The ONE Group currently trades at $2.64 per share and has shown little upside over the past six months, posting a middling return of 4.1%. The stock also fell short of the S&P 500’s 17.4% gain during that period.

Is now the time to buy The ONE Group, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is The ONE Group Not Exciting?

We're swiping left on The ONE Group for now. Here are three reasons why STKS doesn't excite us and a stock we'd rather own.

1. Shrinking Same-Store Sales Indicate Waning Demand

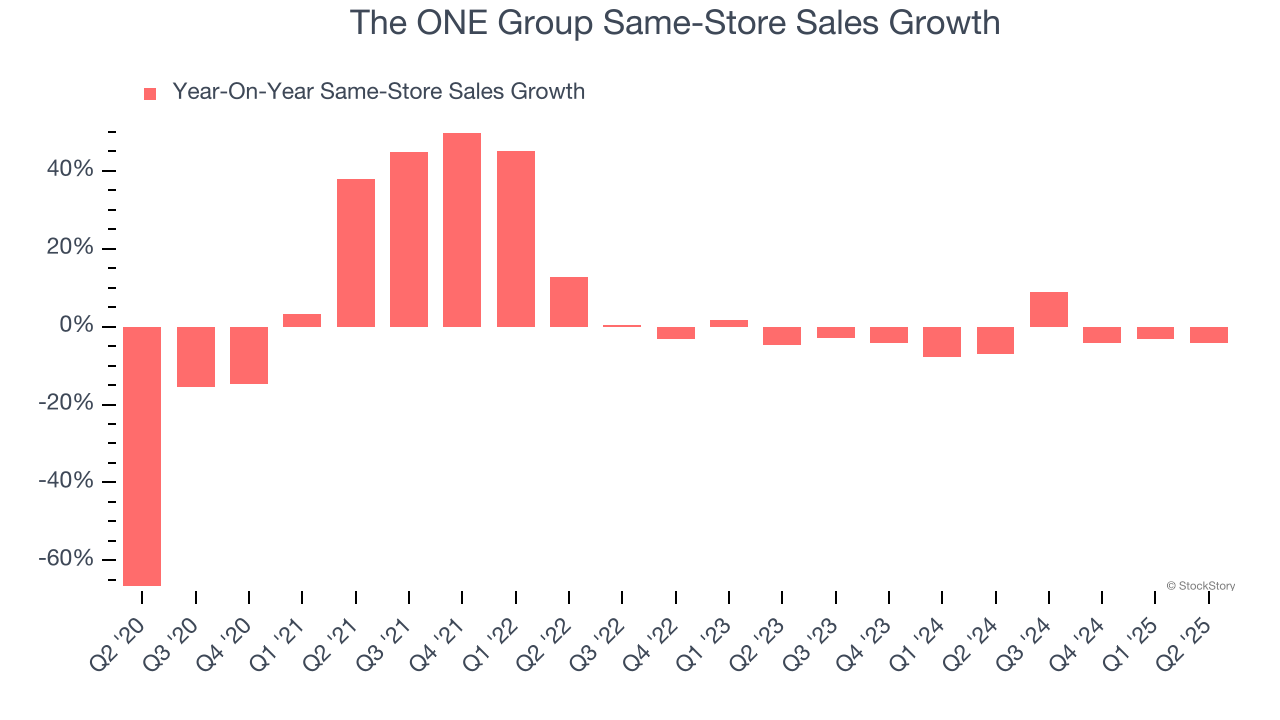

Same-store sales show the change in sales at restaurants open for at least a year. This is a key performance indicator because it measures organic growth.

The ONE Group’s demand has been shrinking over the last two years as its same-store sales have averaged 3.1% annual declines.

