Let’s dig into the relative performance of VeriSign (NASDAQ: VRSN) and its peers as we unravel the now-completed Q2 e-commerce software earnings season.

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

The 5 e-commerce software stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 1.3% on average since the latest earnings results.

Slowest Q2: VeriSign (NASDAQ: VRSN)

While the company is not a domain registrar and does not directly sell domain names to end users, Verisign (NASDAQ: VRSN) operates and maintains the infrastructure to support domain names such as .com and .net.

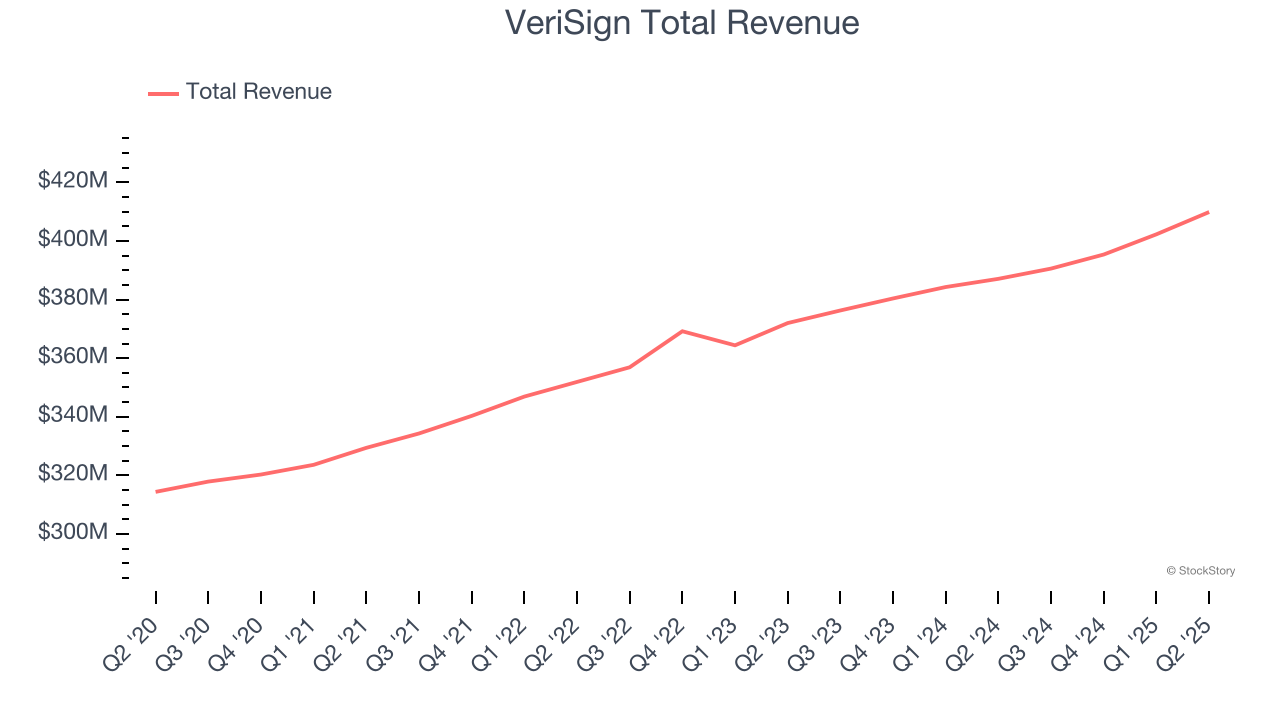

VeriSign reported revenues of $409.9 million, up 5.9% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with some shareholders anticipating a better outcome.

VeriSign delivered the weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is down 6.3% since reporting and currently trades at $268.88.

Is now the time to buy VeriSign? Access our full analysis of the earnings results here, it’s free.

Best Q2: Shopify (NASDAQ: SHOP)

Originally created as an internal tool for a snowboarding company, Shopify (NYSE: SHOP) provides a software platform for building and operating e-commerce businesses.

Shopify reported revenues of $2.68 billion, up 31.1% year on year, outperforming analysts’ expectations by 5.2%. The business had an exceptional quarter with a solid beat of analysts’ gross merchandise volume estimates and an impressive beat of analysts’ EBITDA estimates.

Shopify pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 18.1% since reporting. It currently trades at $150.11.

Is now the time to buy Shopify? Access our full analysis of the earnings results here, it’s free.

Wix (NASDAQ: WIX)

Founded in 2006 in Tel Aviv, Wix.com (NASDAQ: WIX) offers a free and easy to operate website building platform.

Wix reported revenues of $489.9 million, up 12.4% year on year, exceeding analysts’ expectations by 0.6%. Still, it was a mixed quarter as it posted a slight miss of analysts’ EBITDA estimates.

As expected, the stock is down 5.5% since the results and currently trades at $120.84.

Read our full analysis of Wix’s results here.

GoDaddy (NYSE: GDDY)

Founded by Bob Parsons after selling his first company to Intuit, GoDaddy (NYSE: GDDY) provides small and mid-sized businesses with the ability to buy a web domain and tools to create and manage a website.

GoDaddy reported revenues of $1.22 billion, up 8.3% year on year. This result topped analysts’ expectations by 0.9%. Taking a step back, it was a satisfactory quarter as it also logged a decent beat of analysts’ EBITDA estimates but bookings in line with analysts’ estimates.

GoDaddy had the weakest full-year guidance update among its peers. The company lost 75,000 customers and ended up with a total of 20.41 million. The stock is down 4.5% since reporting and currently trades at $143.60.

Read our full, actionable report on GoDaddy here, it’s free.

BigCommerce (NASDAQ: BIGC)

Founded in Sydney, Australia in 2009 by Mitchell Harper and Eddie Machaalani, BigCommerce (NASDAQ: BIGC) provides software for businesses to easily create online stores.

BigCommerce reported revenues of $84.43 million, up 3.2% year on year. This print surpassed analysts’ expectations by 1.3%. Overall, it was a strong quarter as it also put up a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ billings estimates.

BigCommerce had the slowest revenue growth among its peers. The stock is up 4.6% since reporting and currently trades at $4.99.

Read our full, actionable report on BigCommerce here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.