Let’s dig into the relative performance of Micron (NASDAQ: MU) and its peers as we unravel the now-completed Q2 semiconductors earnings season.

The semiconductor industry is driven by cyclical demand for advanced electronic products like smartphones, PCs, servers, and data storage. While analog chips serve as the building blocks of most electronic goods and equipment, processors (CPUs) and graphics chips serve as their brains. The growth of data and technologies like artificial intelligence, 5G, the Internet of Things, and smart cars are creating the next wave of secular growth for the industry.

The 41 semiconductors stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 2.7% while next quarter’s revenue guidance was in line.

Luckily, semiconductors stocks have performed well with share prices up 10.7% on average since the latest earnings results.

Micron (NASDAQ: MU)

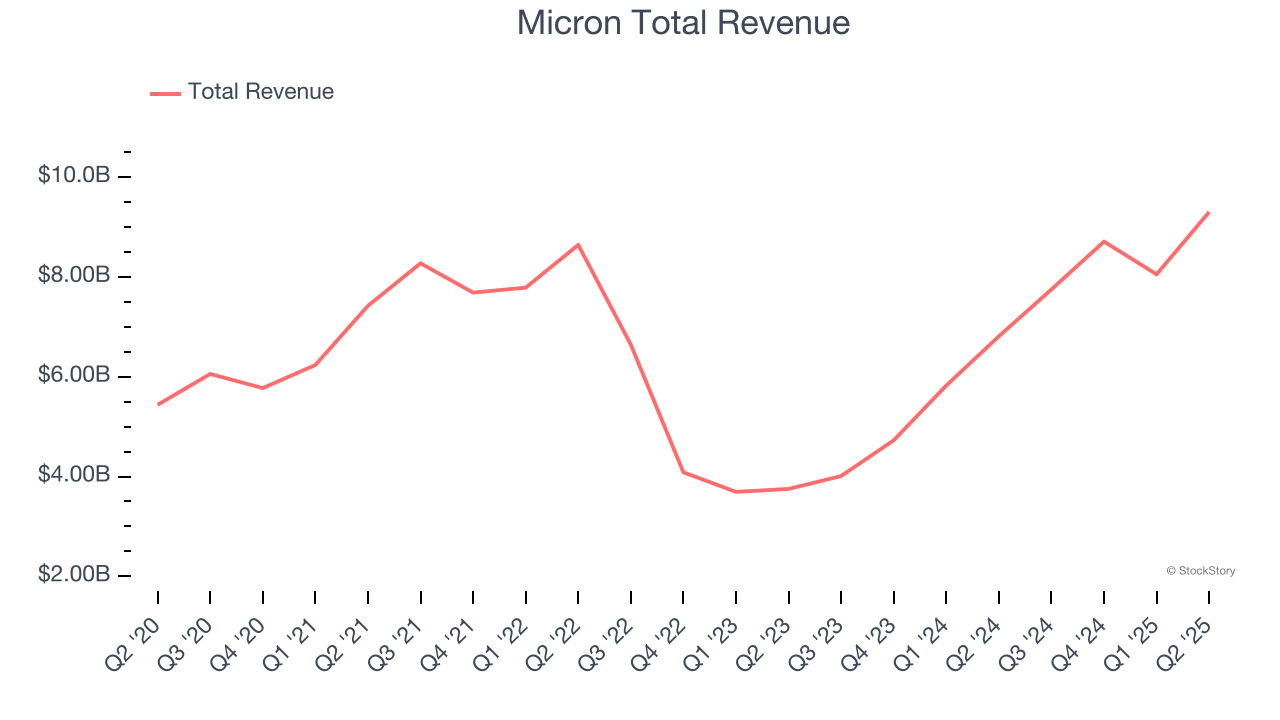

Founded in the basement of a Boise, Idaho dental office in 1978, Micron (NYSE: MU) is a leading provider of memory chips used in thousands of devices across mobile, data centers, industrial, consumer, and automotive markets.

Micron reported revenues of $9.30 billion, up 36.6% year on year. This print exceeded analysts’ expectations by 4.9%. Overall, it was a very strong quarter for the company with a significant improvement in its inventory levels and a beat of analysts’ EPS estimates.

“Micron delivered record revenue in fiscal Q3, driven by all-time-high DRAM revenue including nearly 50% sequential growth in HBM revenue. Data center revenue more than doubled year-over-year and reached a quarterly record, and consumer-oriented end markets had strong sequential growth,” said Sanjay Mehrotra, Chairman, President and CEO of Micron Technology.

Interestingly, the stock is up 27.1% since reporting and currently trades at $162.10.

Is now the time to buy Micron? Access our full analysis of the earnings results here, it’s free.

