Goldman Sachs currently trades at $793.50 and has been a dream stock for shareholders. It’s returned 307% since September 2020, tripling the S&P 500’s 101% gain. The company has also beaten the index over the past six months as its stock price is up 35.4% thanks to its solid quarterly results.

Following the strength, is GS a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Do Investors Watch Goldman Sachs?

Founded in 1869 as a small commercial paper business in New York City, Goldman Sachs (NYSE: GS) is a global financial institution that provides investment banking, securities, asset management, and consumer banking services to corporations, governments, and individuals.

Three Positive Attributes:

1. Revenue Climbing Higher

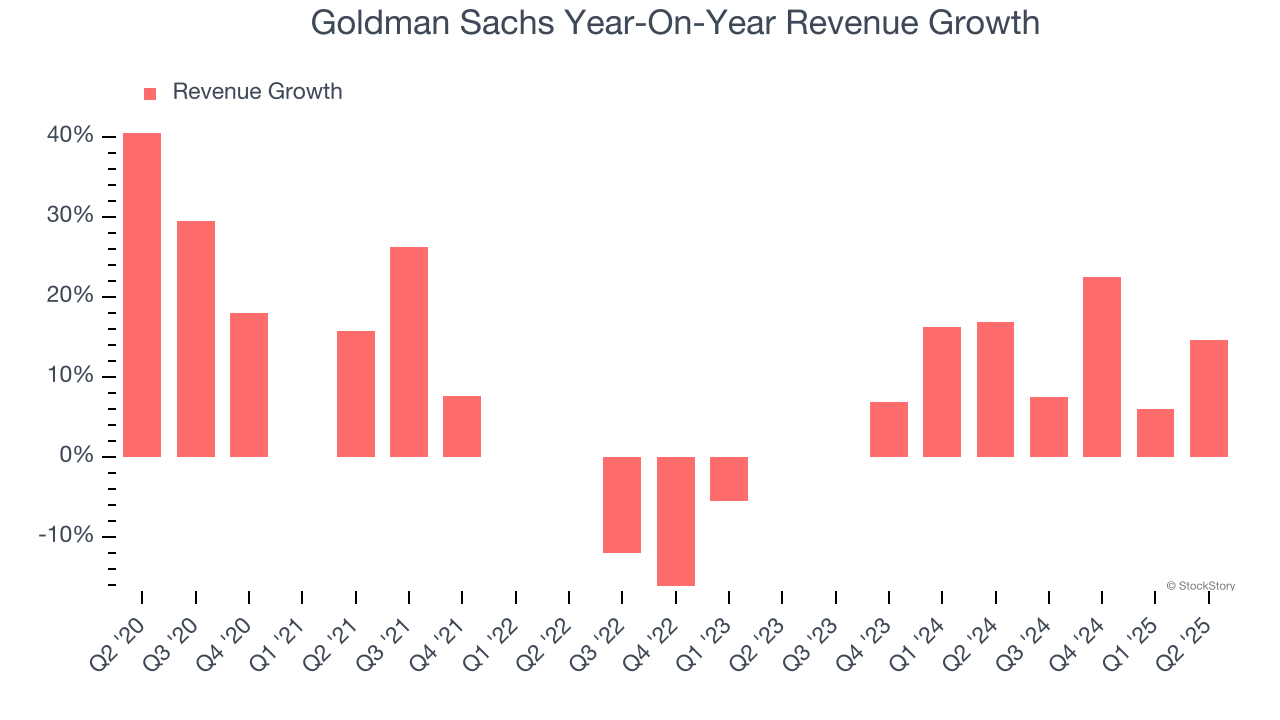

Long-term growth is the most important, but within financials, a stretched historical view may miss recent interest rate changes and market returns. Goldman Sachs’s annualized revenue growth of 10.9% over the last two years is above its five-year trend, suggesting some bright spots.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

