Lincoln Electric has had an impressive run over the past six months as its shares have beaten the S&P 500 by 9.2%. The stock now trades at $239.43, marking a 15.5% gain. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy Lincoln Electric, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Lincoln Electric Not Exciting?

Despite the momentum, we're sitting this one out for now. Here are three reasons why you should be careful with LECO and a stock we'd rather own.

1. Core Business Falling Behind as Demand Declines

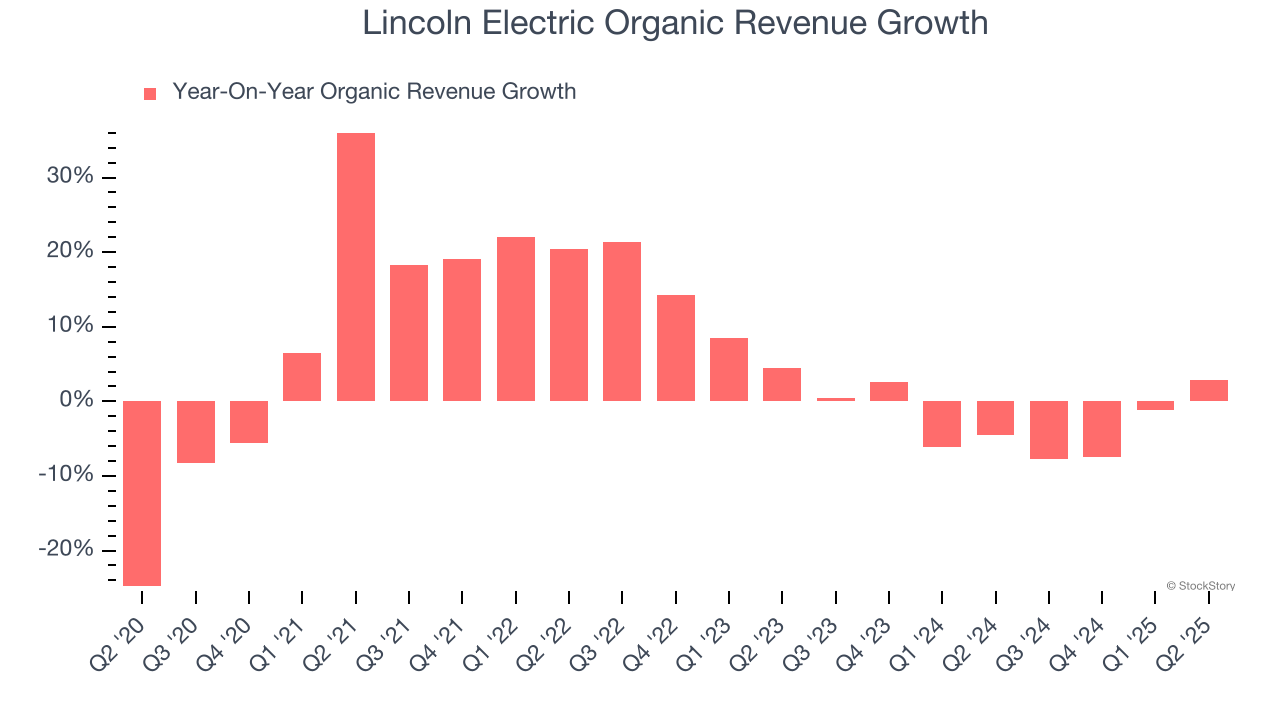

Investors interested in Professional Tools and Equipment companies should track organic revenue in addition to reported revenue. This metric gives visibility into Lincoln Electric’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Lincoln Electric’s organic revenue averaged 2.7% year-on-year declines. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Lincoln Electric might have to lean into acquisitions to grow, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Lincoln Electric’s revenue to rise by 6.4%. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below average for the sector.

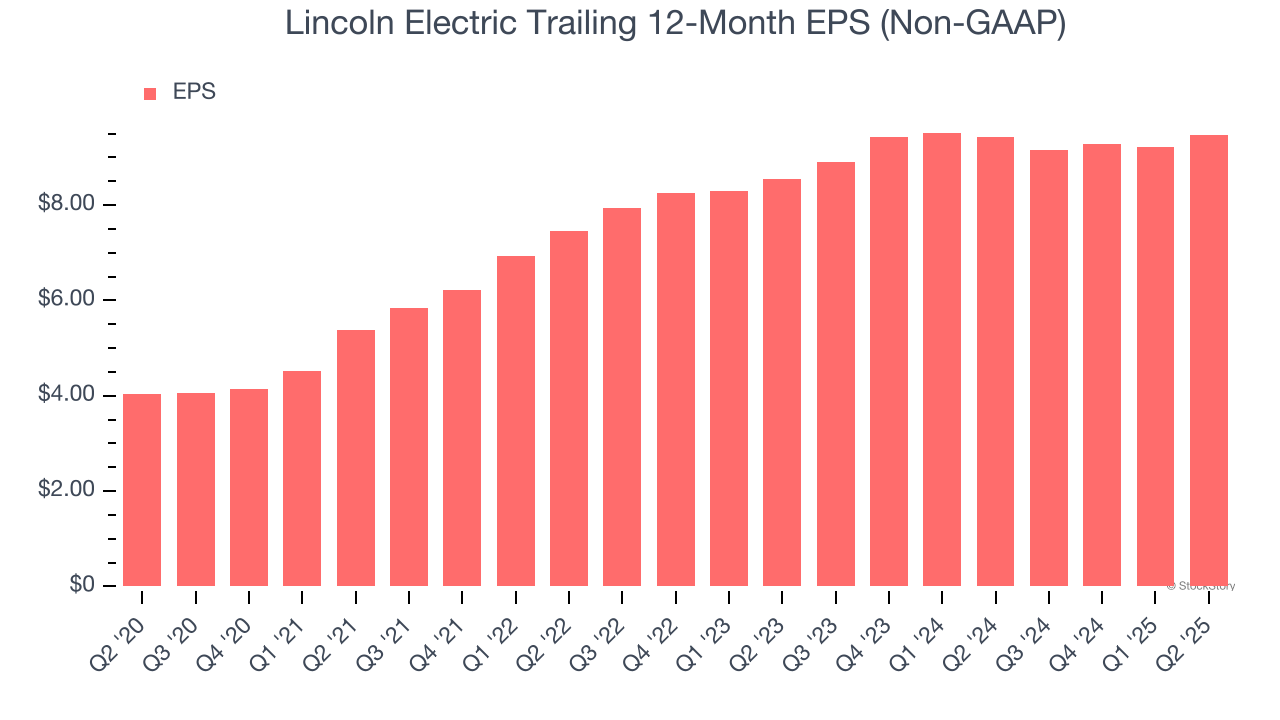

3. Recent EPS Growth Below Our Standards

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Lincoln Electric’s EPS grew at an unimpressive 5.2% compounded annual growth rate over the last two years. On the bright side, this performance was higher than its 1.7% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

Lincoln Electric isn’t a terrible business, but it doesn’t pass our bar. With its shares outperforming the market lately, the stock trades at 24.5× forward P/E (or $239.43 per share). At this valuation, there’s a lot of good news priced in - we think other companies feature superior fundamentals at the moment. We’d suggest looking at the most entrenched endpoint security platform on the market.

Stocks We Would Buy Instead of Lincoln Electric

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.