Since September 2020, the S&P 500 has delivered a total return of 107%. But one standout stock has more than doubled the market - over the past five years, Houlihan Lokey has surged 274% to $209.92 per share. Its momentum hasn’t stopped as it’s also gained 25.9% in the last six months thanks to its solid quarterly results, beating the S&P by 9.7%.

Is it too late to buy HLI? Find out in our full research report, it’s free.

Why Is HLI a Good Business?

Founded in 1972 and known for its expertise in complex financial situations, Houlihan Lokey (NYSE: HLI) is a global investment bank specializing in mergers and acquisitions, capital markets, financial restructurings, and valuation advisory services.

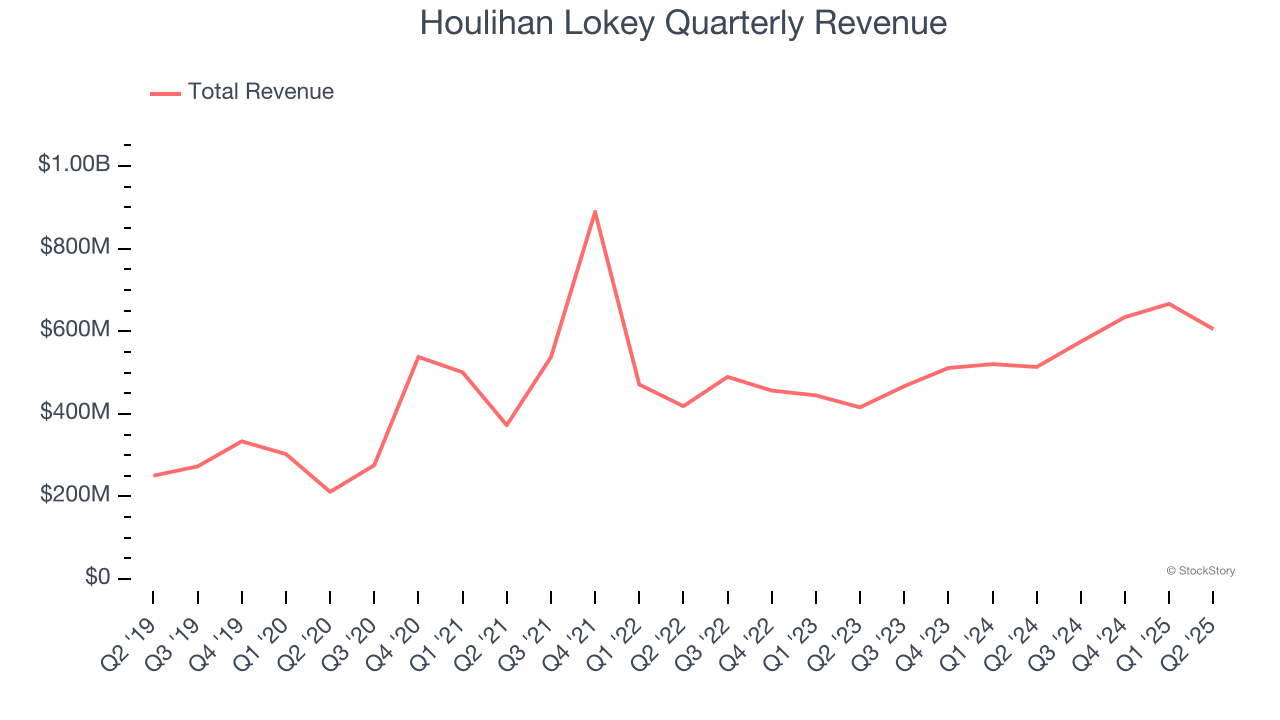

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Over the last five years, Houlihan Lokey grew its revenue at an impressive 17.2% compounded annual growth rate. Its growth surpassed the average financials company and shows its offerings resonate with customers.

