As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q2. Today, we are looking at consumer finance stocks, starting with Nelnet (NYSE: NNI).

Consumer finance companies provide loans and credit products to individuals. Growth drivers include increasing consumer spending, financial inclusion initiatives in developing markets, and digital lending platforms reducing distribution costs. Challenges include credit risk during economic downturns, regulatory scrutiny of lending practices, and intensifying competition from traditional banks and fintech firms offering innovative credit solutions.

The 19 consumer finance stocks we track reported a very strong Q2. As a group, revenues beat analysts’ consensus estimates by 4.5% while next quarter’s revenue guidance was 1.4% below.

In light of this news, share prices of the companies have held steady as they are up 2.8% on average since the latest earnings results.

Nelnet (NYSE: NNI)

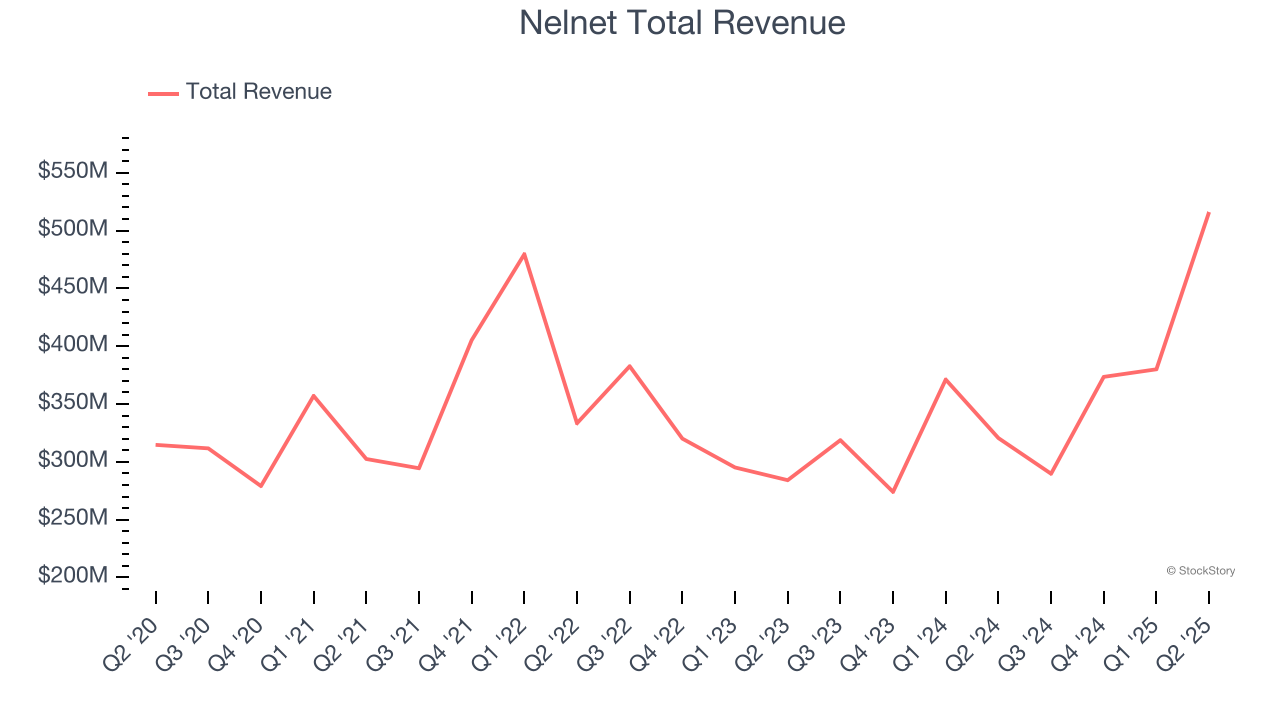

Starting as a student loan servicer in the 1970s and evolving through the changing landscape of education finance, Nelnet (NYSE: NNI) provides student loan servicing, education technology, payment processing, and banking services while managing a portfolio of education loans.

Nelnet reported revenues of $516.1 million, up 61% year on year. This print exceeded analysts’ expectations by 36.2%. Overall, it was an incredible quarter for the company with a beat of analysts’ EPS estimates.

"We delivered a strong quarter, driven by continued performance across our core businesses," said Jeff Noordhoek, chief executive officer of Nelnet.

Nelnet pulled off the biggest analyst estimates beat of the whole group. The results were likely priced in, however, and the stock is flat since reporting. It currently trades at $126.14.

Is now the time to buy Nelnet? Access our full analysis of the earnings results here, it’s free.

