Healthcare solutions company Evolent Health (NYSE: EVH) missed Wall Street’s revenue expectations in Q2 CY2025, with sales falling 31.3% year on year to $444.3 million. Next quarter’s revenue guidance of $470 million underwhelmed, coming in 12.9% below analysts’ estimates. Its non-GAAP loss of $0.10 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Evolent Health? Find out by accessing our full research report, it’s free.

Evolent Health (EVH) Q2 CY2025 Highlights:

- Revenue: $444.3 million vs analyst estimates of $459.5 million (31.3% year-on-year decline, 3.3% miss)

- Adjusted EPS: -$0.10 vs analyst estimates of $0.08 (significant miss)

- Adjusted EBITDA: $37.55 million vs analyst estimates of $35.89 million (8.5% margin, 4.6% beat)

- The company dropped its revenue guidance for the full year to $1.87 billion at the midpoint from $2.09 billion, a 10.6% decrease

- EBITDA guidance for the full year is $152.5 million at the midpoint, in line with analyst expectations

- Operating Margin: -0.3%, down from 1.2% in the same quarter last year

- Free Cash Flow was -$39.1 million, down from $14.31 million in the same quarter last year

- Sales Volumes rose 7.4% year on year (-1.7% in the same quarter last year)

- Market Capitalization: $1.12 billion

Seth Blackley, Co-Founder and Chief Executive Officer of Evolent stated, "Evolent exceeded our EBITDA targets for the second quarter and raised our profitability outlook for the full year. In addition, we continue to see a rapidly accelerating pipeline for new business and based on this acceleration we would expect to exceed our historical growth rates for 2026. The combination of these factors we believe demonstrates Evolent's critical role in the system where our solutions seek to simultaneously improve quality for members, reduce administrative burden for providers and manage affordability for the system. Finally, as we mark the one-year anniversary of launching of Auth Intelligence, we remain confident in achieving the near-term AI and automation targets exiting 2025 while also seeing a path to become a leader in the market on the use of clinical data exchange and AI allowing us to continue to innovate on how specialty care is managed."

Company Overview

Founded in 2011 to transform how healthcare is delivered to patients with complex needs, Evolent Health (NYSE: EVH) provides specialty care management services and technology solutions that help health plans and providers deliver better care for patients with complex conditions.

