Alta’s 29.7% return over the past six months has outpaced the S&P 500 by 12.9%, and its stock price has climbed to $7.34 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in Alta, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Do We Think Alta Will Underperform?

We’re glad investors have benefited from the price increase, but we're swiping left on Alta for now. Here are three reasons we avoid ALTG and a stock we'd rather own.

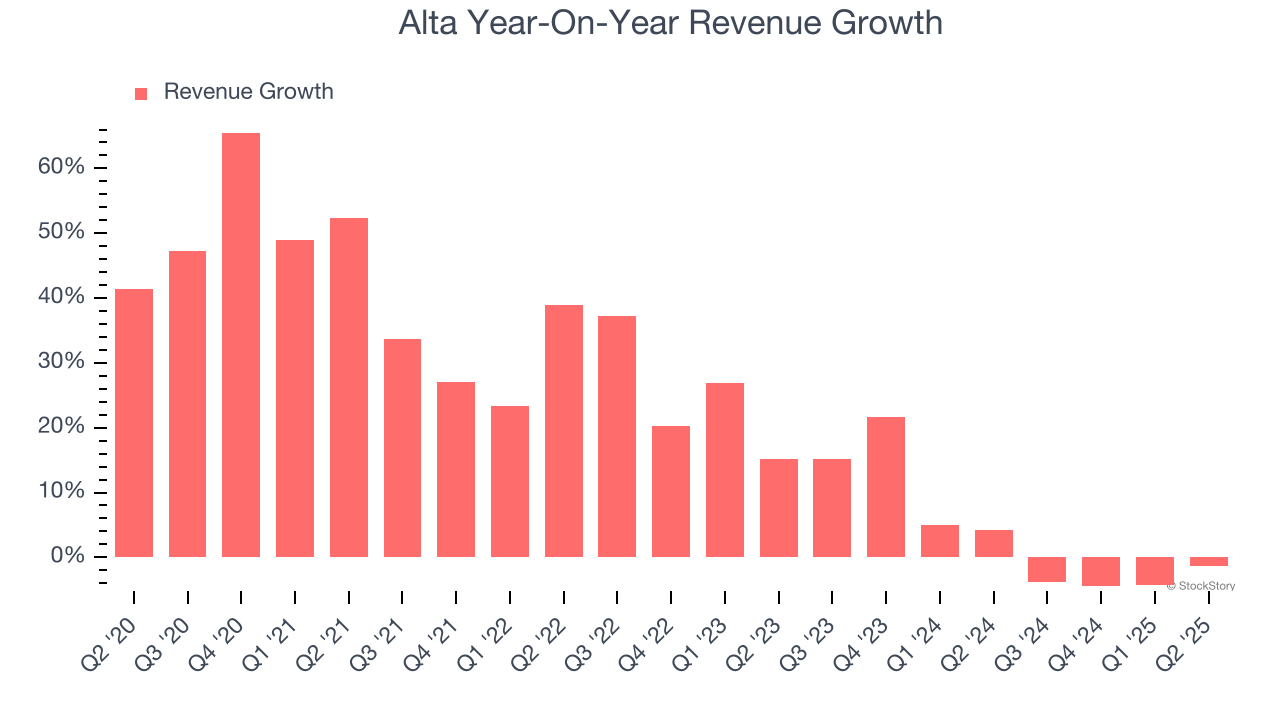

1. Lackluster Revenue Growth

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Alta’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 3.7% over the last two years was well below its five-year trend.