Dave (NASDAQ: DAVE)

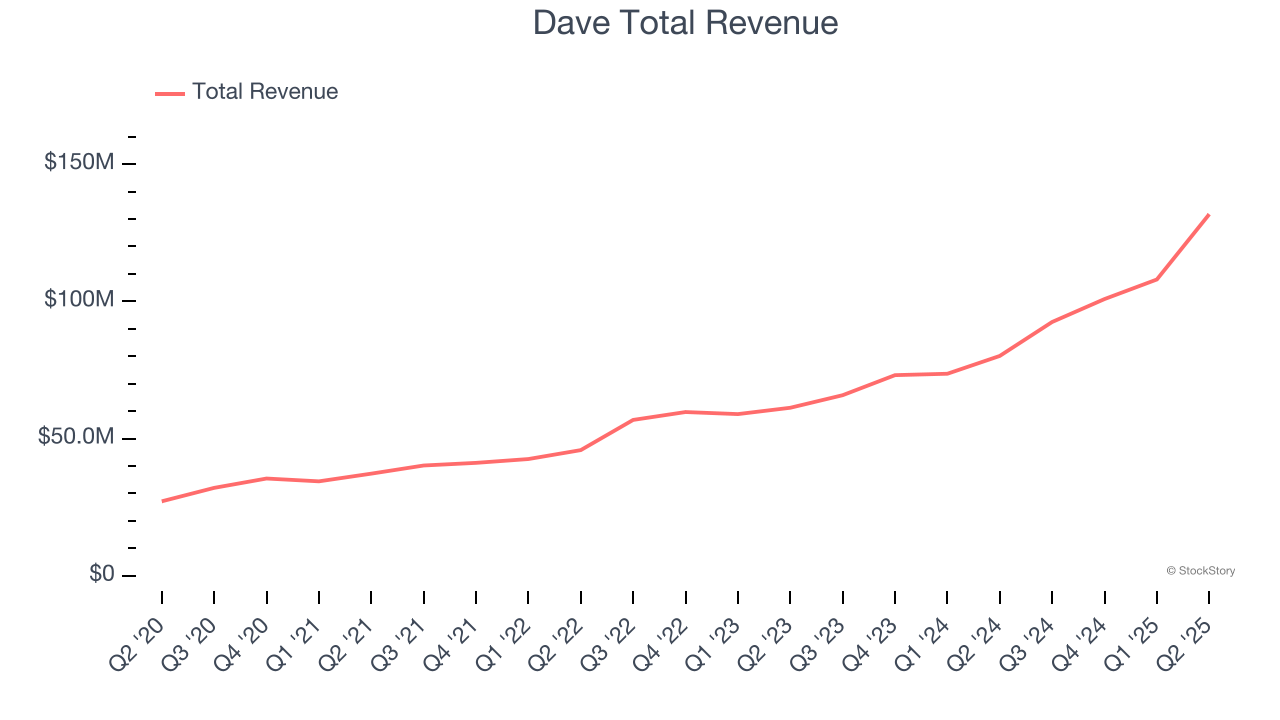

Named after the biblical David fighting financial Goliaths, Dave (NASDAQ: DAVE) is a digital financial services platform that helps Americans living paycheck to paycheck with cash advances, banking services, and tools to improve their financial health.

Dave reported revenues of $131.8 million, up 64.5% year on year, outperforming analysts’ expectations by 16%. The business had an incredible quarter with a beat of analysts’ EPS estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 6.9% since reporting. It currently trades at $222.40.

Is now the time to buy Dave? Access our full analysis of the earnings results here, it’s free.

Slowest Q2: Sallie Mae (NASDAQ: SLM)

Originally created as a government-sponsored enterprise before privatizing in 2004, Sallie Mae (NASDAQ: SLM) is a financial services company that provides private education loans, savings products, and educational resources to help students and families pay for college.

Sallie Mae reported revenues of $403.6 million, down 21.5% year on year, in line with analysts’ expectations. It was a softer quarter as it posted a significant miss of analysts’ EPS estimates.

Sallie Mae delivered the slowest revenue growth in the group. As expected, the stock is down 11.7% since the results and currently trades at $28.26.

Read our full analysis of Sallie Mae’s results here.

Bread Financial (NYSE: BFH)

Formerly known as Alliance Data Systems until its 2022 rebranding, Bread Financial (NYSE: BFH) provides credit cards, installment loans, and savings products to consumers while powering branded payment solutions for retailers and merchants.

Bread Financial reported revenues of $929 million, down 1.1% year on year. This result came in 0.6% below analysts' expectations. Taking a step back, it was still a very strong quarter as it logged a beat of analysts’ EPS estimates.

The stock is down 7.2% since reporting and currently trades at $59.59.

Read our full, actionable report on Bread Financial here, it’s free.

OneMain (NYSE: OMF)

Dating back to 1912 and formerly known as Springleaf, OneMain Holdings (NYSE: OMF) provides personal loans, auto financing, and credit cards to nonprime consumers who have limited access to traditional banking services.

OneMain reported revenues of $1.21 billion, up 10.2% year on year. This print topped analysts’ expectations by 1.7%. It was a very strong quarter as it also produced an impressive beat of analysts’ yield estimates and a beat of analysts’ EPS estimates.

The stock is flat since reporting and currently trades at $58.54.

Read our full, actionable report on OneMain here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.