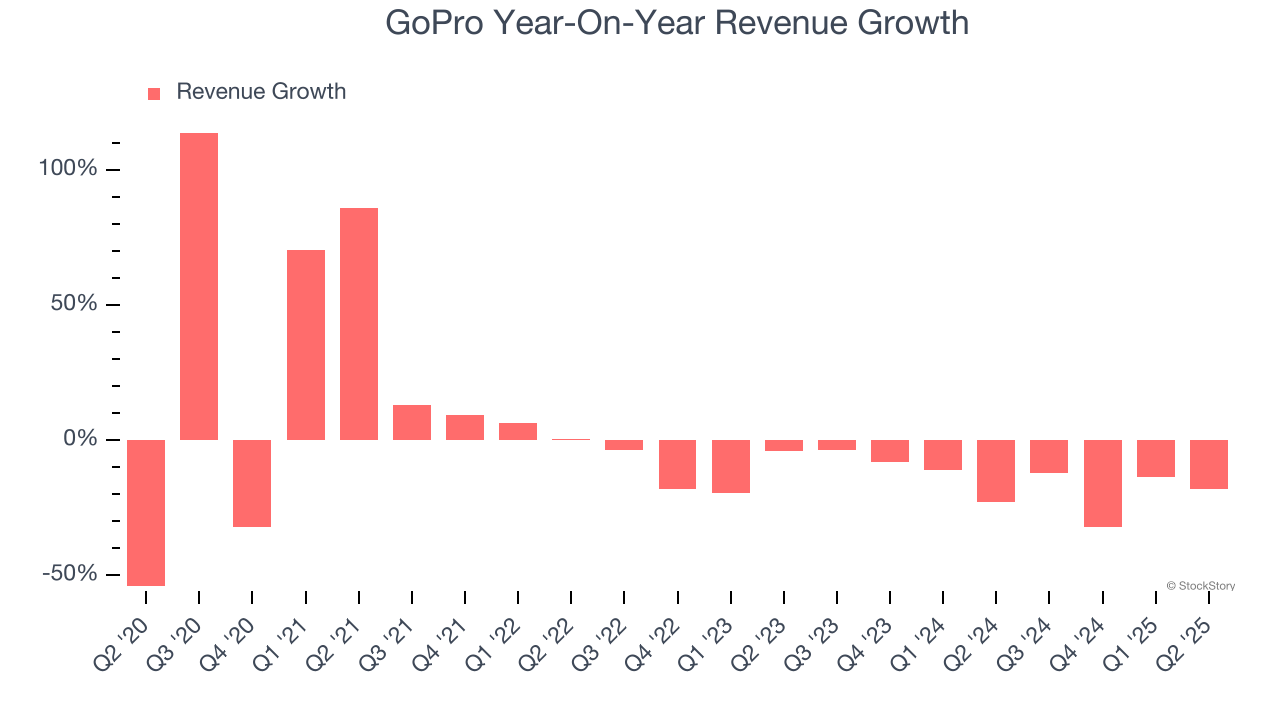

Action camera company GoPro (NASDAQ: GPRO) posted $152.6 million of revenue in Q2 CY2025, down 18% year on year. Its non-GAAP loss of $0.08 per share was 33.3% below analysts’ consensus estimates.

Is now the time to buy GoPro? Find out by accessing our full research report, it’s free.

GoPro (GPRO) Q2 CY2025 Highlights:

- "...in the second half of 2025, which we believe will restore revenue growth and profitability to our business starting in Q4 2025"

- Revenue: $152.6 million (18% year-on-year decline)

- Adjusted EPS: -$0.08 vs analyst expectations of -$0.06 (33.3% miss)

