Bowhead Specialty trades at $34.82 per share and has stayed right on track with the overall market, gaining 9.4% over the last six months. At the same time, the S&P 500 has returned 5.3%.

Is BOW a buy right now? Find out in our full research report, it’s free.

Why Is Bowhead Specialty a Good Business?

Named after the Arctic bowhead whale known for navigating challenging waters, Bowhead Specialty Holdings (NYSE: BOW) is a specialty insurance company that provides customized coverage for complex and high-risk commercial sectors.

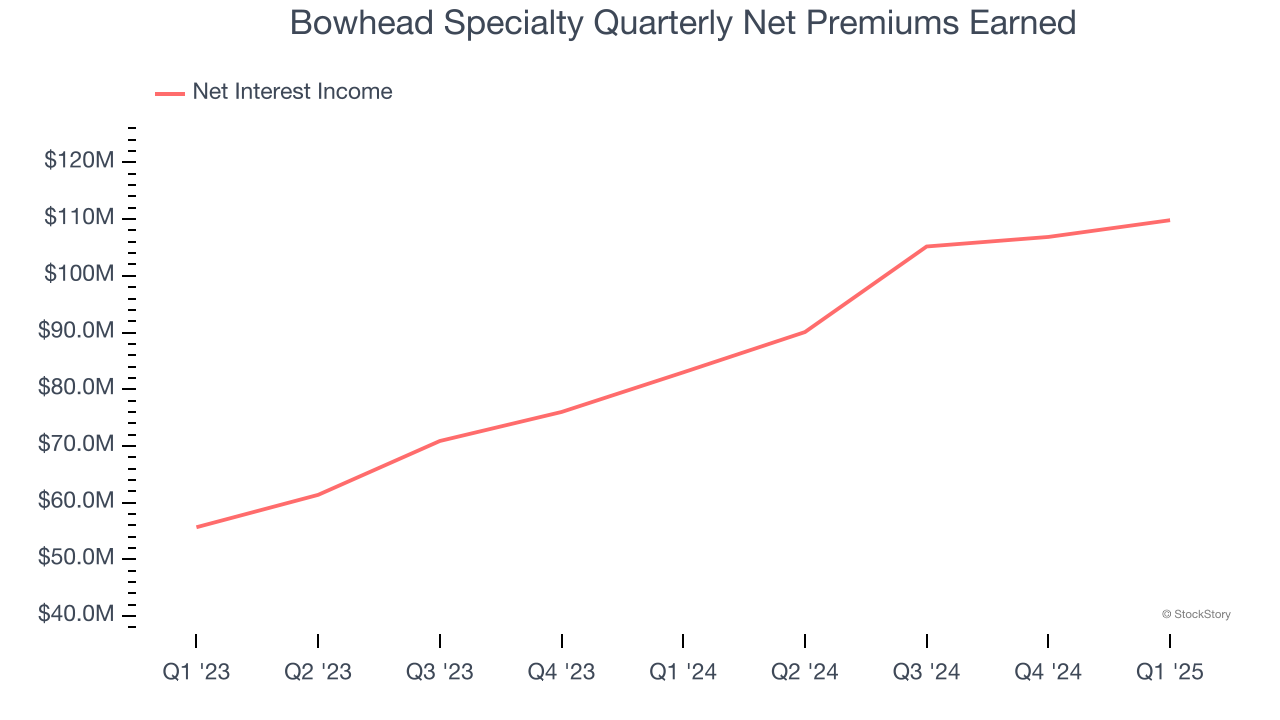

1. Net Premiums Earned Skyrockets, Fueling Growth Opportunities

Markets consistently prioritize net premiums earned growth over investment and fee income, recognizing its superior quality as a core indicator of the company’s underwriting success and market penetration.

Bowhead Specialty’s net premiums earned has grown at a 41.5% annualized rate over the last one years, much better than the broader insurance industry.

