Kitchen product manufacturer Middleby (NYSE: MIDD) reported revenue ahead of Wall Street’s expectations in Q2 CY2025, but sales fell by 1.4% year on year to $977.9 million. On the other hand, next quarter’s revenue guidance of $962.5 million was less impressive, coming in 0.8% below analysts’ estimates. Its non-GAAP profit of $2.35 per share was 5.3% above analysts’ consensus estimates.

Is now the time to buy Middleby? Find out by accessing our full research report, it’s free.

Middleby (MIDD) Q2 CY2025 Highlights:

- Revenue: $977.9 million vs analyst estimates of $972.2 million (1.4% year-on-year decline, 0.6% beat)

- Adjusted EPS: $2.35 vs analyst estimates of $2.23 (5.3% beat)

- Adjusted EBITDA: $200.2 million vs analyst estimates of $202.8 million (20.5% margin, 1.3% miss)

- Revenue Guidance for the full year is $3.84 billion at the midpoint, below analyst estimates of $3.88 billion

- Adjusted EPS guidance for the full year is $8.85 at the midpoint, missing analyst estimates by 4.4%

- EBITDA guidance for the full year is $785 million at the midpoint, below analyst estimates of $829.8 million

- Operating Margin: 15.9%, down from 17.7% in the same quarter last year

- Free Cash Flow Margin: 10.3%, down from 14% in the same quarter last year

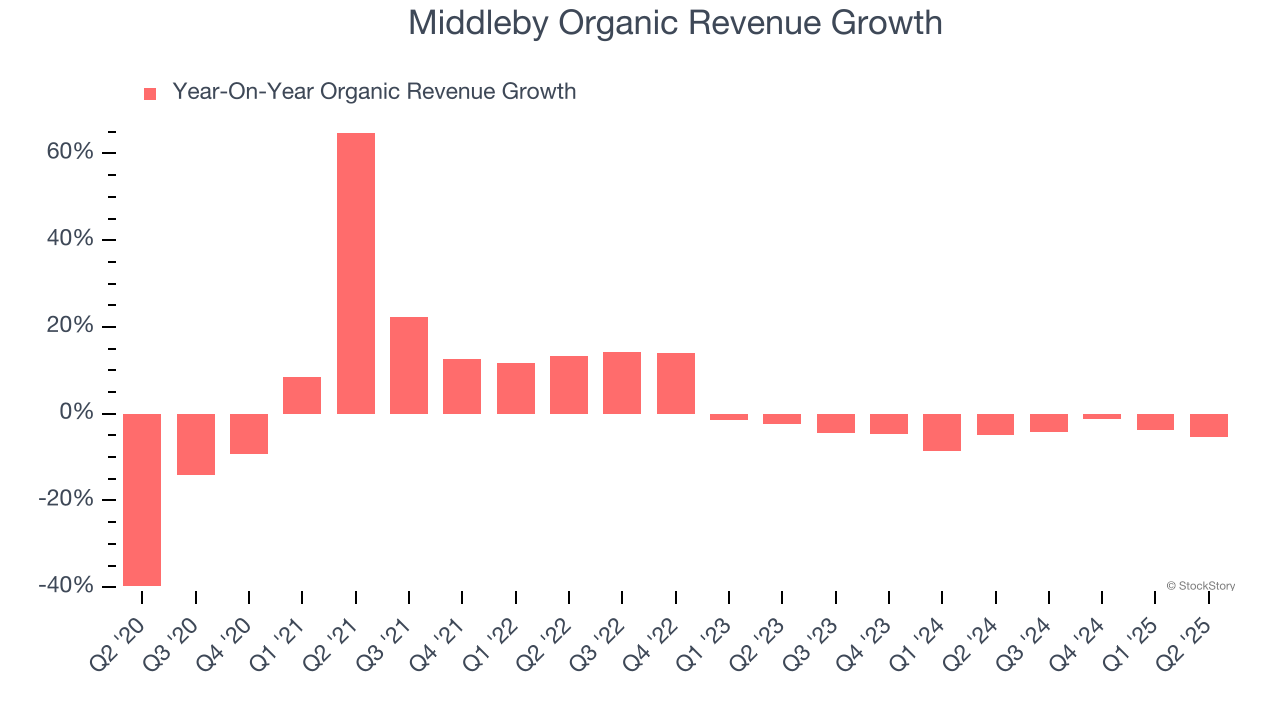

- Organic Revenue fell 5.4% year on year, in line with the same quarter last year

