Over the past six months, Mueller Water Products’s shares (currently trading at $24.67) have posted a disappointing 7% loss, well below the S&P 500’s 17.4% gain. This may have investors wondering how to approach the situation.

Following the pullback, is now the time to buy MWA? Find out in our full research report, it’s free.

Why Does Mueller Water Products Spark Debate?

As one of the oldest companies in the water infrastructure industry, Mueller (NYSE: MWA) is a provider of water infrastructure products and flow control systems for various sectors.

Two Positive Attributes:

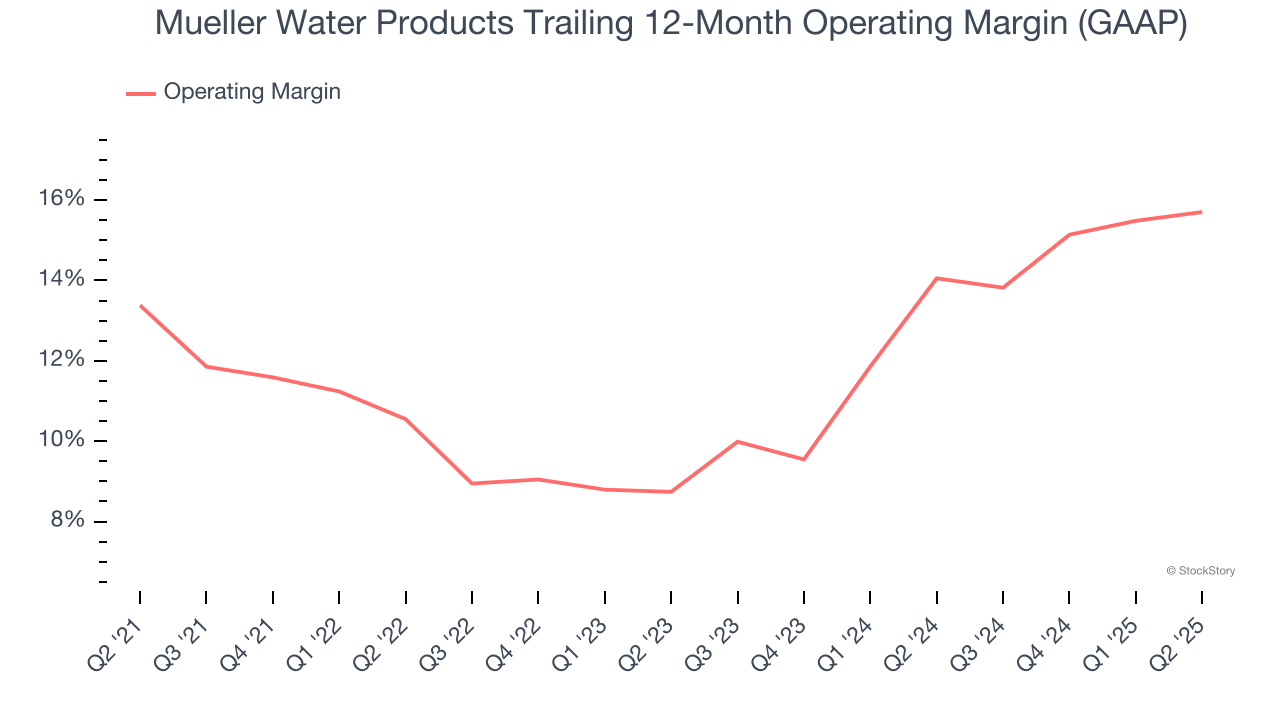

1. Operating Margin Reveals a Well-Run Organization

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Mueller Water Products has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.5%.

