What a fantastic six months it’s been for KLA Corporation. Shares of the company have skyrocketed 46.6%, hitting $1,067. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Following the strength, is KLAC a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Are We Positive On KLAC?

Formed by the 1997 merger of the two leading semiconductor yield management companies, KLA Corporation (NASDAQ: KLAC) is the leading supplier of equipment used to measure and inspect semiconductor chips.

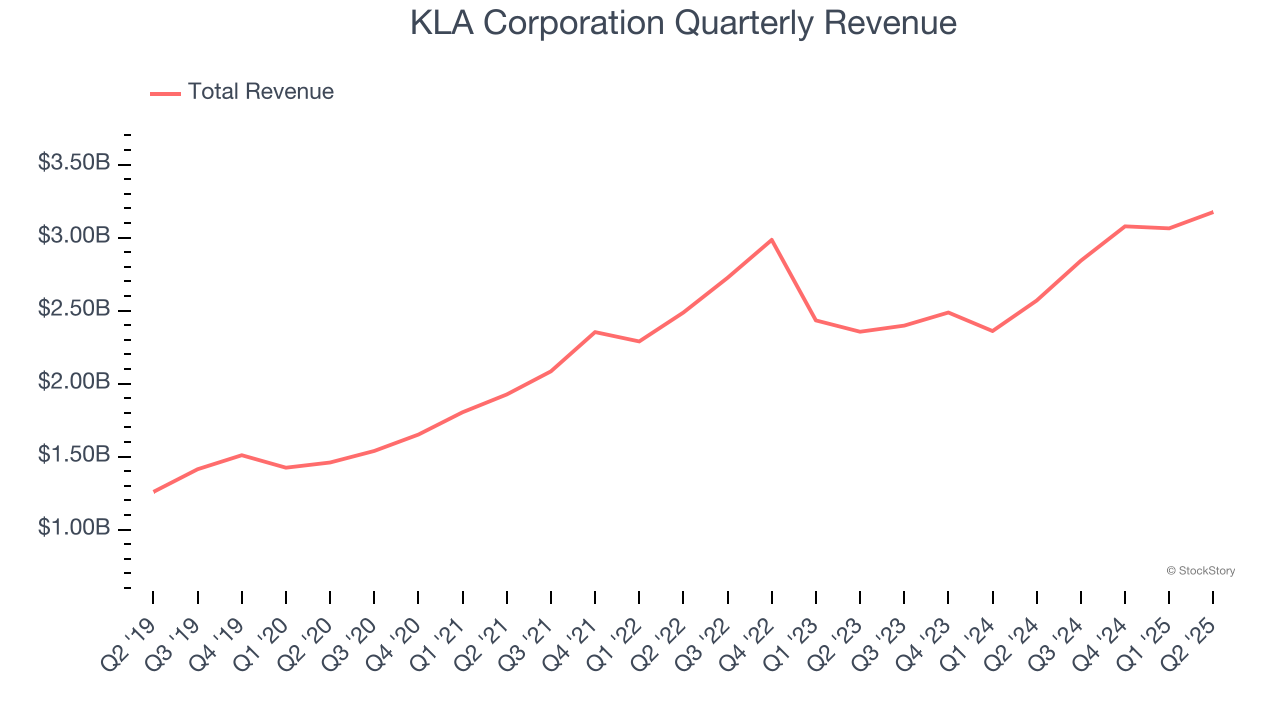

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, KLA Corporation grew its sales at an excellent 15.9% compounded annual growth rate. Its growth surpassed the average semiconductor company and shows its offerings resonate with customers. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