- Market Capitalization: $7.74 billion

Tim FitzGerald, CEO of The Middleby Corporation said, “Our second quarter results reflect the economic uncertainty our customers continue to navigate in key end markets. Despite these headwinds, I’m proud of our team’s continued execution in areas within our control. We’re delivering strong operational performance, gaining market share with new product launches, and growing the partnerships with our customers. While these quarterly results reflect our market conditions, they don’t appropriately capture the fundamental transformation we’ve achieved across our business to drive long-term growth, particularly across innovation and go-to-market capabilities. We believe we have created an unmatched platform, and as the market inflects, Middleby is poised for outsized growth as we solve increasingly complex challenges for our growing customer base.”

Company Overview

Holding a Guinness World Record for creating the world’s fastest conveyor pizza oven, Middleby (NYSE: MIDD) is a food service and equipment manufacturer.

Revenue Growth

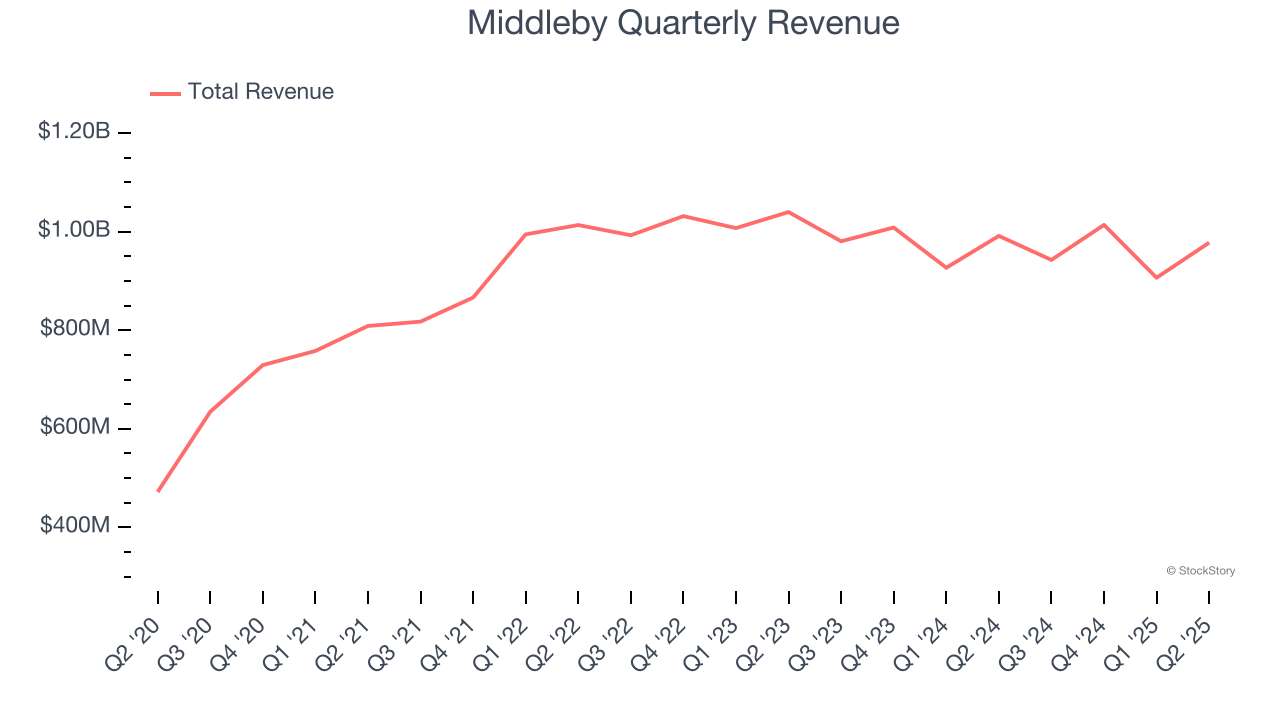

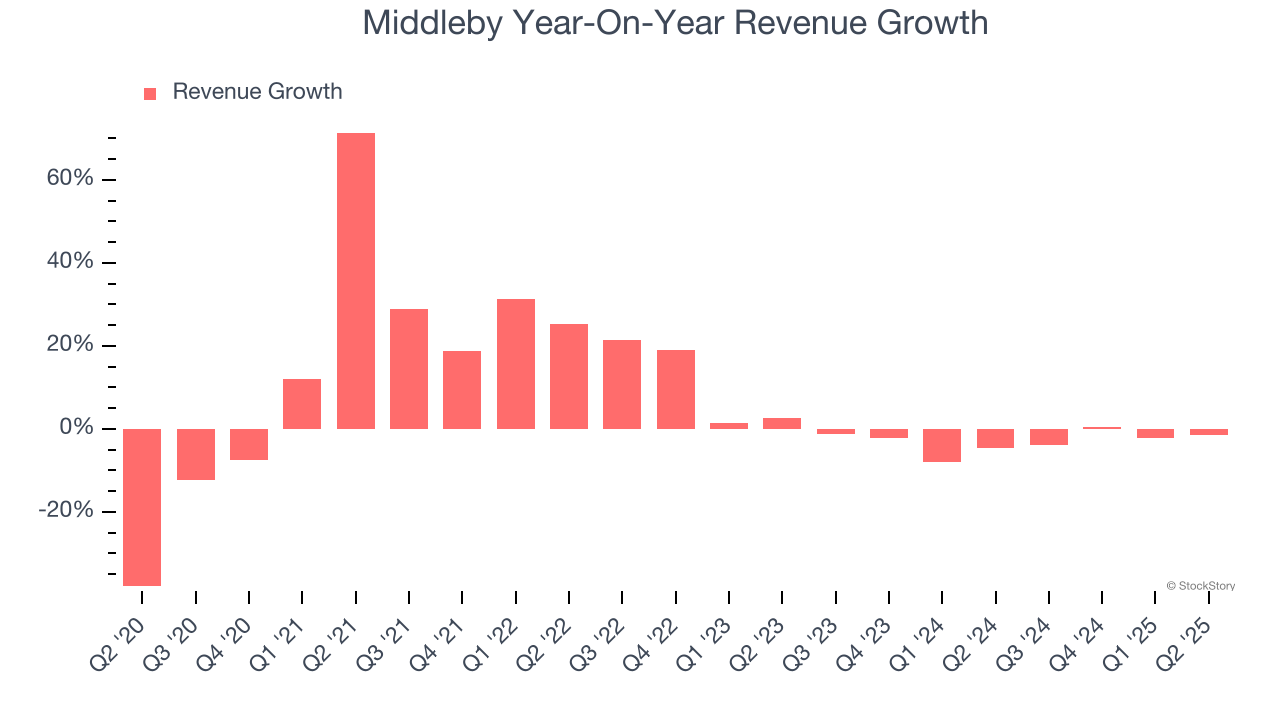

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Middleby grew its sales at a decent 7.6% compounded annual growth rate. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Middleby’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 2.9% over the last two years.

Middleby also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Middleby’s organic revenue averaged 4.6% year-on-year declines. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, Middleby’s revenue fell by 1.4% year on year to $977.9 million but beat Wall Street’s estimates by 0.6%. Company management is currently guiding for a 2.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3% over the next 12 months. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

