Charles Schwab trades at $92.25 and has moved in lockstep with the market. Its shares have returned 18.6% over the last six months while the S&P 500 has gained 16.5%.

Is now the time to buy Charles Schwab, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Charles Schwab Not Exciting?

We don't have much confidence in Charles Schwab. Here are two reasons you should be careful with SCHW and a stock we'd rather own.

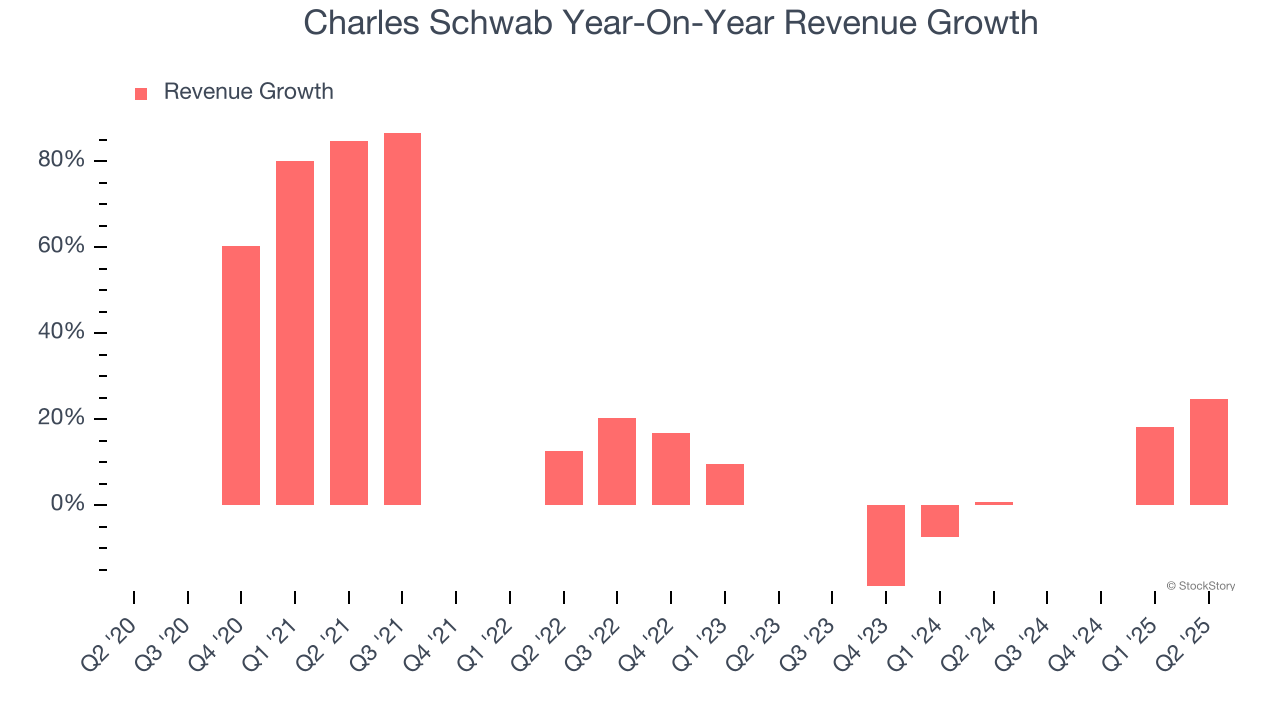

1. Lackluster Revenue Growth

Long-term growth is the most important, but within financials, a stretched historical view may miss recent interest rate changes and market returns. Charles Schwab’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 2% over the last two years was well below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

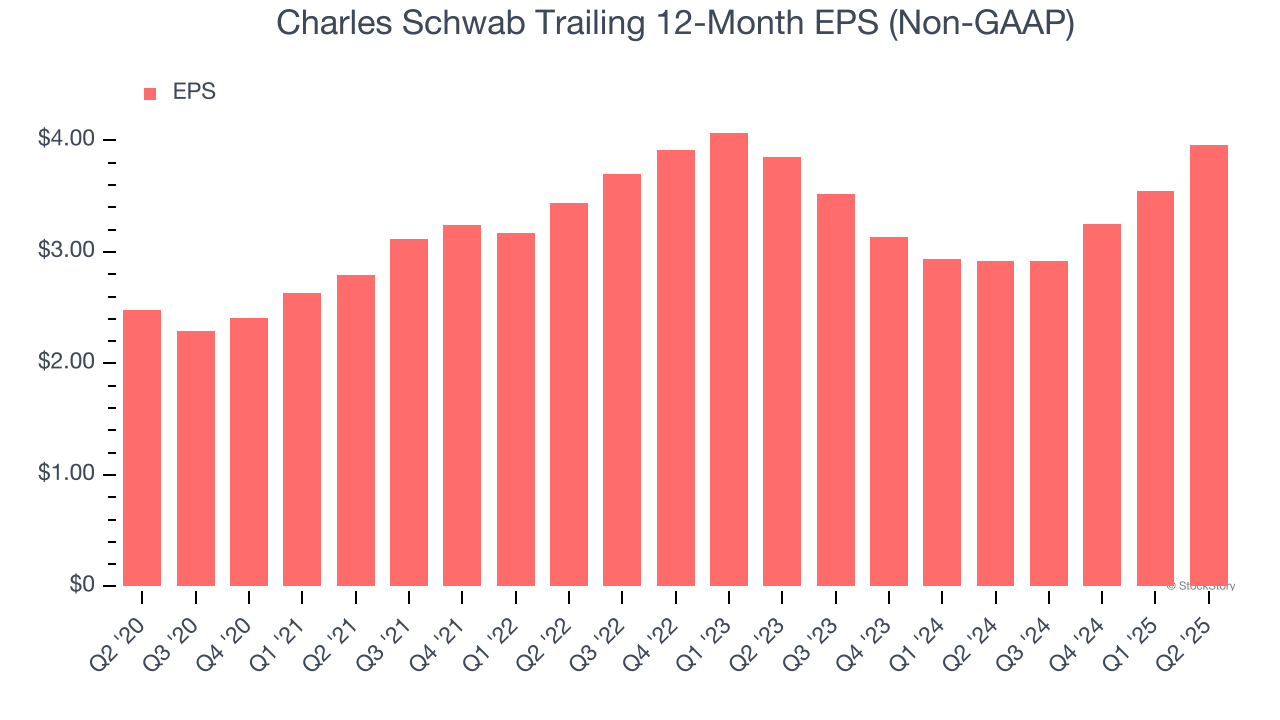

2. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Charles Schwab’s EPS grew at an unimpressive 9.8% compounded annual growth rate over the last five years, lower than its 15.8% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Charles Schwab’s business quality ultimately falls short of our standards. That said, the stock currently trades at 19× forward P/E (or $92.25 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at the Amazon and PayPal of Latin America.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.