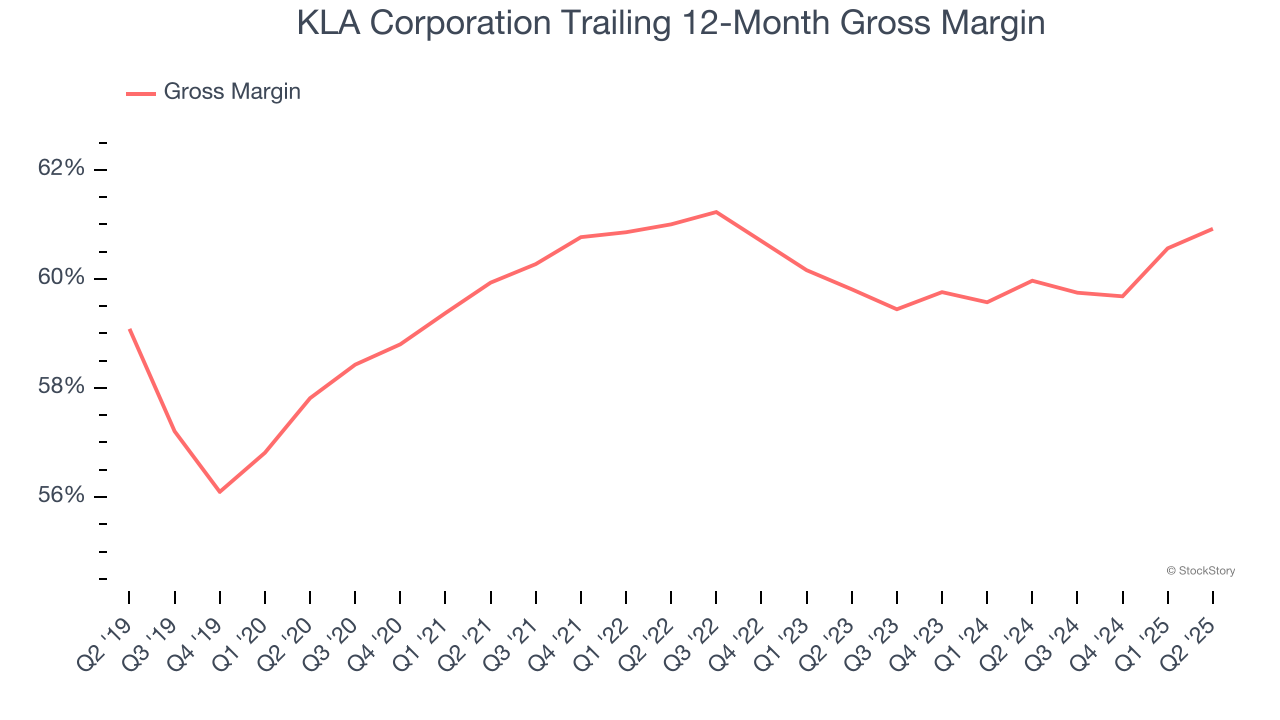

2. Elite Gross Margin Powers Best-In-Class Business Model

In the semiconductor industry, a company’s gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

KLA Corporation’s gross margin is one of the best in the semiconductor sector, and its differentiated products give it strong pricing power. As you can see below, it averaged an elite 60.5% gross margin over the last two years. Said differently, roughly $60.49 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

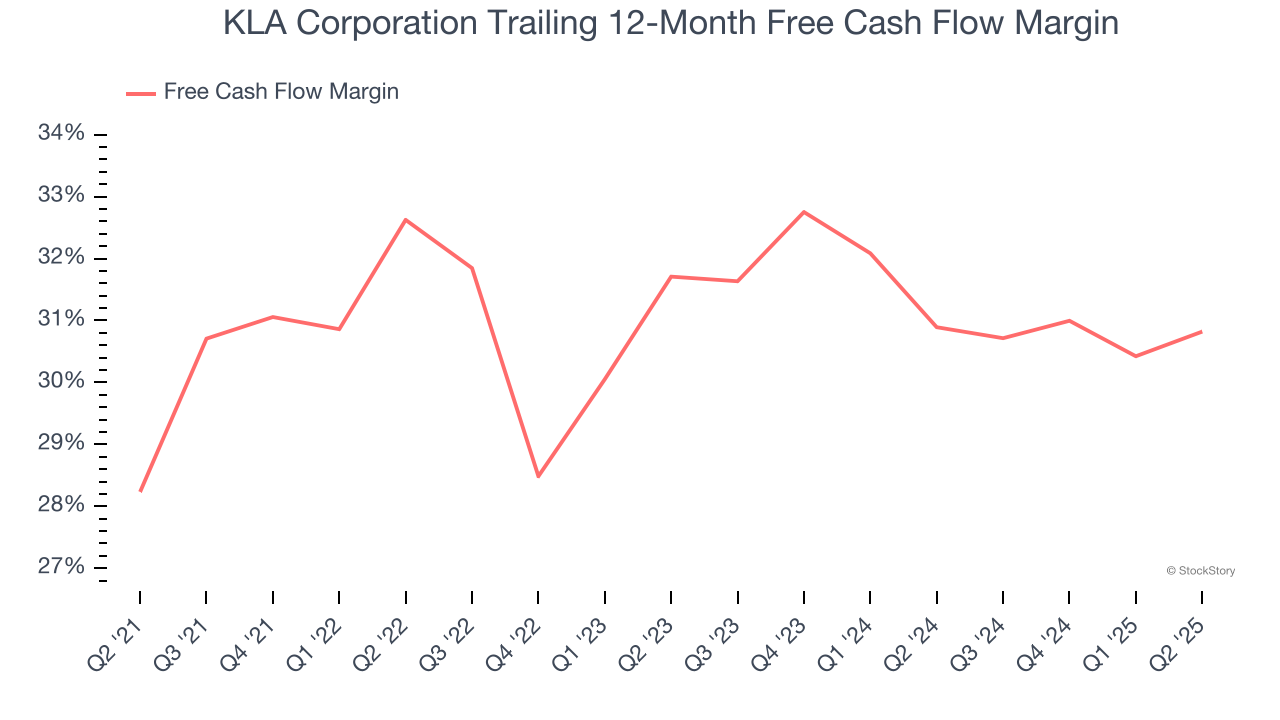

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

KLA Corporation has shown terrific cash profitability, and if sustainable, puts it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the semiconductor sector, averaging an eye-popping 30.9% over the last two years.

Final Judgment

These are just a few reasons KLA Corporation is a rock-solid business worth owning, and after the recent rally, the stock trades at 32.4× forward P/E (or $1,067 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than KLA Corporation

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.