Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Edgewell Personal Care (NYSE: EPC) and its peers.

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

The 12 personal care stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 1.7% while next quarter’s revenue guidance was 7% below.

Thankfully, share prices of the companies have been resilient as they are up 5.5% on average since the latest earnings results.

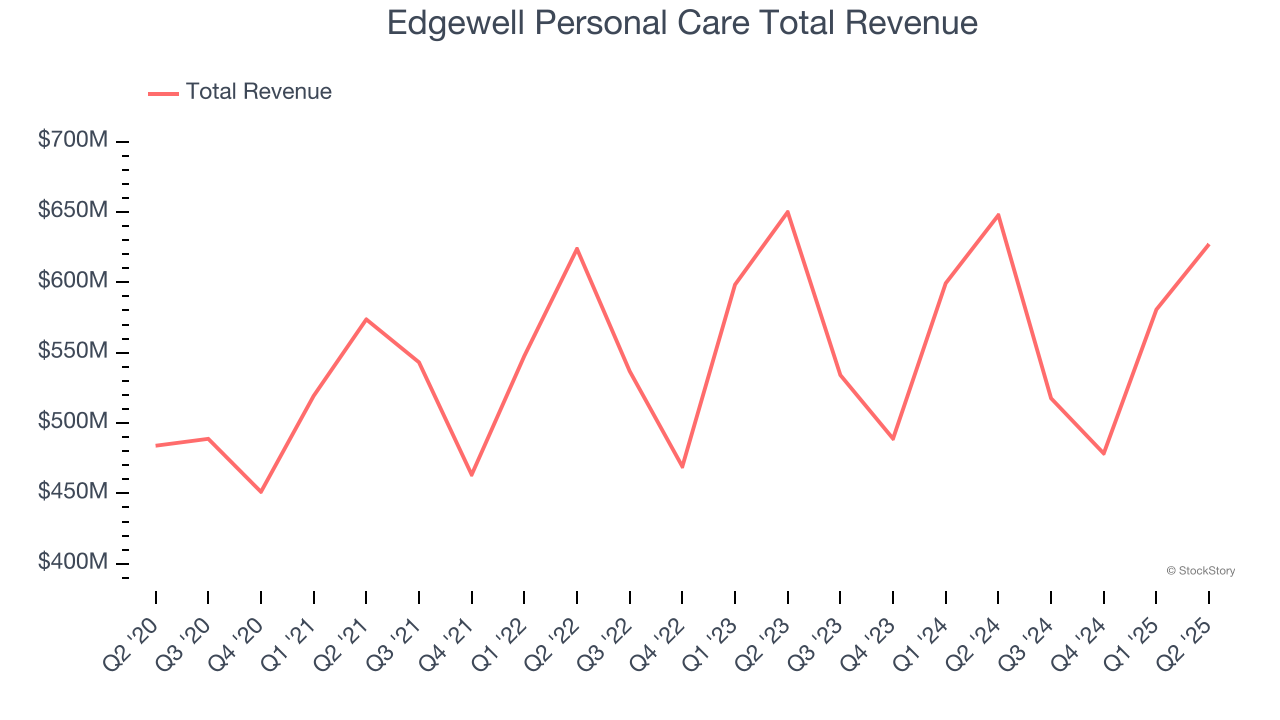

Weakest Q2: Edgewell Personal Care (NYSE: EPC)

Boasting brands such as Banana Boat, Schick, and Skintimate, Edgewell Personal Care (NYSE: EPC) sells personal care products in the skin and sun care, shave, and feminine care categories.

Edgewell Personal Care reported revenues of $627.2 million, down 3.2% year on year. This print fell short of analysts’ expectations by 4.2%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ organic revenue and EBITDA estimates.

"This was a challenging quarter, with our top and bottom-line performance falling below expectations, significantly impacted by very weak Sun Care seasons in North America and certain Latin American markets. Furthermore, the operating environment remains challenging with both tariffs and foreign exchange contributing to full-year profit headwinds," said Rod Little, Edgewell's President and Chief Executive Officer.

Edgewell Personal Care delivered the weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is down 15.4% since reporting and currently trades at $21.17.

Read our full report on Edgewell Personal Care here, it’s free.

