Moving and storage solutions provider U-Haul (NYSE: UHAL) posted $1.63 billion of revenue in Q2 CY2025, up 5.3% year on year. Its GAAP profit of $0.73 per share was 4.3% above analysts’ consensus estimates.

Is now the time to buy U-Haul? Find out by accessing our full research report, it’s free.

U-Haul (UHAL) Q2 CY2025 Highlights:

- Revenue: $1.63 billion (5.3% year-on-year growth)

- EPS (GAAP): $0.73 vs analyst estimates of $0.70 (4.3% beat)

- Operating Margin: 15.8%, down from 20% in the same quarter last year

- Market Capitalization: $10.12 billion

Company Overview

Founded by a husband and wife duo, U-Haul (NYSE: UHAL) is a provider of rental trucks and storage facilities.

Revenue Growth

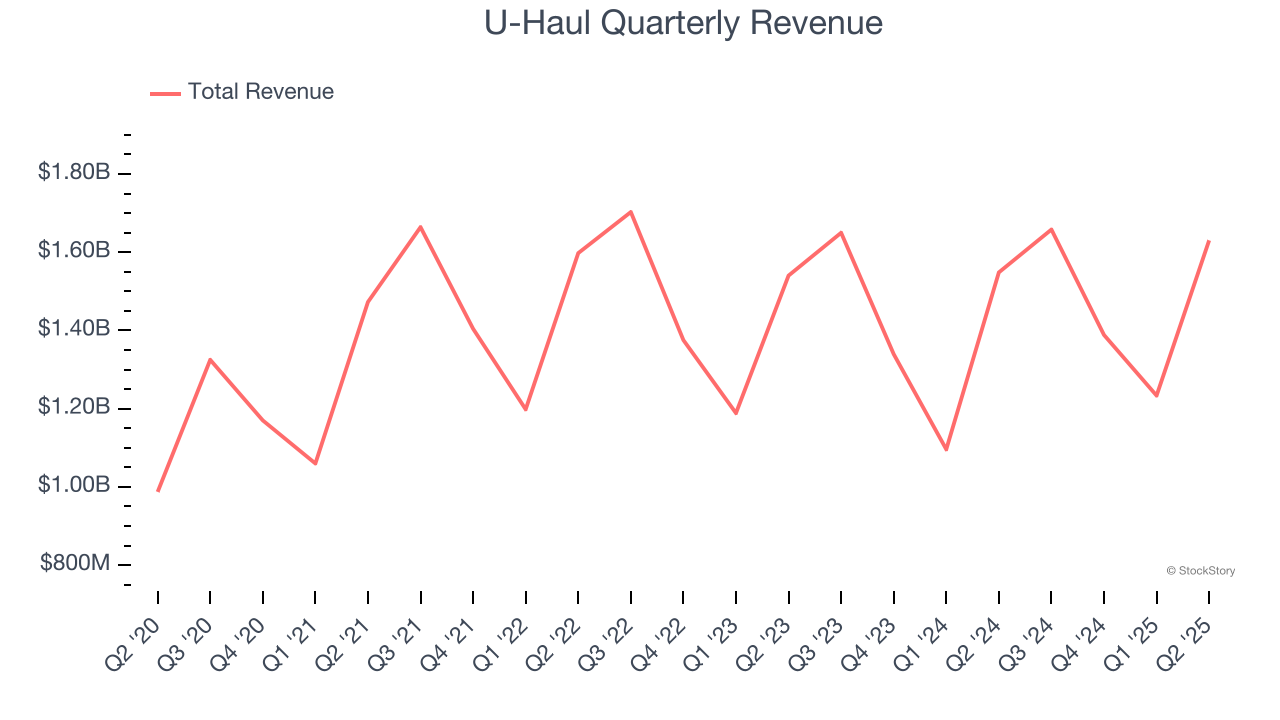

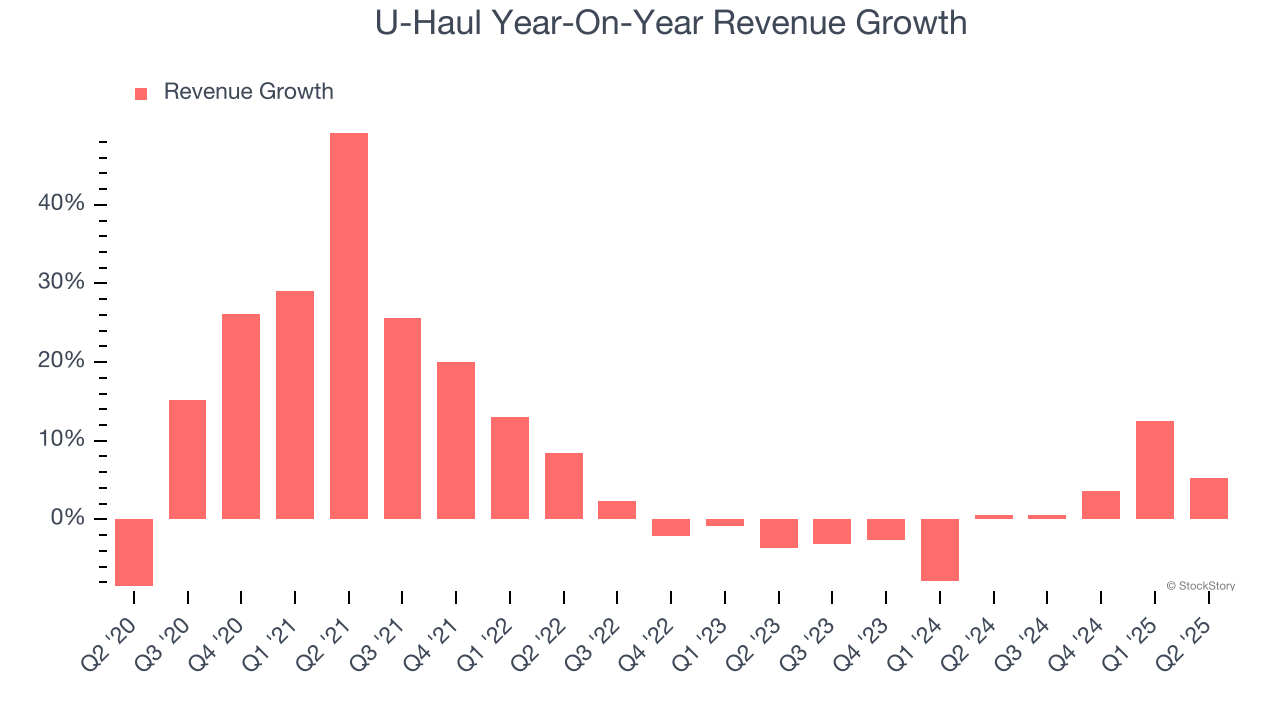

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, U-Haul grew its sales at a decent 8.7% compounded annual growth rate. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. U-Haul’s recent performance shows its demand has slowed as its revenue was flat over the last two years. We also note many other Ground Transportation businesses have faced declining sales because of cyclical headwinds. While U-Haul’s growth wasn’t the best, it did do better than its peers.

This quarter, U-Haul’s revenue grew by 5.3% year on year to $1.63 billion.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

