Lake City Bank currently trades at $68.73 per share and has shown little upside over the past six months, posting a middling return of 3.5%. The stock also fell short of the S&P 500’s 9.2% gain during that period.

Is there a buying opportunity in Lake City Bank, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Lake City Bank Not Exciting?

We're swiping left on Lake City Bank for now. Here are three reasons we avoid LKFN and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

In general, banks make money from two primary sources. The first is net interest income, which is interest earned on loans, mortgages, and investments in securities minus interest paid out on deposits. The second source is non-interest income, which can come from bank account, credit card, wealth management, investing banking, and trading fees.

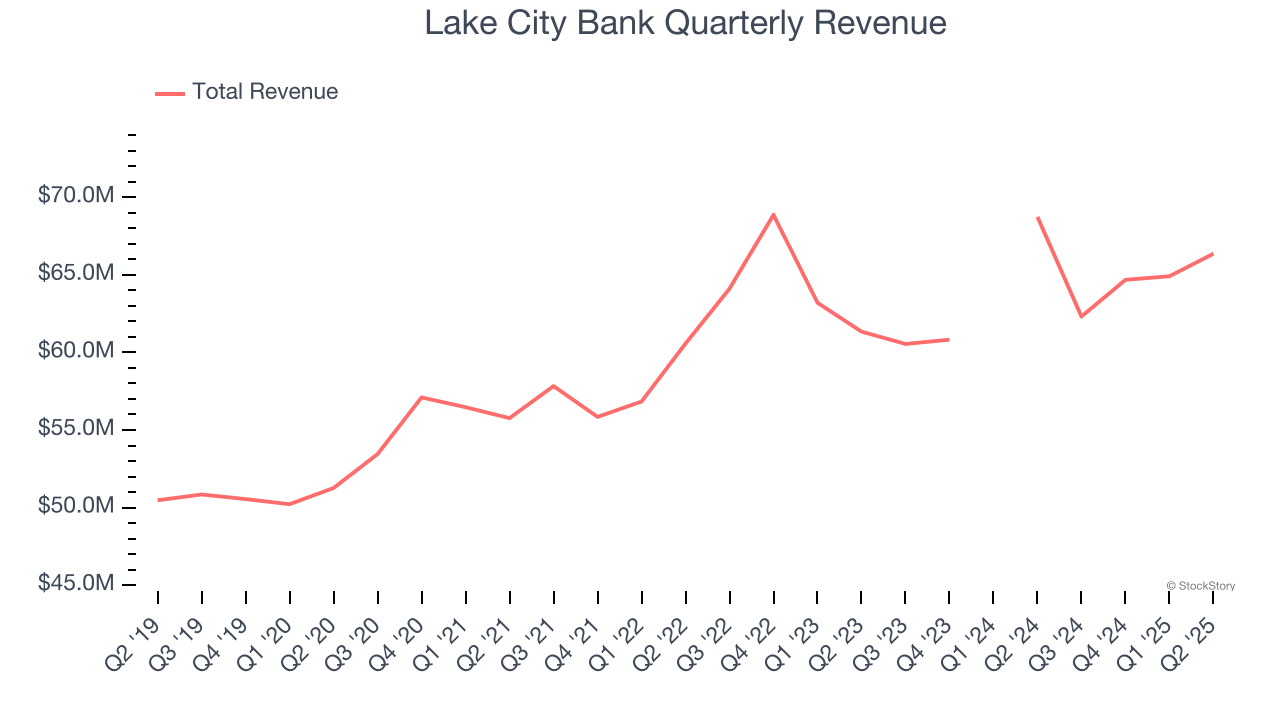

Over the last five years, Lake City Bank grew its revenue at a mediocre 4.9% compounded annual growth rate. This was below our standard for the banking sector.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.2. Net Interest Income Points to Soft Demand

