Content production and distribution company Sphere Entertainment (NYSE: SPHR) fell short of the market’s revenue expectations in Q2 CY2025 as sales rose 3.4% year on year to $282.7 million. Its GAAP profit of $3.39 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Sphere Entertainment? Find out by accessing our full research report, it’s free.

Sphere Entertainment (SPHR) Q2 CY2025 Highlights:

- MSG Networks completed a restructuring of its credit facilities and agreed to reductions in annual rights fees payable to the Knicks and Rangers + elimination of annual rights fee escalators

- Revenue: $282.7 million vs analyst estimates of $305.1 million (3.4% year-on-year growth, 7.4% miss)

- EPS (GAAP): $3.39 vs analyst estimates of -$0.91 (significant beat)

- Adjusted EBITDA: -$115.2 million vs analyst estimates of $34.48 million (-40.8% margin, significant miss)

- Operating Margin: -17.7%, down from -2.6% in the same quarter last year

- Market Capitalization: $1.45 billion

Executive Chairman and CEO James L. Dolan said, “We continue to execute our strategic priorities to drive long-term profitable growth for our Sphere business. At the same time, we have been making progress with our expansion plans and remain confident in the global opportunity ahead.”

Company Overview

Famous for its viral Las Vegas Sphere venue, Sphere Entertainment (NYSE: SPHR) hosts live entertainment events and distributes content across various media platforms.

