The Bancorp currently trades at $62 per share and has shown little upside over the past six months, posting a small loss of 0.5%.

Is now the time to buy TBBK? Find out in our full research report, it’s free.

Why Is TBBK a Good Business?

Operating behind the scenes of many popular fintech apps and prepaid cards you might use daily, The Bancorp (NASDAQ: TBBK) is a bank holding company that specializes in providing banking services to fintech companies and offering specialty lending products.

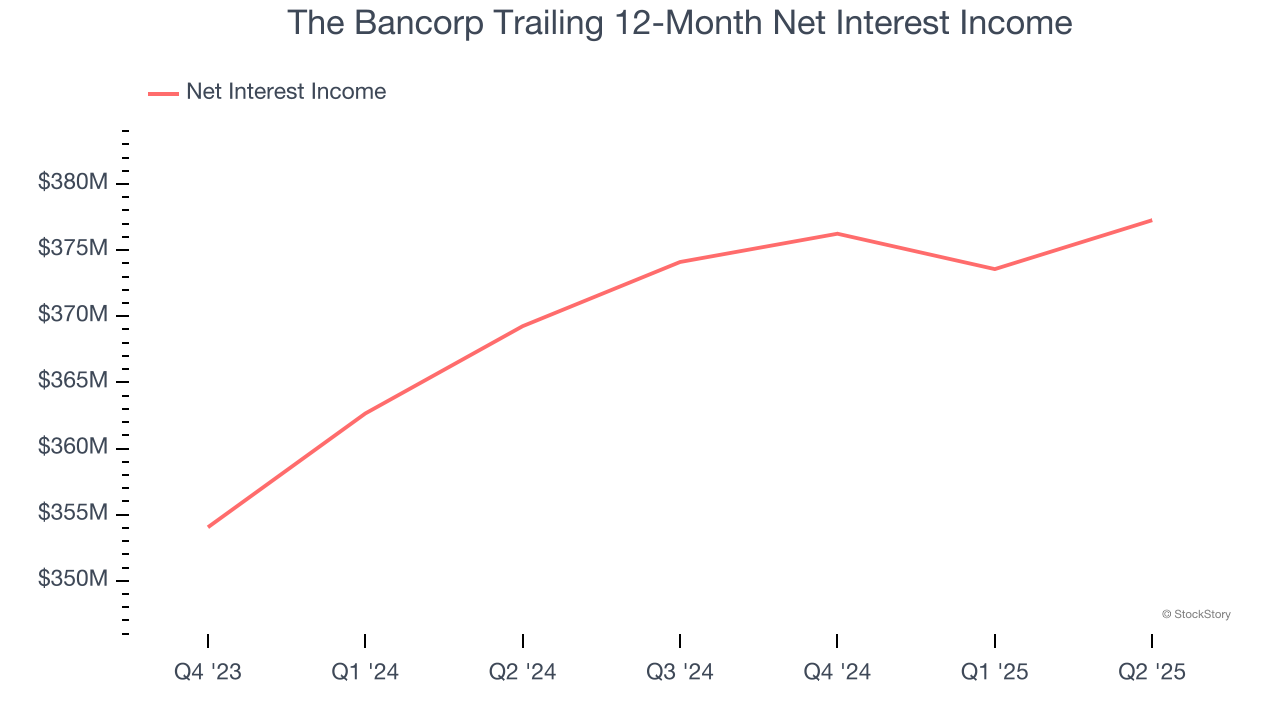

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

Net interest income commands greater market attention due to its reliability and consistency, whereas one-time fees are often seen as lower-quality revenue that lacks the same dependable characteristics.

The Bancorp’s net interest income has grown at a 15.2% annualized rate over the last five years, better than the broader bank industry. Its growth was driven by both an increase in its outstanding loans and net interest margin, which represents how much a bank earns in relation to its outstanding loan book.

