Experiential tourism company Pursuit Attractions and Hospitality (NYSE: PRSU) reported Q2 CY2025 results topping the market’s revenue expectations, but sales fell by 69.2% year on year to $116.7 million. Its non-GAAP profit of $0.36 per share was 38.5% above analysts’ consensus estimates.

Is now the time to buy Pursuit? Find out by accessing our full research report, it’s free.

Pursuit (PRSU) Q2 CY2025 Highlights:

- Revenue: $116.7 million vs analyst estimates of $109.2 million (69.2% year-on-year decline, 6.9% beat)

- Adjusted EPS: $0.36 vs analyst estimates of $0.26 (38.5% beat)

- Adjusted EBITDA: $25.31 million vs analyst estimates of $23.81 million (21.7% margin, 6.3% beat)

- EBITDA guidance for the full year is $113 million at the midpoint, above analyst estimates of $102 million

- Operating Margin: 38.8%, up from 12.7% in the same quarter last year

- Market Capitalization: $818.9 million

Company Overview

With attractions ranging from glacier tours in the Canadian Rockies to an oceanfront geothermal lagoon in Iceland, Pursuit Attractions and Hospitality (NYSE: PRSU) operates iconic travel experiences, experiential marketing services, and exhibition management across North America and Europe.

Revenue Growth

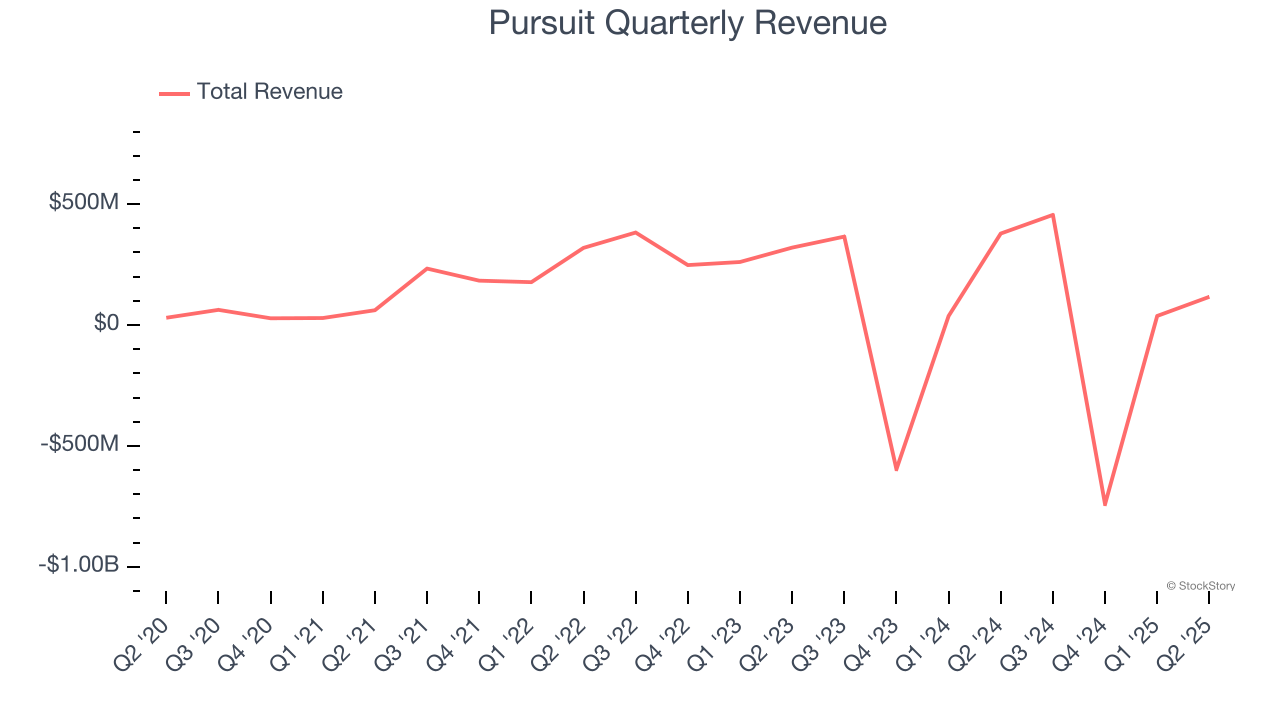

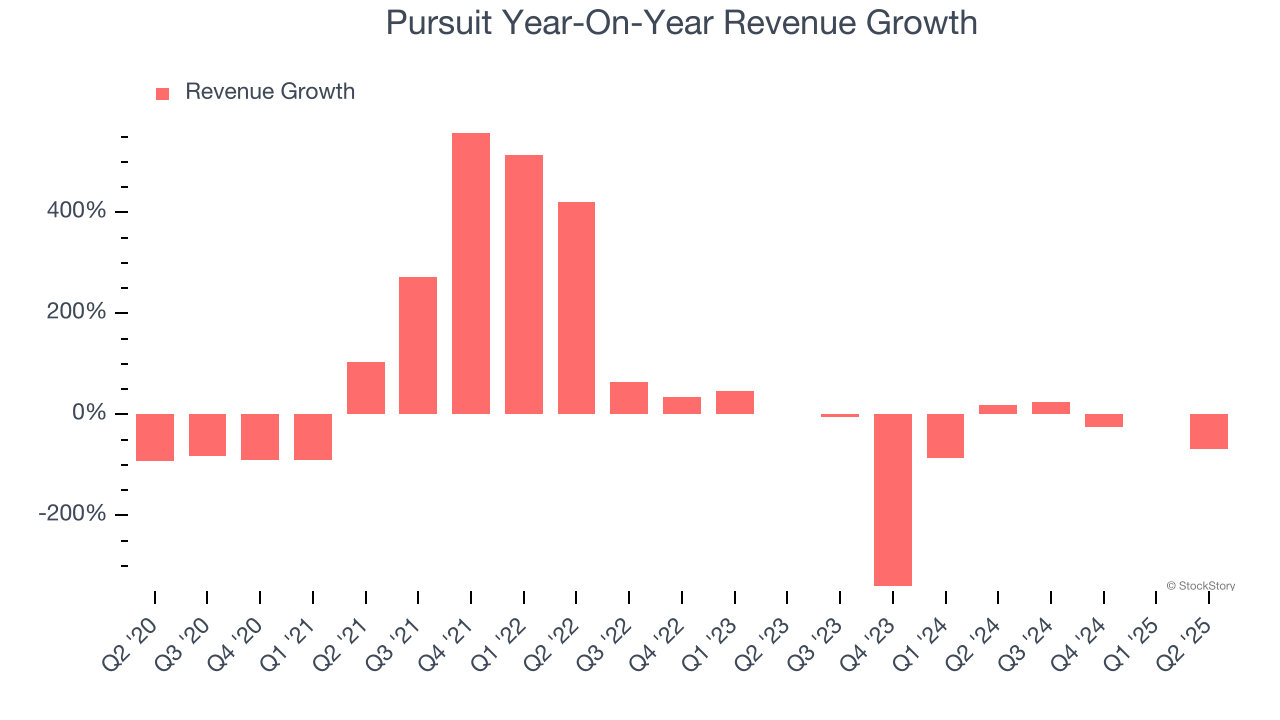

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Pursuit struggled to consistently generate demand over the last five years as its sales dropped at a 16.4% annual rate. This wasn’t a great result, but there are still things to like about Pursuit.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Pursuit’s recent performance shows its demand remained suppressed as its revenue has declined by 45.2% annually over the last two years.

This quarter, Pursuit’s revenue fell by 69.2% year on year to $116.7 million but beat Wall Street’s estimates by 6.9%.

Looking ahead, sell-side analysts expect revenue to grow 424% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and suggests its newer products and services will fuel better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

