Behavioral health company LifeStance Health (NASDAQ: LFST) met Wall Street’s revenue expectations in Q2 CY2025, with sales up 10.6% year on year to $345.3 million. On the other hand, next quarter’s revenue guidance of $355 million was less impressive, coming in 1.4% below analysts’ estimates. Its GAAP loss of $0.01 per share was $0.02 above analysts’ consensus estimates.

Is now the time to buy LifeStance Health Group? Find out by accessing our full research report, it’s free.

LifeStance Health Group (LFST) Q2 CY2025 Highlights:

- Revenue: $345.3 million vs analyst estimates of $346.2 million (10.6% year-on-year growth, in line)

- EPS (GAAP): -$0.01 vs analyst estimates of -$0.03 ($0.02 beat)

- Adjusted EBITDA: $34.01 million vs analyst estimates of $31.03 million (9.8% margin, 9.6% beat)

- The company reconfirmed its revenue guidance for the full year of $1.42 billion at the midpoint

- EBITDA guidance for the full year is $145 million at the midpoint, above analyst estimates of $138.7 million

- Operating Margin: -0.9%, up from -5.1% in the same quarter last year

- Free Cash Flow Margin: 16.4%, up from 12.5% in the same quarter last year

- Sales Volumes rose 10.7% year on year (13.5% in the same quarter last year)

- Market Capitalization: $1.52 billion

“I am incredibly proud of the LifeStance team for the strong results achieved in the second quarter,” said Dave Bourdon, CEO of LifeStance.

Company Overview

With over 6,600 licensed mental health professionals treating more than 880,000 patients annually, LifeStance Health (NASDAQ: LFST) provides outpatient mental health services through a network of clinicians offering psychiatric evaluations, psychological testing, and therapy across 33 states.