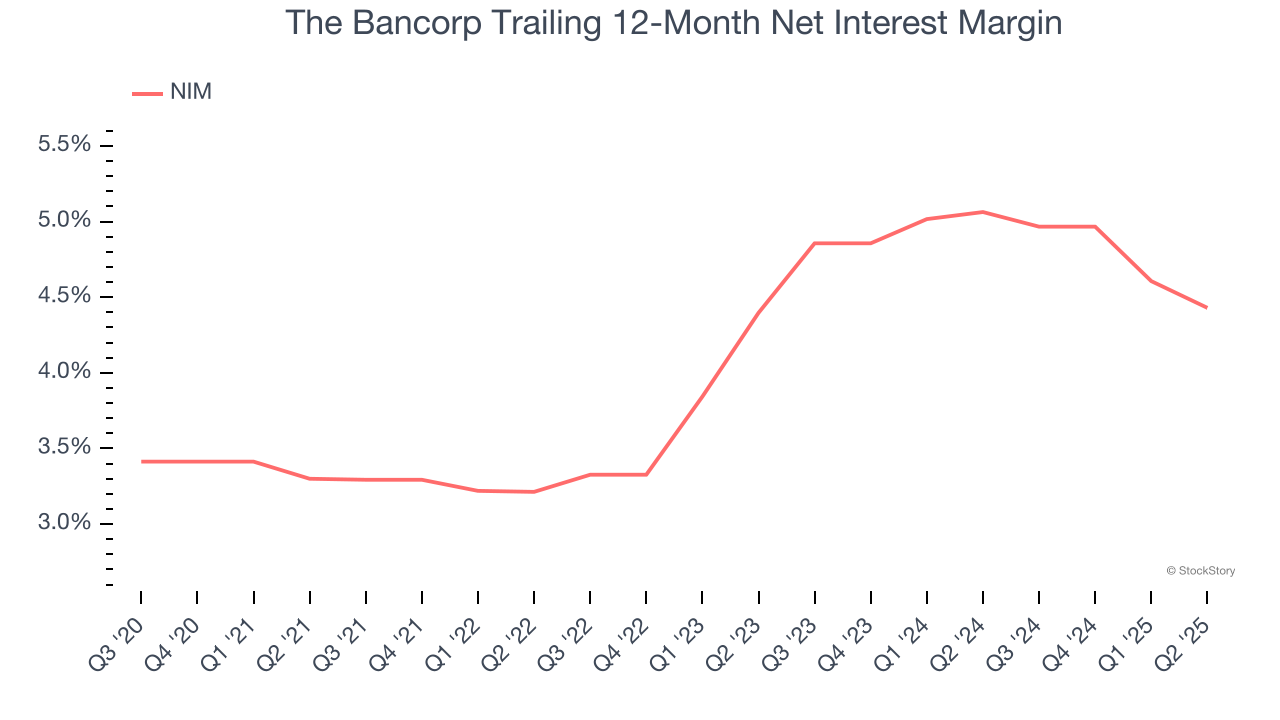

2. Elite Net Interest Margin Powers Best-In-Class Loan Book

Net interest margin (NIM) represents the unit economics of a bank by measuring the profitability of its interest-bearing assets relative to its interest-bearing liabilities. It's a fundamental metric that investors use to assess lending premiums and returns.

Over the past two years, we can see that The Bancorp’s net interest margin averaged an elite 4.7%, indicating the company has a high-yielding loan book and a low cost of funds.

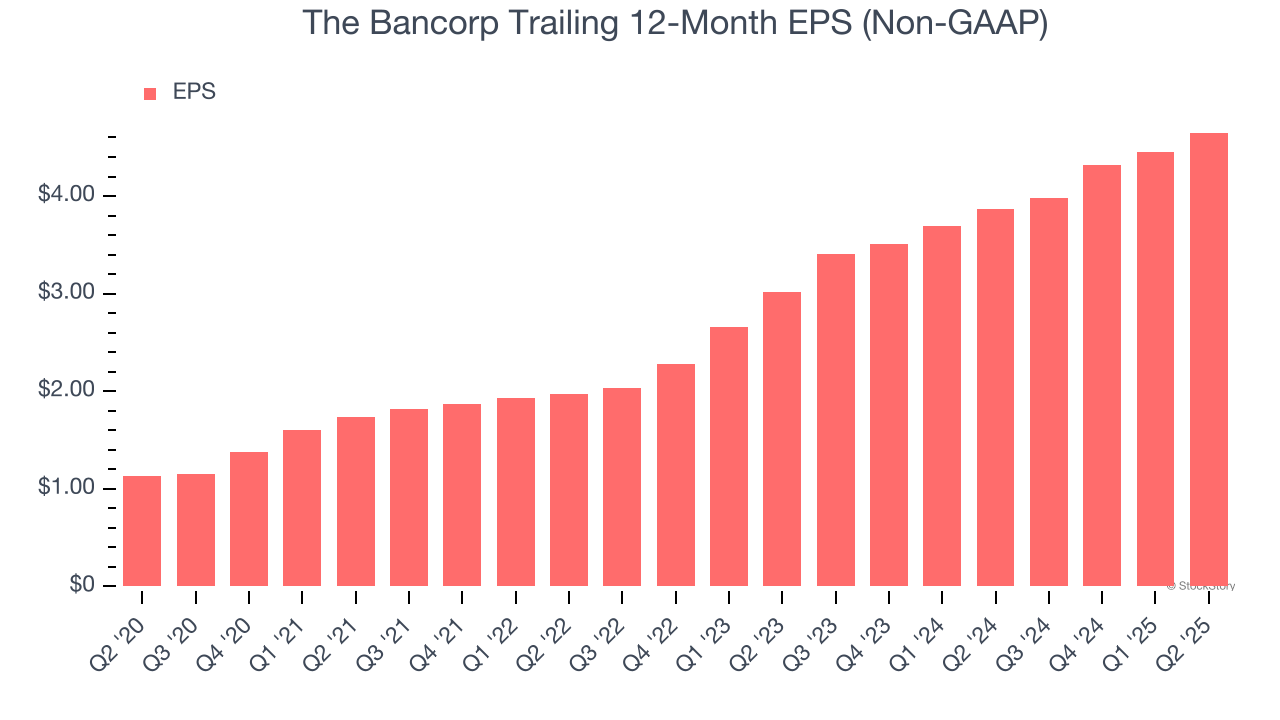

3. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

The Bancorp’s EPS grew at an astounding 32.7% compounded annual growth rate over the last five years, higher than its 22.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

These are just a few reasons why The Bancorp is one of the best bank companies out there, but at $62 per share (or 3.1× forward P/B), is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2024, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.