Wrapping up Q2 earnings, we look at the numbers and key takeaways for the property & casualty insurance stocks, including Bowhead Specialty (NYSE: BOW) and its peers.

Property & Casualty (P&C) insurers protect individuals and businesses against financial loss from damage to property or from legal liability. This is a cyclical industry, and the sector benefits when there is 'hard market', characterized by strong premium rate increases that outpace loss and cost inflation, resulting in robust underwriting margins. The opposite is true in a 'soft market'. Interest rates also matter, as they determine the yields earned on fixed-income portfolios. On the other hand, P&C insurers face a major secular headwind from the increasing frequency and severity of catastrophe losses due to climate change. Furthermore, the liability side of the business is pressured by 'social inflation'—the trend of rising litigation costs and larger jury awards.

The 33 property & casualty insurance stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 1.5%.

In light of this news, share prices of the companies have held steady as they are up 4.2% on average since the latest earnings results.

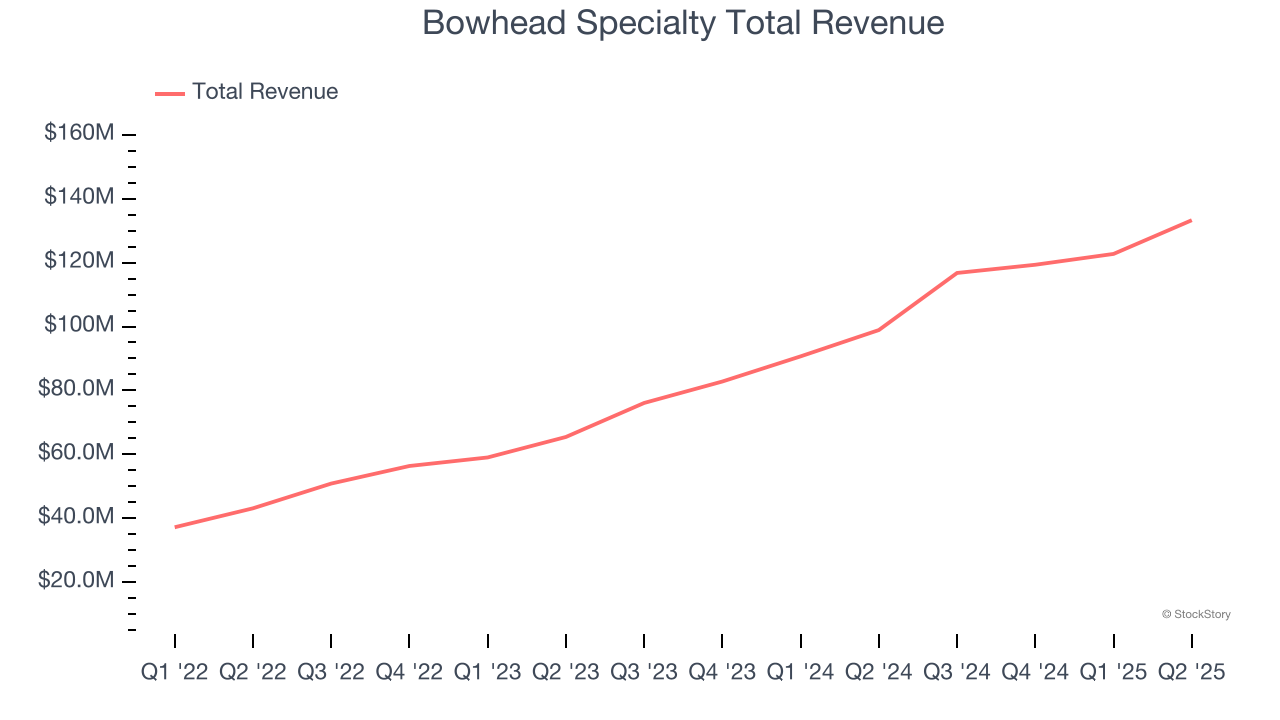

Bowhead Specialty (NYSE: BOW)

Named after the Arctic bowhead whale known for navigating challenging waters, Bowhead Specialty Holdings (NYSE: BOW) is a specialty insurance company that provides customized coverage for complex and high-risk commercial sectors.

Bowhead Specialty reported revenues of $133.3 million, up 34.7% year on year. This print exceeded analysts’ expectations by 1.6%. Despite the top-line beat, it was still a slower quarter for the company with a slight miss of analysts’ net premiums earned estimates and EPS in line with analysts’ estimates.

Unsurprisingly, the stock is down 5.4% since reporting and currently trades at $30.76.

Is now the time to buy Bowhead Specialty? Access our full analysis of the earnings results here, it’s free.

