Although Horace Mann Educators (currently trading at $46.13 per share) has gained 9.7% over the last six months, it has trailed the S&P 500’s 15.5% return during that period. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Horace Mann Educators, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Do We Think Horace Mann Educators Will Underperform?

We don't have much confidence in Horace Mann Educators. Here are three reasons there are better opportunities than HMN and a stock we'd rather own.

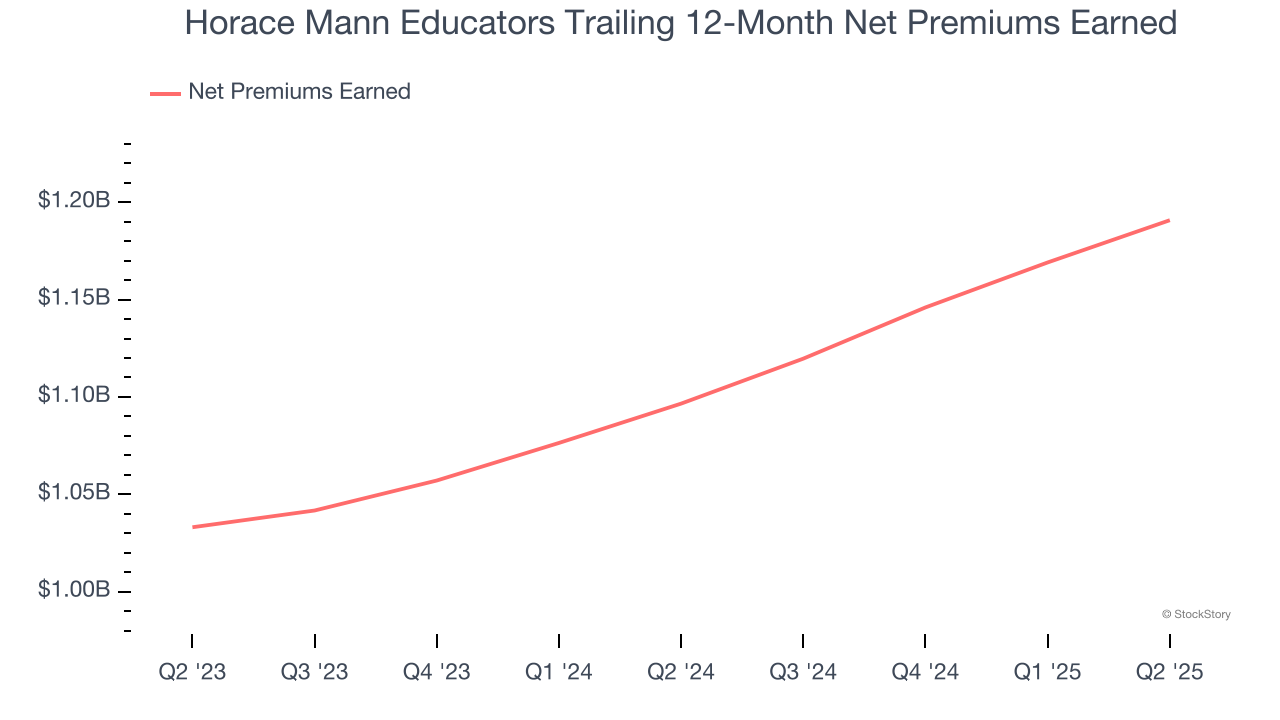

1. Net Premiums Earned Point to Soft Demand

Insurers sell policies then use reinsurance (insurance for insurance companies) to protect themselves from large losses. Net premiums earned are therefore what's collected from selling policies less what’s paid to reinsurers as a risk mitigation tool.

Horace Mann Educators’s net premiums earned has grown at a 5.4% annualized rate over the last five years, worse than the broader insurance industry and in line with its total revenue.

