Pet-focused retailer Petco (NASDAQ: WOOF) met Wall Street’s revenue expectations in Q2 CY2025, but sales fell by 2.3% year on year to $1.49 billion. Its GAAP profit of $0.05 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Petco? Find out by accessing our full research report, it’s free.

Petco (WOOF) Q2 CY2025 Highlights:

- Revenue: $1.49 billion vs analyst estimates of $1.49 billion (2.3% year-on-year decline, in line)

- EPS (GAAP): $0.05 vs analyst estimates of -$0.01 (significant beat)

- Adjusted EBITDA: $113.9 million vs analyst estimates of $94.17 million (7.6% margin, 20.9% beat)

- EBITDA guidance for the full year is $390 million at the midpoint, above analyst estimates of $384.7 million

- Operating Margin: 2.9%, up from 0.2% in the same quarter last year

- Free Cash Flow Margin: 3.6%, similar to the same quarter last year

- Same-Store Sales fell 1.4% year on year (0.3% in the same quarter last year)

- Market Capitalization: $892.8 million

"For the second quarter we once again delivered against our commitments, enabling us to raise our earnings outlook for the full year. The first half of this year established a solid foundation for our transformation as we continued to strengthen our economic model and improve retail operating fundamentals," said Joel Anderson, Petco's Chief Executive Officer.

Company Overview

Historically known for its window displays of pets for sale or adoption, Petco (NASDAQ: WOOF) is a specialty retailer of pet food and supplies as well as a provider of services such as wellness checks and grooming.

Revenue Growth

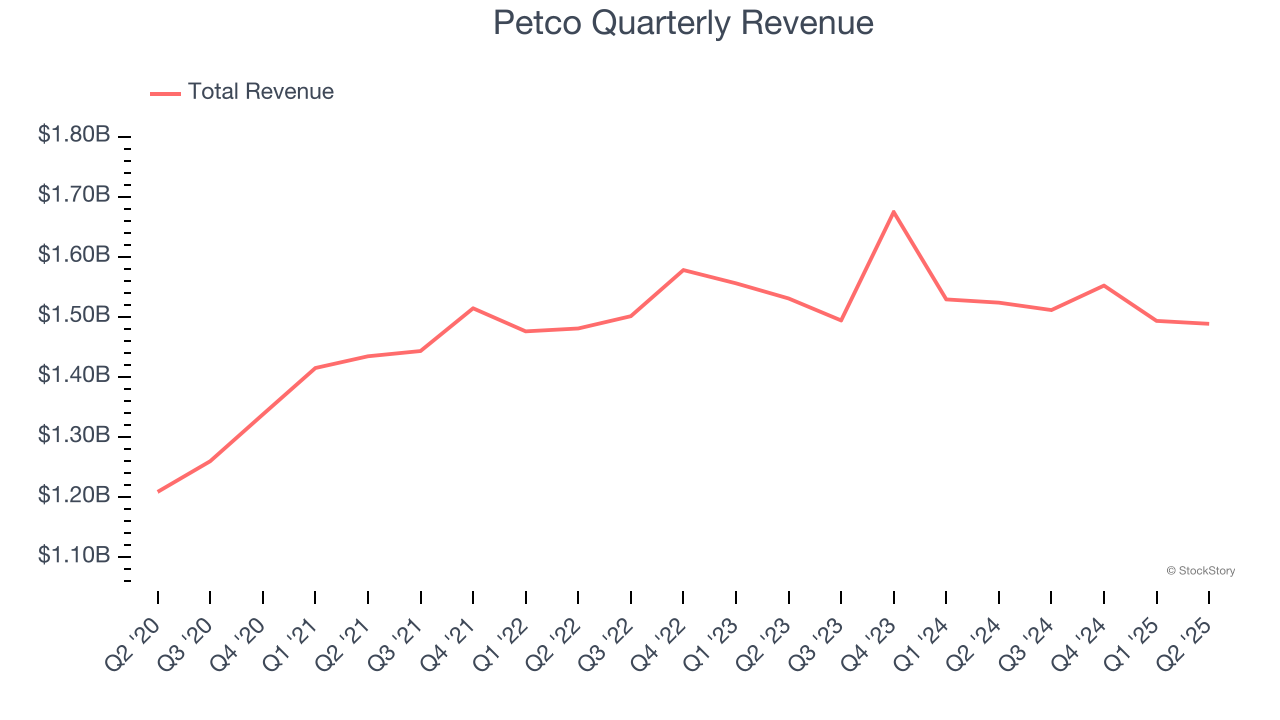

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $6.05 billion in revenue over the past 12 months, Petco is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, Petco grew its sales at a tepid 5.3% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts) as it didn’t open many new stores.

This quarter, Petco reported a rather uninspiring 2.3% year-on-year revenue decline to $1.49 billion of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last six years. This projection is underwhelming and suggests its products will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Store Performance