Revenue Growth

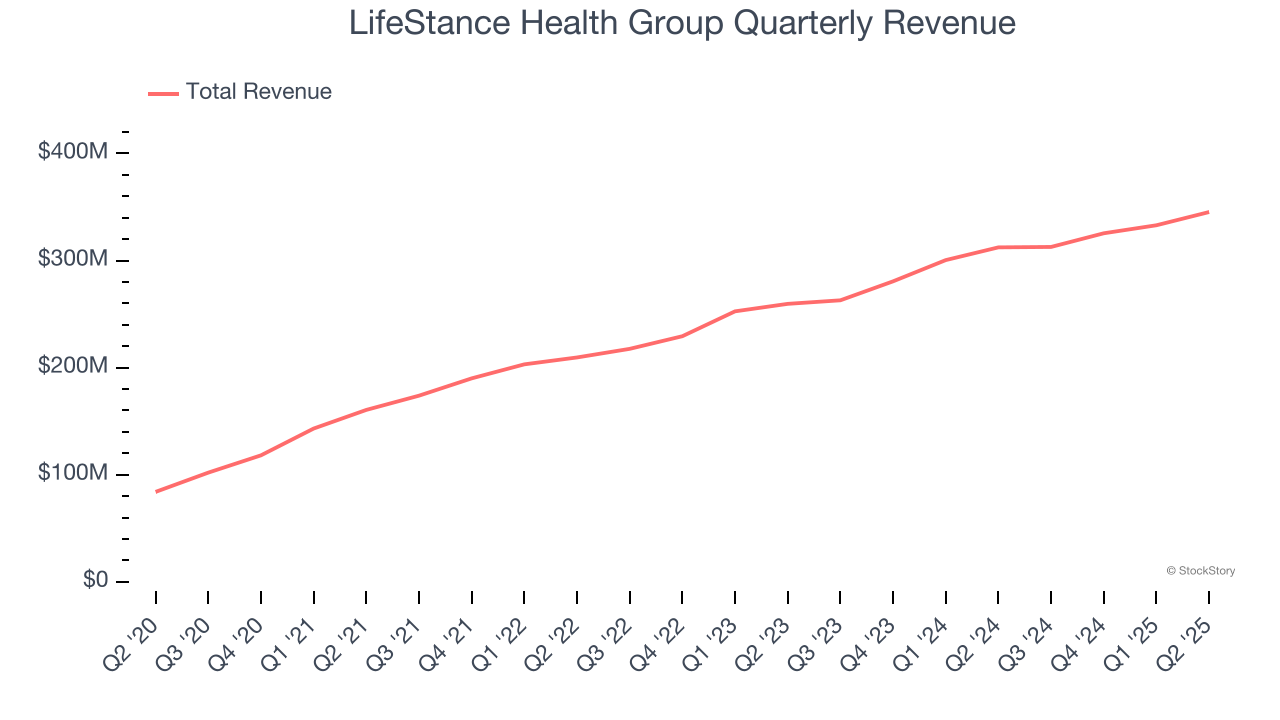

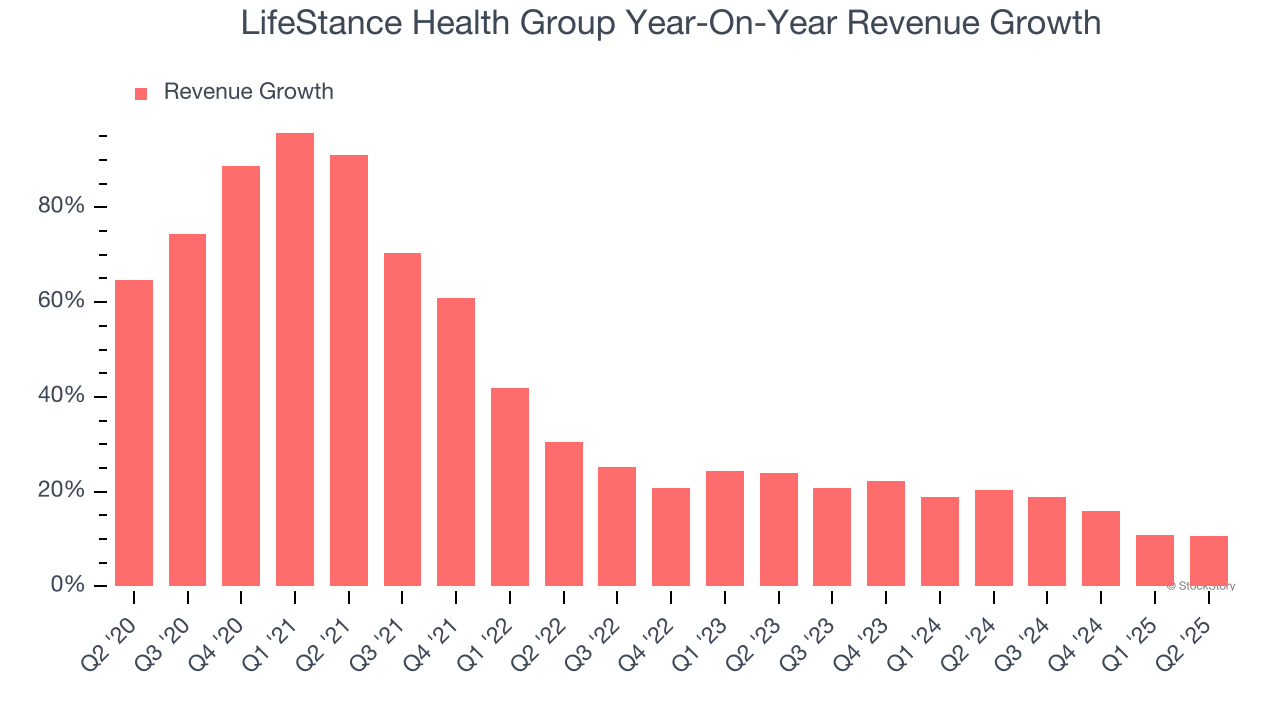

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, LifeStance Health Group grew its sales at an incredible 36.5% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. LifeStance Health Group’s annualized revenue growth of 17.2% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

