Over the past six months, Grand Canyon Education has been a great trade, beating the S&P 500 by 7.2%. Its stock price has climbed to $183.43, representing a healthy 13.4% increase. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Following the strength, is LOPE a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Does Grand Canyon Education Spark Debate?

Founded in 1949, Grand Canyon Education (NASDAQ: LOPE) is an educational services provider known for its operation at Grand Canyon University.

Two Positive Attributes:

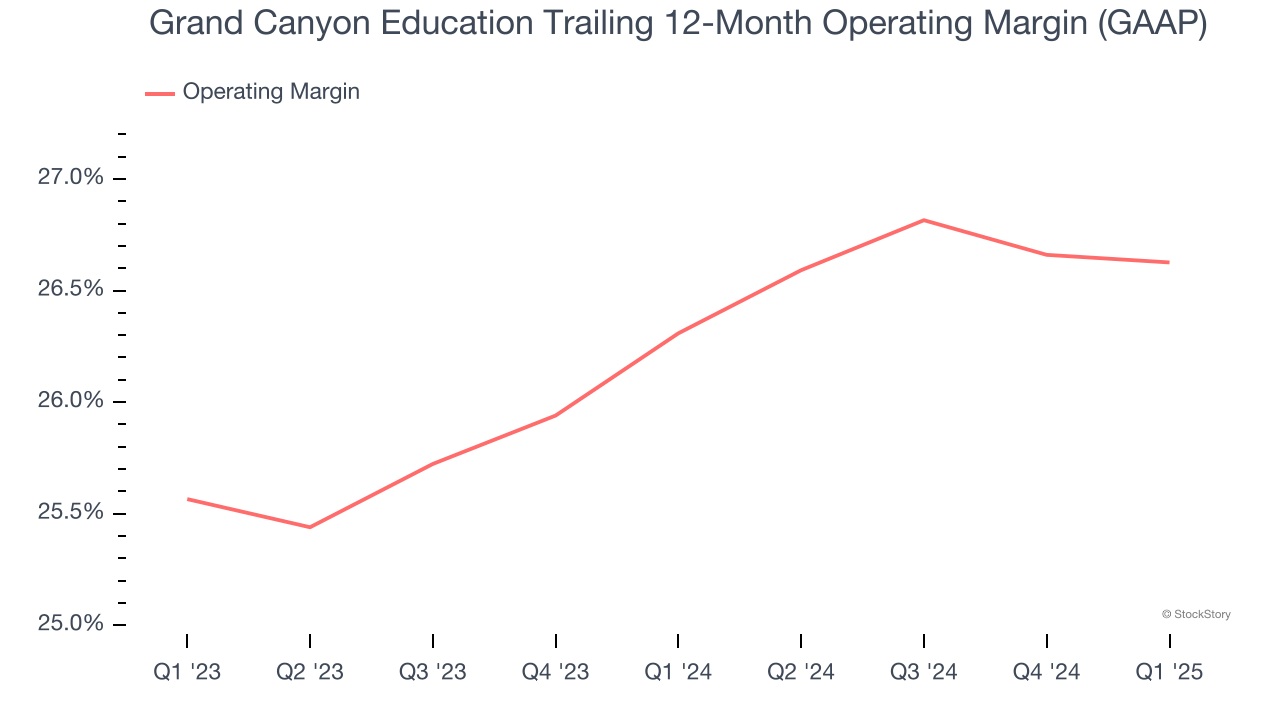

1. Operating Margin Reveals a Well-Run Organization

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Grand Canyon Education’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 26.5% over the last two years. This profitability was elite for a consumer discretionary business thanks to its efficient cost structure and economies of scale.

