As the Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the healthcare providers & services industry, including AMN Healthcare Services (NYSE: AMN) and its peers.

The healthcare providers and services sector, from insurers to hospitals, benefits from consistent demand, generating stable revenue through premiums and patient services. However, it faces challenges from high operational and labor costs, reimbursement pressures that squeeze margins, and regulatory uncertainty. Looking ahead, an aging population with more chronic diseases and a shift toward value-based care create tailwinds. Digitization via telehealth, data analytics, and personalized medicine offers new revenue streams. Nonetheless, headwinds persist, including clinical labor shortages, ongoing reimbursement cuts, and regulatory scrutiny over pricing and quality.

The 40 healthcare providers & services stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 2% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 5.2% on average since the latest earnings results.

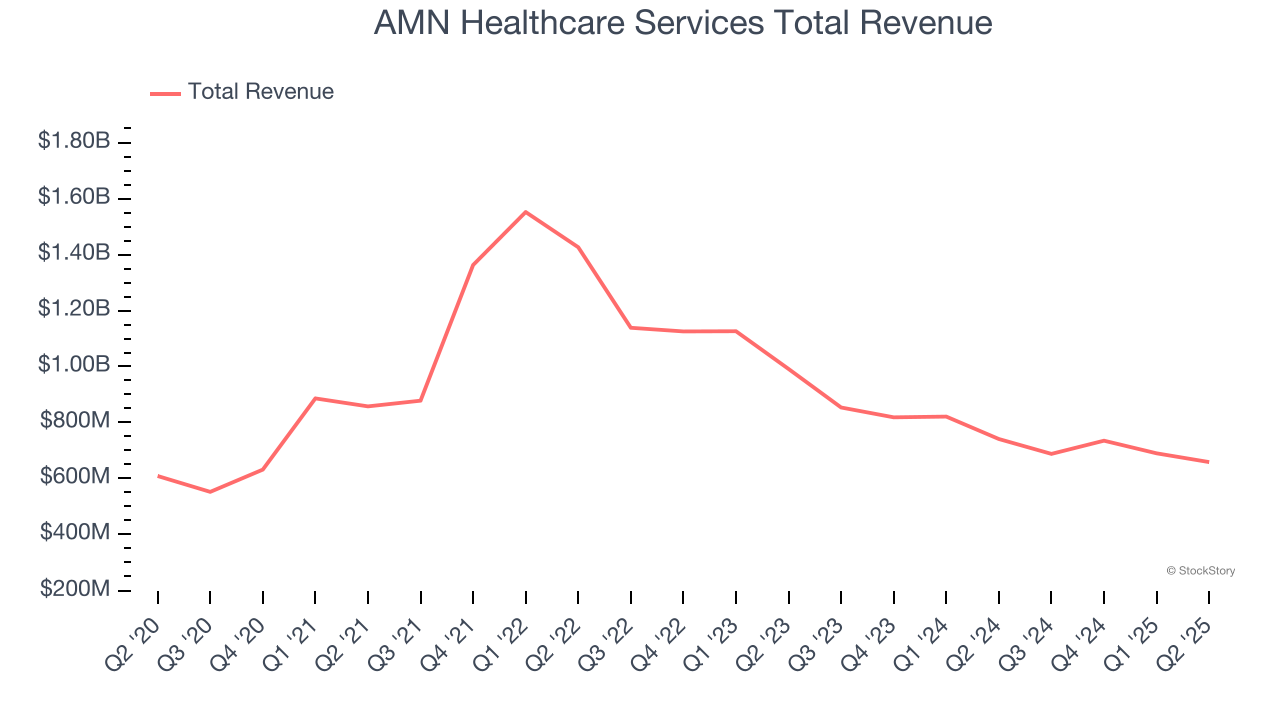

AMN Healthcare Services (NYSE: AMN)

With a network of thousands of healthcare professionals ranging from nurses to physicians to executives, AMN Healthcare (NYSE: AMN) provides healthcare workforce solutions including temporary staffing, permanent placement, and technology platforms for hospitals and healthcare facilities across the United States.

AMN Healthcare Services reported revenues of $658.2 million, down 11.1% year on year. This print exceeded analysts’ expectations by 0.8%. Overall, it was a strong quarter for the company with a beat of analysts’ EPS estimates and sales volume in line with analysts’ estimates.

“Our second quarter financial performance was solid, and we continue to make progress on our ability to serve all market channels and align with clients as their preferred workforce partner,” said Cary Grace, President and Chief Executive Officer of AMN Healthcare.

AMN Healthcare Services delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 10.5% since reporting and currently trades at $18.67.

Is now the time to buy AMN Healthcare Services? Access our full analysis of the earnings results here, it’s free.

