Educator-focused insurance company Horace Mann Educators (NYSE: HMN) missed Wall Street’s revenue expectations in Q2 CY2025, but sales rose 6.1% year on year to $411.7 million. Its non-GAAP profit of $1.06 per share was 78.2% above analysts’ consensus estimates.

Is now the time to buy Horace Mann Educators? Find out by accessing our full research report, it’s free.

Horace Mann Educators (HMN) Q2 CY2025 Highlights:

- Revenue: $411.7 million vs analyst estimates of $426.7 million (6.1% year-on-year growth, 3.5% miss)

- Adjusted EPS: $1.06 vs analyst estimates of $0.60 (78.2% beat)

- Market Capitalization: $1.73 billion

“Record second-quarter core earnings reflect very strong business profitability and solid growth momentum, as well as Property & Casualty catastrophe costs that were meaningfully below prior year and recent prior periods,” said Horace Mann President & CEO Marita Zuraitis.

Company Overview

Founded in 1945 and named after the 19th-century education reformer known as the "father of American public education," Horace Mann Educators (NYSE: HMN) is an insurance company that specializes in providing auto, property, life, and retirement products tailored for educators and other public service employees.

Revenue Growth

Insurers earn revenue three ways. The core insurance business itself, often called underwriting and represented in the income statement as premiums earned, is one way. Investment income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities is the second way. Fees from various sources such as policy administration, annuities, or other value-added services is the third.

