Diner restaurant chain Denny’s (NASDAQ: DENN) fell short of the market’s revenue expectations in Q2 CY2025 as sales only rose 1.5% year on year to $117.7 million. Its non-GAAP profit of $0.09 per share was 16.3% below analysts’ consensus estimates.

Is now the time to buy Denny's? Find out by accessing our full research report, it’s free.

Denny's (DENN) Q2 CY2025 Highlights:

- Revenue: $117.7 million vs analyst estimates of $118.3 million (1.5% year-on-year growth, 0.5% miss)

- Adjusted EPS: $0.09 vs analyst expectations of $0.11 (16.3% miss)

- Adjusted EBITDA: $18.79 million vs analyst estimates of $20.16 million (16% margin, 6.8% miss)

- EBITDA guidance for the full year is $82.5 million at the midpoint, above analyst estimates of $81.29 million

- Operating Margin: 7.3%, in line with the same quarter last year

- Locations: 1,484 at quarter end, down from 1,603 in the same quarter last year

- Same-Store Sales fell 1.3% year on year (0.6% in the same quarter last year)

- Market Capitalization: $184.5 million

Kelli Valade, Chief Executive Officer, stated, "I am incredibly proud of our teams and franchisees for their unwavering commitment to delivering on our strategic initiatives amid shifting consumer trends. We have continued to stay nimble, innovate, and meet the guests where they are. For Denny’s, this meant innovating its value platform, leaning into its off-premises strength, and optimizing the franchise system, while Keke’s expanded its portfolio 7% year-to-date, launched its first ever system-wide promotion, and continued to steal share from its competitive set. Despite near-term choppiness, we are focused on what is within our control which also resulted in corporate administrative expense savings of approximately 3.5% compared to the prior year quarter, and refranchising three Keke’s company cafes with more on the horizon. We will continue to be agile and are committed to delivering shareholder value through balanced investments and returning to share repurchases in a meaningful way."

Company Overview

Open around the clock, Denny’s (NASDAQ: DENN) is a chain of diner restaurants serving breakfast and traditional American fare.

