Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at The Toro Company (NYSE: TTC) and the best and worst performers in the agricultural machinery industry.

Agricultural machinery companies are investing to develop and produce more precise machinery, automated systems, and connected equipment that collects analyzable data to help farmers and other customers improve yields and increase efficiency. On the other hand, agriculture is seasonal and natural disasters or bad weather can impact the entire industry. Additionally, macroeconomic factors such as commodity prices or changes in interest rates–which dictate the willingness of these companies or their customers to invest–can impact demand for agricultural machinery.

The 6 agricultural machinery stocks we track reported a satisfactory Q2. As a group, revenues missed analysts’ consensus estimates by 0.8% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 6.1% since the latest earnings results.

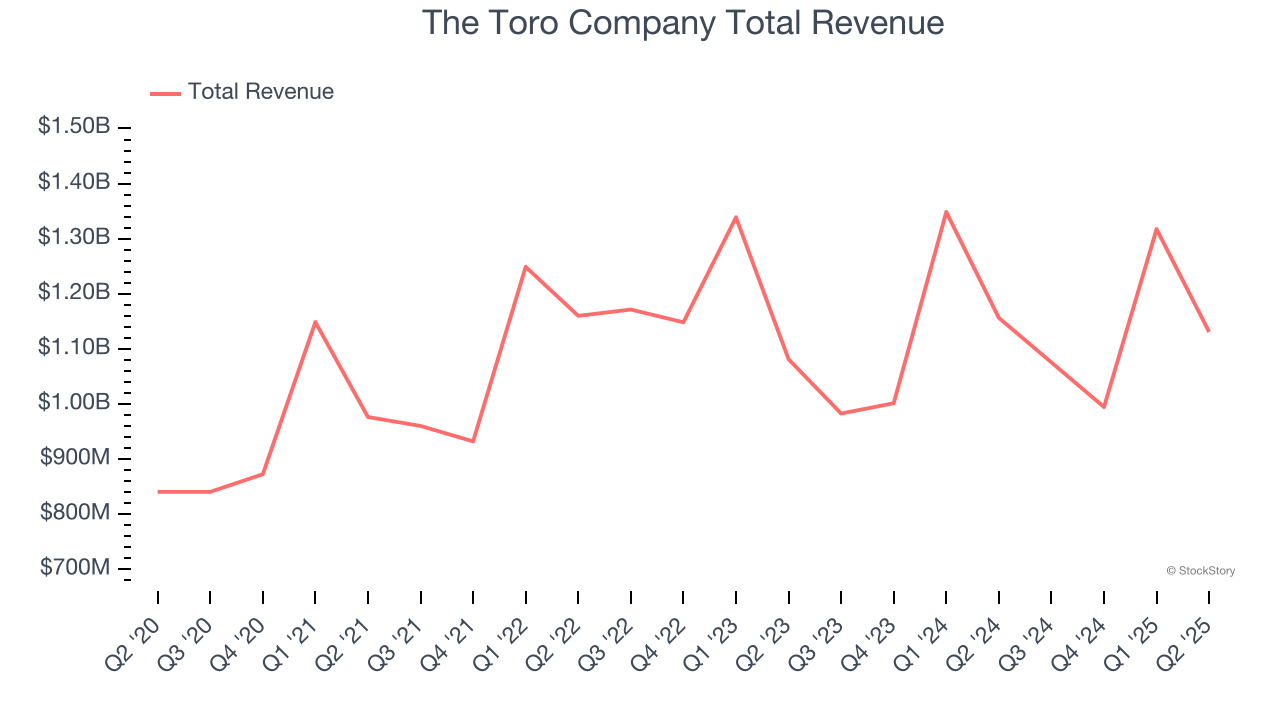

Weakest Q2: The Toro Company (NYSE: TTC)

Ceasing all production to support the war effort during World War II, Toro (NYSE: TTC) offers outdoor equipment for residential, commercial, and agricultural use.

The Toro Company reported revenues of $1.13 billion, down 2.2% year on year. This print fell short of analysts’ expectations by 2.2%. Overall, it was a softer quarter for the company with and full-year EPS guidance missing analysts’ expectations.

“We delivered third-quarter adjusted earnings that exceeded our expectations, with our Professional segment achieving 6 percent growth and 250 basis points of margin expansion,” said Richard M. Olson, chairman and chief executive officer.

Unsurprisingly, the stock is down 4.4% since reporting and currently trades at $77.11.

Read our full report on The Toro Company here, it’s free.