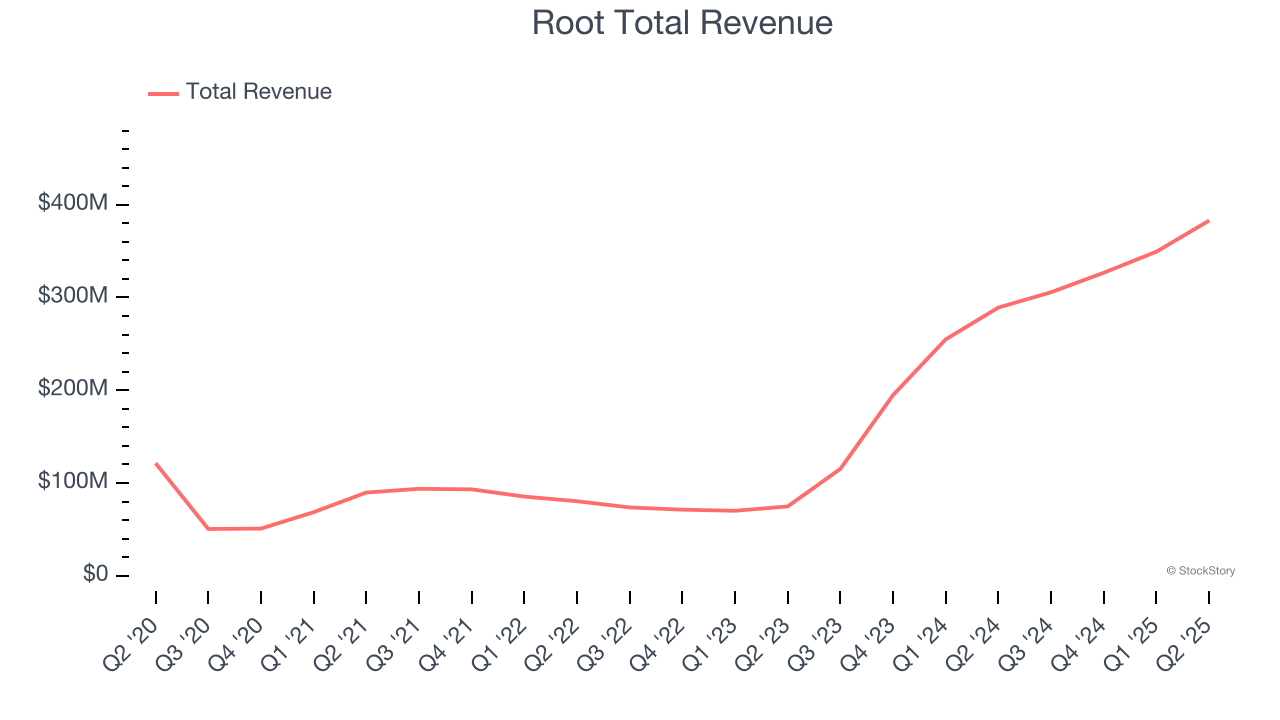

Best Q2: Root (NASDAQ: ROOT)

Pioneering a data-driven approach that rewards good driving habits, Root (NASDAQ: ROOT) is a technology-driven auto insurance company that uses mobile apps to acquire customers and data science to price policies based on individual driving behavior.

Root reported revenues of $382.9 million, up 32.4% year on year, outperforming analysts’ expectations by 7.5%. The business had an incredible quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ net premiums earned estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 29.4% since reporting. It currently trades at $86.90.

Is now the time to buy Root? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Selective Insurance Group (NASDAQ: SIGI)

Founded in 1926 during the early days of automobile insurance, Selective Insurance Group (NASDAQ: SIGI) is a property and casualty insurance company that sells commercial, personal, and excess and surplus lines insurance products through independent agents.

Selective Insurance Group reported revenues of $127.9 million, down 89.3% year on year, falling short of analysts’ expectations by 90.3%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates and a significant miss of analysts’ book value per share estimates.

Selective Insurance Group delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 14.6% since the results and currently trades at $77.29.

Read our full analysis of Selective Insurance Group’s results here.

Cincinnati Financial (NASDAQ: CINF)

Founded in 1950 by independent insurance agents seeking stable market options for their clients, Cincinnati Financial (NASDAQ: CINF) provides property casualty insurance, life insurance, and related financial services through independent agencies across 46 states.

Cincinnati Financial reported revenues of $3.25 billion, up 34.9% year on year. This result topped analysts’ expectations by 12.8%. It was an exceptional quarter as it also produced a beat of analysts’ EPS estimates and a decent beat of analysts’ book value per share estimates.

The stock is up 4.4% since reporting and currently trades at $153.63.

Read our full, actionable report on Cincinnati Financial here, it’s free.

Stewart Information Services (NYSE: STC)

Founded in 1893 during America's westward expansion when property records were often disputed, Stewart Information Services (NYSE: STC) provides title insurance and real estate services, helping homebuyers, sellers, and lenders verify property ownership and protect against title defects.

Stewart Information Services reported revenues of $723.4 million, up 20.1% year on year. This number surpassed analysts’ expectations by 9.2%. It was an exceptional quarter as it also recorded a beat of analysts’ EPS estimates.

The stock is up 19% since reporting and currently trades at $70.87.

Read our full, actionable report on Stewart Information Services here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.