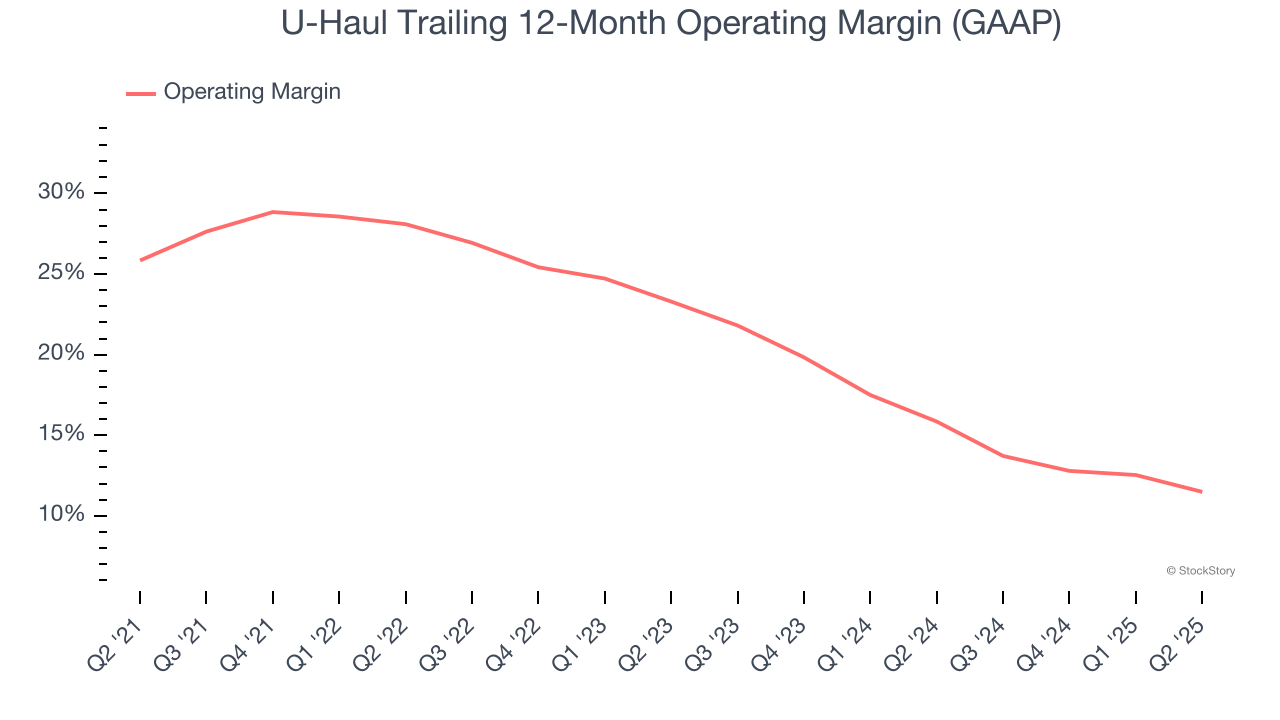

U-Haul has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 20.8%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Looking at the trend in its profitability, U-Haul’s operating margin decreased by 14.4 percentage points over the last five years. Many Ground Transportation companies also saw their margins fall (along with revenue, as mentioned above) because the cycle turned in the wrong direction. We hope U-Haul can emerge from this a stronger company, as the silver lining of a downturn is that market share can be won and efficiencies found.

This quarter, U-Haul generated an operating margin profit margin of 15.8%, down 4.2 percentage points year on year. Conversely, its revenue and gross margin actually rose, so we can assume it was less efficient because its operating expenses like marketing, R&D, and administrative overhead grew faster than its revenue.

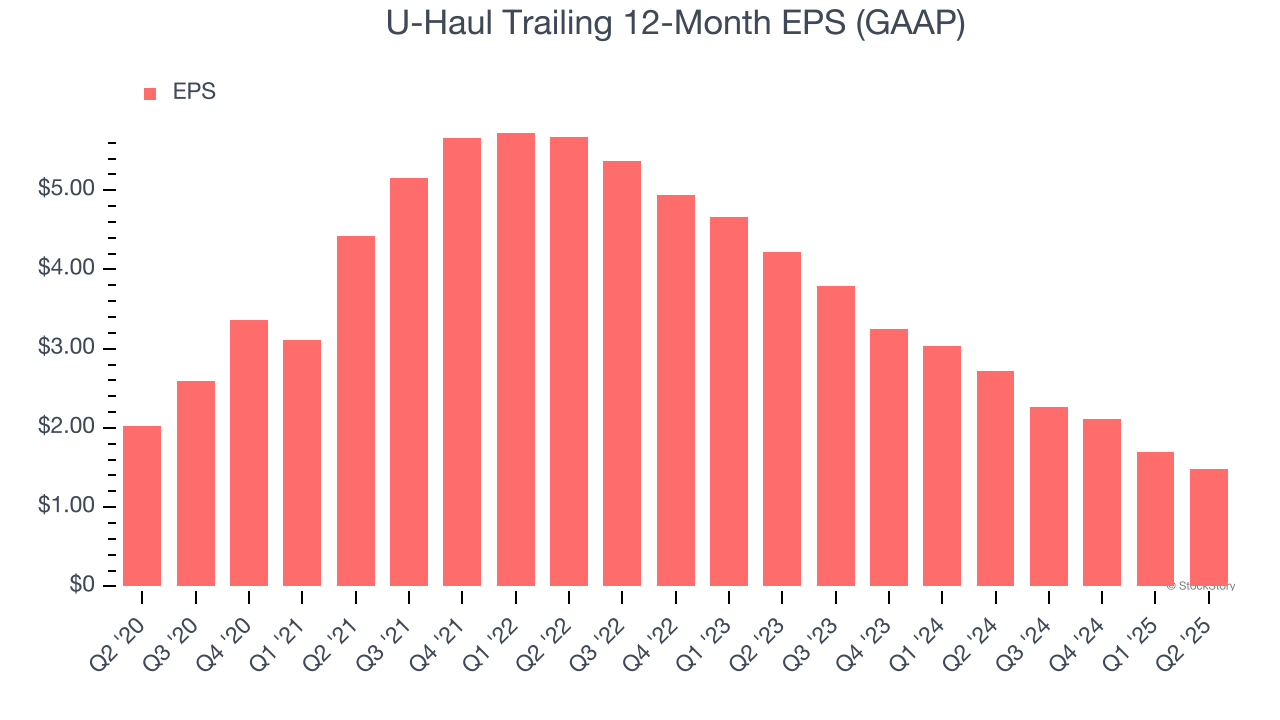

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for U-Haul, its EPS declined by 6.1% annually over the last five years while its revenue grew by 8.7%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

We can take a deeper look into U-Haul’s earnings to better understand the drivers of its performance. As we mentioned earlier, U-Haul’s operating margin declined by 14.4 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

U-Haul’s two-year annual EPS declines of 40.8% were bad and lower than its flat revenue.

In Q2, U-Haul reported EPS at $0.73, down from $0.95 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 4.3%. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from U-Haul’s Q2 Results

It was encouraging to see U-Haul beat analysts’ EPS expectations this quarter. Overall, this print had some key positives. The stock traded up 1.9% to $57.70 immediately after reporting.

Should you buy the stock or not? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.