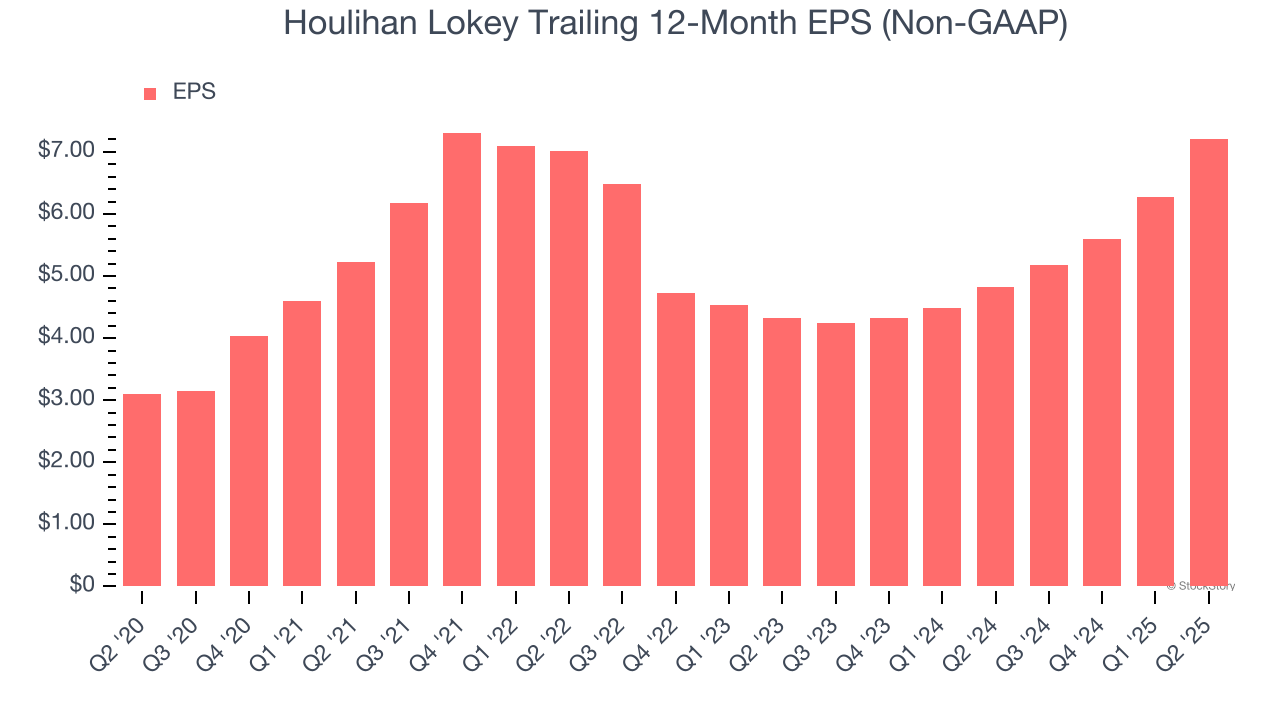

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Houlihan Lokey’s remarkable 18.4% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

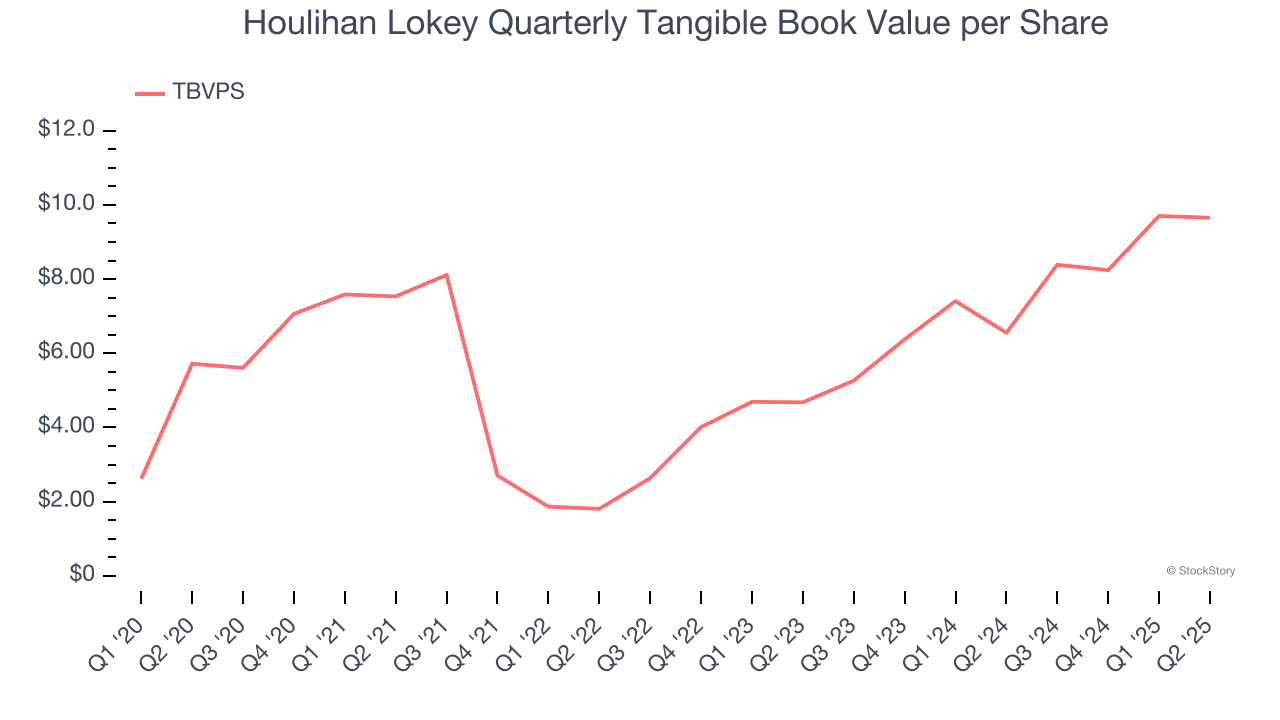

3. Growing TBVPS Reflects Strong Asset Base

Tangible book value per share (TBVPS) serves as a key indicator of a financial institution’s strength, representing the hard assets available to shareholders after removing intangible assets that could evaporate during economic distress.

Houlihan Lokey’s TBVPS increased by 11% annually over the last five years, and growth has recently accelerated as TBVPS grew at an incredible 43.7% annual clip over the past two years (from $4.68 to $9.65 per share).

Final Judgment

These are just a few reasons why we think Houlihan Lokey is one of the best financials companies out there, and with its shares topping the market in recent months, the stock trades at 27.2× forward P/E (or $209.92 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.