Revenue Growth

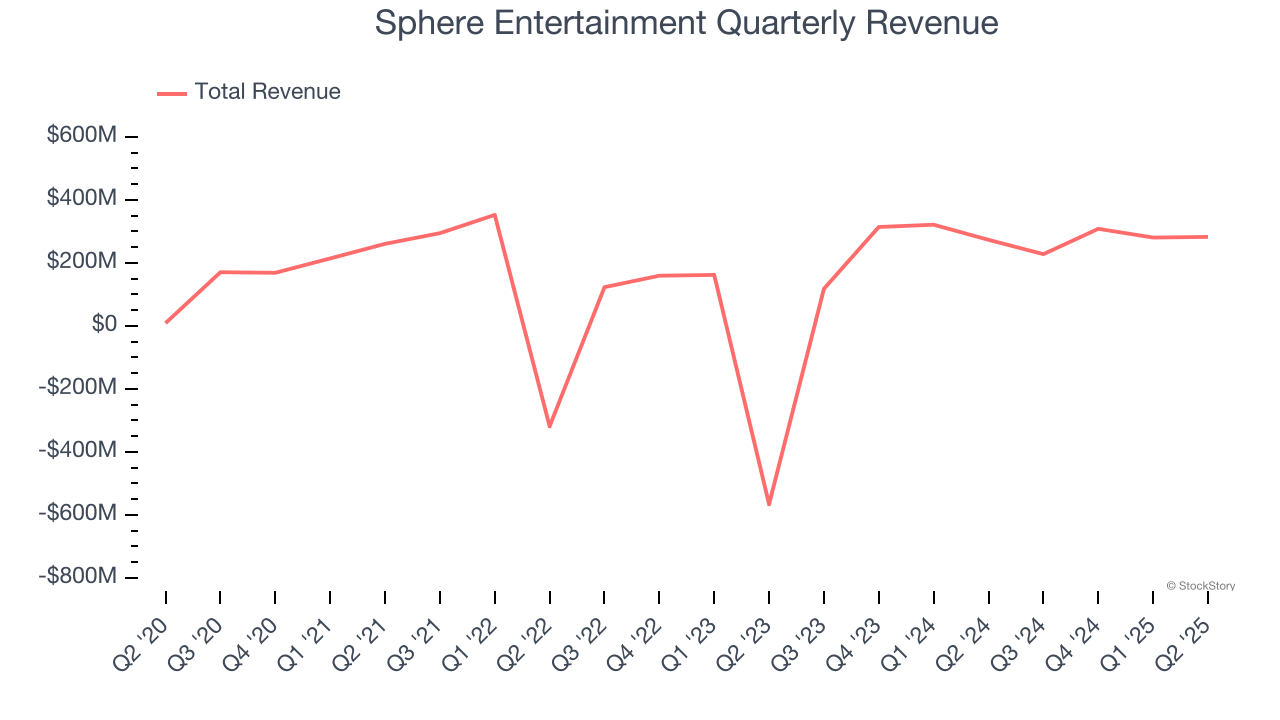

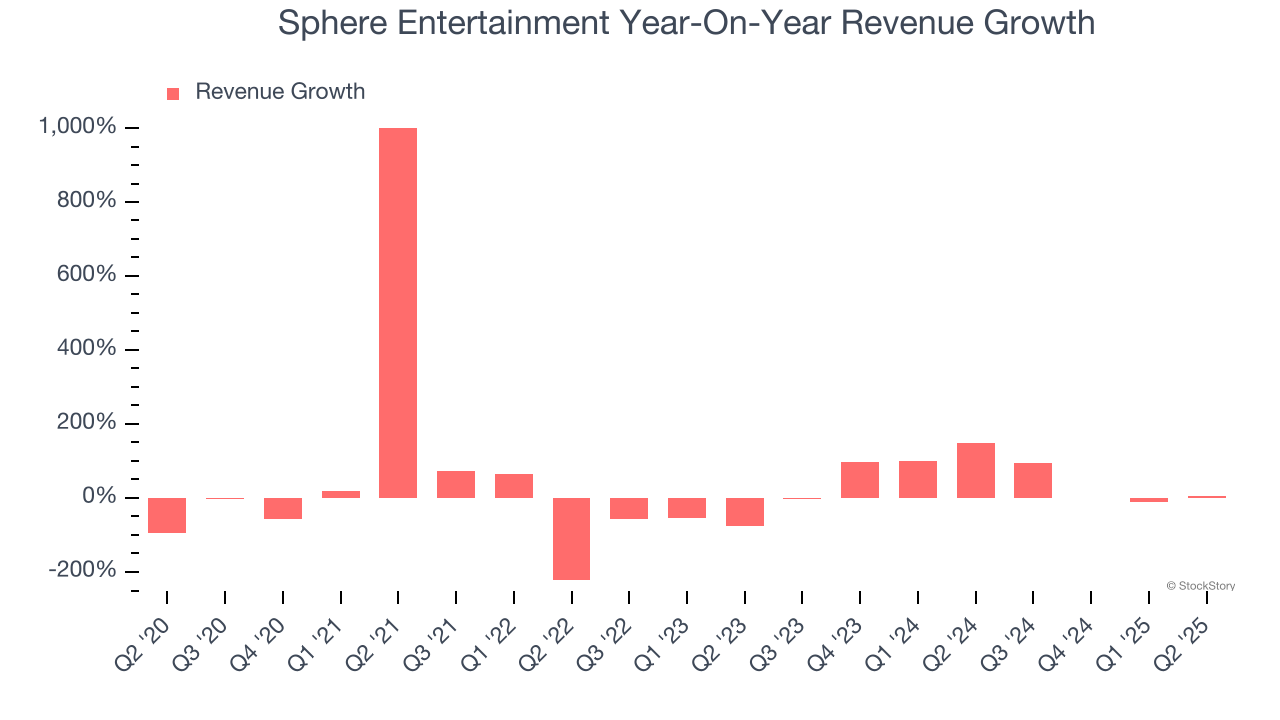

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Sphere Entertainment’s 7.6% annualized revenue growth over the last five years was sluggish. This was below our standard for the consumer discretionary sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Sphere Entertainment’s annualized revenue growth of 233% over the last two years is above its five-year trend, suggesting its demand recently accelerated. Note that COVID hurt Sphere Entertainment’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

