As the Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the personal loan industry, including SoFi (NASDAQ: SOFI) and its peers.

Personal loan providers offer unsecured credit for various consumer needs. The sector benefits from digital application processes, increasing consumer comfort with online financial services, and opportunities in underserved credit segments. Headwinds include credit risk management in unsecured lending, regulatory oversight of lending practices, and intense competition affecting margins from both traditional and fintech lenders.

The 9 personal loan stocks we track reported an exceptional Q2. As a group, revenues beat analysts’ consensus estimates by 4.9% while next quarter’s revenue guidance was 1.5% below.

Thankfully, share prices of the companies have been resilient as they are up 7.2% on average since the latest earnings results.

SoFi (NASDAQ: SOFI)

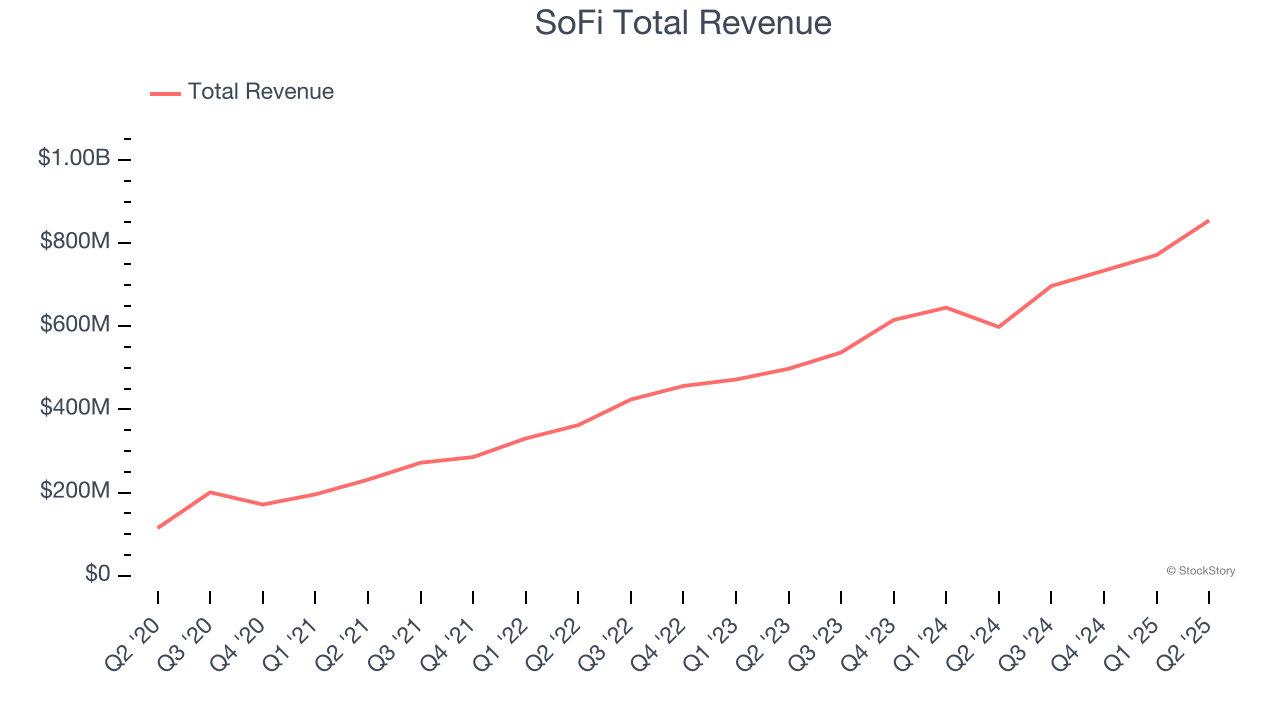

Starting as a student loan refinancing company founded by Stanford business school students in 2011, SoFi Technologies (NASDAQ: SOFI) operates a digital financial platform offering lending, banking, investing, and other financial services to help members borrow, save, spend, invest, and protect their money.

SoFi reported revenues of $854.9 million, up 42.8% year on year. This print exceeded analysts’ expectations by 5.7%. Overall, it was a stunning quarter for the company with a beat of analysts’ EPS estimates and a solid beat of analysts’ transaction volumes estimates.

“We had an exceptional second quarter, driving durable growth and strong returns through our relentless focus on product innovation and brand building,” said Anthony Noto, CEO of SoFi.

Interestingly, the stock is up 23.7% since reporting and currently trades at $26.03.

We think SoFi is a good business, but is it a buy today? Read our full report here, it’s free.