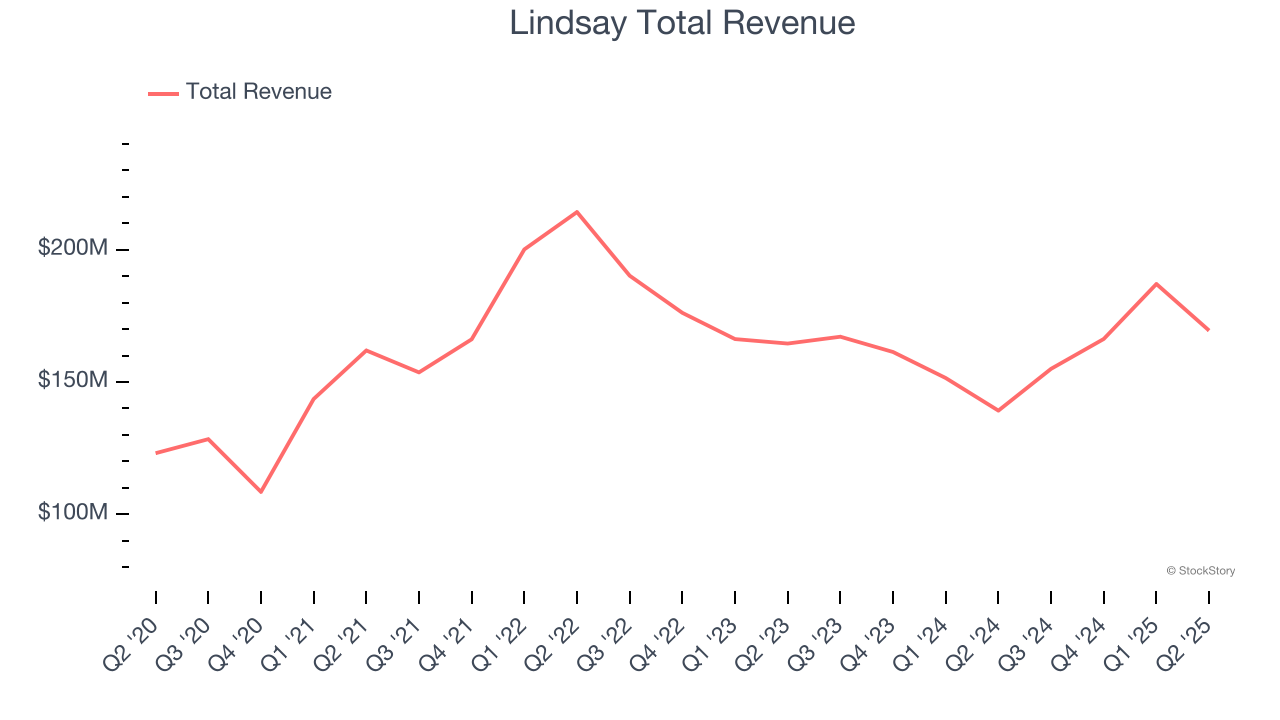

Best Q2: Lindsay (NYSE: LNN)

A pioneer in the field of center pivot and lateral move irrigation, Lindsay (NYSE: LNN) provides a variety of proprietary water management and road infrastructure products and services.

Lindsay reported revenues of $169.5 million, up 21.7% year on year, outperforming analysts’ expectations by 4.6%. The business had an incredible quarter with a solid beat of analysts’ organic revenue and EPS estimates.

Lindsay pulled off the fastest revenue growth among its peers. The market seems content with the results as the stock is up 1.7% since reporting. It currently trades at $139.68.

Is now the time to buy Lindsay? Access our full analysis of the earnings results here, it’s free.

Titan International (NYSE: TWI)

Acquiring Goodyear’s farm tire business in 2005, Titan (NSYE:TWI) is a manufacturer and supplier of wheels, tires, and undercarriages used in off-highway vehicles such as construction vehicles.

Titan International reported revenues of $460.8 million, down 13.4% year on year, falling short of analysts’ expectations by 3.6%. It was a slower quarter as it posted EPS in line with analysts’ estimates and EBITDA guidance for next quarter missing analysts’ expectations.

As expected, the stock is down 16.4% since the results and currently trades at $7.60.

Read our full analysis of Titan International’s results here.

AGCO (NYSE: AGCO)

With a history that features both organic growth and acquisitions, AGCO (NYSE: AGCO) designs, manufactures, and sells agricultural machinery and related technology.

AGCO reported revenues of $2.64 billion, down 18.8% year on year. This number surpassed analysts’ expectations by 5.9%. Overall, it was an exceptional quarter as it also logged a beat of analysts’ EPS and EBITDA estimates.

AGCO pulled off the biggest analyst estimates beat but had the slowest revenue growth among its peers. The stock is up 2.9% since reporting and currently trades at $109.67.

Read our full, actionable report on AGCO here, it’s free.

Alamo (NYSE: ALG)

Expanding its markets through acquisitions since its founding, Alamo (NSYE:ALG) designs, manufactures, and services vegetation management and infrastructure maintenance equipment for governmental, industrial, and agricultural use.

Alamo reported revenues of $419.1 million, flat year on year. This result topped analysts’ expectations by 2.4%. Overall, it was a strong quarter as it also recorded a solid beat of analysts’ EBITDA estimates.

The stock is down 12.5% since reporting and currently trades at $196.80.

Read our full, actionable report on Alamo here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.