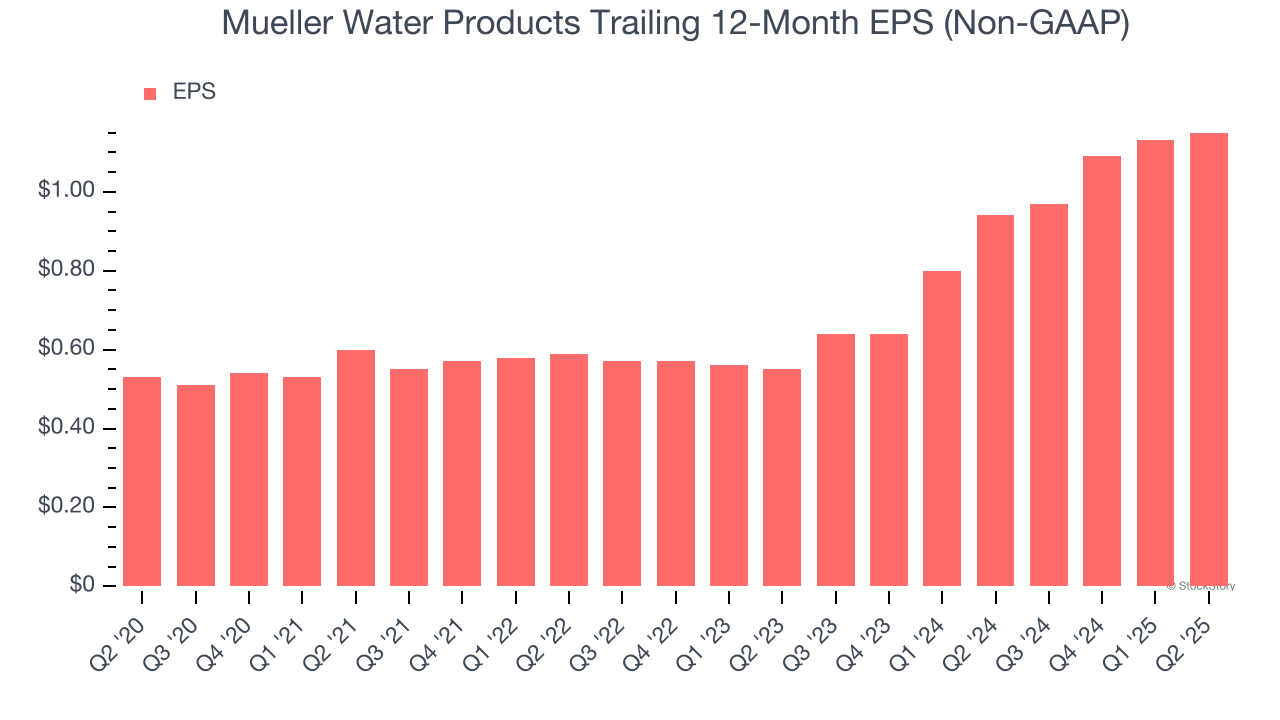

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Mueller Water Products’s EPS grew at a spectacular 16.8% compounded annual growth rate over the last five years, higher than its 7.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

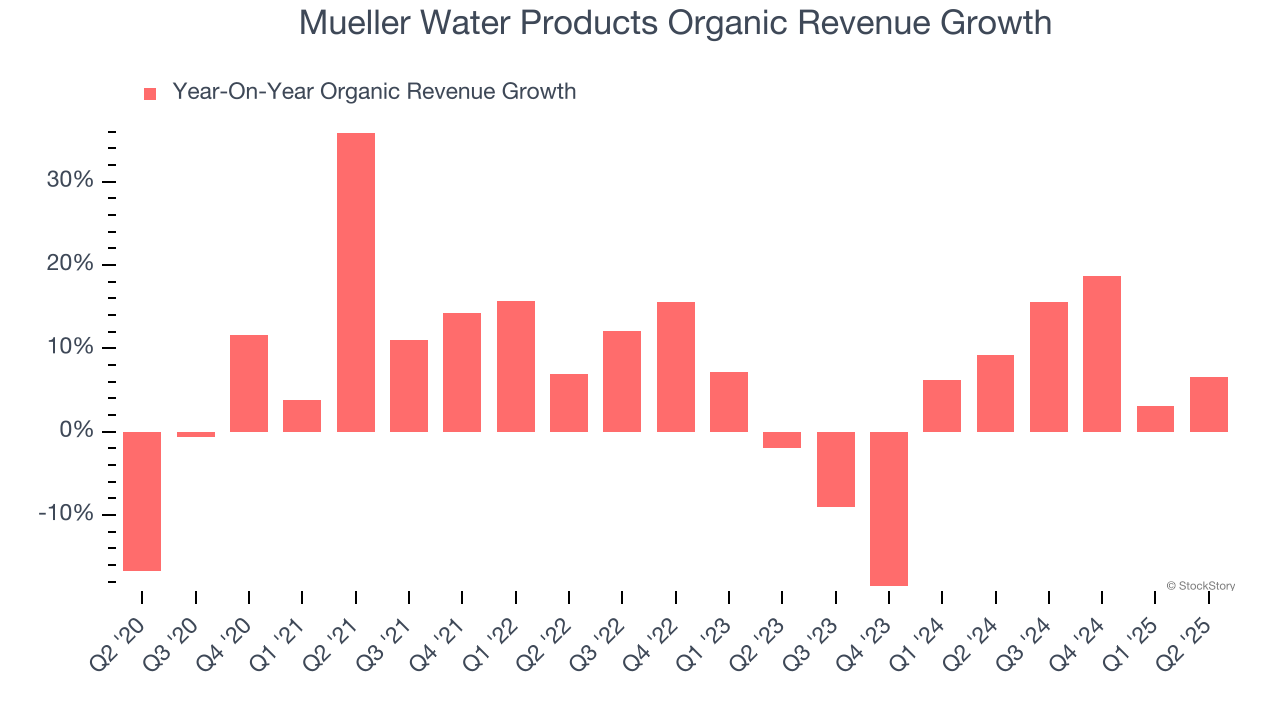

Slow Organic Growth Suggests Waning Demand In Core Business

We can better understand Water Infrastructure companies by analyzing their organic revenue. This metric gives visibility into Mueller Water Products’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Mueller Water Products’s organic revenue averaged 4% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

Final Judgment

Mueller Water Products has huge potential even though it has some open questions. With the recent decline, the stock trades at 18.8× forward P/E (or $24.67 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.