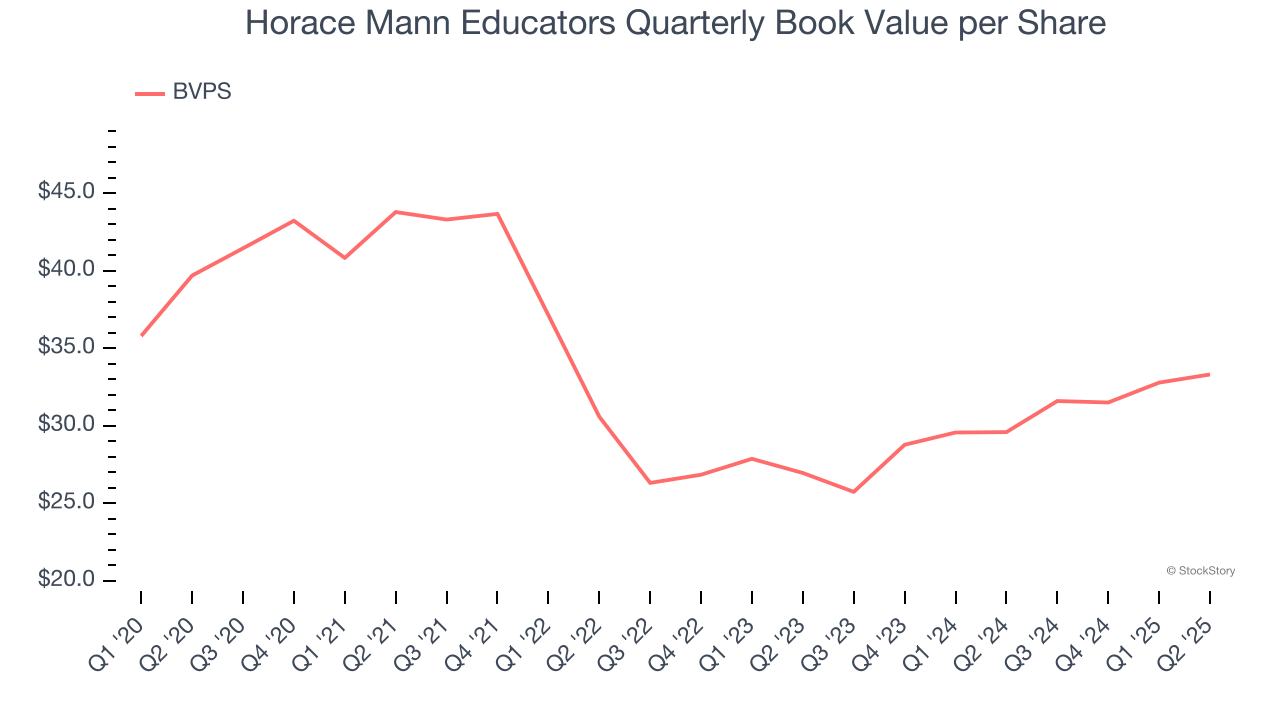

2. Substandard BVPS Growth Indicates Limited Asset Expansion

In the insurance industry, book value per share (BVPS) provides a clear picture of shareholder value, as it represents the total equity backing a company’s insurance operations and growth initiatives.

Disappointingly for investors, Horace Mann Educators’s BVPS grew at a mediocre 11.2% annual clip over the last two years.

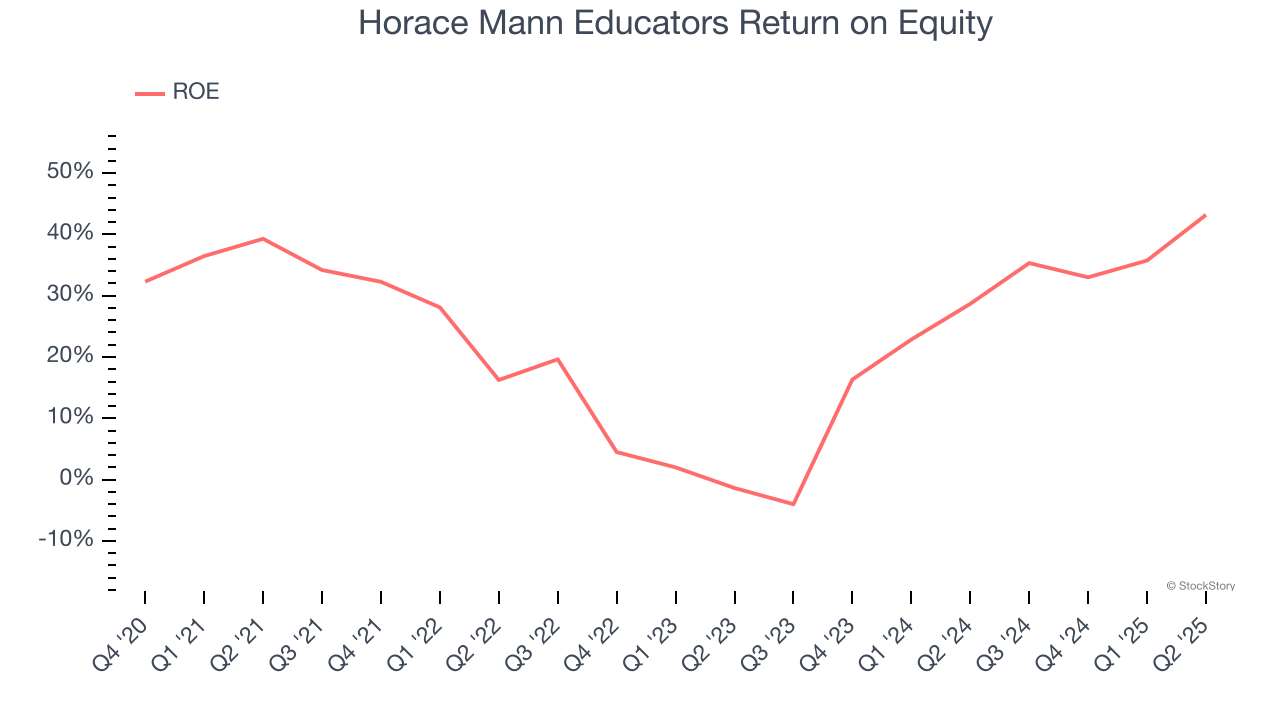

3. Previous Growth Initiatives Haven’t Impressed

Return on equity, or ROE, represents the ultimate measure of an insurer's effectiveness, quantifying how well it transforms shareholder investments into profits. Over the long term, insurance companies with robust ROE metrics typically deliver superior shareholder returns through a balanced approach to capital management.

Over the last five years, Horace Mann Educators has averaged an ROE of 6.3%, uninspiring for a company operating in a sector where the average shakes out around 12.5%.

Final Judgment

Horace Mann Educators doesn’t pass our quality test. With its shares trailing the market in recent months, the stock trades at 1.3× forward P/B (or $46.13 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are better stocks to buy right now. We’d suggest looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of Horace Mann Educators

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.