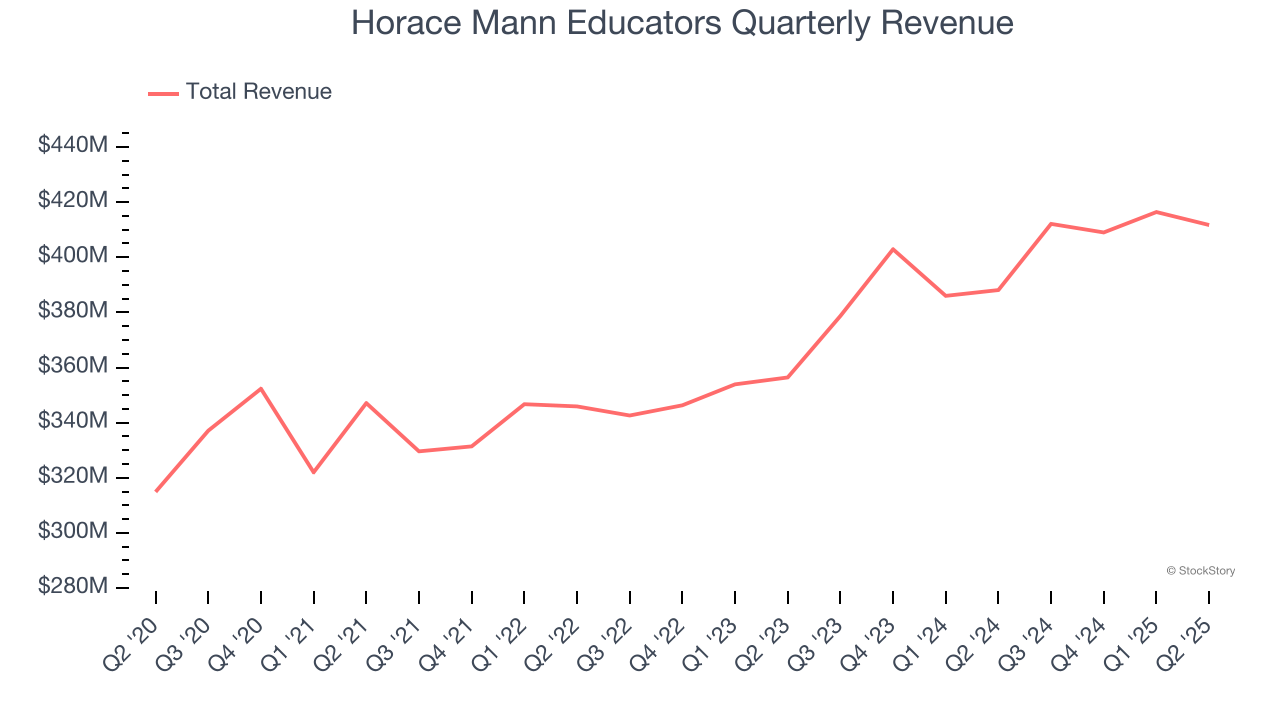

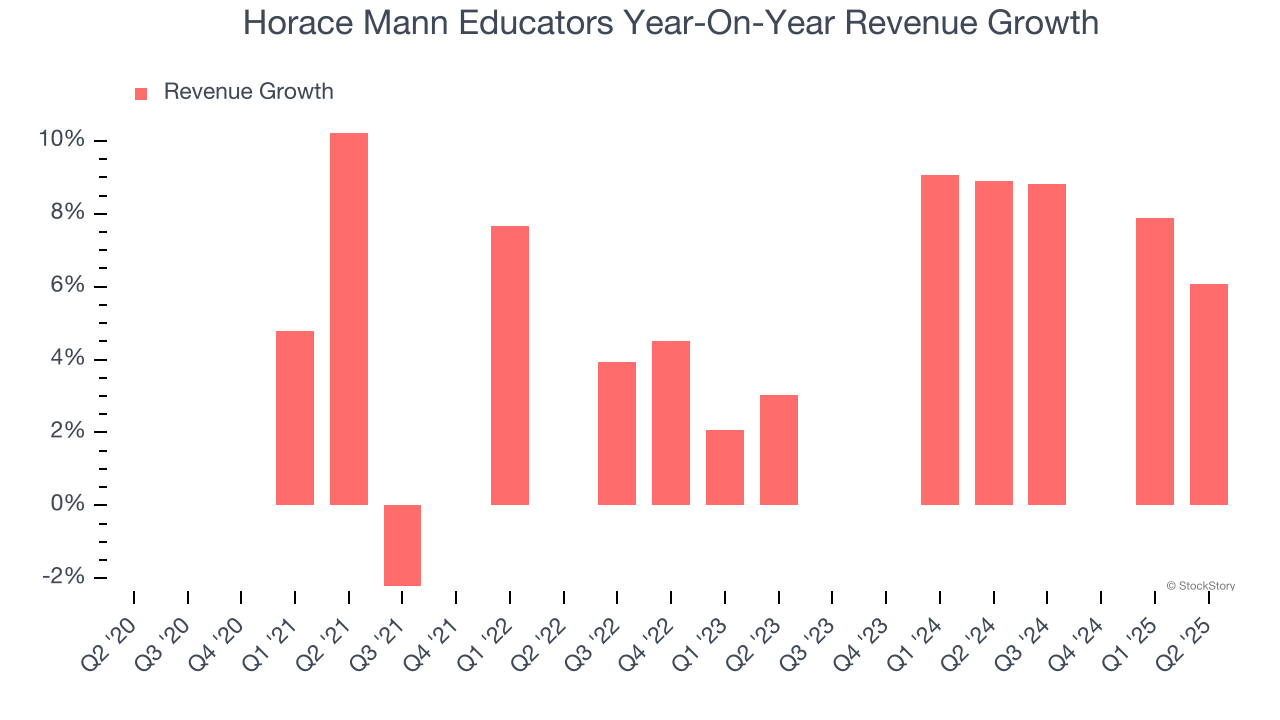

Unfortunately, Horace Mann Educators’s 5% annualized revenue growth over the last five years was tepid. This was below our standard for the insurance sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Horace Mann Educators’s annualized revenue growth of 8.6% over the last two years is above its five-year trend, suggesting some bright spots.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Horace Mann Educators’s revenue grew by 6.1% year on year to $411.7 million, missing Wall Street’s estimates.

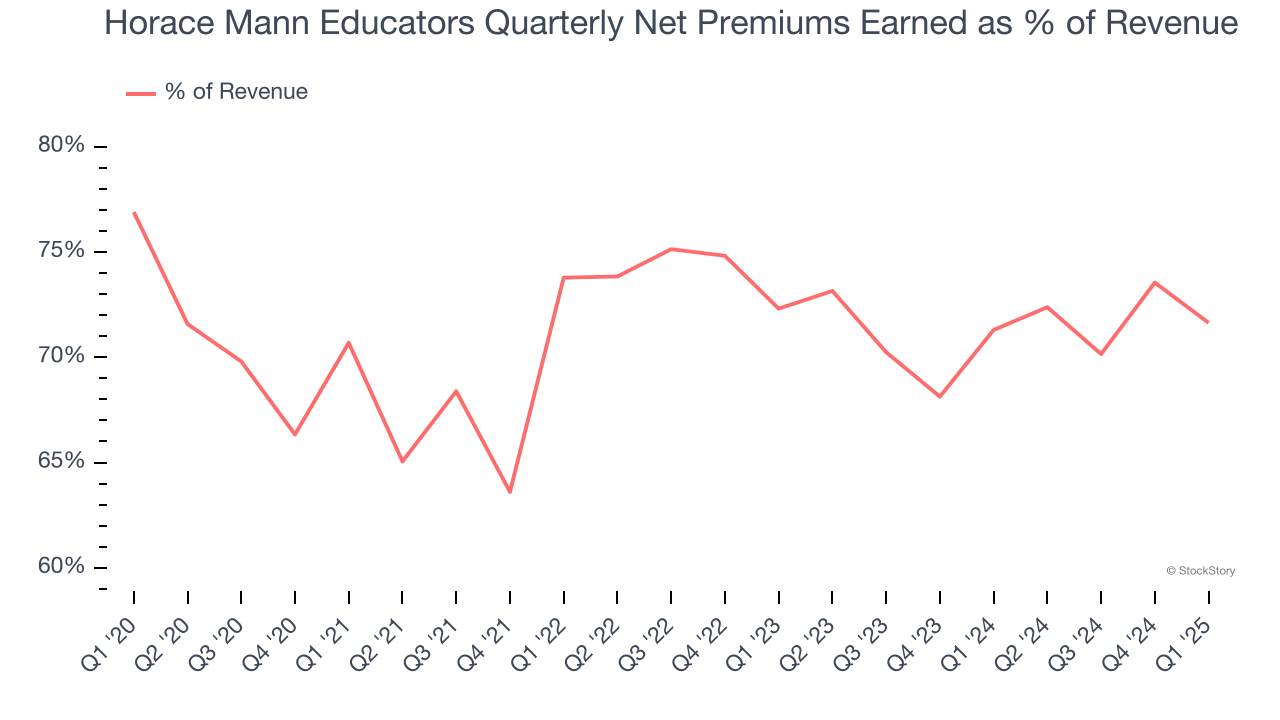

Net premiums earned made up 70.8% of the company’s total revenue during the last five years, meaning insurance operations are Horace Mann Educators’s largest source of revenue.