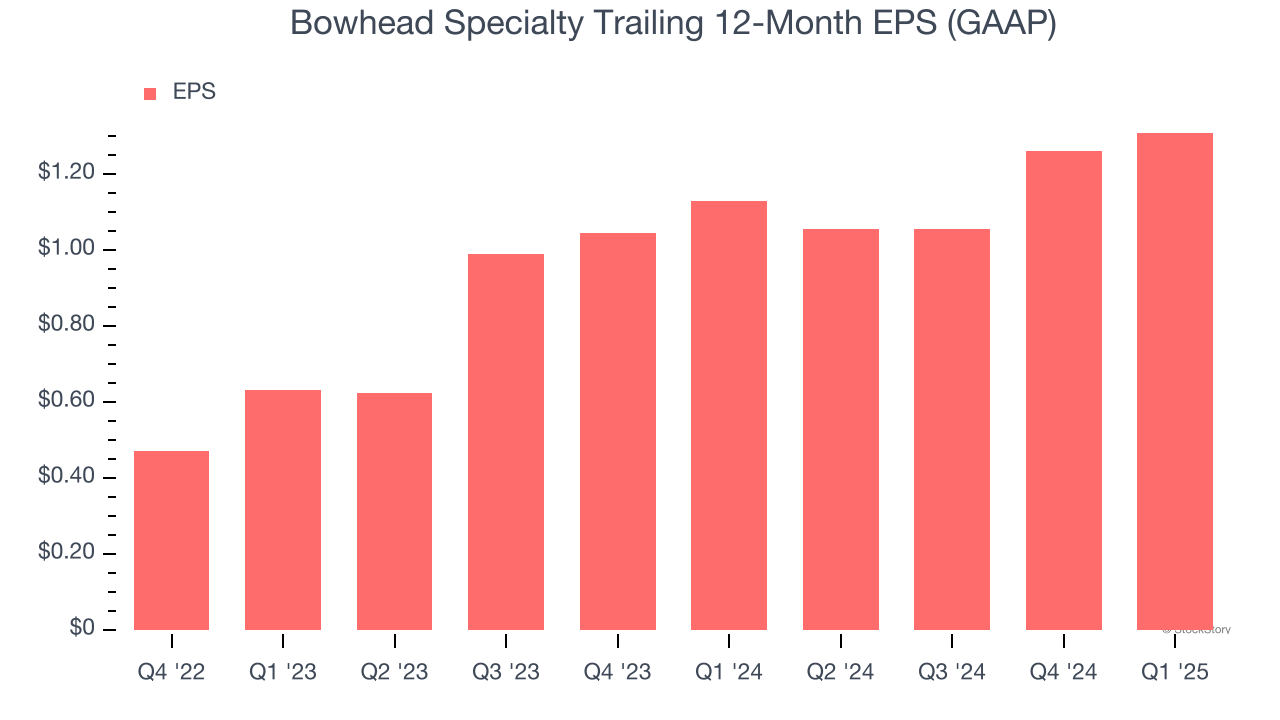

2. Outstanding Long-Term EPS Growth

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Bowhead Specialty’s EPS grew at an astounding 44% compounded annual growth rate over the last two years. This performance was better than most insurance businesses.

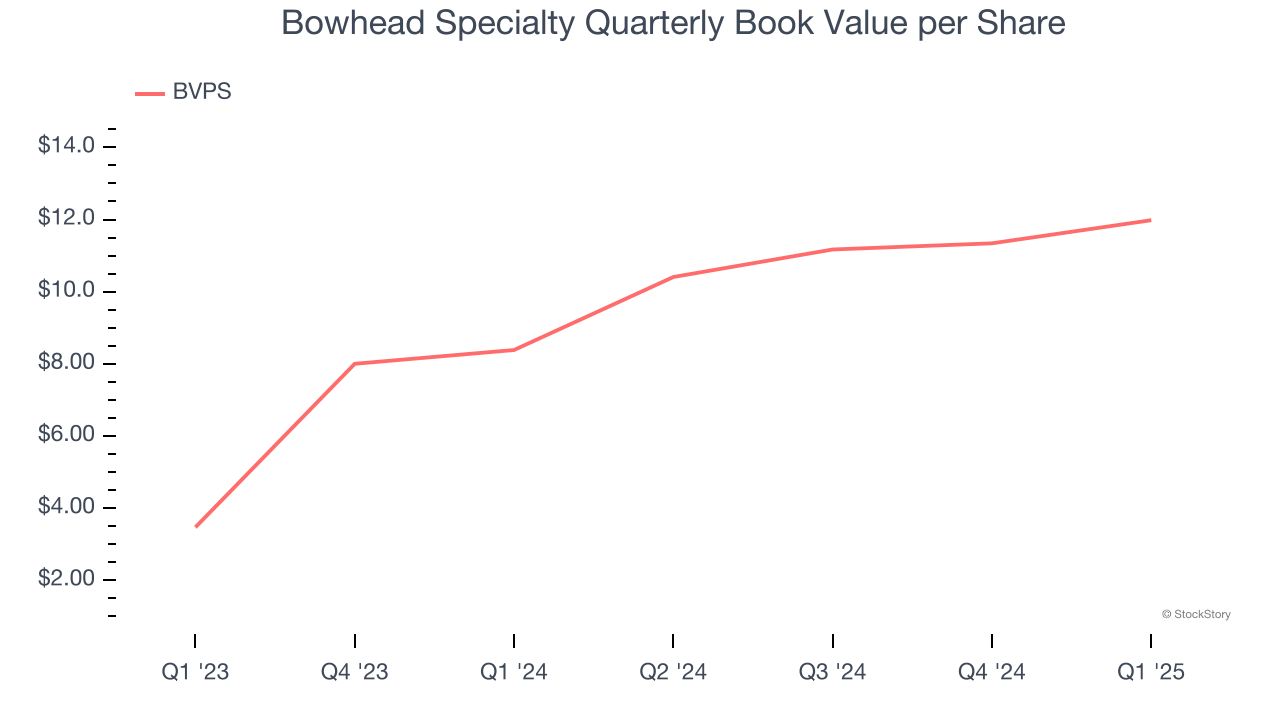

3. Growing BVPS Reflects Strong Asset Base

We consider book value per share (BVPS) a critical metric for insurance companies. BVPS represents the total net worth per share, providing insight into a company’s financial strength and ability to meet policyholder obligations.

To investors’ benefit, Bowhead Specialty’s BVPS grew at an incredible 85.7% annual clip over the last two years.

Final Judgment

These are just a few reasons why Bowhead Specialty is a cream-of-the-crop insurance company, but at $34.82 per share (or 2.7× forward P/B), is now the right time to buy the stock? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.