2. Outstanding Long-Term EPS Growth

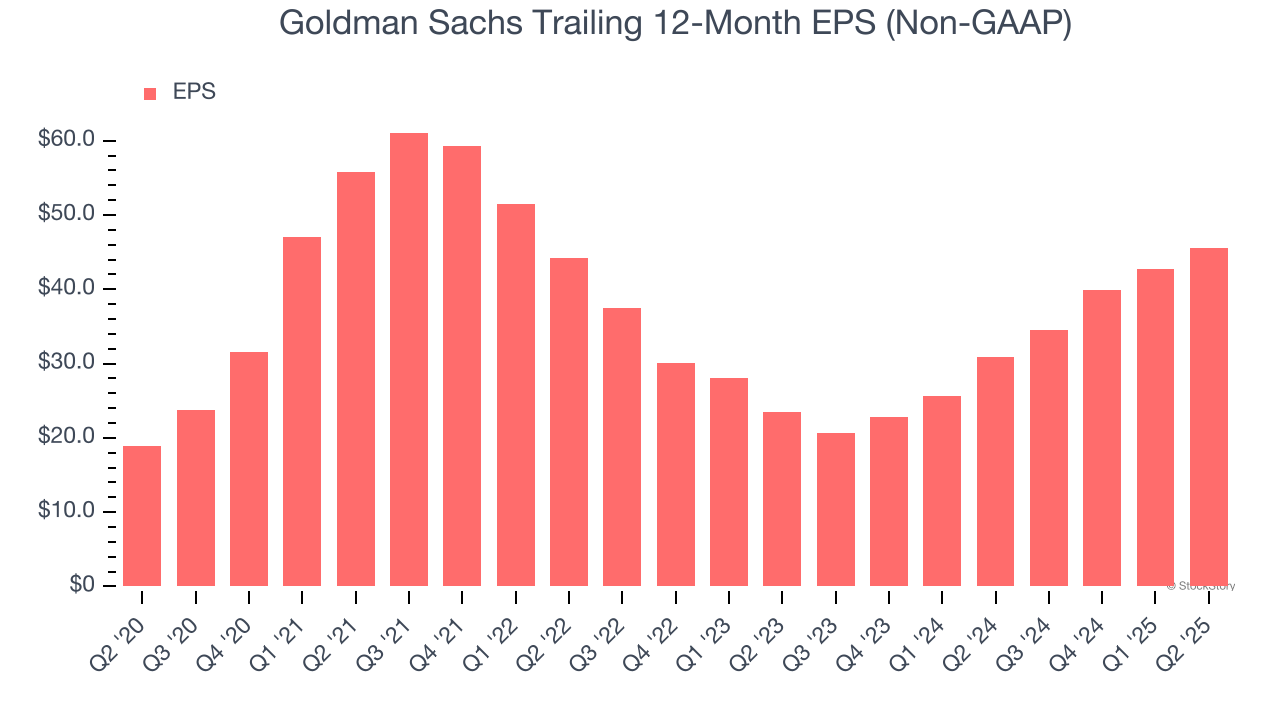

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Goldman Sachs’s EPS grew at a remarkable 19.3% compounded annual growth rate over the last five years, higher than its 6.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

3. Previous Growth Initiatives Are Paying Off

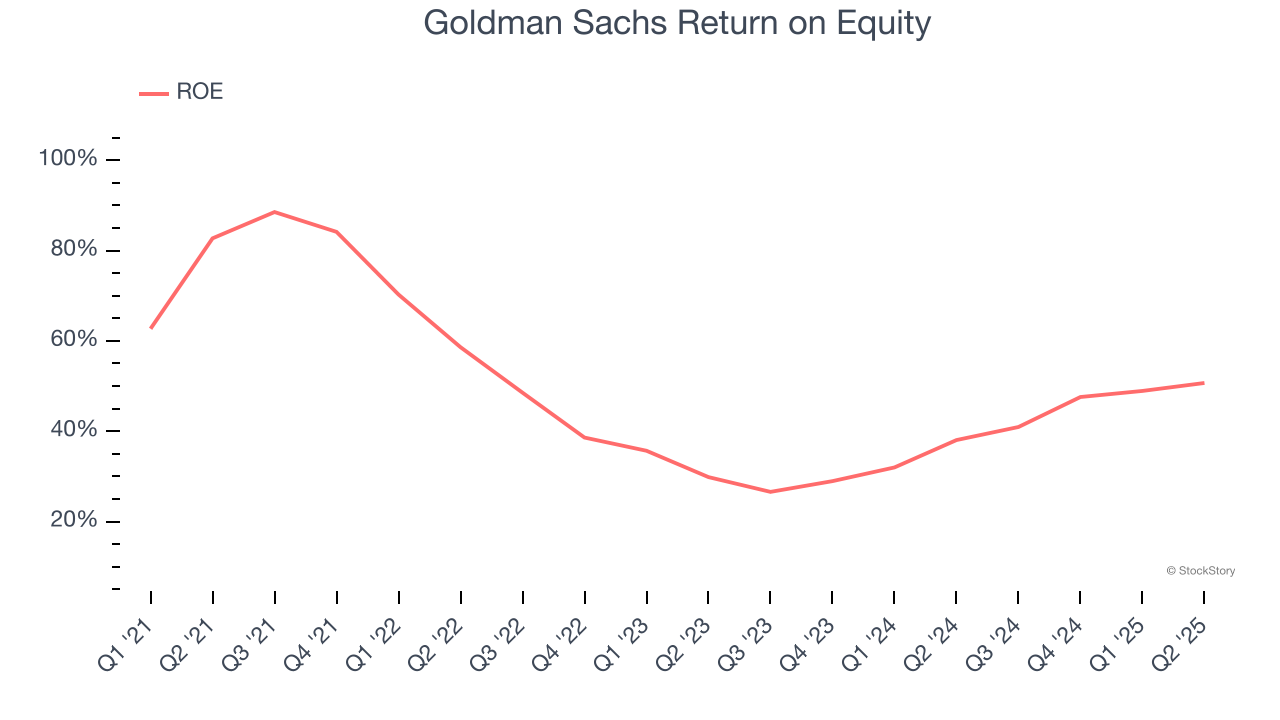

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, Goldman Sachs has averaged an ROE of 13%, respectable for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Goldman Sachs has a narrow competitive moat.

Final Judgment

Goldman Sachs is an interesting business with potential, and with its shares topping the market in recent months, the stock trades at 16.6× forward P/E (or $793.50 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.