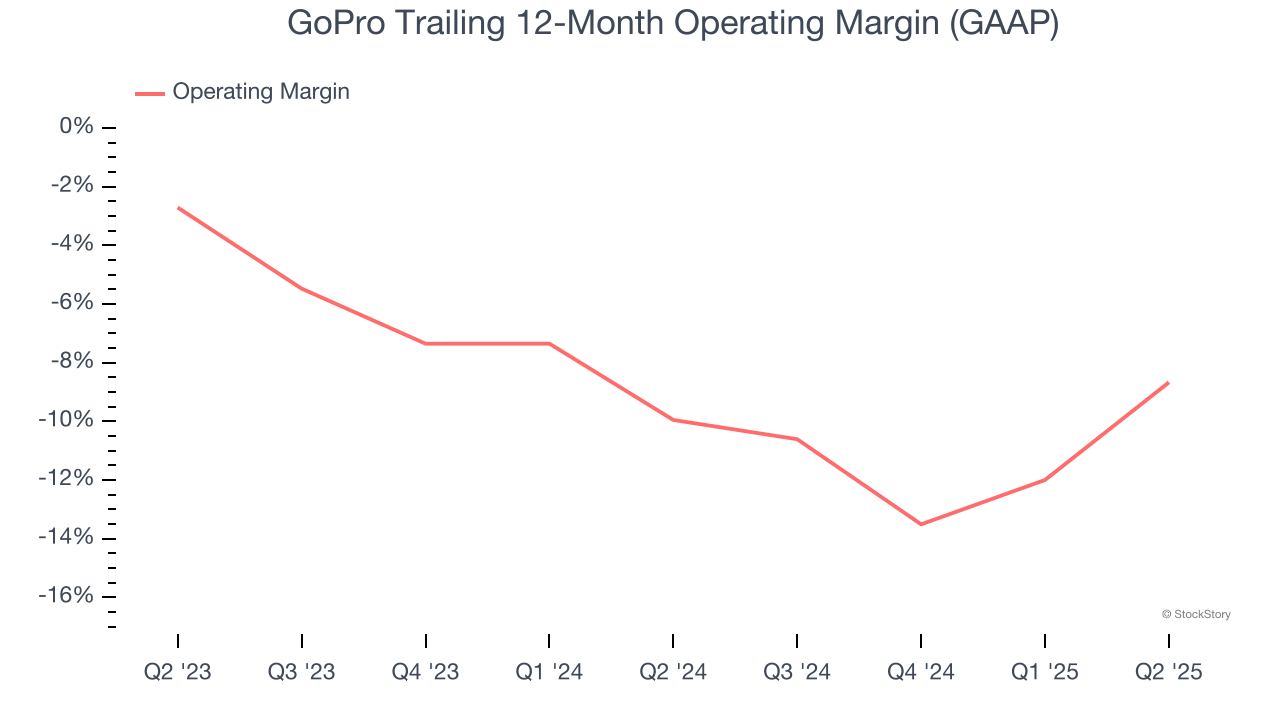

- Operating Margin: -9.2%, up from -23% in the same quarter last year

- Free Cash Flow was $8.27 million, up from -$111,000 in the same quarter last year

- Market Capitalization: $222.1 million

"Our Q2 results reflect consistent operational execution and efficiency, and we're excited to launch a broader, more diversified suite of hardware and software products in the second half of 2025, which we believe will restore revenue growth and profitability to our business starting in Q4 2025," said Nicholas Woodman, GoPro's founder and CEO.

Company Overview

Known for sponsoring extreme athletes, GoPro (NASDAQ: GPRO) is a camera company known for its POV videos and editing software.