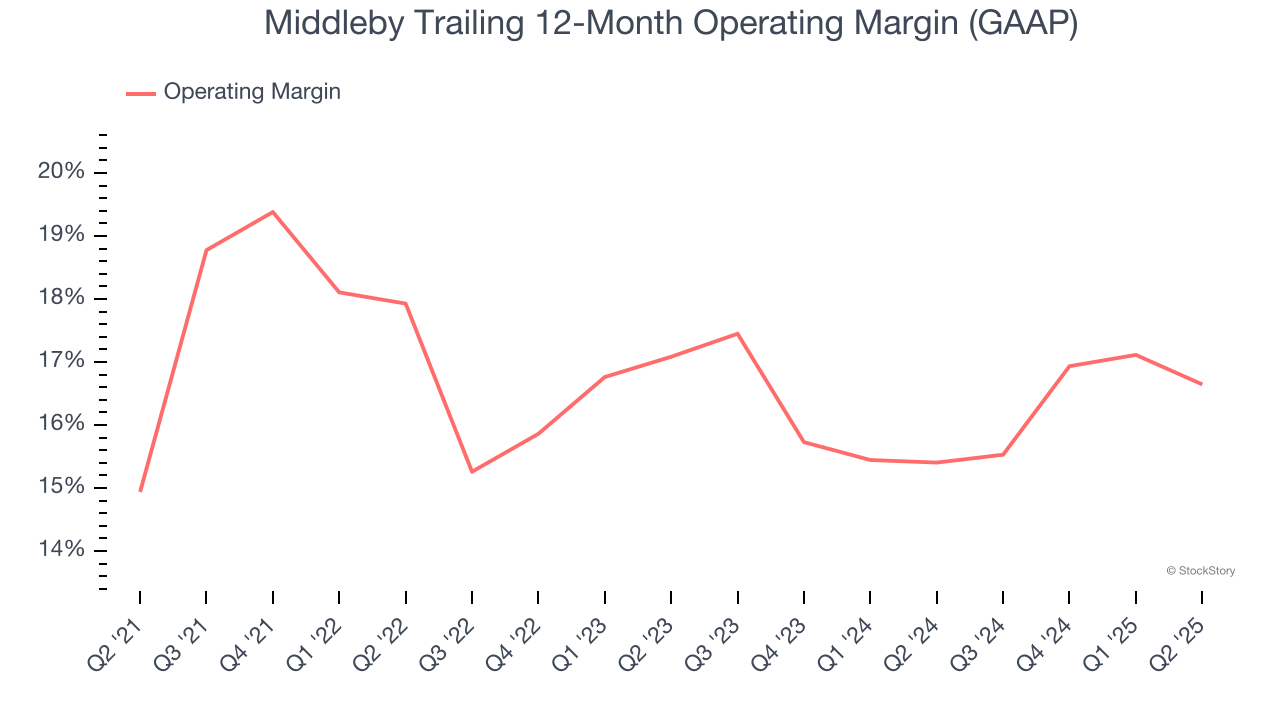

Middleby has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 16.5%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Middleby’s operating margin rose by 1.7 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q2, Middleby generated an operating margin profit margin of 15.9%, down 1.8 percentage points year on year. Since Middleby’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

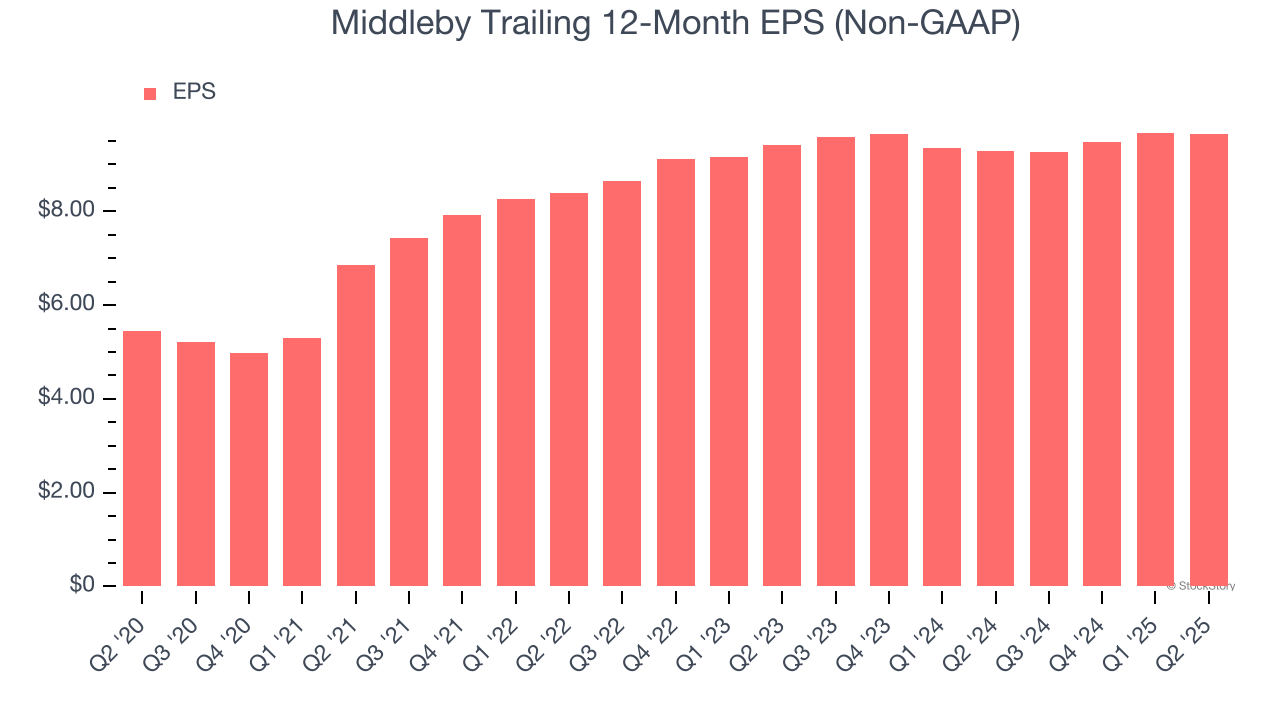

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Middleby’s EPS grew at a remarkable 12.1% compounded annual growth rate over the last five years, higher than its 7.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