Best Q2: Dave (NASDAQ: DAVE)

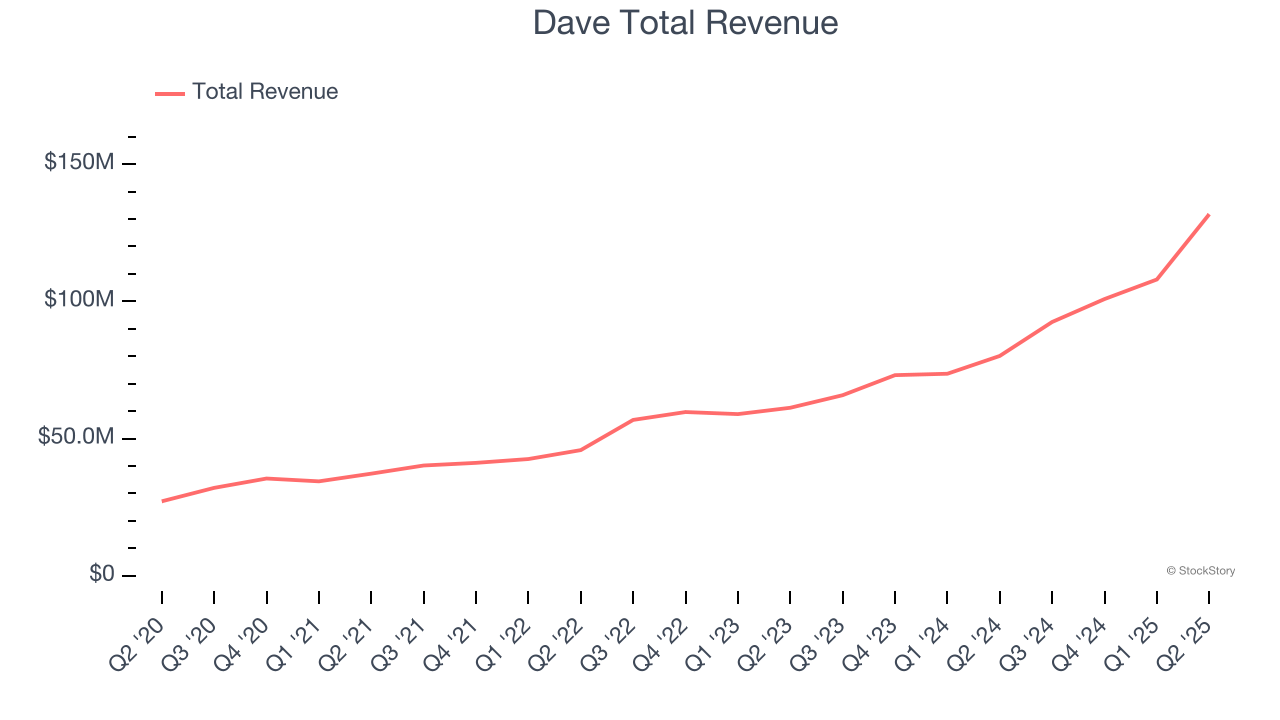

Named after the biblical David fighting financial Goliaths, Dave (NASDAQ: DAVE) is a digital financial services platform that helps Americans living paycheck to paycheck with cash advances, banking services, and tools to improve their financial health.

Dave reported revenues of $131.8 million, up 64.5% year on year, outperforming analysts’ expectations by 16%. The business had an incredible quarter with a beat of analysts’ EPS estimates.

Dave delivered the biggest analyst estimates beat among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 5.3% since reporting. It currently trades at $226.30.

Is now the time to buy Dave? Access our full analysis of the earnings results here, it’s free.

Slowest Q2: Nubank (NYSE: NU)

With nearly 94 million customers across Brazil, Mexico, and Colombia through its viral member-get-member referral program, Nubank (NYSE: NU) is a digital banking platform that offers financial services including spending, saving, investing, borrowing, and protection products to millions of customers across Latin America.

Nubank reported revenues of $2.64 billion, up 20.8% year on year, exceeding analysts’ expectations by 1.3%. It was a satisfactory quarter as it also posted EPS in line with analysts’ estimates.

Interestingly, the stock is up 30.5% since the results and currently trades at $15.66.

Read our full analysis of Nubank’s results here.

Affirm (NASDAQ: AFRM)

Founded by PayPal co-founder Max Levchin with a mission to create honest financial products, Affirm (NASDAQ: AFRM) provides a payment network that allows consumers to make purchases and pay for them over time with transparent, flexible installment loans.

Affirm reported revenues of $876.4 million, up 33% year on year. This number surpassed analysts’ expectations by 4.7%. It was a stunning quarter as it also logged a beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The stock is up 1.9% since reporting and currently trades at $81.49.

Read our full, actionable report on Affirm here, it’s free.

OneMain (NYSE: OMF)

Dating back to 1912 and formerly known as Springleaf, OneMain Holdings (NYSE: OMF) provides personal loans, auto financing, and credit cards to nonprime consumers who have limited access to traditional banking services.

OneMain reported revenues of $1.21 billion, up 10.2% year on year. This print beat analysts’ expectations by 1.7%. Overall, it was a very strong quarter as it also recorded a solid beat of analysts’ yield estimates and a beat of analysts’ EPS estimates.

The stock is up 6.1% since reporting and currently trades at $62.23.

Read our full, actionable report on OneMain here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.