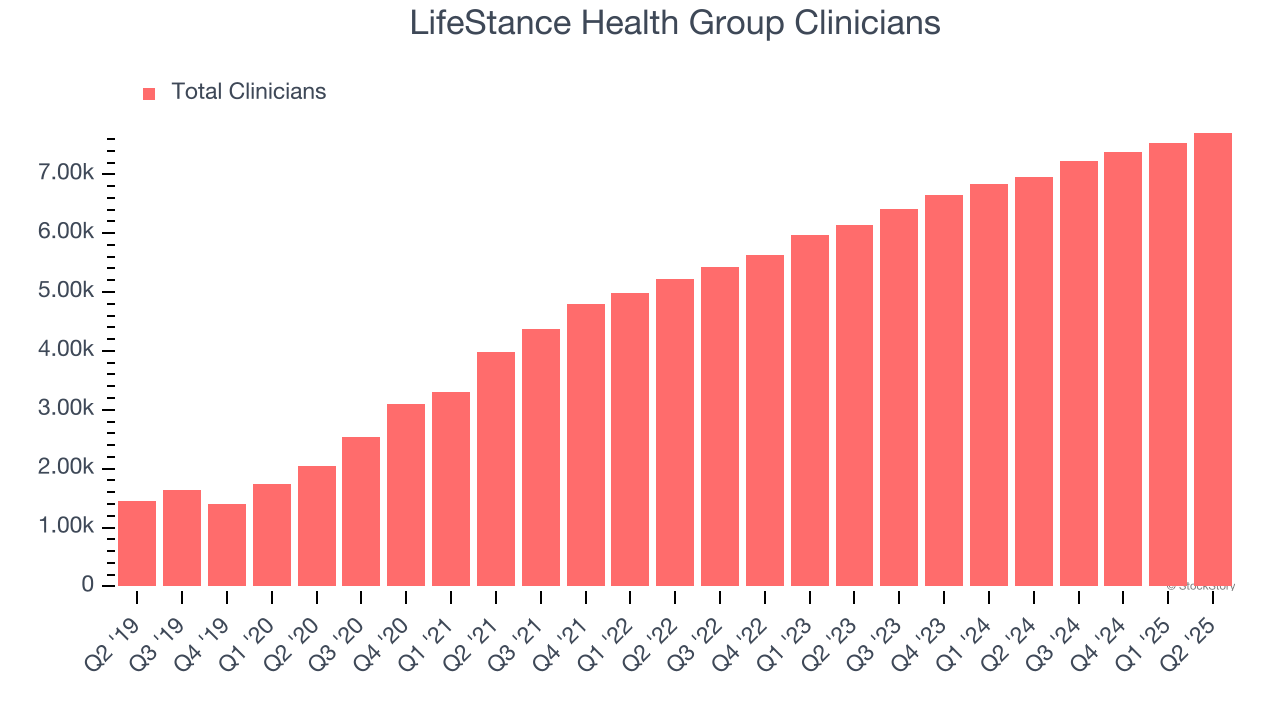

LifeStance Health Group also reports its number of clinicians, which reached 7,708 in the latest quarter. Over the last two years, LifeStance Health Group’s clinicians averaged 13.6% year-on-year growth. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, LifeStance Health Group’s year-on-year revenue growth was 10.6%, and its $345.3 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 13.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 14.9% over the next 12 months, a slight deceleration versus the last two years. Still, this projection is noteworthy and suggests the market is forecasting success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

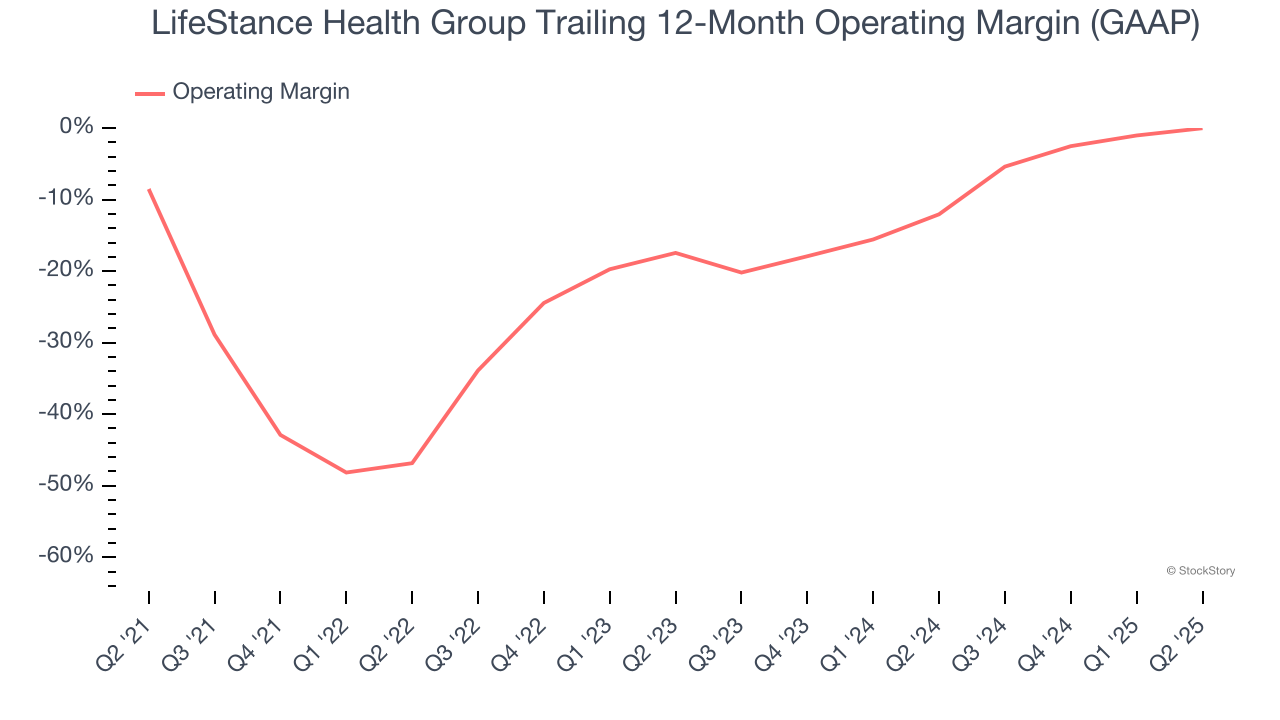

Although LifeStance Health Group broke even this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 15.1% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, LifeStance Health Group’s operating margin rose by 8.5 percentage points over the last five years, as its sales growth gave it operating leverage. This performance was mostly driven by its recent improvements as the company’s margin has increased by 17.4 percentage points on a two-year basis.