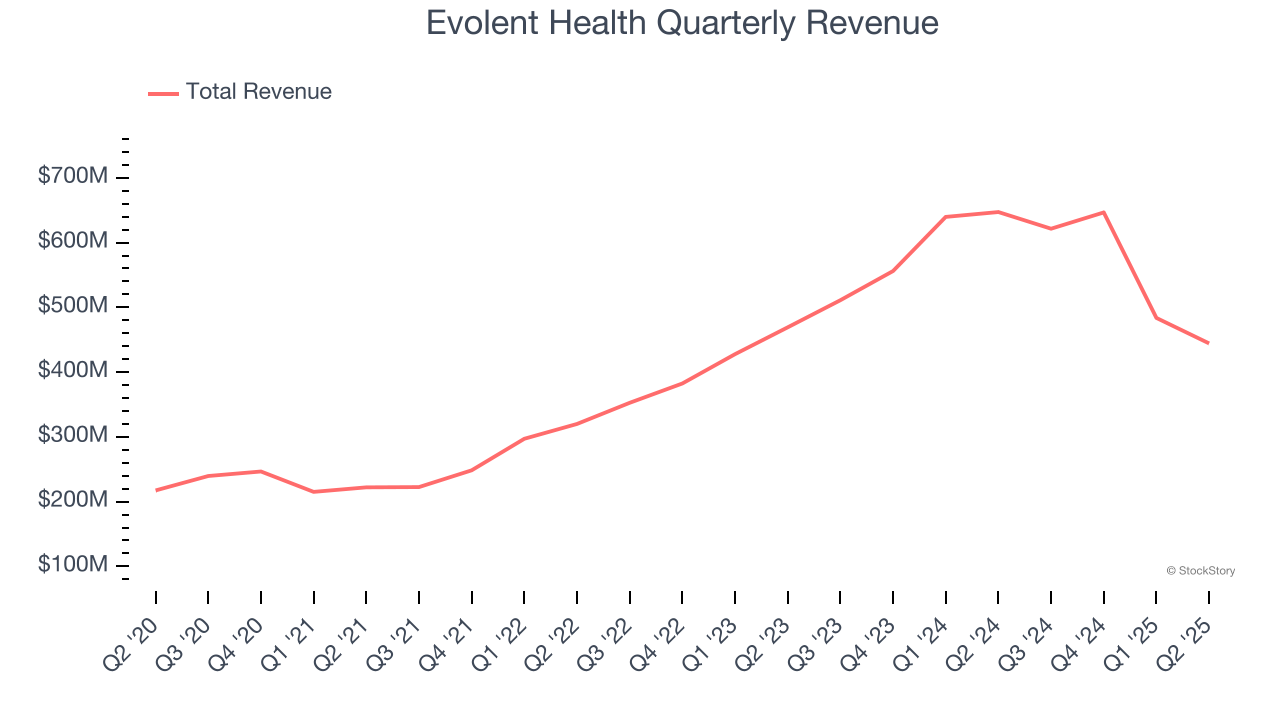

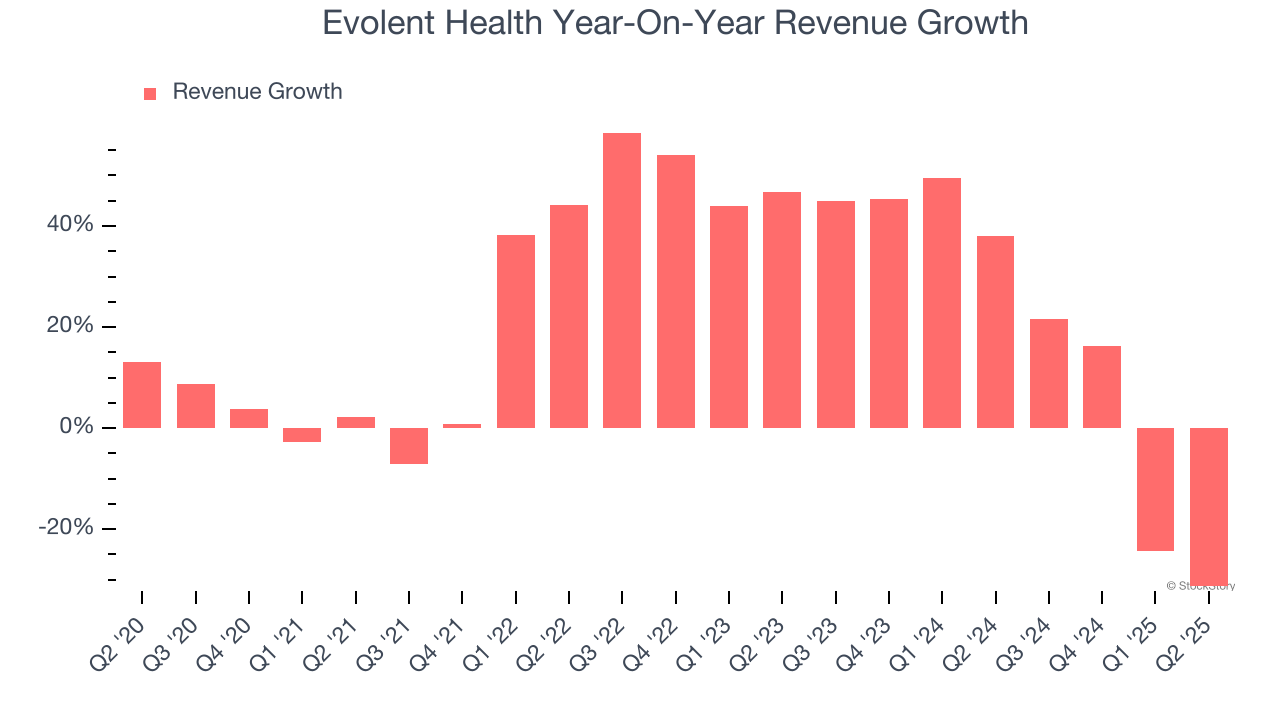

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Evolent Health’s 19.6% annualized revenue growth over the last five years was impressive. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Evolent Health’s annualized revenue growth of 16% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

