Over the last six months, Starbucks’s shares have sunk to $83.85, producing a disappointing 17.1% loss - a stark contrast to the S&P 500’s 16% gain. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Starbucks, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Starbucks Not Exciting?

Even with the cheaper entry price, we're swiping left on Starbucks for now. Here are three reasons why SBUX doesn't excite us and a stock we'd rather own.

1. Shrinking Same-Store Sales Indicate Waning Demand

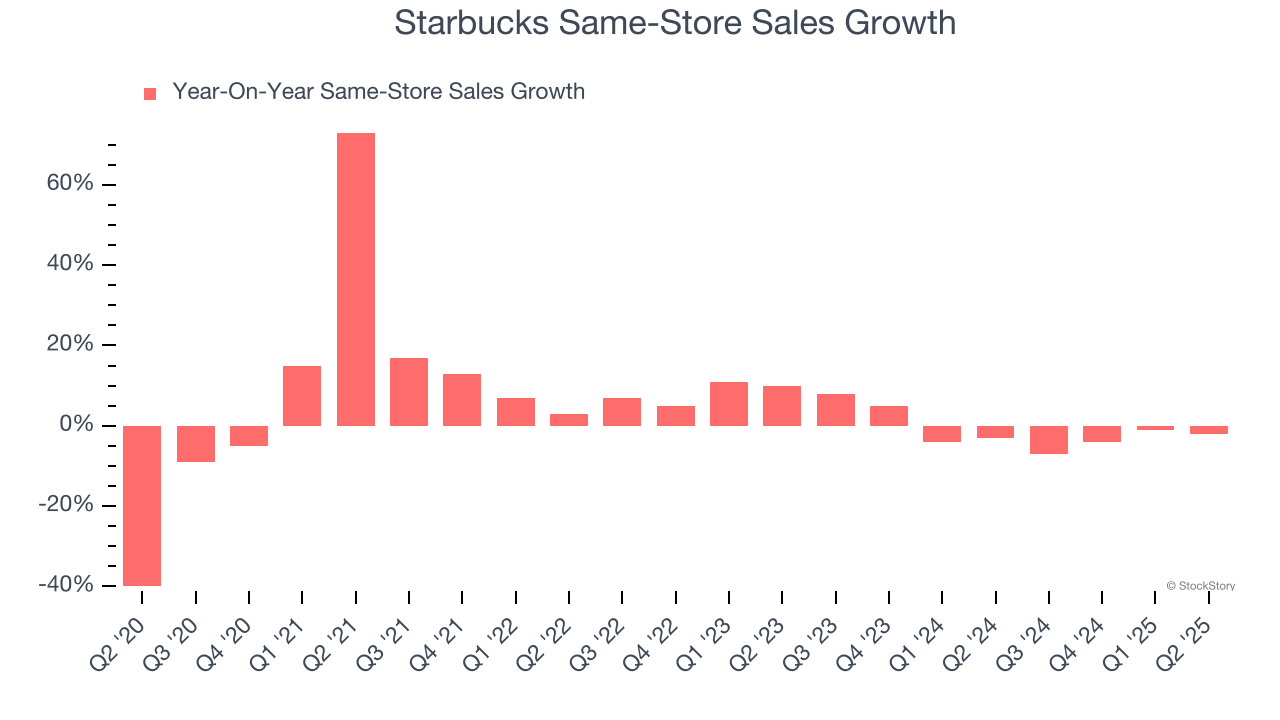

Same-store sales show the change in sales at restaurants open for at least a year. This is a key performance indicator because it measures organic growth.

Starbucks’s demand has been shrinking over the last two years as its same-store sales have averaged 1% annual declines.