Revenue Growth

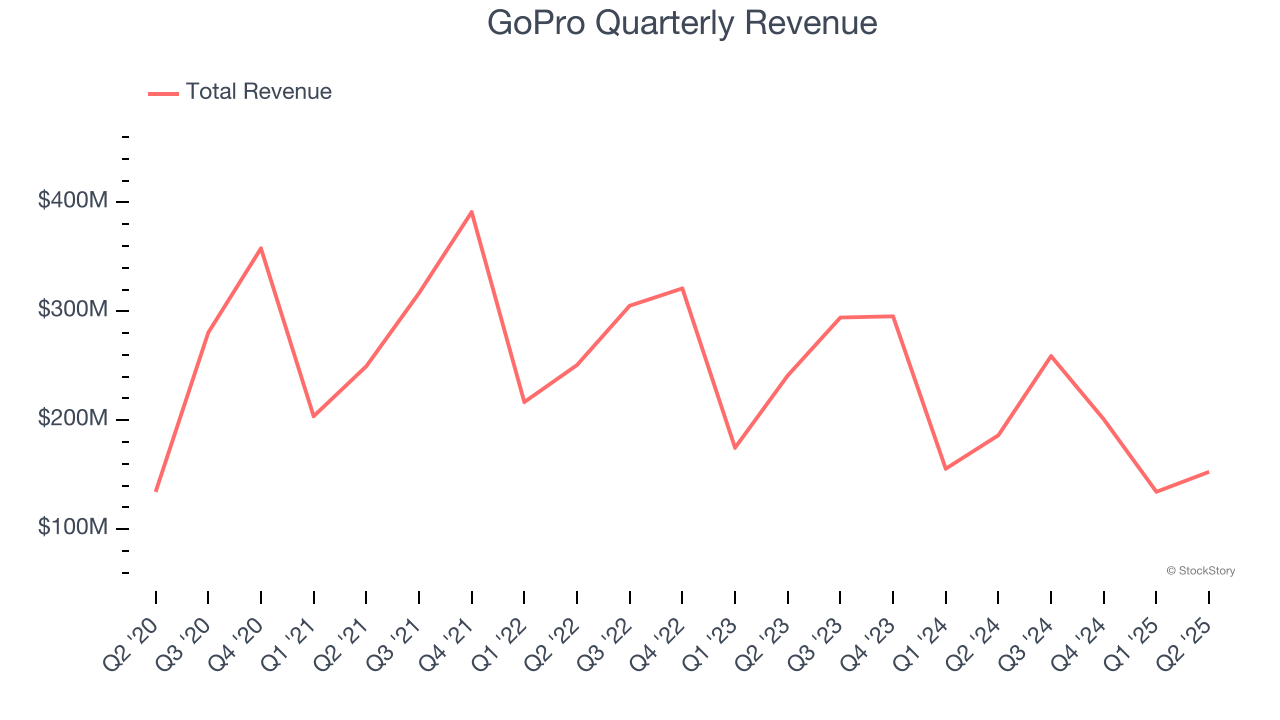

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, GoPro’s demand was weak and its revenue declined by 3.9% per year. This wasn’t a great result and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. GoPro’s recent performance shows its demand remained suppressed as its revenue has declined by 15.3% annually over the last two years.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

GoPro’s operating margin has risen over the last 12 months, but it still averaged negative 9.4% over the last two years. This is due to its large expense base and inefficient cost structure.

This quarter, GoPro generated a negative 9.2% operating margin. The company's consistent lack of profits raise a flag.

Earnings Per Share

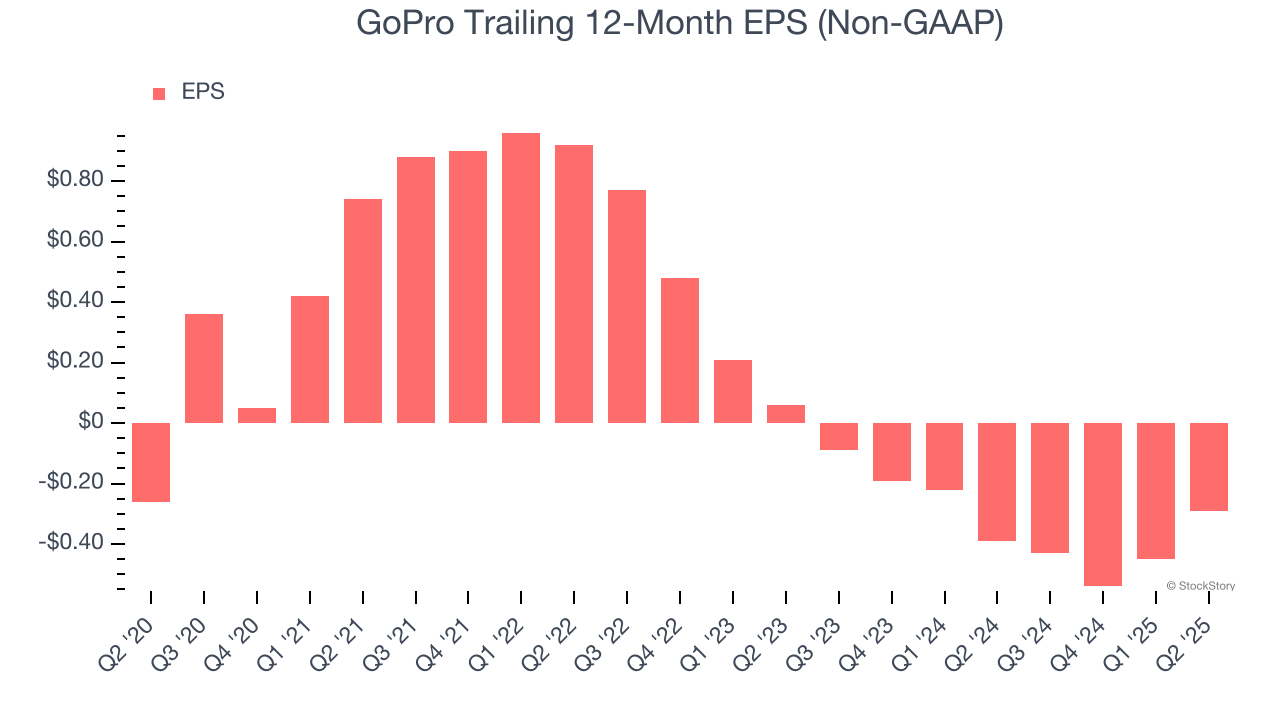

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

GoPro’s earnings losses deepened over the last five years as its EPS dropped 2.2% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. Consumer Discretionary companies are particularly exposed to this, and if the tide turns unexpectedly, GoPro’s low margin of safety could leave its stock price susceptible to large downswings.

In Q2, GoPro reported adjusted EPS at negative $0.08, up from negative $0.24 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from GoPro’s Q2 Results

While the quarter itself was soft due to declining year-on-year revenue and an EPS miss, the CEO mentioned that "in the second half of 2025, which we believe will restore revenue growth and profitability to our business starting in Q4 2025." The stock reacted positively to this, trading up 4.7% to $1.35 immediately after reporting.

Big picture, is GoPro a buy here and now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.