The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Vishay Precision (NYSE: VPG) and the rest of the electronic components stocks fared in Q2.

Like many equipment and component manufacturers, electronic components companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include data centers and telecommunications, which can benefit companies whose optical and transceiver offerings fit those markets. But like the broader industrials sector, these companies are also at the whim of economic cycles. Consumer spending, for example, can greatly impact these companies’ volumes.

The 10 electronic components stocks we track reported a very strong Q2. As a group, revenues beat analysts’ consensus estimates by 4.8% while next quarter’s revenue guidance was in line.

Luckily, electronic components stocks have performed well with share prices up 12.4% on average since the latest earnings results.

Vishay Precision (NYSE: VPG)

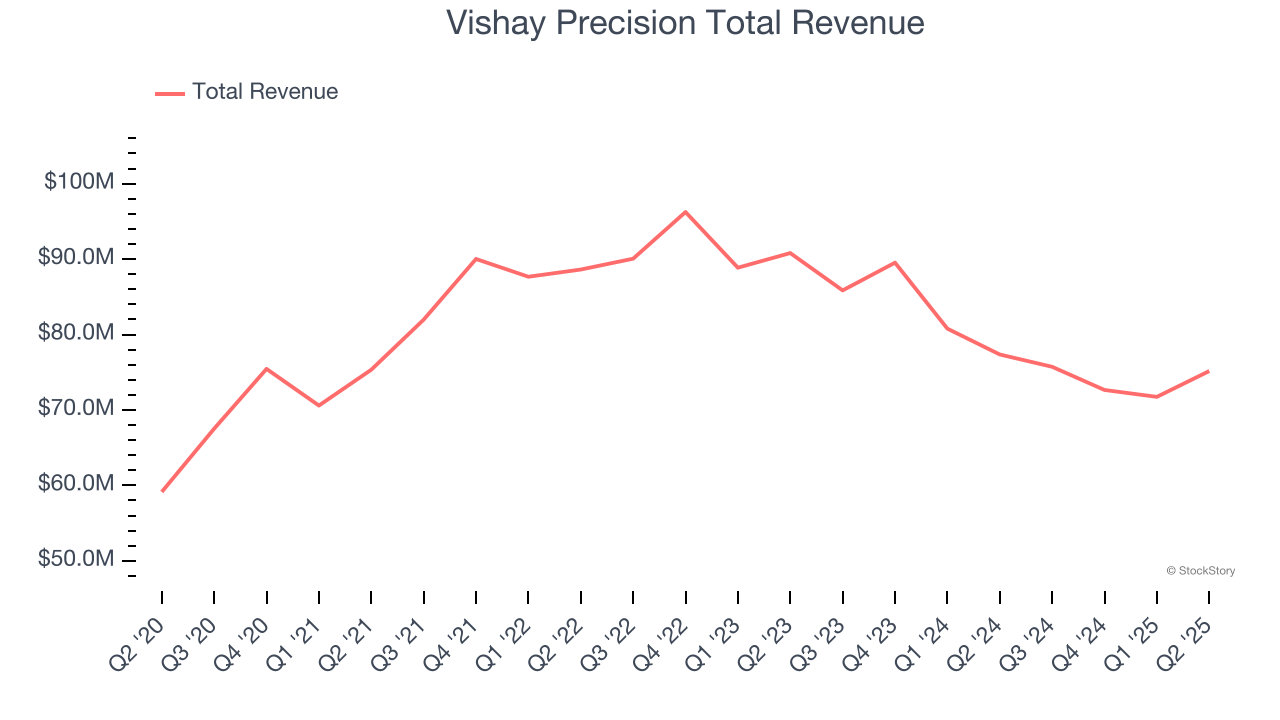

Emerging from Vishay Intertechnology in 2010, Vishay Precision (NYSE: VPG) operates as a global provider of precision measurement and sensing technologies.

Vishay Precision reported revenues of $75.16 million, down 2.8% year on year. This print exceeded analysts’ expectations by 3.1%. Overall, it was an exceptional quarter for the company with a beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Ziv Shoshani, Chief Executive Officer of VPG, commented, “We were pleased with the positive sequential trends in the quarter, which reflected a moderately improved business climate. Second quarter sales grew 4.8% sequentially, and total orders of $79.9 million grew 7.5% sequentially, our third consecutive quarter of order growth. This resulted in a book-to-bill of 1.06, as our Measurement Systems and Sensors reporting segments recorded book-to-bill ratios of 1.20 and 1.12, respectively.”

Vishay Precision delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 4% since reporting and currently trades at $27.10.

Is now the time to buy Vishay Precision? Access our full analysis of the earnings results here, it’s free.

