seems happy with the results as the stock is up 23.7% since reporting. It currently trades at $74.23.

Is now the time to buy The Trade Desk? Access our full analysis of the earnings results here, it’s free.

Slowest Q1: LiveRamp (NYSE: RAMP)

Started in 2011 as a spin-out of RapLeaf, LiveRamp (NYSE: RAMP) is a software-as-a-service provider that helps companies better target their marketing by merging offline and online data about their customers.

LiveRamp reported revenues of $188.7 million, up 9.8% year on year, exceeding analysts’ expectations by 1.3%. Still, it was a mixed quarter as it posted full-year guidance of slowing revenue growth.

LiveRamp delivered the weakest performance against analyst estimates in the group. The company added 3 enterprise customers paying more than $1 million annually to reach a total of 128. Interestingly, the stock is up 19.5% since the results and currently trades at $33.55.

Read our full analysis of LiveRamp’s results here.

Integral Ad Science (NASDAQ: IAS)

Founded in 2009, Integral Ad Science (NASDAQ: IAS) provides digital advertising verification and optimization solutions, ensuring that ads are viewable by real people in brand-safe environments across various platforms and devices.

Integral Ad Science reported revenues of $134.1 million, up 17.1% year on year. This print topped analysts’ expectations by 3.2%. Zooming out, it was a mixed quarter as it also produced an impressive beat of analysts’ EBITDA estimates but EBITDA guidance for next quarter missing analysts’ expectations significantly.

Integral Ad Science had the weakest full-year guidance update among its peers. The stock is up 4.5% since reporting and currently trades at $8.53.

Read our full, actionable report on Integral Ad Science here, it’s free.

AppLovin (NASDAQ: APP)

Co-founded by Adam Foroughi, who was frustrated with not being able to find a good solution to market his own dating app, AppLovin (NASDAQ: APP) is both a mobile game studio and provider of marketing and monetization tools for mobile app developers.

AppLovin reported revenues of $1.48 billion, up 40.3% year on year. This number beat analysts’ expectations by 7.3%. It was a very strong quarter as it also recorded EBITDA guidance for next quarter exceeding analysts’ expectations.

AppLovin achieved the fastest revenue growth among its peers. The stock is up 12.1% since reporting and currently trades at $340.40.

Read our full, actionable report on AppLovin here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.