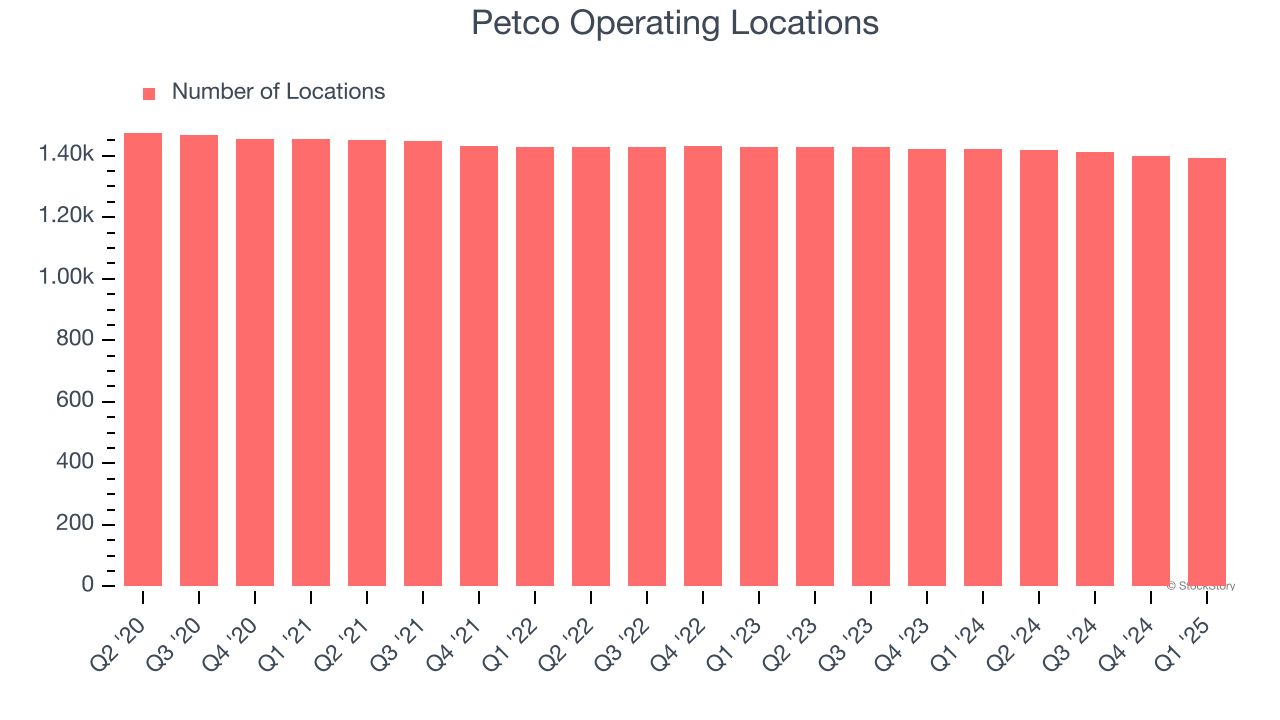

Number of Stores

Petco has kept its store count flat over the last two years while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

Note that Petco reports its store count intermittently, so some data points are missing in the chart below.

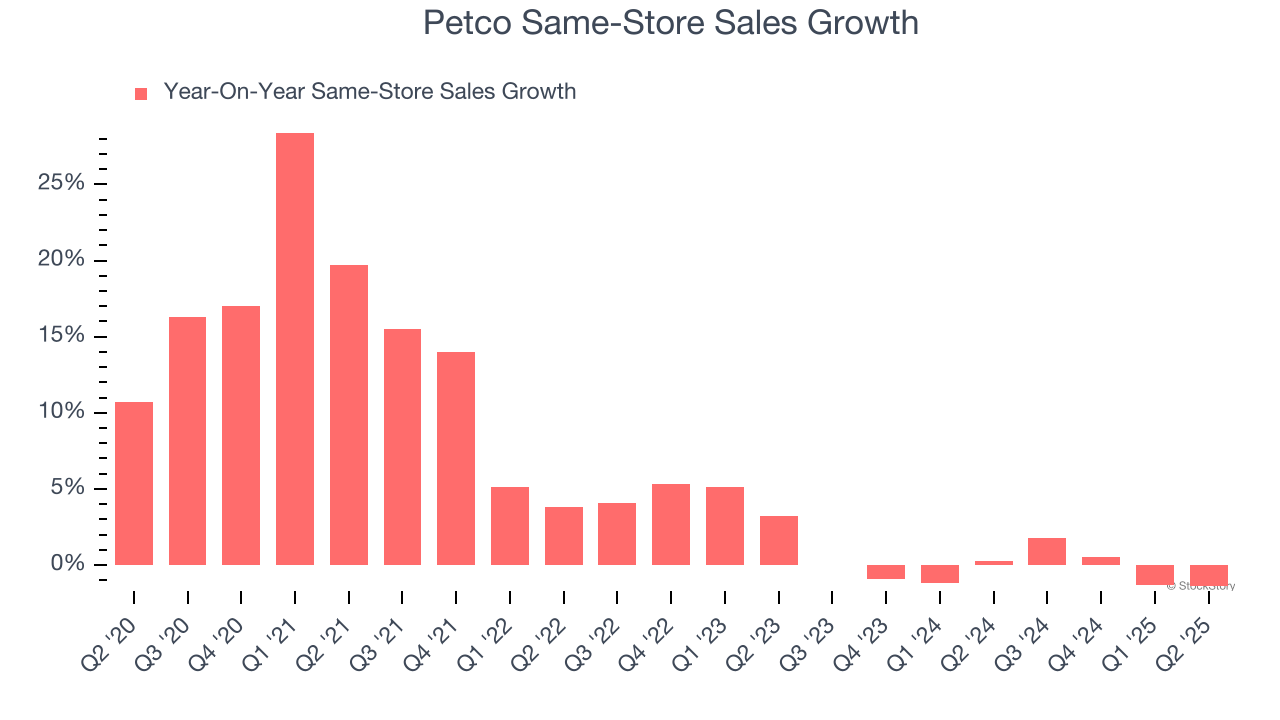

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Petco’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. This performance isn’t ideal, and we’d be skeptical if Petco starts opening new stores to artificially boost revenue growth.

In the latest quarter, Petco’s same-store sales fell by 1.4% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from Petco’s Q2 Results

It was good to see Petco beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 15.2% to $3.72 immediately after reporting.

Petco had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.