LifeStance Health Group’s operating margin was negative 0.9% this quarter.

Earnings Per Share

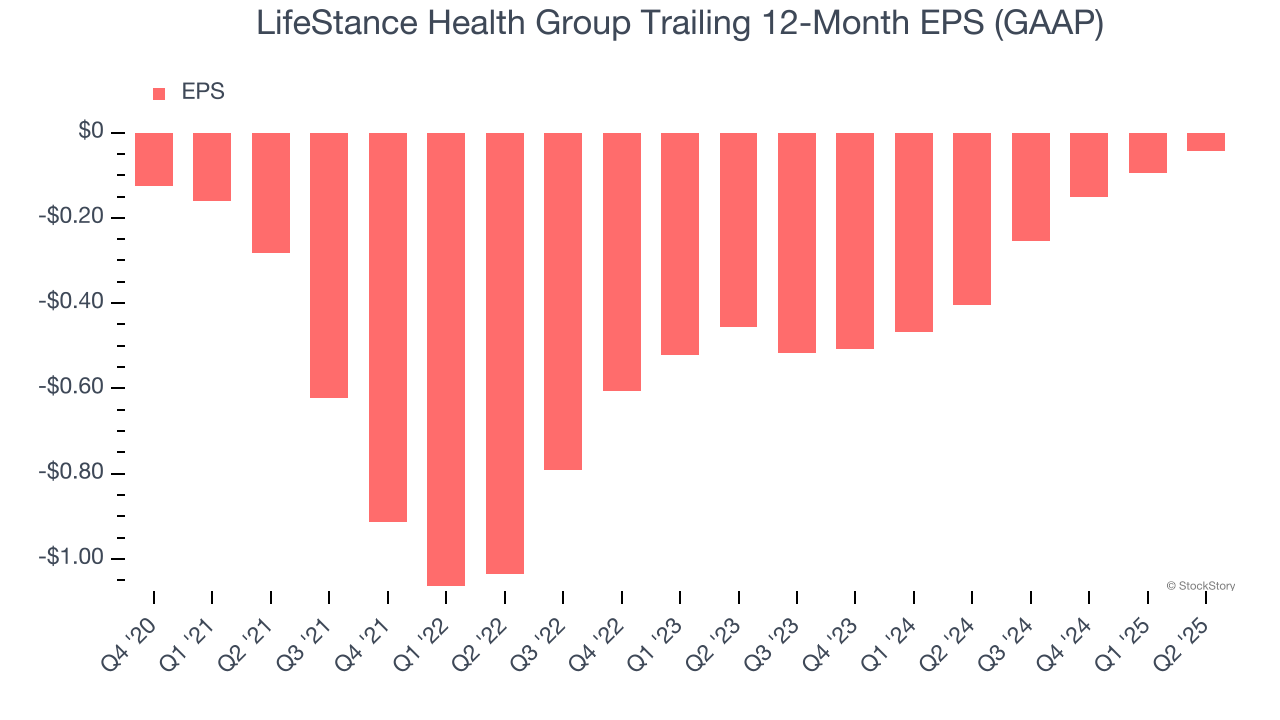

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although LifeStance Health Group’s full-year earnings are still negative, it reduced its losses and improved its EPS by 38.1% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q2, LifeStance Health Group reported EPS at negative $0.01, up from negative $0.06 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street is optimistic. Analysts forecast LifeStance Health Group’s full-year EPS of negative $0.04 will reach break even.

Key Takeaways from LifeStance Health Group’s Q2 Results

We were impressed by how significantly LifeStance Health Group blew past analysts’ EPS expectations this quarter. We were also glad its EBITDA guidance for next quarter exceeded Wall Street’s estimates. On the other hand, its revenue guidance for next quarter slightly missed and its revenue was in line with Wall Street’s estimates. Overall, this print was mixed but still had some key positives. The stock remained flat at $3.93 immediately after reporting.

Indeed, LifeStance Health Group had a rock-solid quarterly earnings result, but is this stock a good investment here? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.