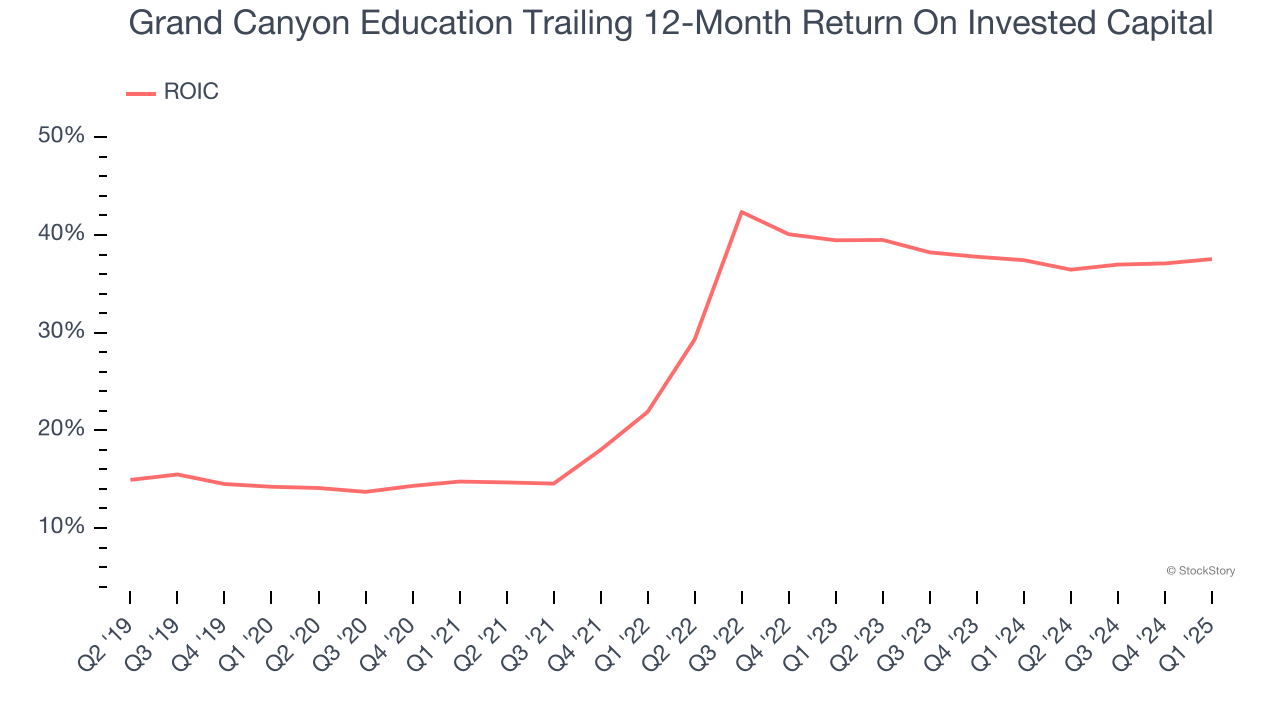

2. New Investments Bear Fruit as ROIC Jumps

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Grand Canyon Education’s ROIC has increased significantly. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

One Reason to be Careful:

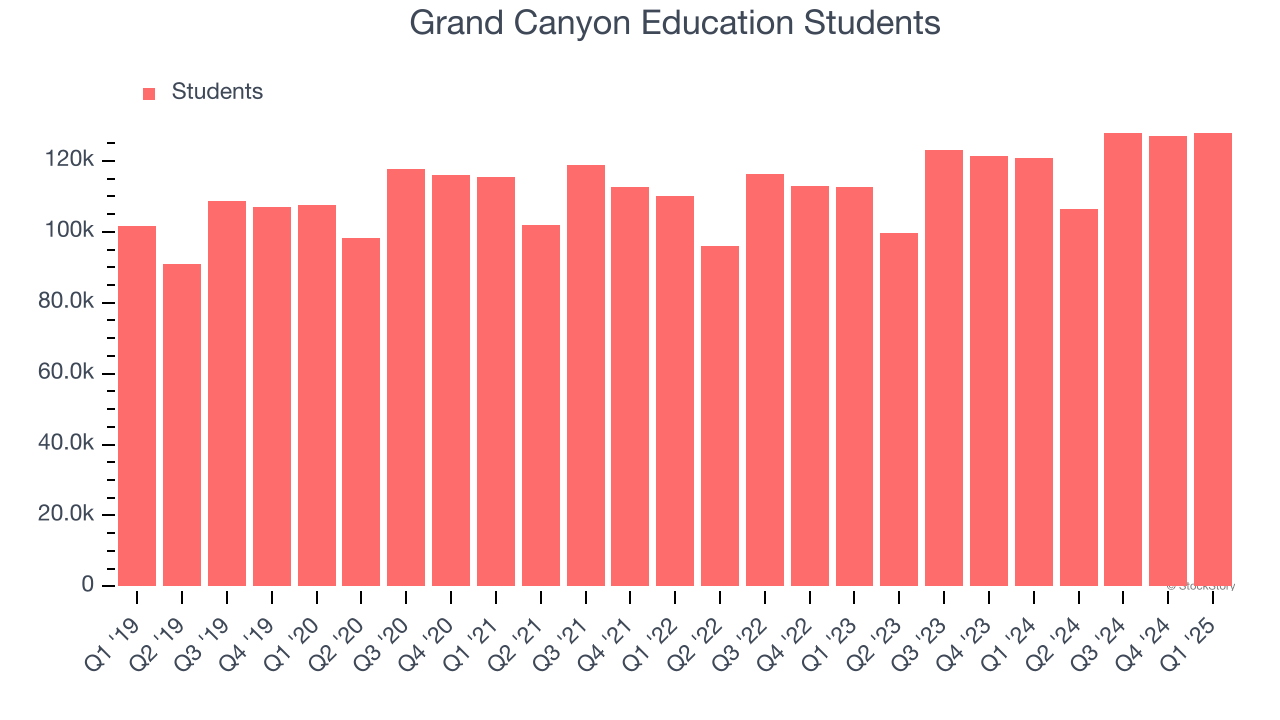

Weak Growth in Students Points to Soft Demand

Revenue growth can be broken down into changes in price and volume (for companies like Grand Canyon Education, our preferred volume metric is students). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Grand Canyon Education’s students came in at 127,779 in the latest quarter, and over the last two years, averaged 5.7% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

Final Judgment

Grand Canyon Education has huge potential even though it has some open questions, and with its shares outperforming the market lately, the stock trades at 20.5× forward P/E (or $183.43 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Grand Canyon Education

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.