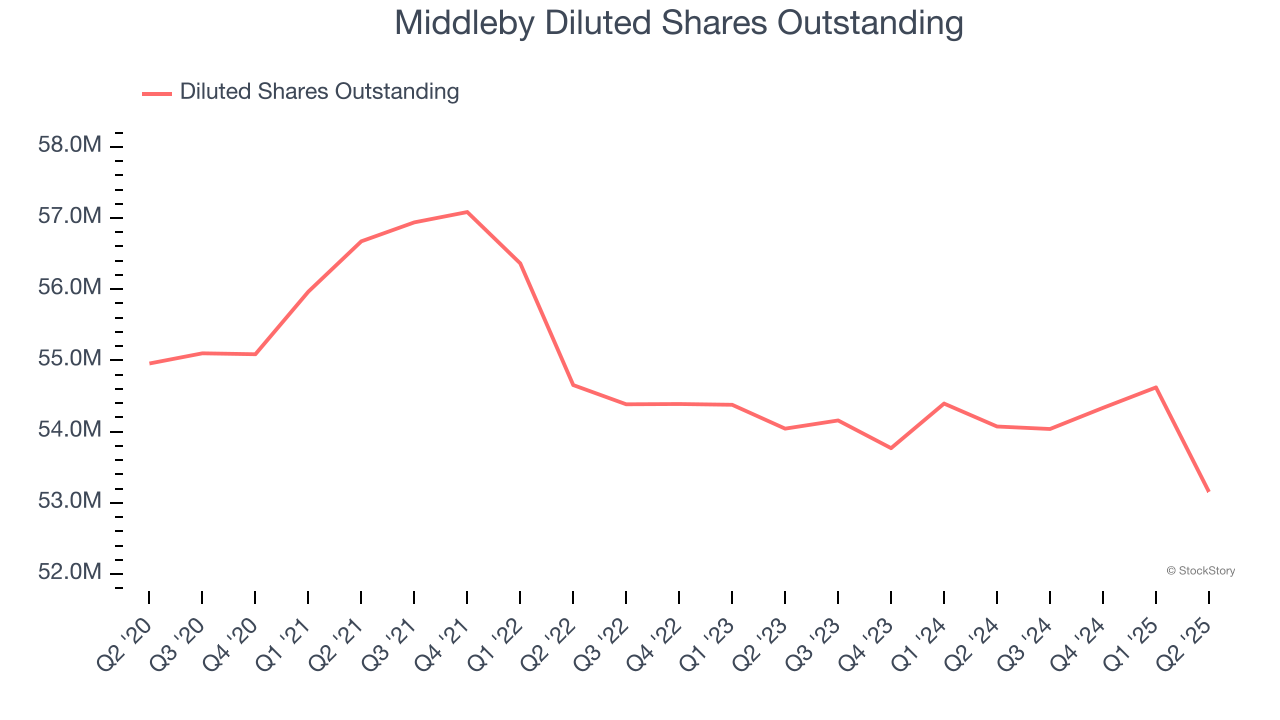

Diving into the nuances of Middleby’s earnings can give us a better understanding of its performance. As we mentioned earlier, Middleby’s operating margin declined this quarter but expanded by 1.7 percentage points over the last five years. Its share count also shrank by 3.3%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Middleby, its two-year annual EPS growth of 1.2% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q2, Middleby reported adjusted EPS at $2.35, down from $2.39 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 5.3%. Over the next 12 months, Wall Street expects Middleby’s full-year EPS of $9.64 to shrink by 1.4%.

Key Takeaways from Middleby’s Q2 Results

It was encouraging to see Middleby beat analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its full-year EBITDA guidance missed. Overall, this was a weaker quarter. The stock remained flat at $145 immediately after reporting.

Is Middleby an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.