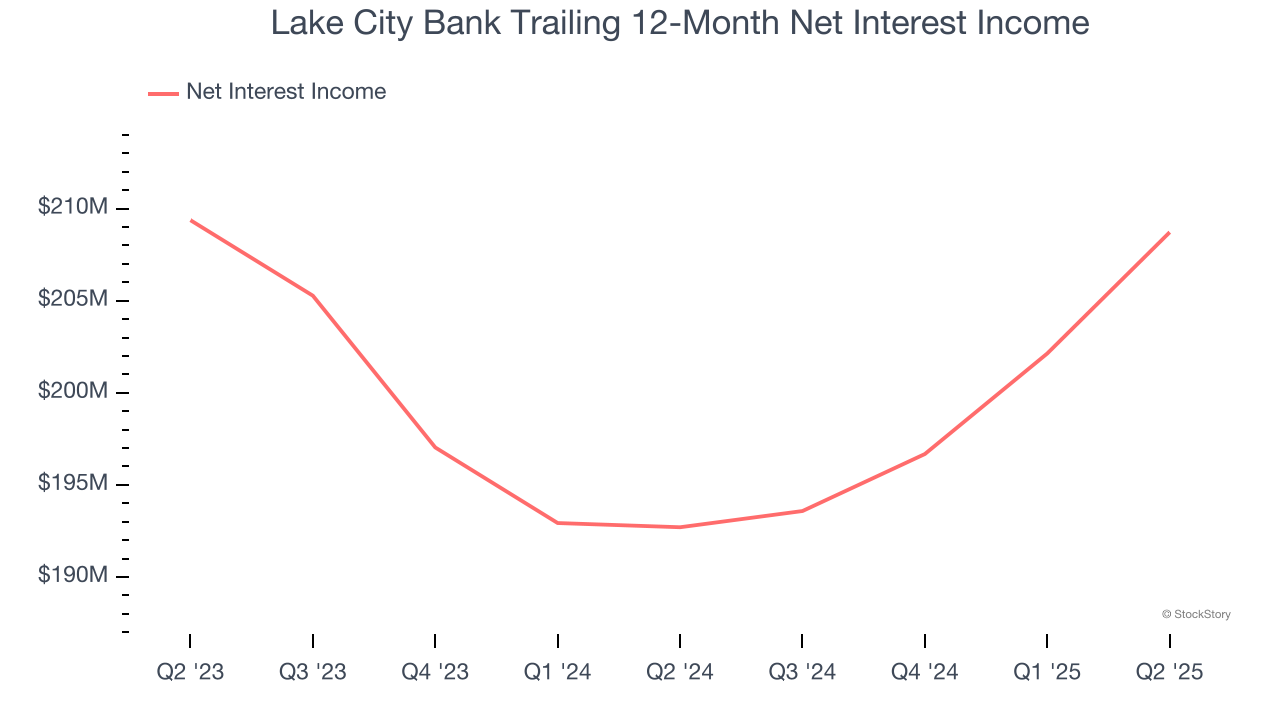

Markets consistently prioritize net interest income over non-recurring fees, recognizing its superior quality compared to the more unpredictable revenue streams.

Lake City Bank’s net interest income has grown at a 6.6% annualized rate over the last five years, slightly worse than the broader banking industry. Its growth was driven by an increase in its net interest margin, which represents how much a bank earns in relation to its outstanding loans, as its loan book shrank throughout that period.

3. Substandard TBVPS Growth Indicates Limited Asset Expansion

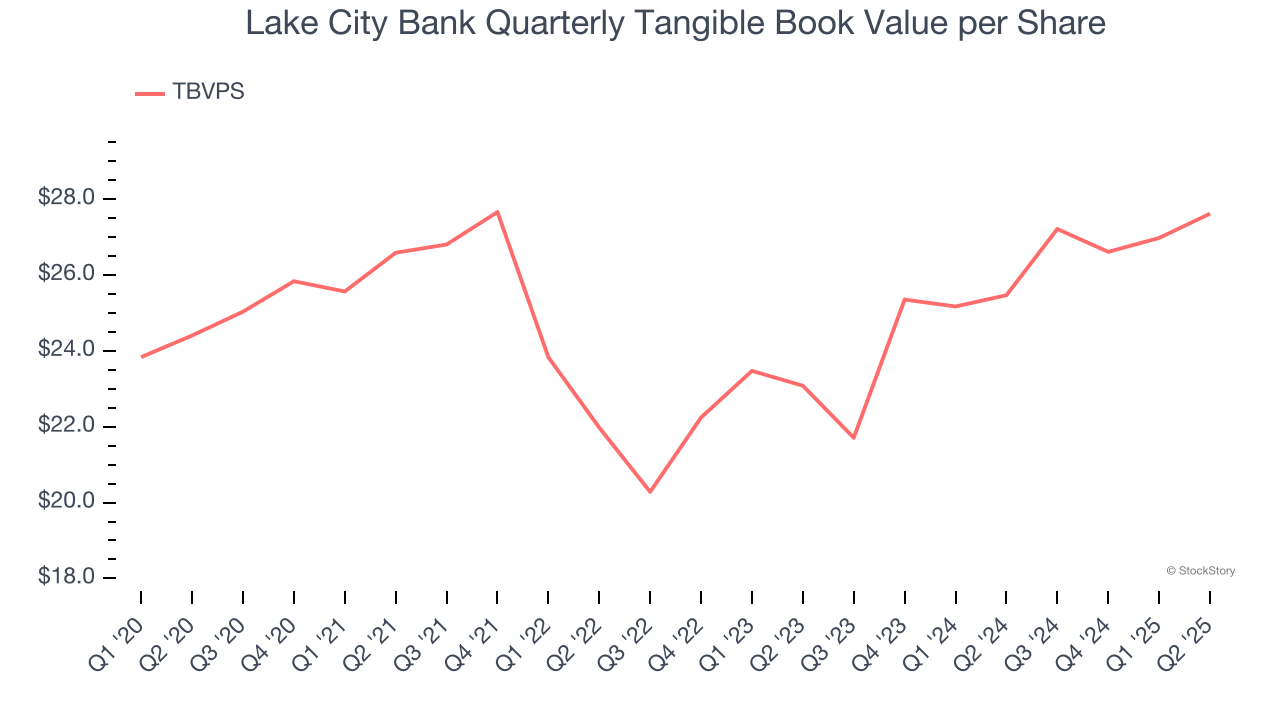

In the banking industry, tangible book value per share (TBVPS) provides the clearest picture of shareholder value, as it focuses on concrete assets while excluding intangible items that may not hold value during challenging times.

To the detriment of investors, Lake City Bank’s TBVPS grew at a mediocre 9.4% annual clip over the last two years.

Final Judgment

Lake City Bank isn’t a terrible business, but it doesn’t pass our bar. With its shares underperforming the market lately, the stock trades at 2.4× forward P/B (or $68.73 per share). At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere. Let us point you toward the most entrenched endpoint security platform on the market.

Stocks We Like More Than Lake City Bank

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.