AutoZone trades at $4,229 and has moved in lockstep with the market. Its shares have returned 16.8% over the last six months while the S&P 500 has gained 16.5%.

Is now the time to buy AZO? Find out in our full research report, it’s free.

Why Is AutoZone a Good Business?

Aiming to be a one-stop shop for the DIY customer, AutoZone (NYSE: AZO) is an auto parts and accessories retailer that sells everything from car batteries to windshield wiper fluid to brake pads.

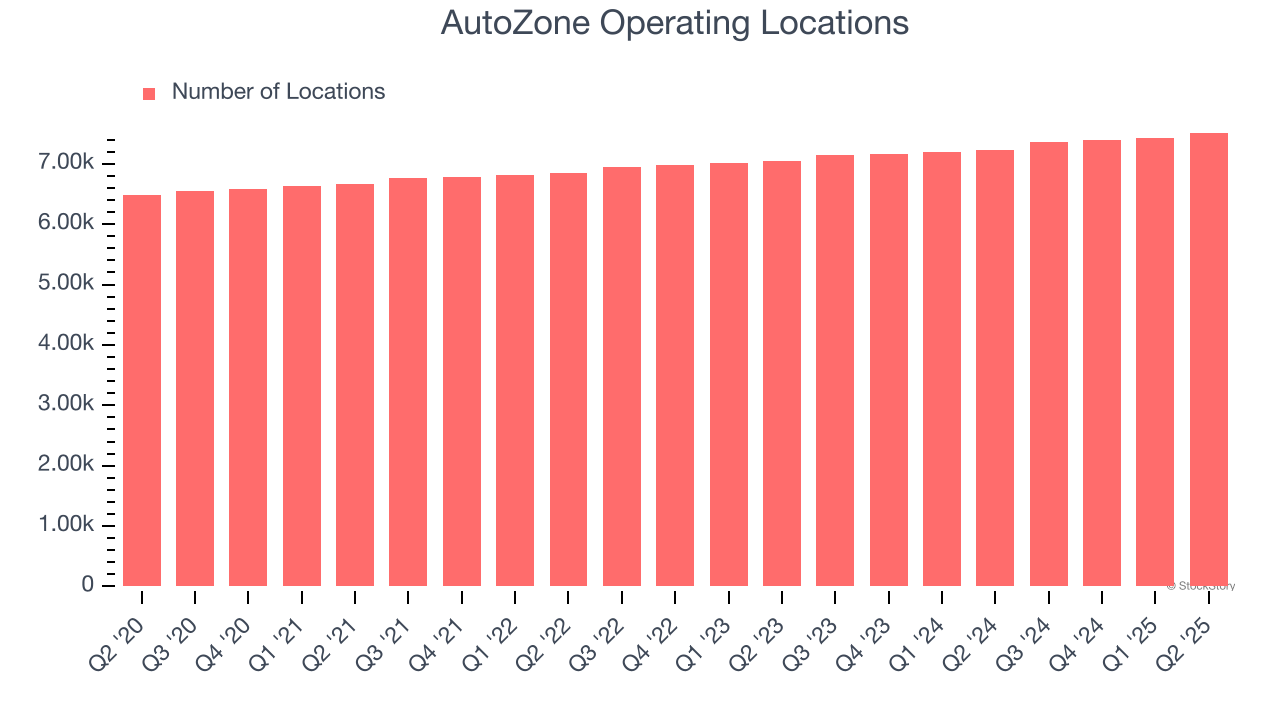

1. New Stores Popping Up Gradually, Supports Growth

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

AutoZone sported 7,516 locations in the latest quarter. Over the last two years, it has opened new stores quickly, averaging 3% annual growth. This was faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