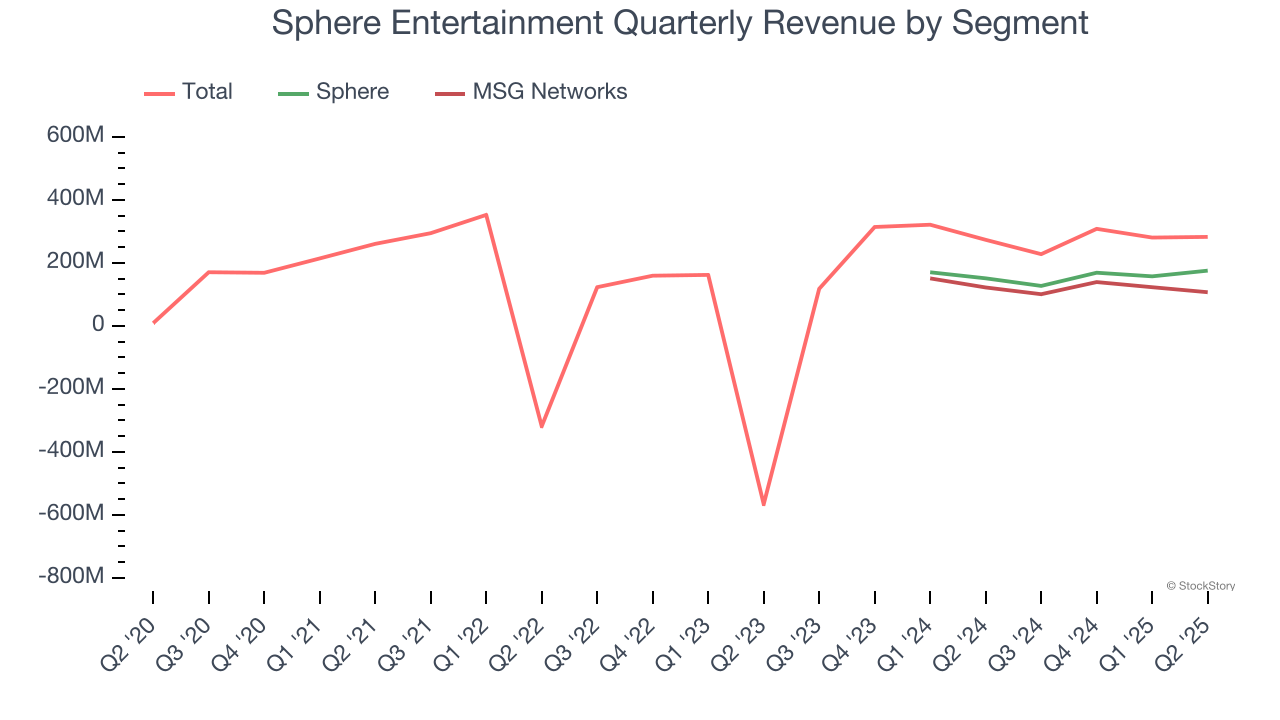

We can better understand the company’s revenue dynamics by analyzing its most important segments, Sphere and MSG Networks, which are 62.1% and 37.9% of revenue. Over the last two years, Sphere Entertainment’s Sphere revenue (live events and advertising) averaged 4.3% year-on-year growth. On the other hand, its MSG Networks revenue (content distribution) averaged 15.5% declines.

This quarter, Sphere Entertainment’s revenue grew by 3.4% year on year to $282.7 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 14.2% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is above average for the sector and suggests the market sees some success for its newer products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

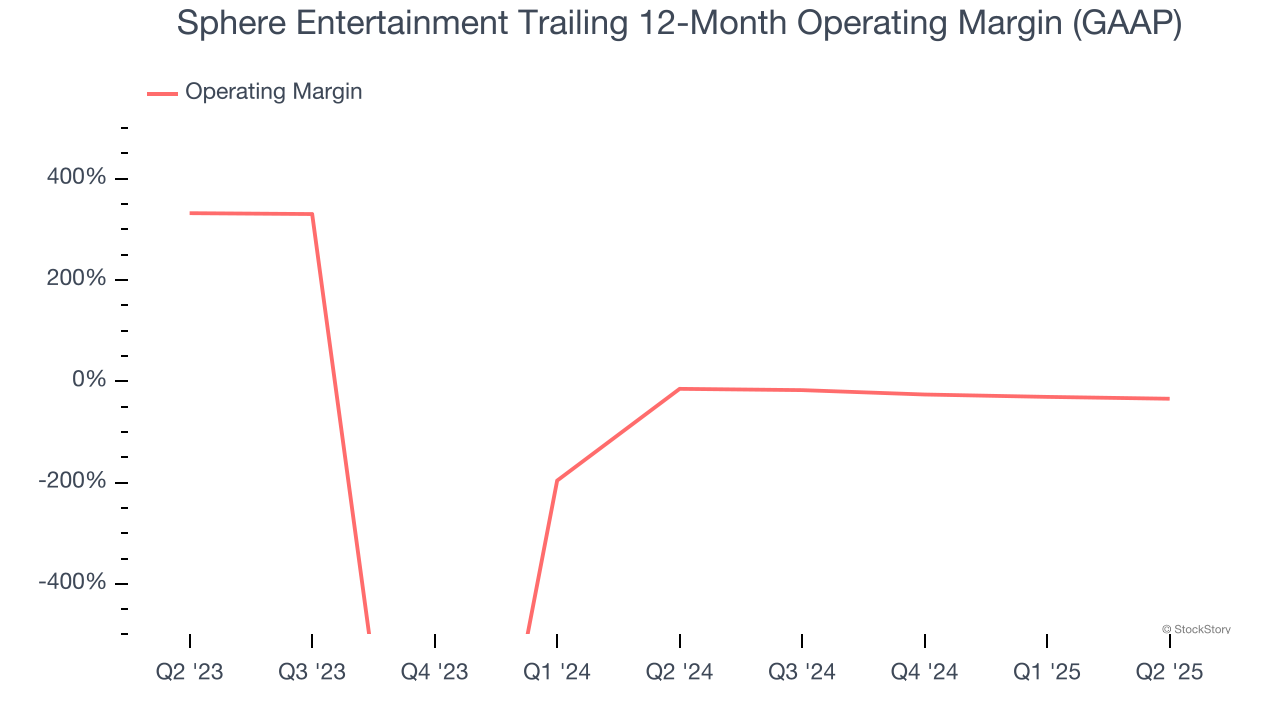

Sphere Entertainment’s operating margin has been trending down over the last 12 months and averaged negative 25% over the last two years. Unprofitable consumer discretionary companies with falling margins deserve extra scrutiny because they’re spending loads of money to stay relevant, an unsustainable practice.

