The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how S&P Global (NYSE: SPGI) and the rest of the financial exchanges & data stocks fared in Q2.

Financial exchanges and data providers operate trading platforms and sell market information. They enjoy relatively stable revenue from trading fees and subscriptions, increasing demand for data analytics, and expansion opportunities in emerging markets. Challenges include regulatory oversight of market structure, competition from alternative trading venues, and substantial technology investments needed to maintain low-latency trading infrastructure and data security.

The 10 financial exchanges & data stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.1%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 9.7% since the latest earnings results.

S&P Global (NYSE: SPGI)

Tracing its roots back to 1860 when it published the first railroad industry manual, S&P Global (NYSE: SPGI) provides credit ratings, market intelligence, commodity data, automotive analytics, and financial indices that help investors and businesses make decisions.

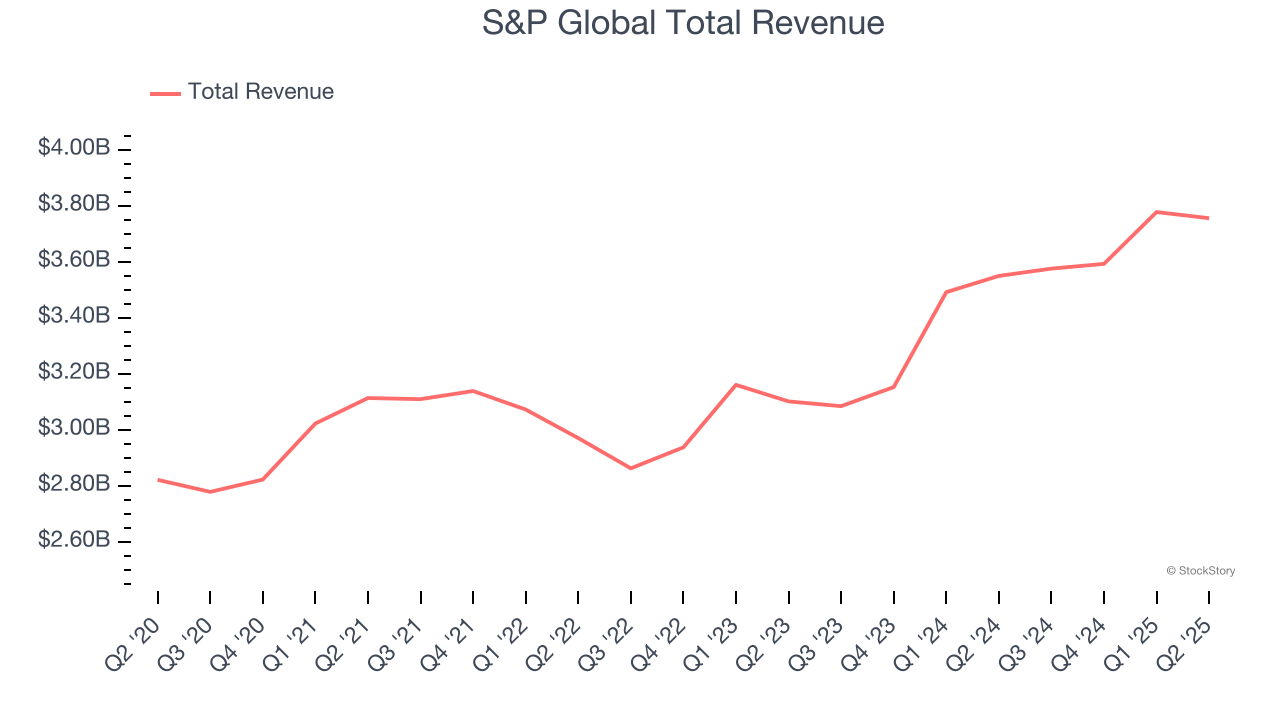

S&P Global reported revenues of $3.76 billion, up 5.8% year on year. This print exceeded analysts’ expectations by 2.3%. Overall, it was a strong quarter for the company with a solid beat of analysts’ Ratings segment estimates and an impressive beat of analysts’ EBITDA estimates.

Unsurprisingly, the stock is down 8.4% since reporting and currently trades at $485.55.

We think S&P Global is a good business, but is it a buy today? Read our full report here, it’s free.

Best Q2: Moody's (NYSE: MCO)

Founded in 1900 during America's railroad boom when investors needed reliable information on bond risks, Moody's (NYSE: MCO) provides credit ratings, risk assessment tools, and analytical solutions that help organizations evaluate financial risks and make informed investment decisions.