Best Q2: IPG Photonics (NASDAQ: IPGP)

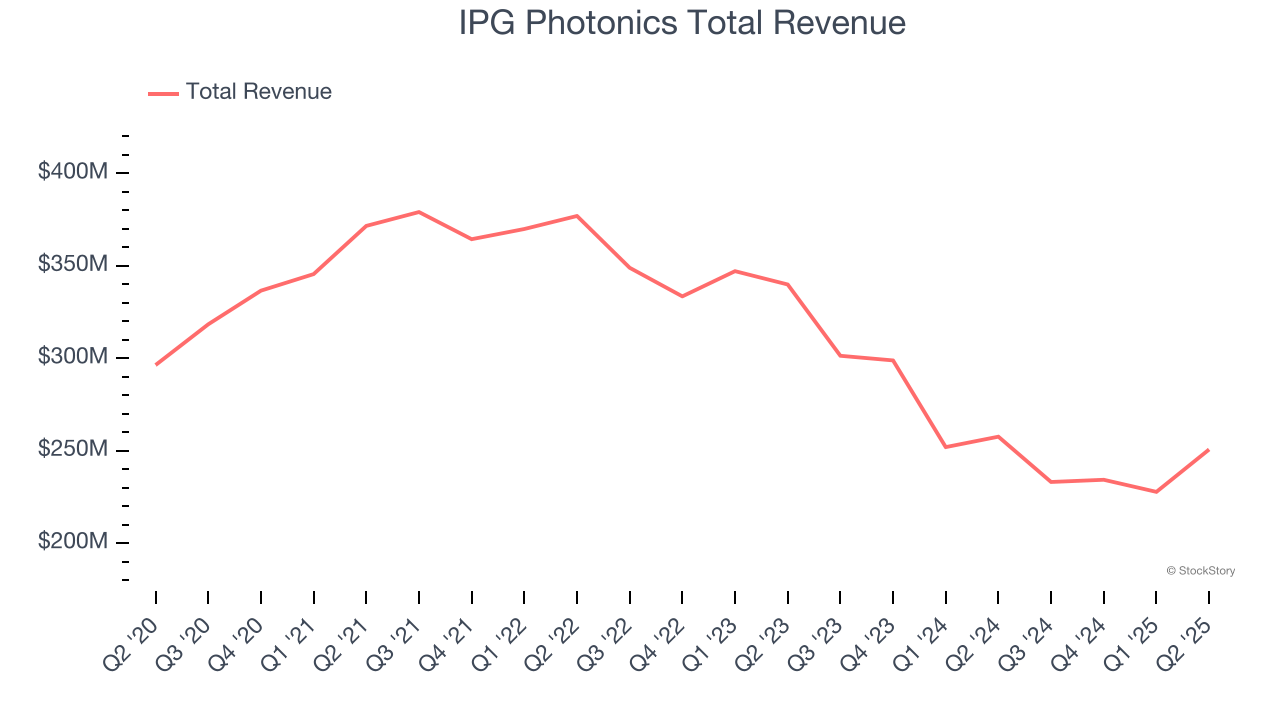

Both a designer and manufacturer of its products, IPG Photonics (NASDAQ: IPGP) is a provider of high-performance fiber lasers used for cutting, welding, and processing raw materials.

IPG Photonics reported revenues of $250.7 million, down 2.7% year on year, outperforming analysts’ expectations by 9.4%. The business had an exceptional quarter with a beat of analysts’ EPS and adjusted operating income estimates.

The market seems content with the results as the stock is up 2.3% since reporting. It currently trades at $79.40.

Is now the time to buy IPG Photonics? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Himax (NASDAQ: HIMX)

Taiwan-based Himax Technologies (NASDAQ: HIMX) is a leading manufacturer of display driver chips and timing controllers used in TVs, laptops, and mobile phones.

Himax reported revenues of $214.8 million, down 10.4% year on year, exceeding analysts’ expectations by 1.3%. Still, it was a softer quarter as it posted EPS in line with analysts’ estimates and an increase in its inventory levels.

As expected, the stock is down 1.7% since the results and currently trades at $8.49.

Read our full analysis of Himax’s results here.

Microchip Technology (NASDAQ: MCHP)

Spun out from General Instrument in 1987, Microchip Technology (NASDAQ: MCHP) is a leading provider of microcontrollers and integrated circuits used mainly in the automotive world, especially in electric vehicles and their charging devices.

Microchip Technology reported revenues of $1.08 billion, down 13.4% year on year. This result beat analysts’ expectations by 1.7%. Overall, it was a very strong quarter as it also logged a significant improvement in its inventory levels and a beat of analysts’ EPS estimates.

The stock is up 1.9% since reporting and currently trades at $67.50.

Read our full, actionable report on Microchip Technology here, it’s free.

Skyworks Solutions (NASDAQ: SWKS)

Result of a merger of Alpha Industries and the wireless communications division of Conexant, Skyworks Solutions (NASDAQ: SWKS) is a designer and manufacturer of chips used in smartphones, autos, and industrial applications to amplify, filter, and process wireless signals.

Skyworks Solutions reported revenues of $965 million, up 6.6% year on year. This number surpassed analysts’ expectations by 2.6%. It was a very strong quarter as it also produced a beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is up 9.3% since reporting and currently trades at $74.

Read our full, actionable report on Skyworks Solutions here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.