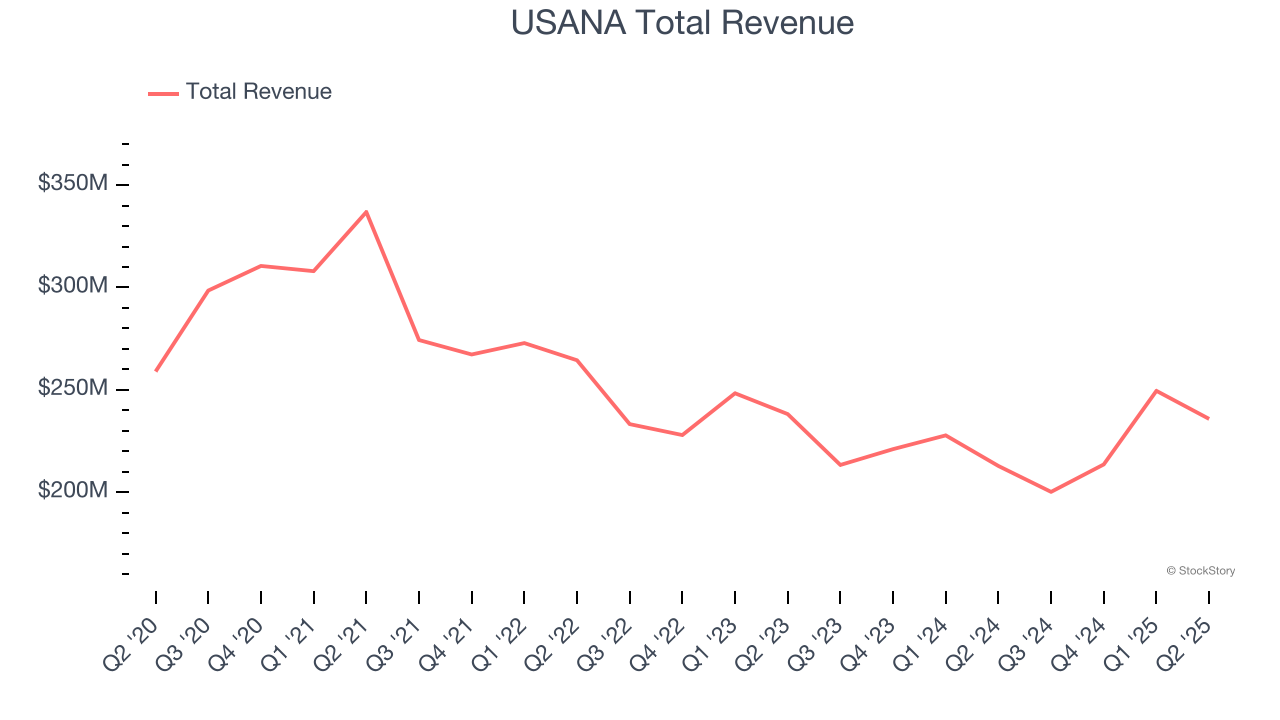

Best Q2: USANA (NYSE: USNA)

Going to market with a direct selling model rather than through traditional retailers, USANA Health Sciences (NYSE: USNA) manufactures and sells nutritional, personal care, and skincare products.

USANA reported revenues of $235.8 million, up 10.8% year on year, outperforming analysts’ expectations by 4.7%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA and EPS estimates.

USANA scored the fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 2.2% since reporting. It currently trades at $30.84.

Is now the time to buy USANA? Access our full analysis of the earnings results here, it’s free.

Coty (NYSE: COTY)

With a portfolio boasting many household brands, Coty (NYSE: COTY) is a beauty products powerhouse spanning cosmetics, fragrances, and skincare.

Coty reported revenues of $1.25 billion, down 8.1% year on year, exceeding analysts’ expectations by 3.9%. Still, it was a softer quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

As expected, the stock is down 11.3% since the results and currently trades at $4.28.

Read our full analysis of Coty’s results here.

The Honest Company (NASDAQ: HNST)

Co-founded by actress Jessica Alba, The Honest Company (NASDAQ: HNST) sells diapers and wipes, skin care products, and household cleaning products.

The Honest Company reported revenues of $93.46 million, flat year on year. This number topped analysts’ expectations by 1.5%. It was a very strong quarter as it also recorded a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is down 10.9% since reporting and currently trades at $4.04.

Read our full, actionable report on The Honest Company here, it’s free.

Inter Parfums (NASDAQ: IPAR)

With licenses to produce colognes and perfumes under brands such as Kate Spade, Van Cleef & Arpels, and Abercrombie & Fitch, Inter Parfums (NASDAQ: IPAR) manufactures and distributes fragrances worldwide.

Inter Parfums reported revenues of $333.9 million, down 2.4% year on year. This result met analysts’ expectations. Taking a step back, it was a mixed quarter as it also logged full-year revenue guidance beating analysts’ expectations but a significant miss of analysts’ gross margin estimates.

Inter Parfums scored the highest full-year guidance raise among its peers. The stock is down 11.9% since reporting and currently trades at $104.20.

Read our full, actionable report on Inter Parfums here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.