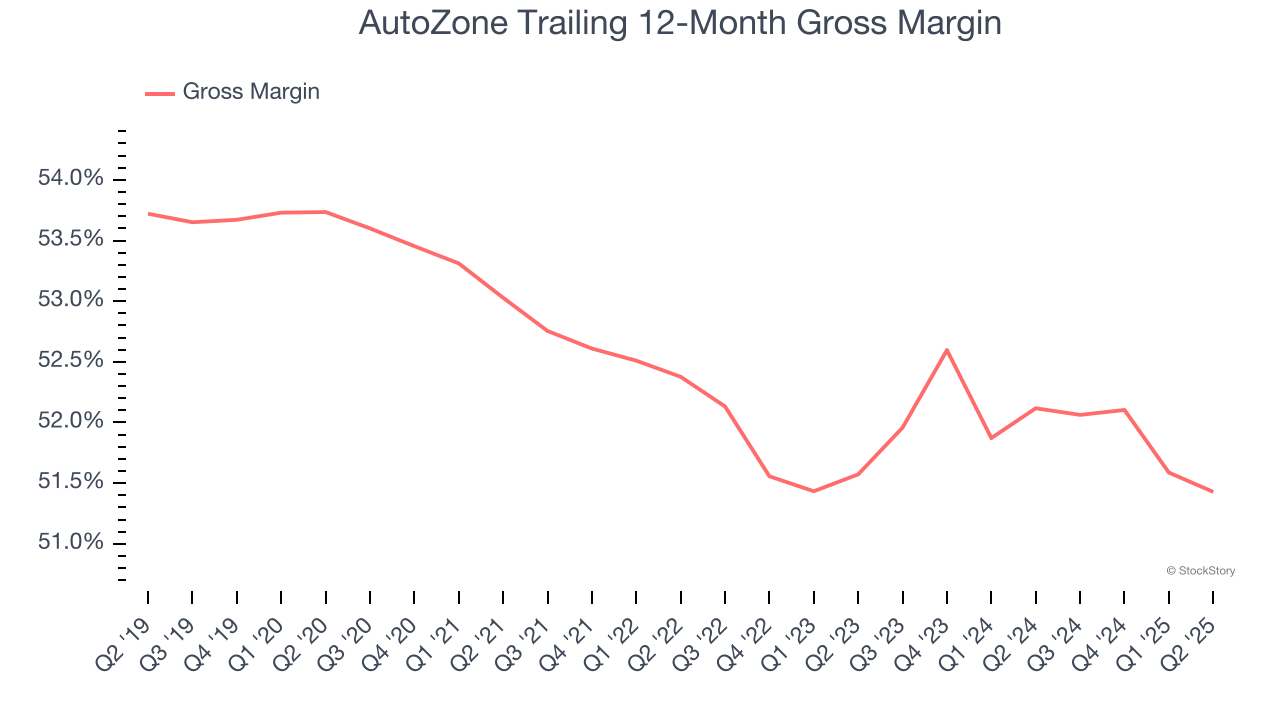

2. Elite Gross Margin Powers Best-In-Class Business Model

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

AutoZone has best-in-class unit economics for a retailer, enabling it to invest in areas such as marketing and talent. As you can see below, it averaged an elite 51.8% gross margin over the last two years. That means AutoZone only paid its suppliers $48.24 for every $100 in revenue.

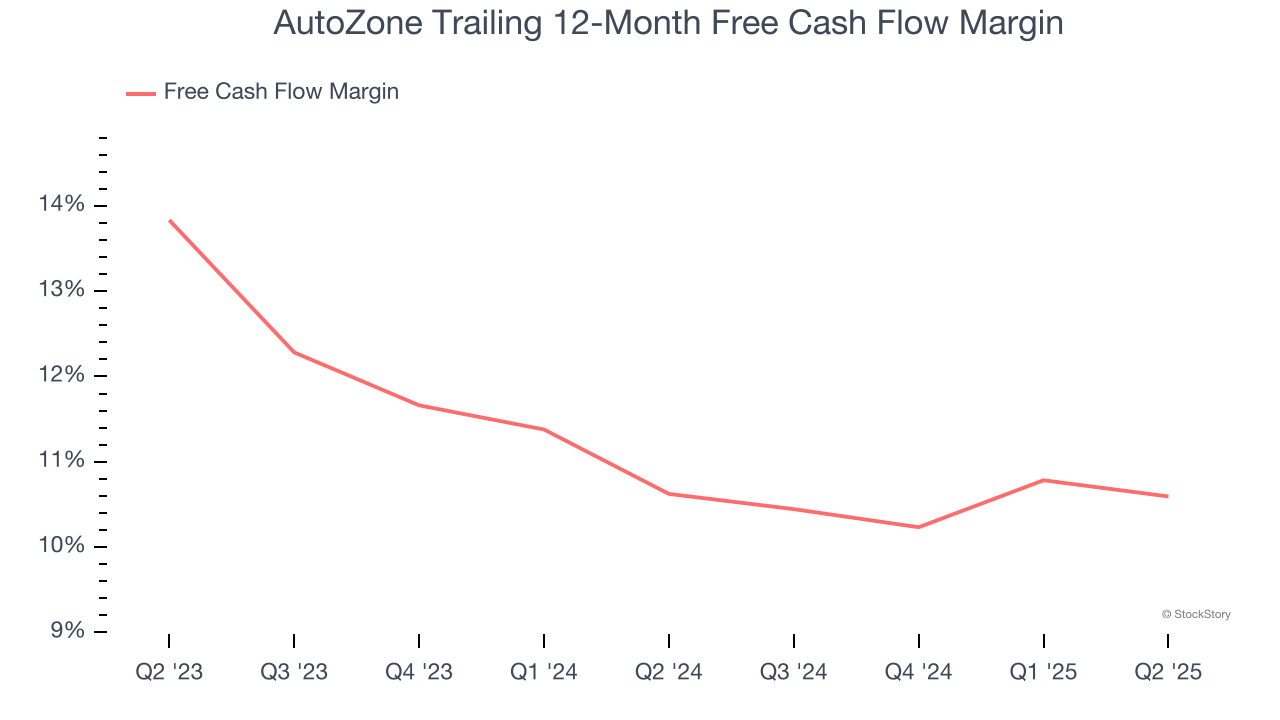

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

AutoZone has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer retail sector, averaging 10.6% over the last two years.

Final Judgment

These are just a few reasons why AutoZone ranks highly on our list, but at $4,229 per share (or 25.6× forward P/E), is now the right time to buy the stock? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than AutoZone

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.