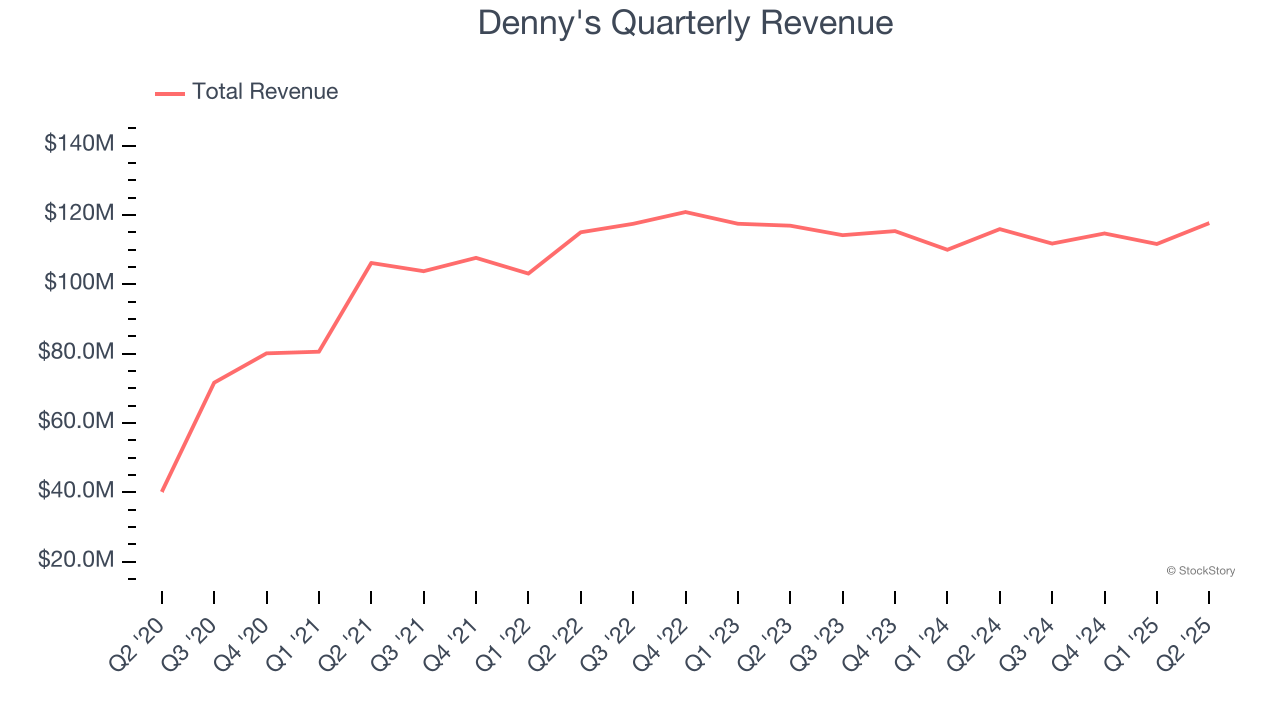

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $455.7 million in revenue over the past 12 months, Denny's is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

As you can see below, Denny's struggled to generate demand over the last six years (we compare to 2019 to normalize for COVID-19 impacts). Its sales dropped by 5% annually as it closed restaurants.

This quarter, Denny’s revenue grew by 1.5% year on year to $117.7 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.7% over the next 12 months. While this projection implies its newer menu offerings will spur better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Restaurant Performance

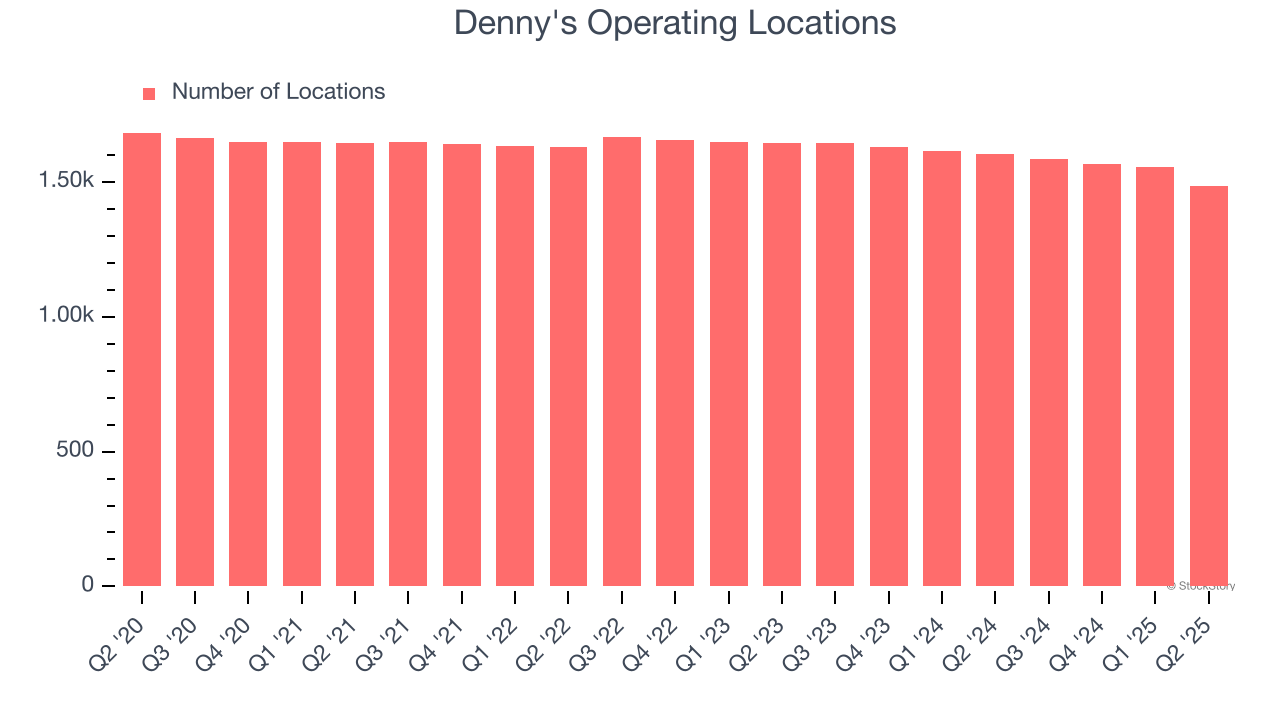

Number of Restaurants

The number of dining locations a restaurant chain operates is a critical driver of how quickly company-level sales can grow.