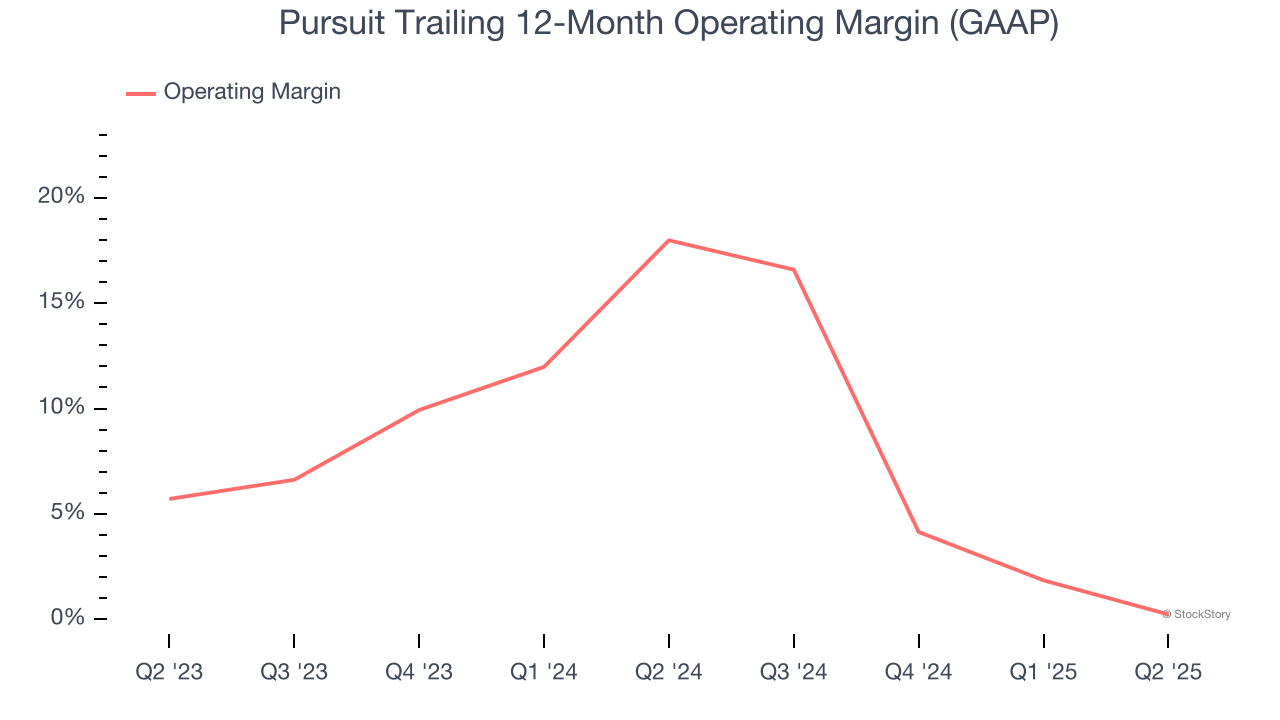

Operating Margin

Pursuit’s operating margin has been trending down over the last 12 months, but it still averaged 61.3% over the last two years, elite for a consumer discretionary business. This shows it’s an well-run company with an efficient cost structure, and we wouldn’t weigh the short-term trend too heavily.

In Q2, Pursuit generated an operating margin profit margin of 38.8%, up 26.1 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

Earnings Per Share

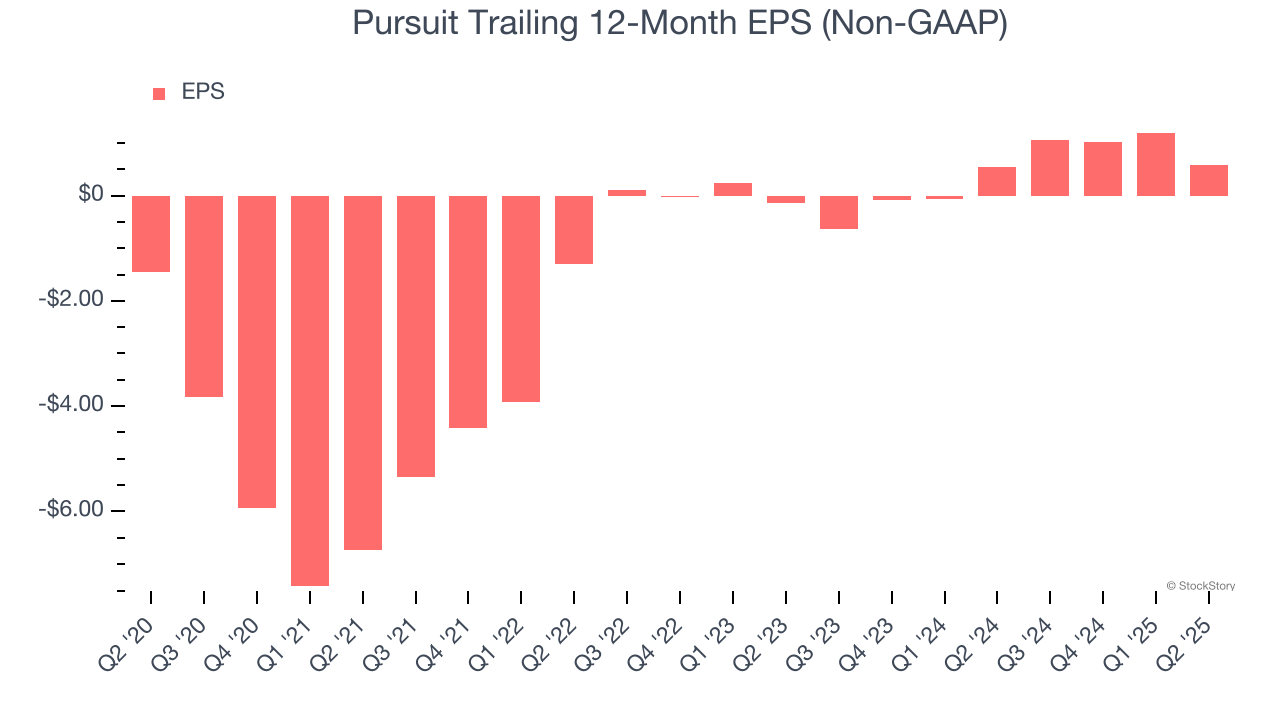

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Pursuit’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

In Q2, Pursuit reported adjusted EPS at $0.36, down from $0.97 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Pursuit’s full-year EPS of $0.59 to grow 55.9%.

Key Takeaways from Pursuit’s Q2 Results

We were impressed by how significantly Pursuit blew past analysts’ EPS expectations this quarter. We were also glad its full-year EBITDA guidance trumped Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 11.8% to $33.58 immediately following the results.

Sure, Pursuit had a solid quarter, but if we look at the bigger picture, is this stock a buy? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.