FTI Consulting has been treading water for the past six months, recording a small loss of 1.7% while holding steady at $161.26. The stock also fell short of the S&P 500’s 18.6% gain during that period.

Is there a buying opportunity in FTI Consulting, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is FTI Consulting Not Exciting?

We're swiping left on FTI Consulting for now. Here are three reasons why FCN doesn't excite us and a stock we'd rather own.

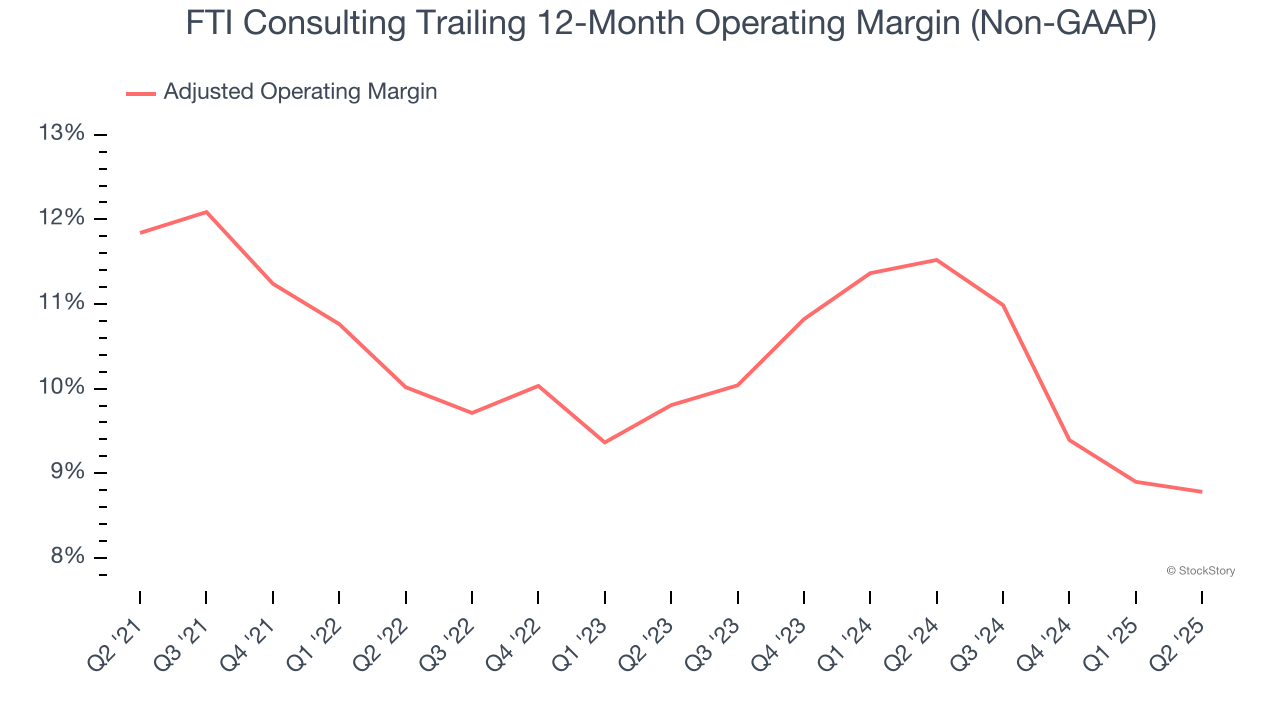

1. Shrinking Adjusted Operating Margin

Adjusted operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D. It also removes various one-time costs to paint a better picture of normalized profits.

Analyzing the trend in its profitability, FTI Consulting’s adjusted operating margin decreased by 3.1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its adjusted operating margin for the trailing 12 months was 8.8%.

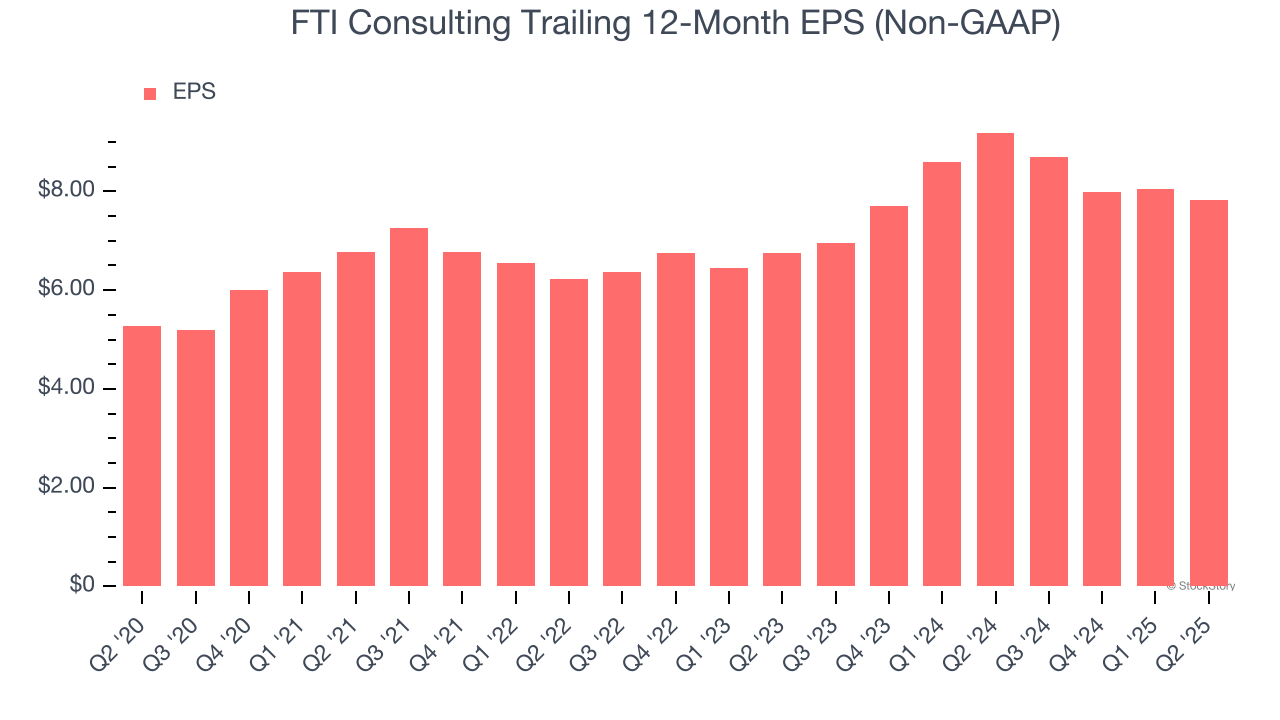

2. Recent EPS Growth Below Our Standards

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

FTI Consulting’s unimpressive 7.6% annual EPS growth over the last two years aligns with its revenue trend. This tells us it maintained its per-share profitability as it expanded.

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, FTI Consulting’s margin dropped by 6 percentage points over the last five years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business. FTI Consulting’s free cash flow margin for the trailing 12 months was 1.9%.

Final Judgment

FTI Consulting isn’t a terrible business, but it isn’t one of our picks. With its shares trailing the market in recent months, the stock trades at 19.7× forward P/E (or $161.26 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. Let us point you toward the most entrenched endpoint security platform on the market.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.