Since February 2025, Visa has been in a holding pattern, posting a small loss of 1.6% while floating around $344.30. The stock also fell short of the S&P 500’s 6.4% gain during that period.

Given the weaker price action, is now a good time to buy V? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free.

Why Are We Positive On Visa?

Processing over 829 million transactions daily and connecting billions of cards to 150 million merchant locations worldwide, Visa (NYSE: V) operates one of the world's largest electronic payments networks, facilitating secure money movement across more than 200 countries through its VisaNet processing platform.

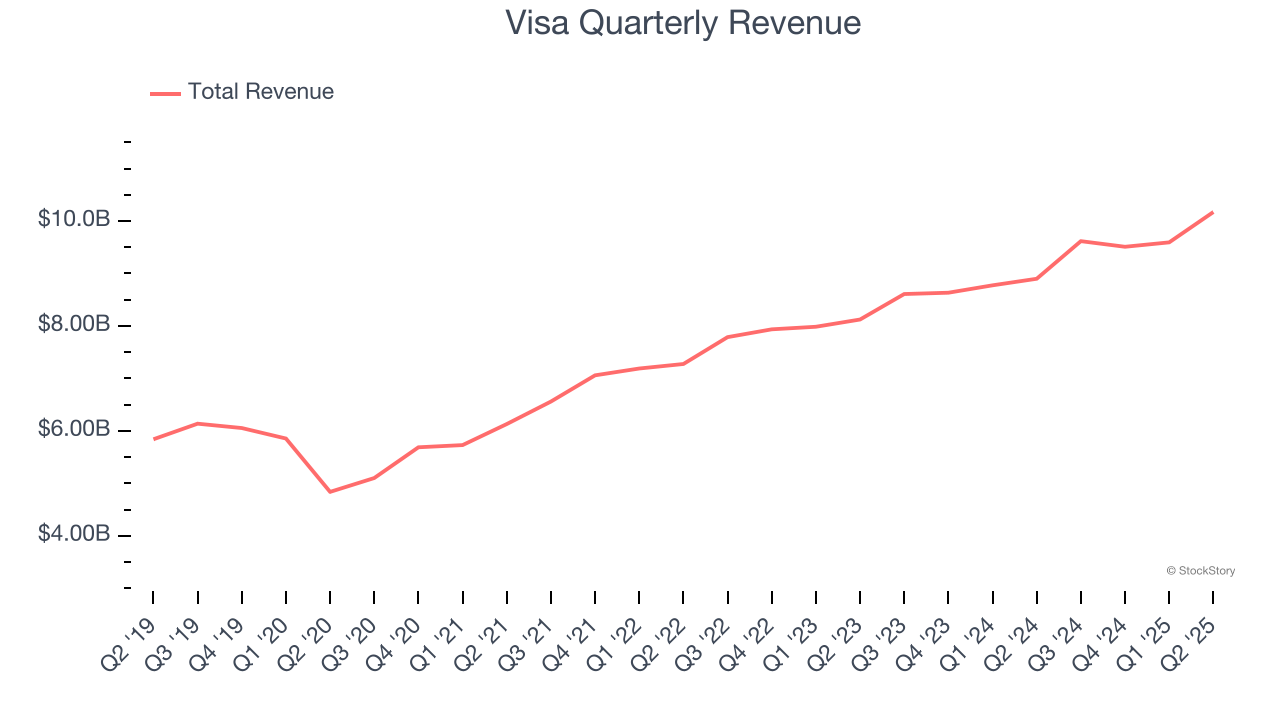

1. Long-Term Revenue Growth Shows Strong Momentum

From lending activities to service fees, most banks build their revenue model around two income sources. Interest rate spreads between loans and deposits create the first stream, with the second coming from charges on everything from basic bank accounts to complex investment banking transactions.

Thankfully, Visa’s 11.2% annualized revenue growth over the last five years was solid. Its growth beat the average financials company and shows its offerings resonate with customers.