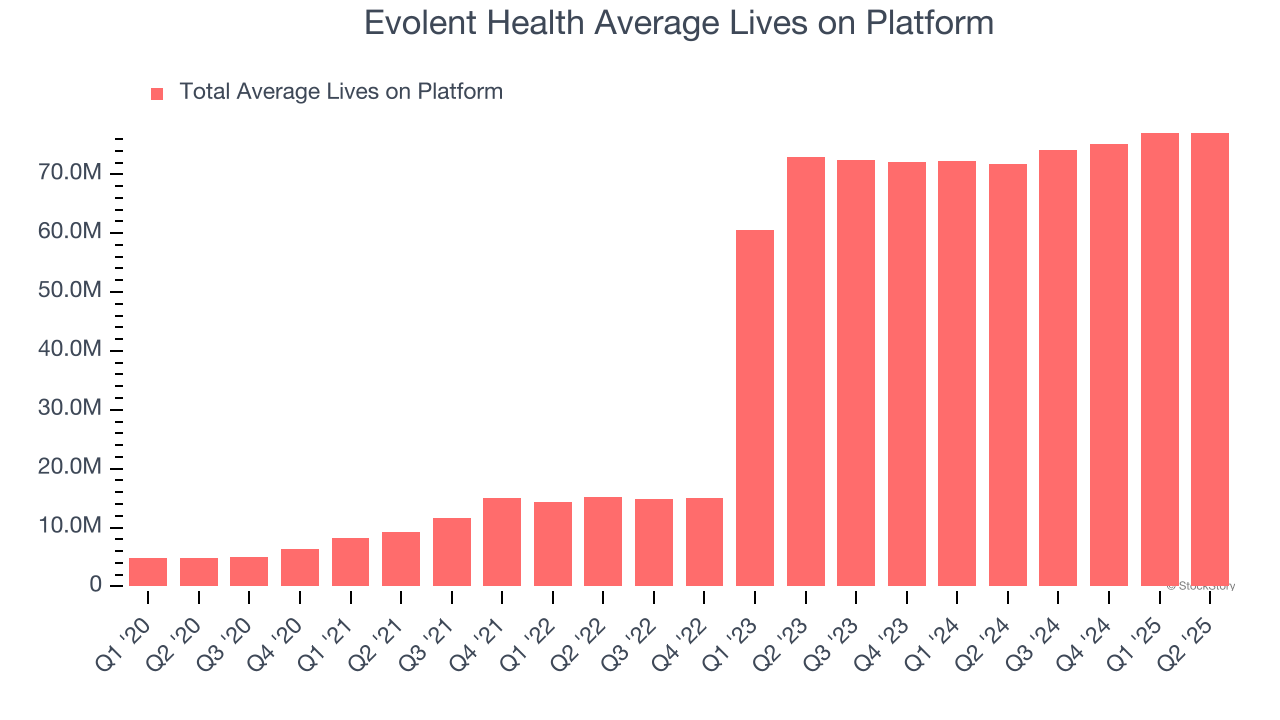

Evolent Health also reports its number of average lives on platform, which reached 77.02 million in the latest quarter. Over the last two years, Evolent Health’s average lives on platform averaged 101% year-on-year growth. Because this number is better than its revenue growth, we can see the company’s average selling price decreased.

This quarter, Evolent Health missed Wall Street’s estimates and reported a rather uninspiring 31.3% year-on-year revenue decline, generating $444.3 million of revenue. Company management is currently guiding for a 24.4% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.9% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will face some demand challenges.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