While insurers generate revenue from multiple sources, investors view net premiums earned as the cornerstone - its direct link to core operations stands in sharp contrast to the unpredictability of investment returns and fees.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Book Value Per Share (BVPS)

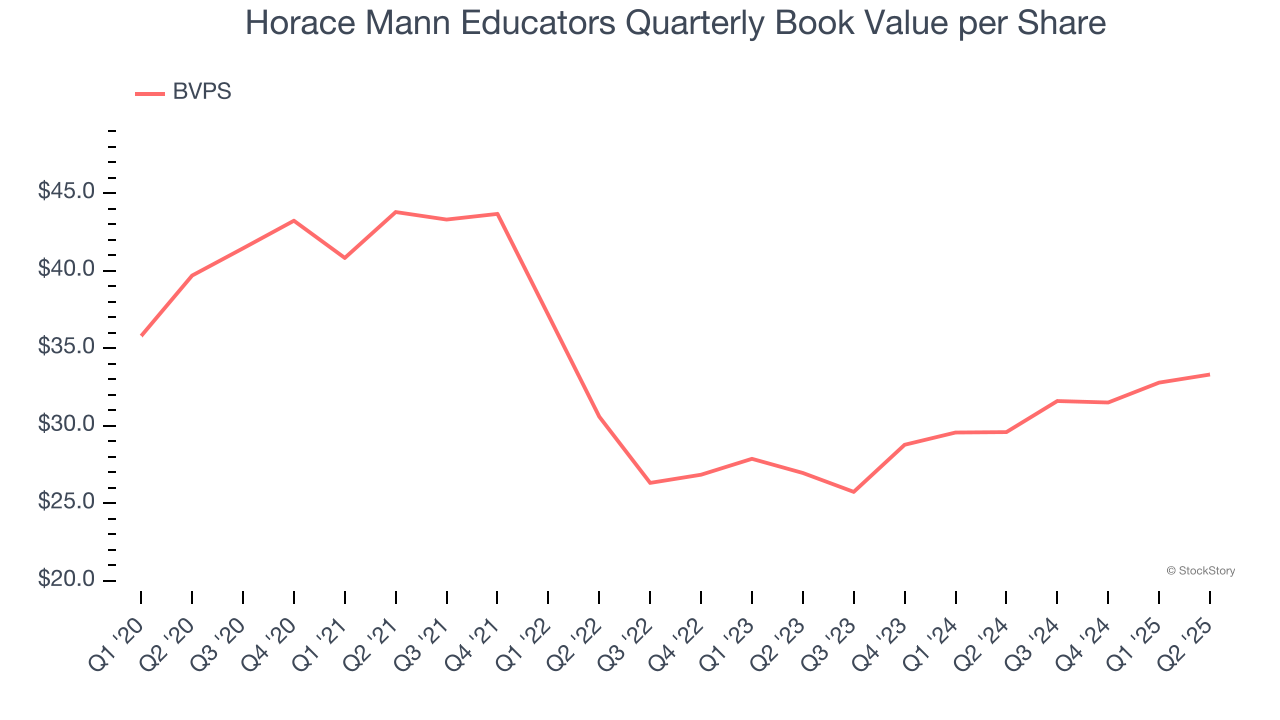

Insurance companies are balance sheet businesses, collecting premiums upfront and paying out claims over time. The float–premiums collected but not yet paid out–are invested, creating an asset base supported by a liability structure. Book value per share (BVPS) captures this dynamic by measuring these assets (investment portfolio, cash, reinsurance recoverables) less liabilities (claim reserves, debt, future policy benefits). BVPS is essentially the residual value for shareholders.

We therefore consider BVPS very important to track for insurers and a metric that sheds light on business quality because it reflects long-term capital growth and is harder to manipulate than more commonly-used metrics like EPS.

Horace Mann Educators’s BVPS declined at a 3.4% annual clip over the last five years. However, BVPS growth has accelerated recently, growing by 11.1% annually over the last two years from $26.96 to $33.31 per share.

Over the next 12 months, Consensus estimates call for Horace Mann Educators’s BVPS to grow by 23.5% to $38.49, elite growth rate.

Key Takeaways from Horace Mann Educators’s Q2 Results

We were impressed by how significantly Horace Mann Educators blew past analysts’ EPS expectations this quarter. On the other hand, its revenue missed and its book value per share fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $42.34 immediately after reporting.

Is Horace Mann Educators an attractive investment opportunity at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.