In Q2, Sphere Entertainment generated a negative 17.7% operating margin. The company's consistent lack of profits raise a flag.

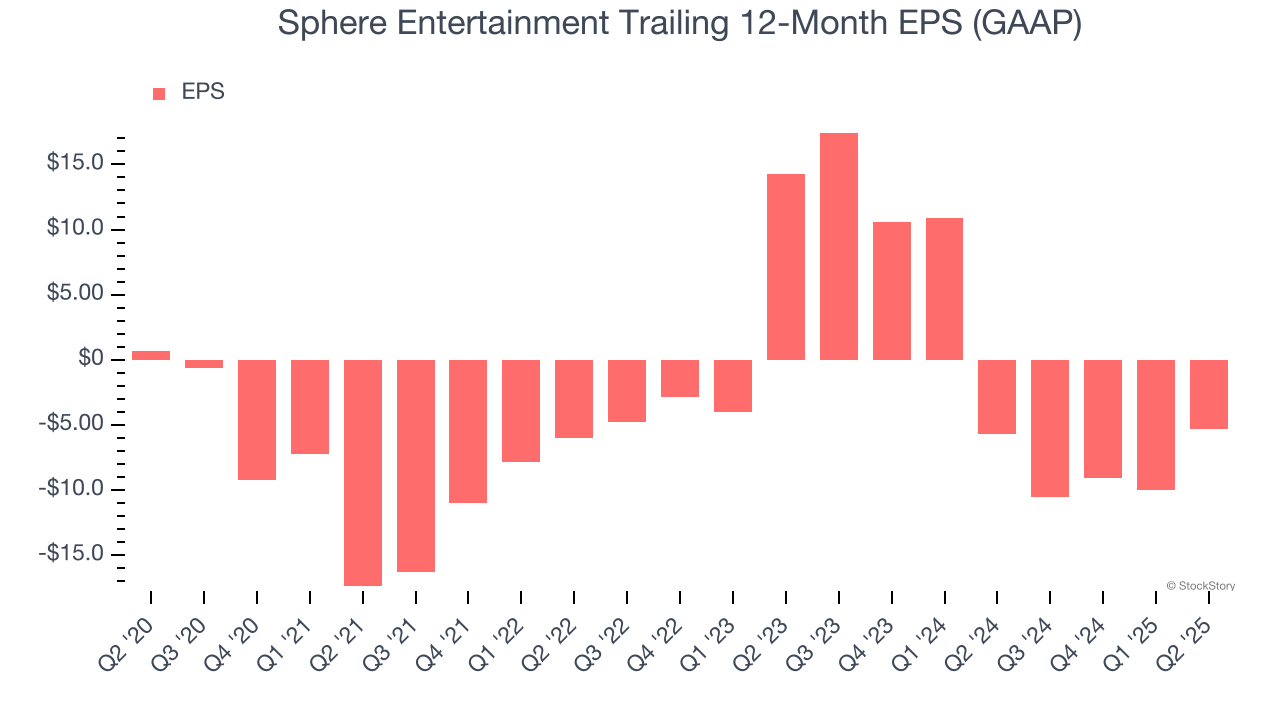

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Sphere Entertainment, its EPS declined by 57.4% annually over the last five years while its revenue grew by 7.6%. However, its operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

In Q2, Sphere Entertainment reported EPS at $3.39, up from negative $1.31 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Sphere Entertainment to improve its earnings losses. Analysts forecast its full-year EPS of negative $5.32 will advance to negative $4.28.

Key Takeaways from Sphere Entertainment’s Q2 Results

We were impressed by how significantly Sphere Entertainment blew past analysts’ EPS expectations this quarter. On the other hand, its revenue missed and its EBITDA fell short of Wall Street’s estimates. Additionally, news that MSG Networks restructured its credit facilities and agreed to reductions in annual rights fees payable to the Knicks and Rangers seemed to be received positively. The stock traded up 10.5% to $44.50 immediately after reporting.

So should you invest in Sphere Entertainment right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.