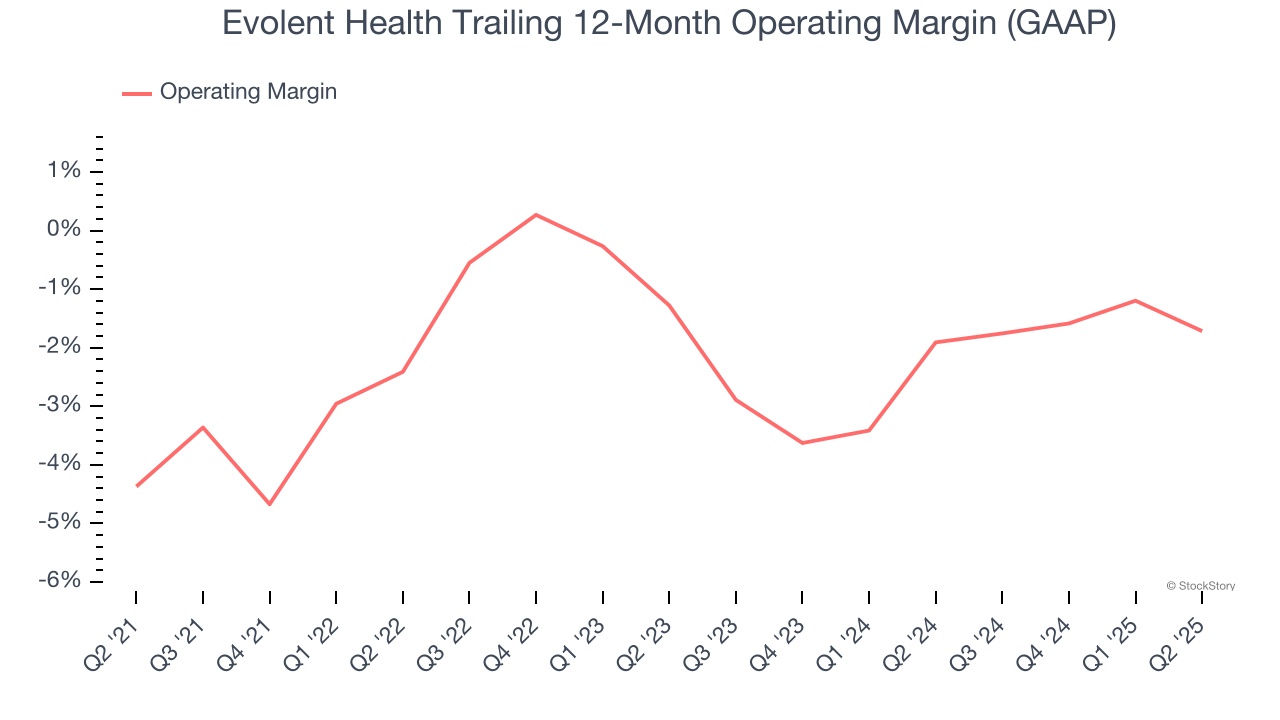

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

Although Evolent Health broke even this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 2.1% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Evolent Health’s operating margin rose by 2.7 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

In Q2, Evolent Health generated a negative 0.3% operating margin.

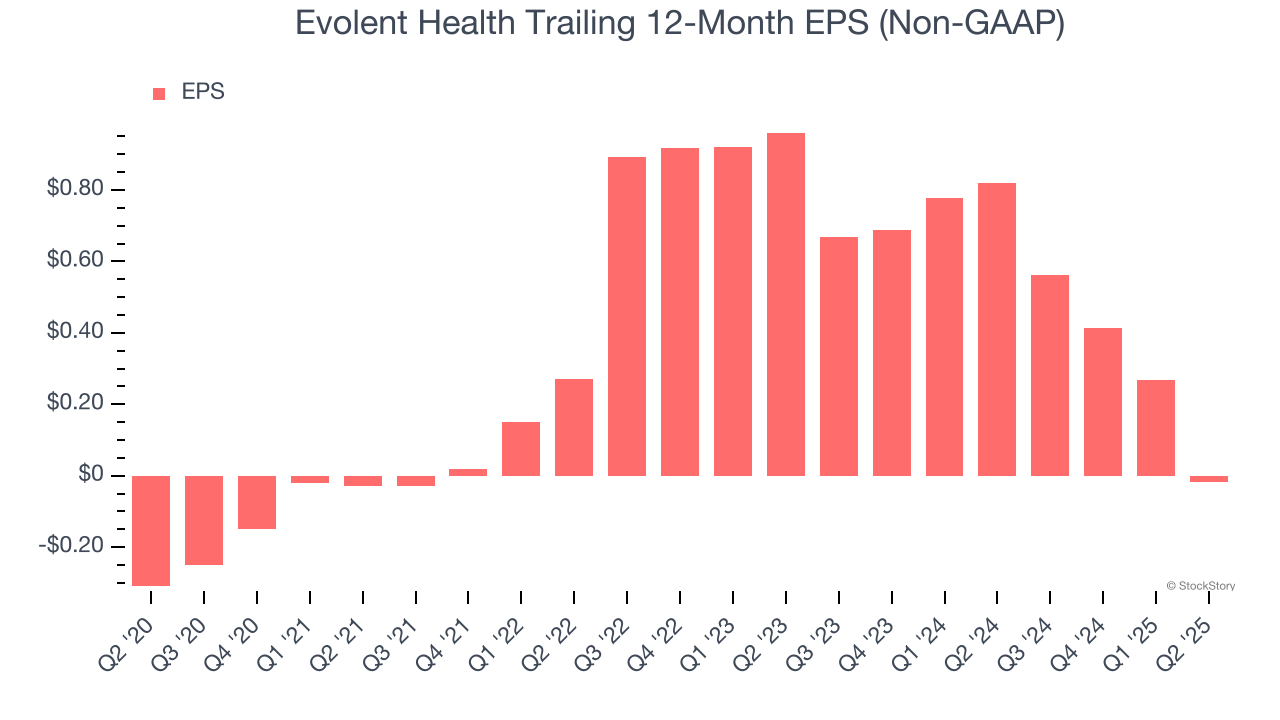

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although Evolent Health’s full-year earnings are still negative, it reduced its losses and improved its EPS by 44.5% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q2, Evolent Health reported adjusted EPS at negative $0.10, down from $0.18 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Evolent Health’s full-year EPS of negative $0.02 will reach break even.

Key Takeaways from Evolent Health’s Q2 Results

We struggled to find many positives in these results. Its full-year revenue guidance missed and its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 5.6% to $9.15 immediately following the results.

Evolent Health’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.