Denny's listed 1,484 locations in the latest quarter and has generally closed its restaurants over the last two years, averaging 3.2% annual declines.

When a chain shutters restaurants, it usually means demand for its meals is waning, and it is responding by closing underperforming locations to improve profitability.

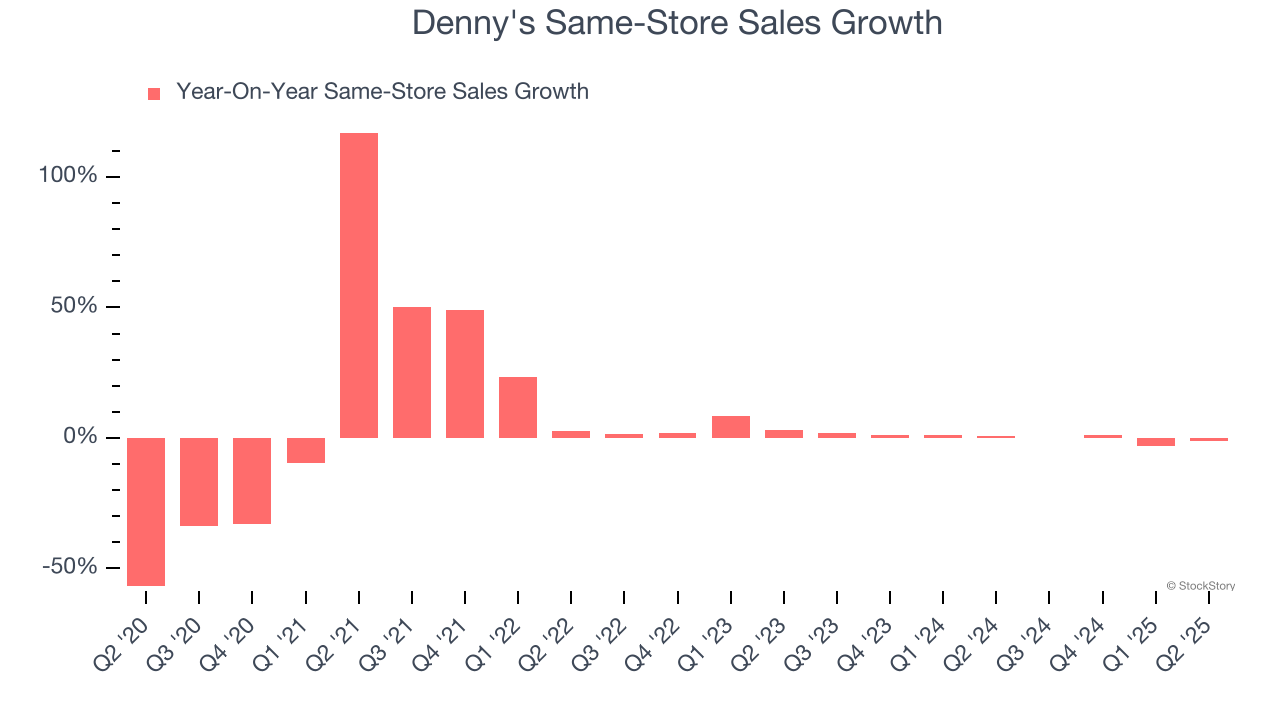

Same-Store Sales

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at restaurants open for at least a year.

Denny’s demand within its existing dining locations has barely increased over the last two years as its same-store sales were flat. This performance isn’t ideal, and Denny's is attempting to boost same-store sales by closing restaurants (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Denny’s same-store sales fell by 1.3% year on year. This decline was a reversal from its historical levels.

Key Takeaways from Denny’s Q2 Results

It was good to see Denny's provide full-year EBITDA guidance that slightly beat analysts’ expectations. On the other hand, its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $3.68 immediately after reporting.

Is Denny's an attractive investment opportunity right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.