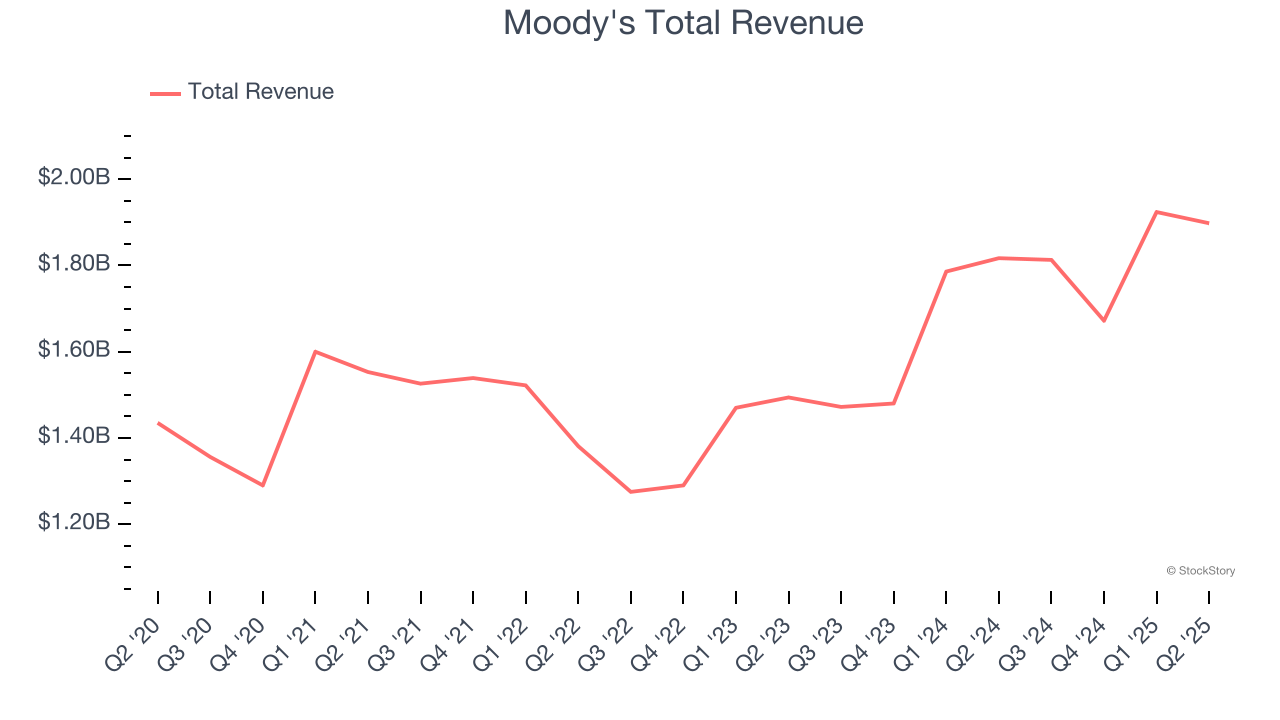

Moody's reported revenues of $1.90 billion, up 4.5% year on year, outperforming analysts’ expectations by 2.9%. The business had a strong quarter with an impressive beat of analysts’ EBITDA estimates.

Moody's pulled off the biggest analyst estimates beat among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 5.1% since reporting. It currently trades at $473.80.

Is now the time to buy Moody's? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Tradeweb Markets (NASDAQ: TW)

Founded in 1996 as one of the pioneers in electronic bond trading, Tradeweb Markets (NASDAQ: TW) builds and operates electronic marketplaces that connect financial institutions for trading across rates, credit, equities, and money markets.

Tradeweb Markets reported revenues of $513 million, up 26.7% year on year, in line with analysts’ expectations. It was a slower quarter as it posted a significant miss of analysts’ EPS estimates and transaction volumes in line with analysts’ estimates.

As expected, the stock is down 19.9% since the results and currently trades at $110.71.

Read our full analysis of Tradeweb Markets’s results here.

FactSet (NYSE: FDS)

Founded in 1978 when financial data was still primarily delivered through paper reports, FactSet (NYSE: FDS) provides financial data, analytics, and technology solutions that investment professionals use to research, analyze, and manage their portfolios.

FactSet reported revenues of $596.9 million, up 6.2% year on year. This print topped analysts’ expectations by 0.6%. However, it was a slower quarter as it logged full-year EPS guidance missing analysts’ expectations significantly and a significant miss of analysts’ EPS estimates.

The stock is down 14.9% since reporting and currently trades at $285.78.

Read our full, actionable report on FactSet here, it’s free.

Intercontinental Exchange (NYSE: ICE)

Starting as an energy trading platform in 2000 before acquiring the iconic New York Stock Exchange in 2013, Intercontinental Exchange (NYSE: ICE) operates global financial exchanges, clearing houses, and provides data services and mortgage technology solutions to financial institutions and corporations.

Intercontinental Exchange reported revenues of $2.54 billion, up 9.8% year on year. This result was in line with analysts’ expectations. Aside from that, it was a mixed quarter as it also produced a beat of analysts’ EPS estimates but a slight miss of analysts’ Exchanges segment estimates.

The stock is down 9.8% since reporting and currently trades at $167.62.

Read our full, actionable report on Intercontinental Exchange here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.