2. Shrinking Operating Margin

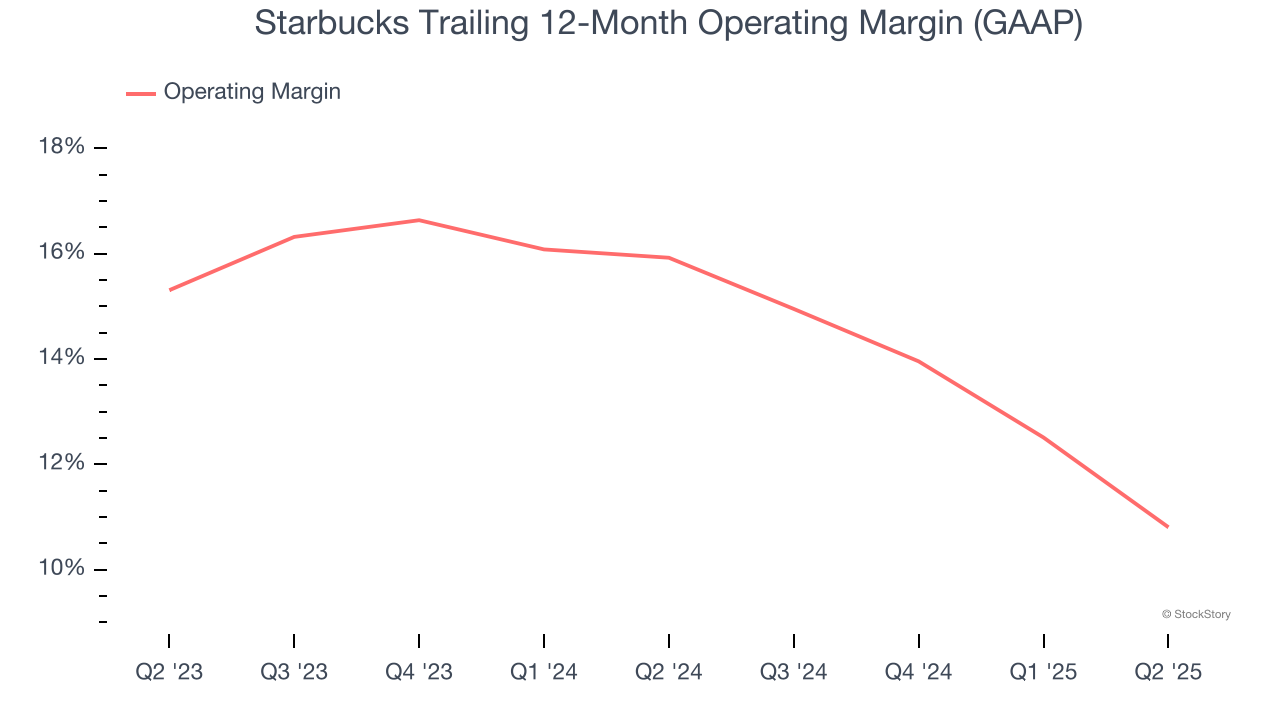

Operating margin is a key profitability metric because it accounts for all expenses keeping the business in motion, including food costs, wages, rent, advertising, and other administrative costs.

Looking at the trend in its profitability, Starbucks’s operating margin decreased by 5.1 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its operating margin for the trailing 12 months was 10.8%.

3. EPS Trending Down

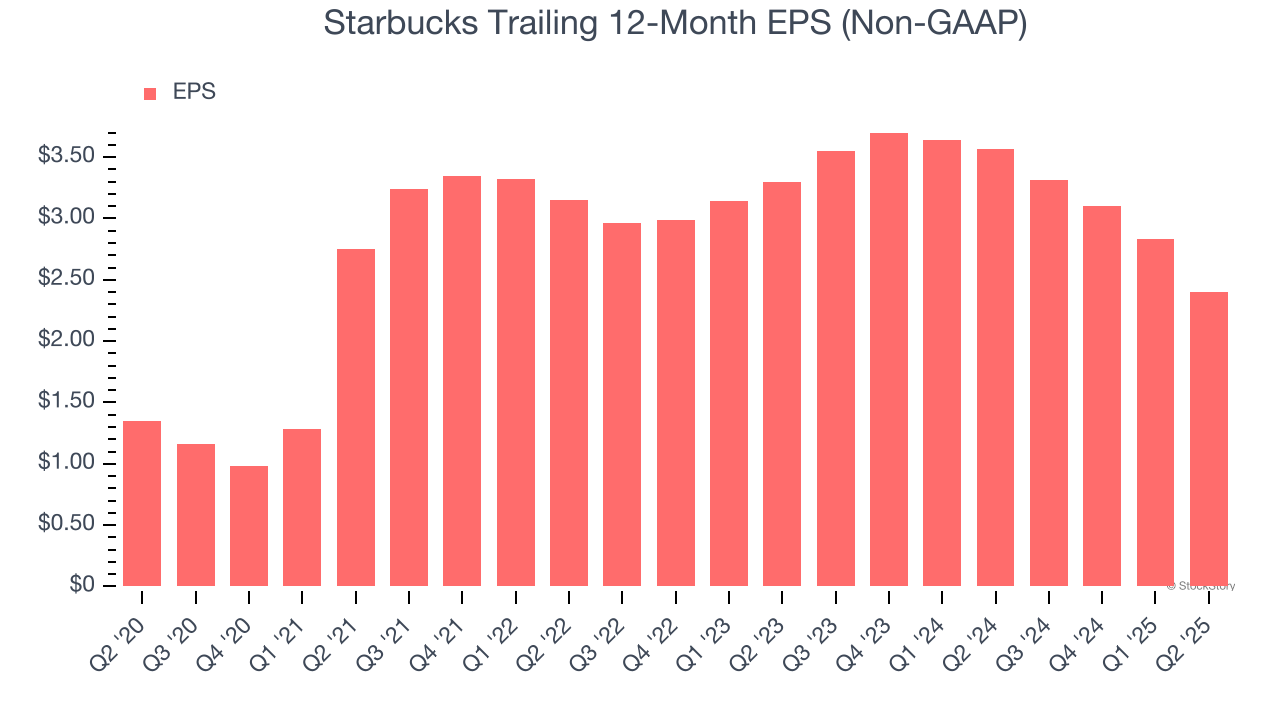

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Starbucks, its EPS declined by 2.2% annually over the last six years while its revenue grew by 5.9%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Starbucks isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 31× forward P/E (or $83.85 per share). This valuation tells us a lot of optimism is priced in - we think other companies feature superior fundamentals at the moment. Let us point you toward a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than Starbucks

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.