Over the past six months, Zoetis’s shares (currently trading at $156.80) have posted a disappointing 7% loss, well below the S&P 500’s 8.6% gain. This might have investors contemplating their next move.

Following the drawdown, is this a buying opportunity for ZTS? Find out in our full research report, it’s free.

Why Does ZTS Stock Spark Debate?

Originally spun off from Pfizer in 2013 as the world's largest pure-play animal health company, Zoetis (NYSE: ZTS) discovers, develops, and sells medicines, vaccines, diagnostic products, and services for pets and livestock animals worldwide.

Two Positive Attributes:

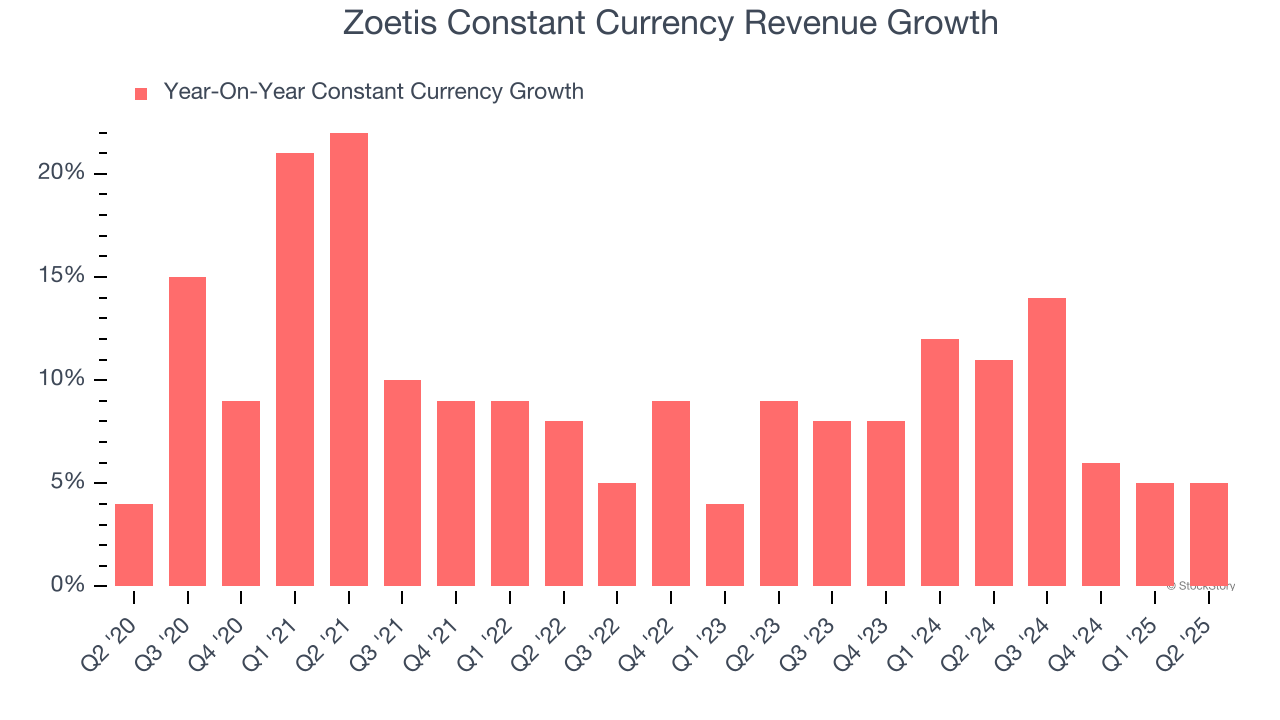

1. Constant Currency Revenue Drives Growth

In addition to reported revenue, constant currency revenue is a useful data point for analyzing Branded Pharmaceuticals companies. This metric excludes currency movements, which are outside of Zoetis’s control and are not indicative of underlying demand.

Over the last two years, Zoetis’s constant currency revenue averaged 8.6% year-on-year growth. This performance was solid and shows it can expand steadily on a global scale regardless of the macroeconomic environment.