Best Q2: Bel Fuse (NASDAQ: BELFA)

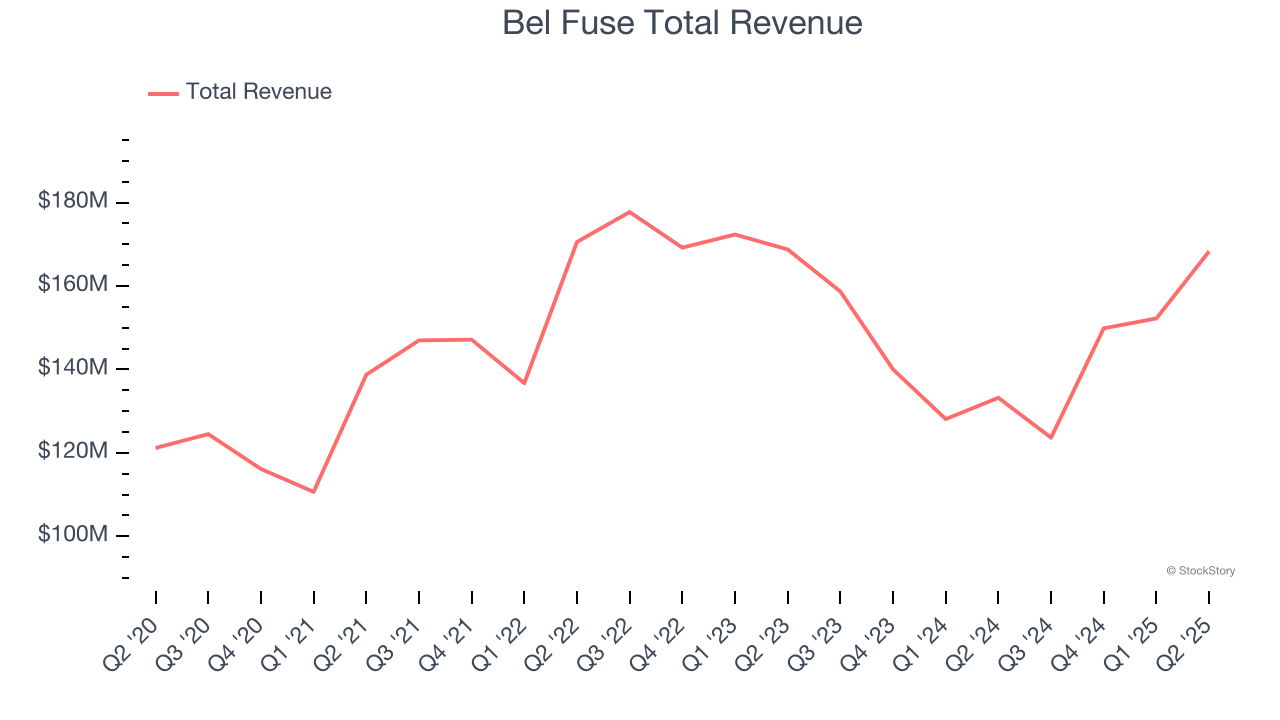

Founded by 26-year-old Elliot Bernstein during the electronics boom after WW2, Bel Fuse (NASDAQ: BELF.A) provides electronic systems and devices to the telecommunications, networking, transportation, and industrial sectors.

Bel Fuse reported revenues of $168.3 million, up 26.3% year on year, outperforming analysts’ expectations by 10.1%. The business had an incredible quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Bel Fuse pulled off the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 26.5% since reporting. It currently trades at $117.

Is now the time to buy Bel Fuse? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Novanta (NASDAQ: NOVT)

Originally a pioneer in the laser scanning industry during the late 1960s, Novanta (NASDAQ: NOVT) offers medicine and manufacturing technology to the medical, life sciences, and manufacturing industries.

Novanta reported revenues of $241 million, up 2.2% year on year, exceeding analysts’ expectations by 1.3%. Still, it was a slower quarter as it posted EBITDA guidance for next quarter missing analysts’ expectations significantly and full-year EBITDA guidance missing analysts’ expectations.

As expected, the stock is down 2.4% since the results and currently trades at $121.19.

Read our full analysis of Novanta’s results here.

Advanced Energy (NASDAQ: AEIS)

Pioneering technologies for radio frequency power delivery, Advanced Energy (NASDAQ: AEIS) provides power supplies, thermal management systems, and measurement and control instruments for various manufacturing processes.

Advanced Energy reported revenues of $441.5 million, up 21% year on year. This number beat analysts’ expectations by 5%. It was a very strong quarter as it also logged EPS guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ adjusted operating income estimates.

The stock is up 13.6% since reporting and currently trades at $159.

Read our full, actionable report on Advanced Energy here, it’s free.

nLIGHT (NASDAQ: LASR)

Founded by a former CEO and Harvard-educated entrepreneur Scott Keeneyn, nLIGHT (NASDAQ: LASR) offers semiconductor and fiber lasers to the industrial, aerospace & defense, and medical sectors.

nLIGHT reported revenues of $61.74 million, up 22.2% year on year. This result surpassed analysts’ expectations by 11%. Overall, it was a stunning quarter as it also produced EBITDA guidance for next quarter exceeding analysts’ expectations and a beat of analysts’ EPS estimates.

nLIGHT delivered the biggest analyst estimates beat among its peers. The stock is up 36.3% since reporting and currently trades at $27.89.

Read our full, actionable report on nLIGHT here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.