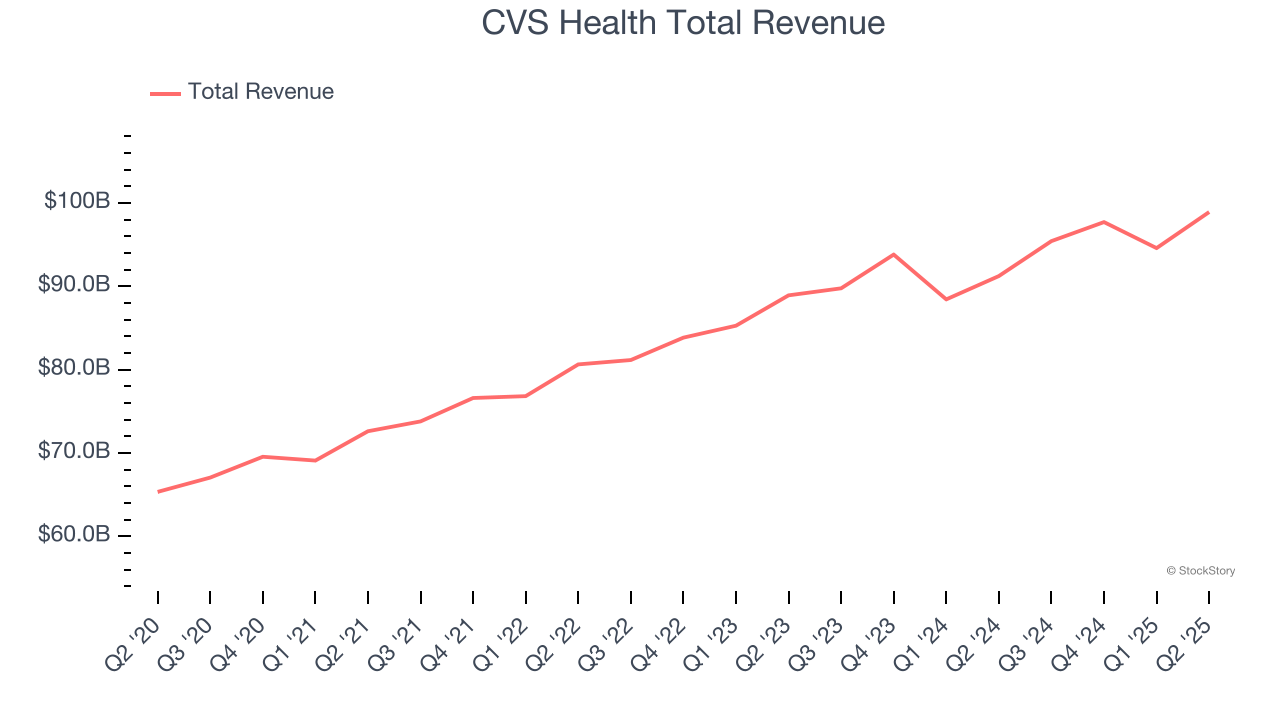

Best Q2: CVS Health (NYSE: CVS)

With over 9,000 retail pharmacy locations serving as neighborhood health destinations across America, CVS Health (NYSE: CVS) operates retail pharmacies, provides pharmacy benefit management services, and offers health insurance through its Aetna subsidiary.

CVS Health reported revenues of $98.92 billion, up 8.4% year on year, outperforming analysts’ expectations by 5.1%. The business had a stunning quarter with an impressive beat of analysts’ same-store sales estimates and a beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 8.6% since reporting. It currently trades at $67.71.

Is now the time to buy CVS Health? Access our full analysis of the earnings results here, it’s free.

Oscar Health (NYSE: OSCR)

Founded in 2012 to simplify the notoriously complex American healthcare system, Oscar Health (NYSE: OSCR) is a technology-focused health insurance company that offers individual and small group health plans through its cloud-native platform.

Oscar Health reported revenues of $2.86 billion, up 29% year on year, falling short of analysts’ expectations by 3.5%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

Interestingly, the stock is up 9.2% since the results and currently trades at $15.09.

Read our full analysis of Oscar Health’s results here.

Pediatrix Medical Group (NYSE: MD)

With a network of approximately 2,620 affiliated physicians caring for some of the most vulnerable patients, Pediatrix Medical Group (NYSE: MD) provides specialized physician services focused on neonatal, maternal-fetal, pediatric cardiology and other pediatric subspecialty care across 37 states.

Pediatrix Medical Group reported revenues of $468.8 million, down 7% year on year. This number surpassed analysts’ expectations by 1%. Overall, it was an exceptional quarter as it also recorded a solid beat of analysts’ same-store sales estimates and a beat of analysts’ EPS estimates.

The stock is up 26.3% since reporting and currently trades at $15.54.

Read our full, actionable report on Pediatrix Medical Group here, it’s free.

Encompass Health (NYSE: EHC)

With a network of 161 specialized facilities across 37 states and Puerto Rico, Encompass Health (NYSE: EHC) operates inpatient rehabilitation hospitals that help patients recover from strokes, hip fractures, and other debilitating conditions.

Encompass Health reported revenues of $1.46 billion, up 12% year on year. This print topped analysts’ expectations by 2.2%. It was a very strong quarter as it also put up an impressive beat of analysts’ full-year EPS guidance estimates and a beat of analysts’ EPS estimates.

The stock is up 9.6% since reporting and currently trades at $119.65.

Read our full, actionable report on Encompass Health here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.