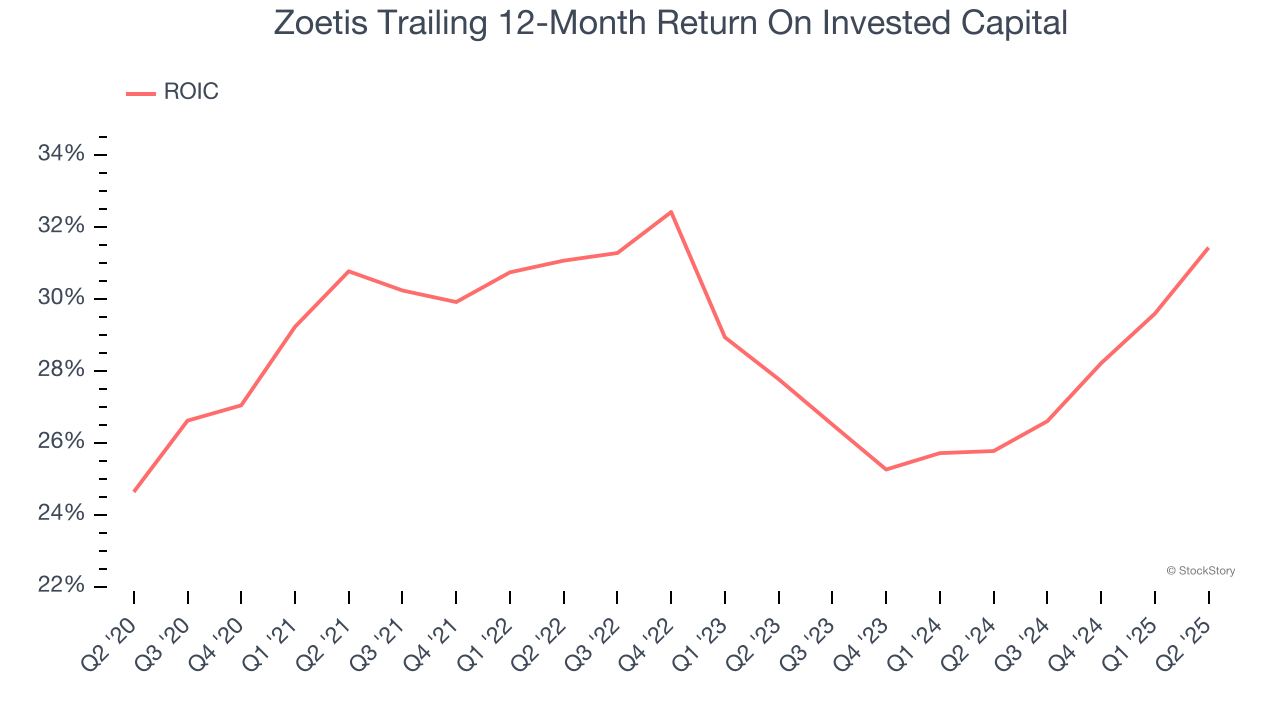

2. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Zoetis’s five-year average ROIC was 29.4%, placing it among the best healthcare companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

One Reason to be Careful:

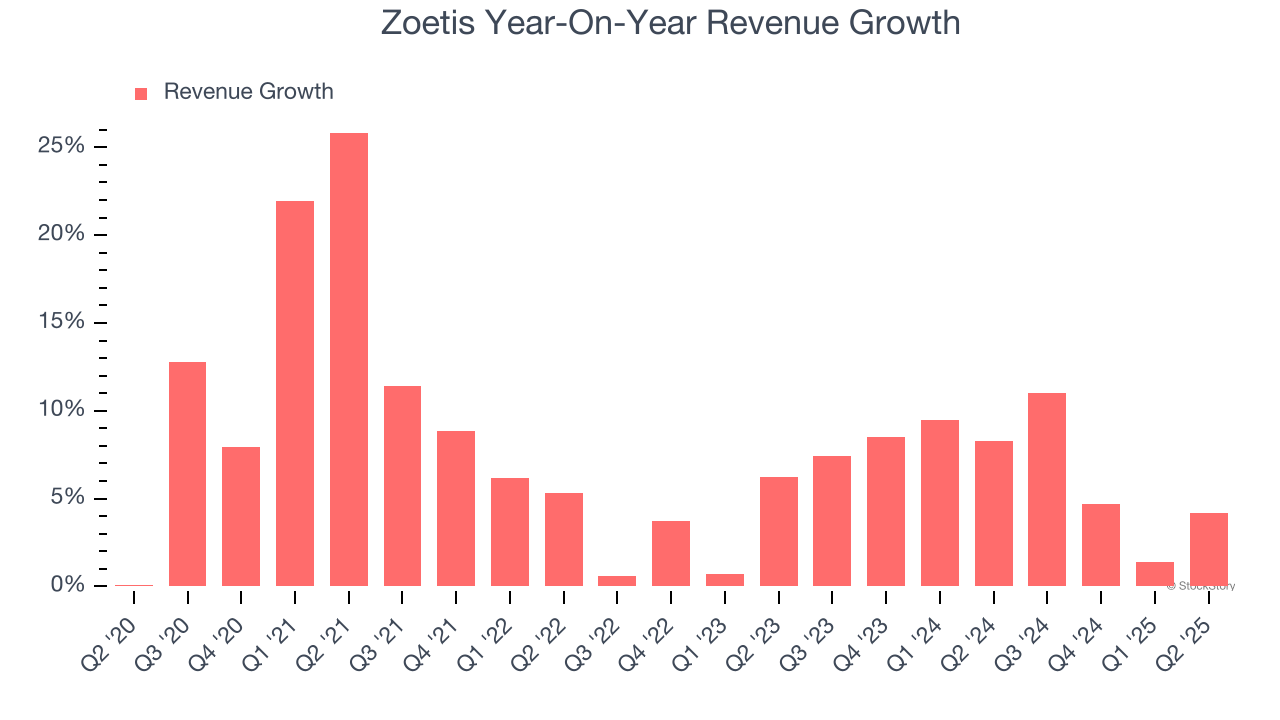

Lackluster Revenue Growth

We at StockStory place the most emphasis on long-term growth, but within healthcare, a stretched historical view may miss recent innovations or disruptive industry trends. Zoetis’s recent performance shows its demand has slowed as its annualized revenue growth of 6.8% over the last two years was below its five-year trend.

Final Judgment

Zoetis has huge potential even though it has some open questions. With the recent decline, the stock trades at 24.2× forward P/E (or $156.80 per share). Is now a good time to initiate a position? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.