2. EPS Trending Down

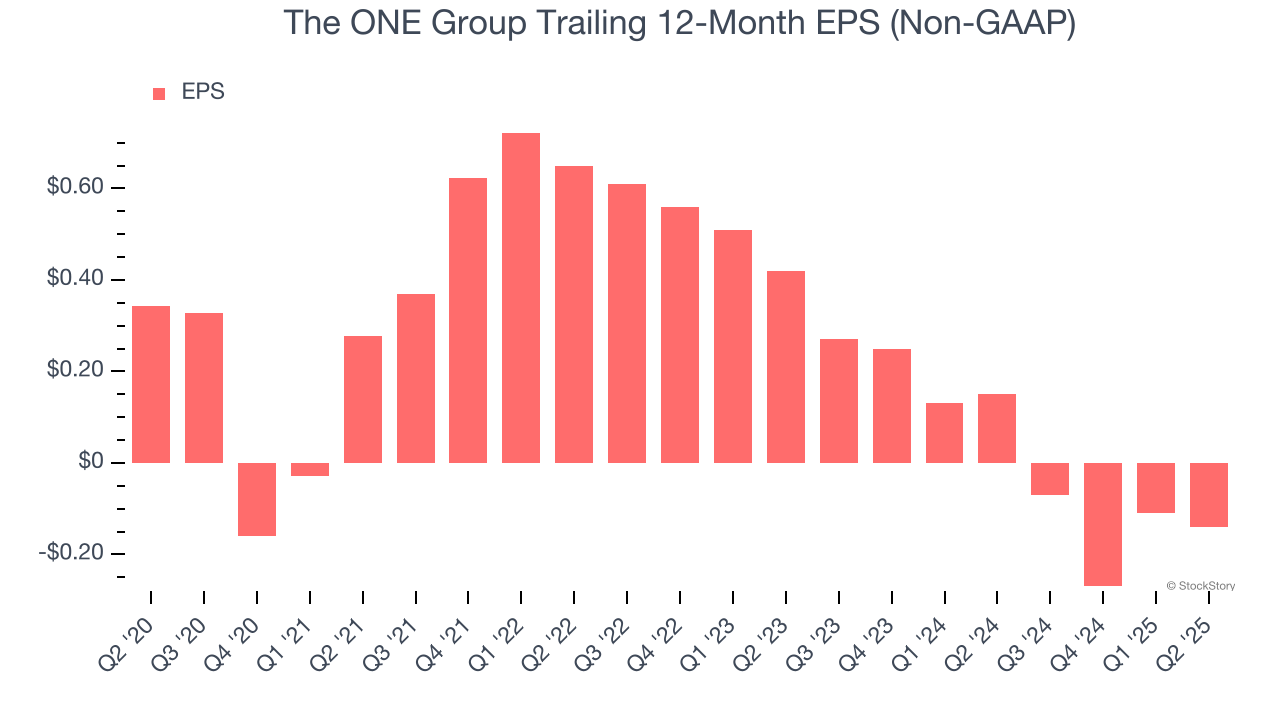

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

The ONE Group’s full-year EPS turned negative over the last five years. We tend to steer our readers away from companies with falling EPS, especially restaurants, which are arguably some of the hardest businesses to manage because of constantly changing consumer tastes, input costs, and labor dynamics. If the tide turns unexpectedly, The ONE Group’s low margin of safety could leave its stock price susceptible to large downswings.

3. High Debt Levels Increase Risk

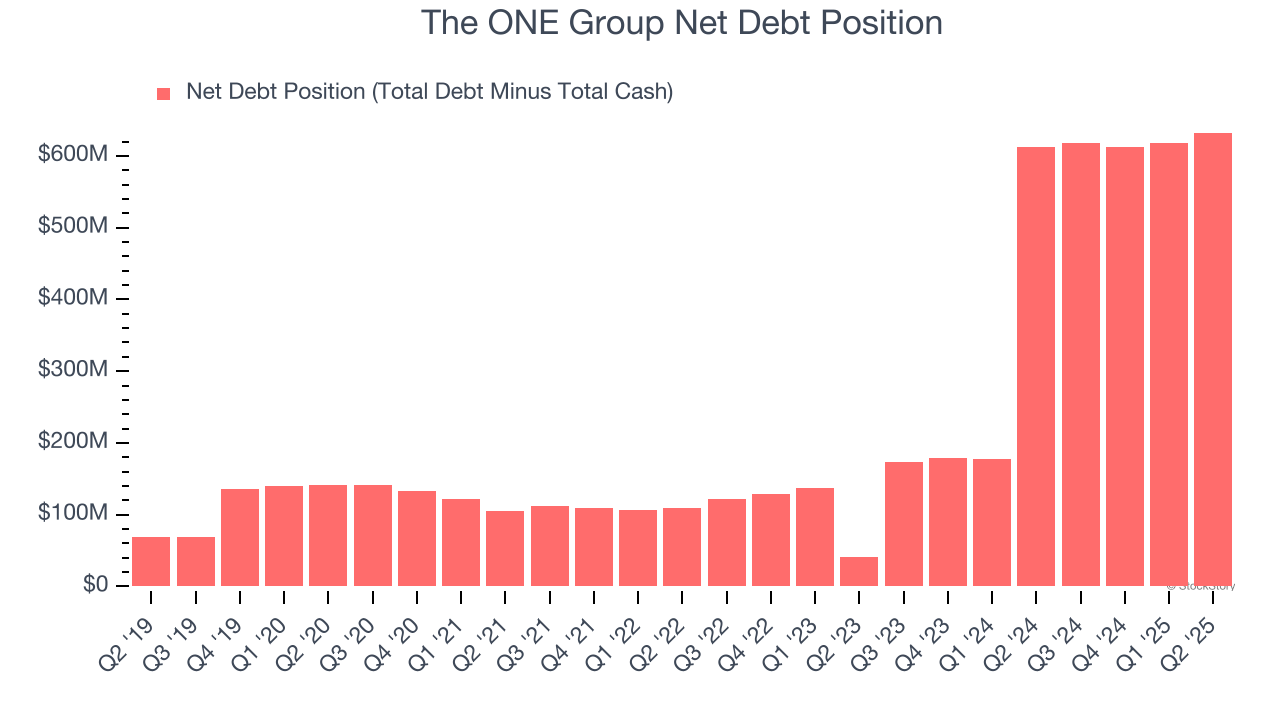

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

The ONE Group’s $637.7 million of debt exceeds the $5.16 million of cash on its balance sheet. Furthermore, its 7× net-debt-to-EBITDA ratio (based on its EBITDA of $93.64 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. The ONE Group could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope The ONE Group can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

The ONE Group isn’t a terrible business, but it isn’t one of our picks. With its shares trailing the market in recent months, the stock trades at 5.8× forward P/E (or $2.64 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better investments elsewhere. We’d suggest looking at the Amazon and PayPal of Latin America.

Stocks We Would Buy Instead of The ONE Group

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.