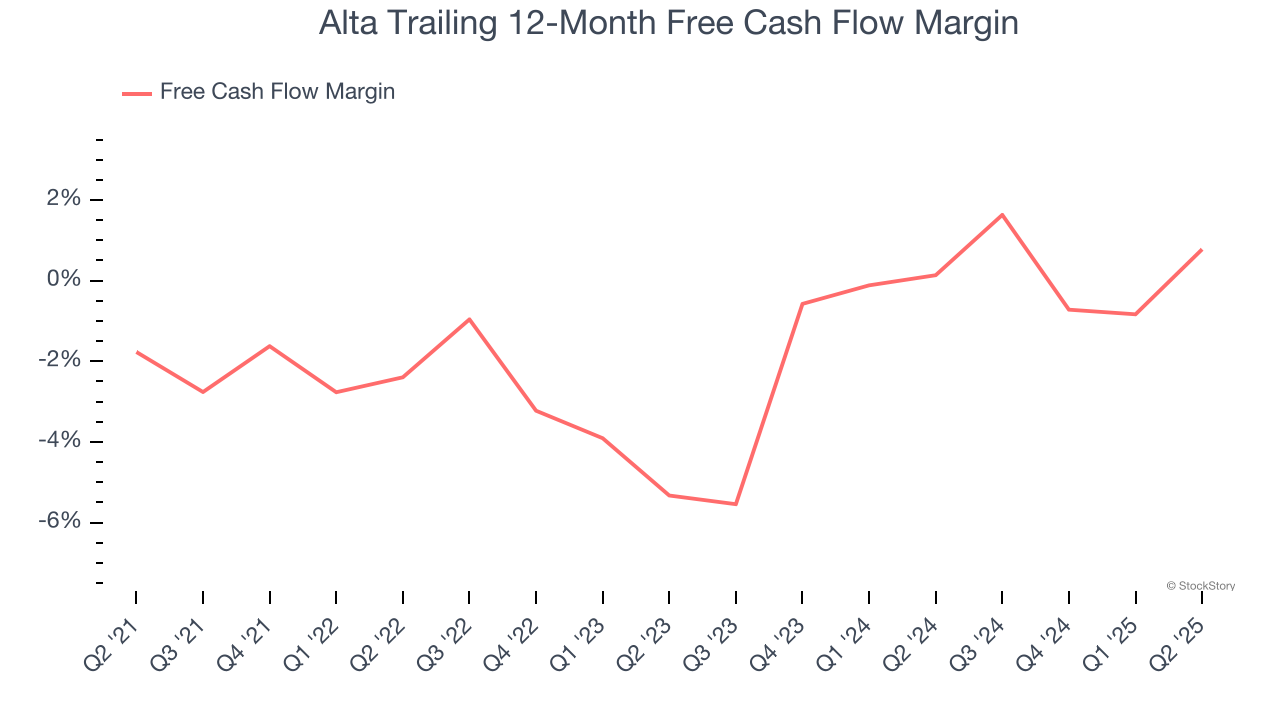

2. Cash Burn Ignites Concerns

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

While Alta’s free cash flow broke even this quarter, the broader story hasn’t been so clean. Alta’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 1.6%, meaning it lit $1.60 of cash on fire for every $100 in revenue.

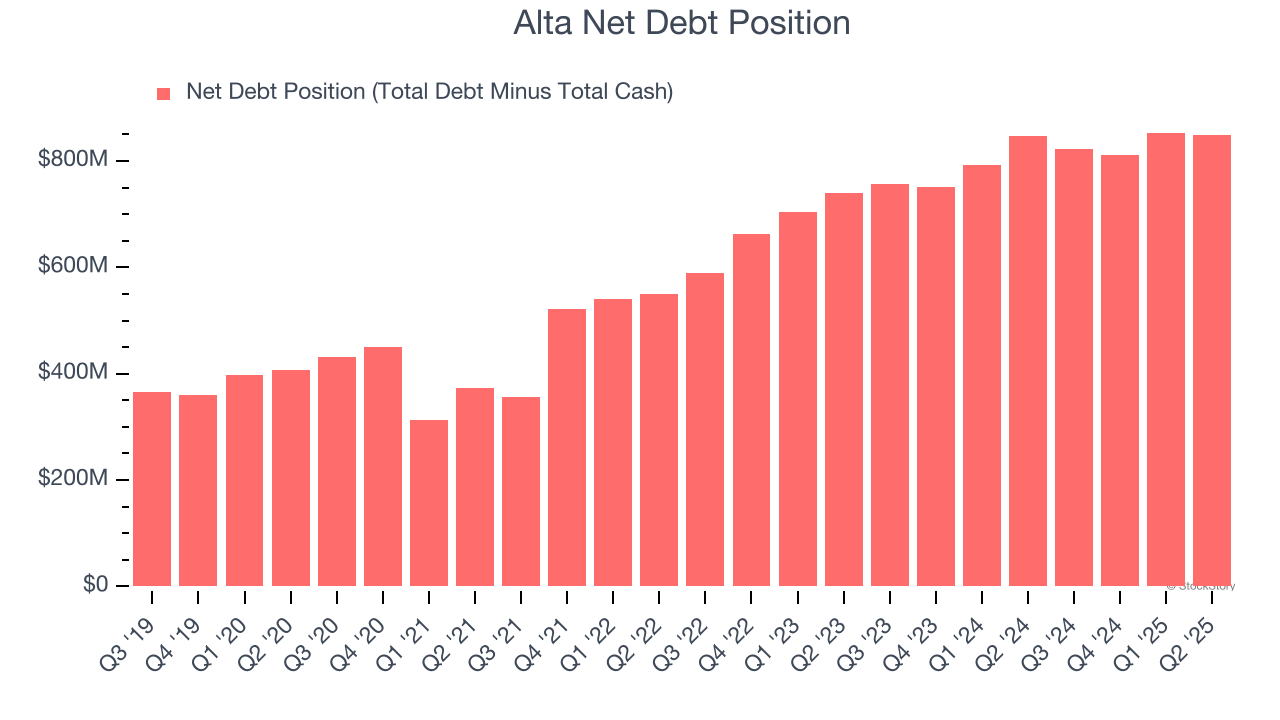

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Alta’s $861.6 million of debt exceeds the $13.2 million of cash on its balance sheet. Furthermore, its 5× net-debt-to-EBITDA ratio (based on its EBITDA of $166 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Alta could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Alta can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

Alta falls short of our quality standards. With its shares beating the market recently, the stock trades at 1.4× forward EV-to-EBITDA (or $7.34 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are more exciting stocks to buy at the moment. We’d recommend looking at one of our all-time favorite software stocks.

Stocks We Like More Than Alta

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.