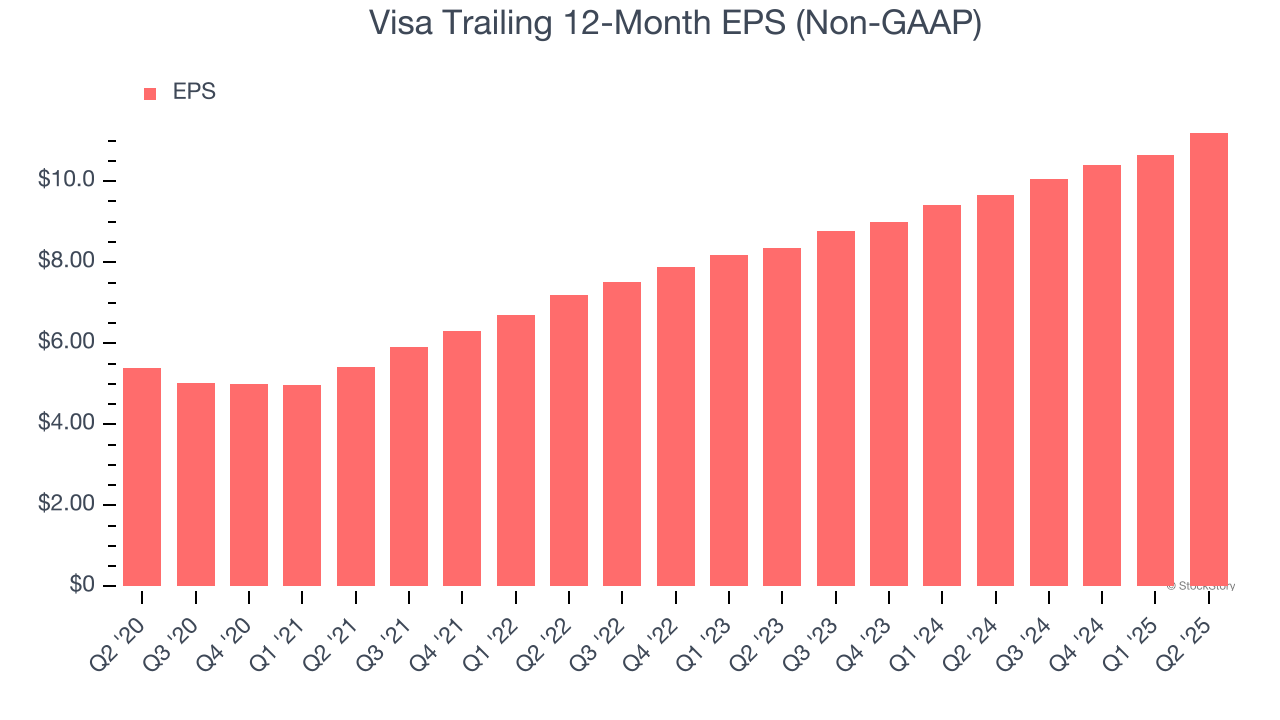

2. EPS Increasing Steadily

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Visa’s EPS grew at a solid 15.8% compounded annual growth rate over the last five years, higher than its 11.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

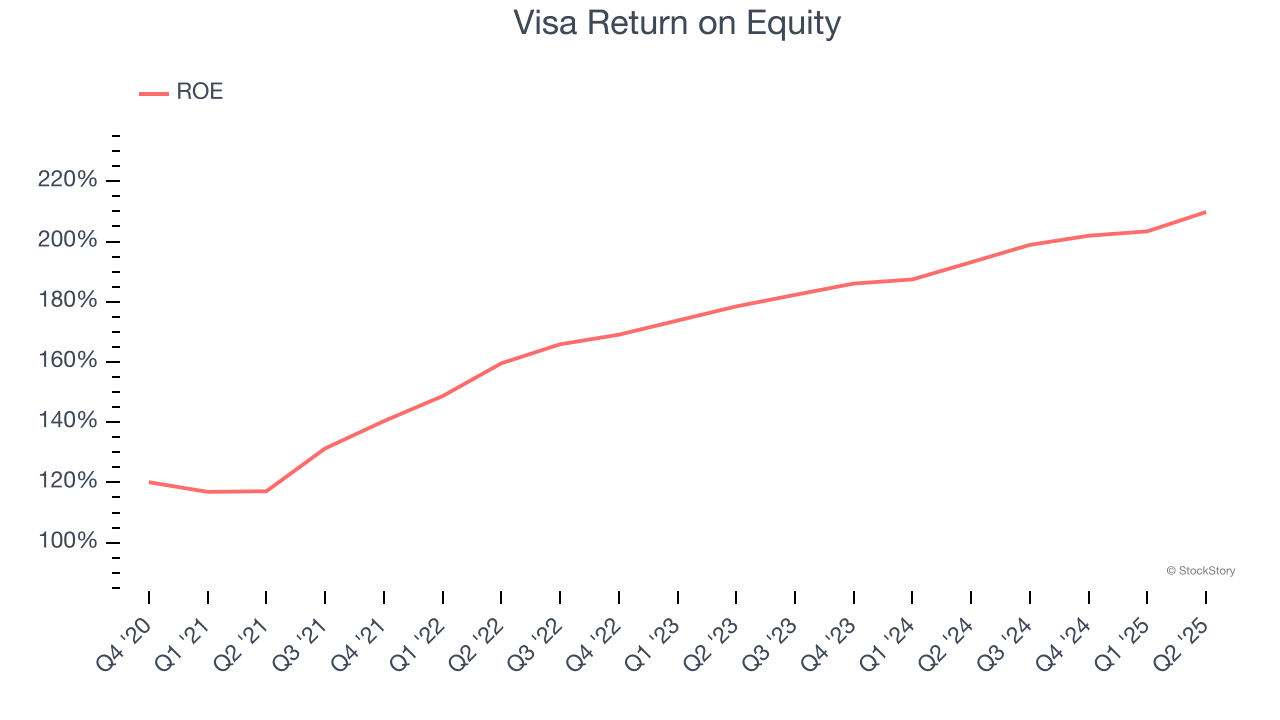

3. Stellar ROE Showcases Lucrative Growth Opportunities

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, Visa has averaged an ROE of 42.9%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Visa has a strong competitive moat.

Final Judgment

These are just a few reasons Visa is a high-quality business worth owning. With its shares lagging the market recently, the stock trades at 27.8× forward P/E (or $344.30 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.