Scholastic has had an impressive run over the past six months as its shares have beaten the S&P 500 by 7.3%. The stock now trades at $25.05, marking a 18.9% gain. This run-up might have investors contemplating their next move.

Is now the time to buy Scholastic, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Do We Think Scholastic Will Underperform?

Despite the momentum, we don't have much confidence in Scholastic. Here are three reasons you should be careful with SCHL and a stock we'd rather own.

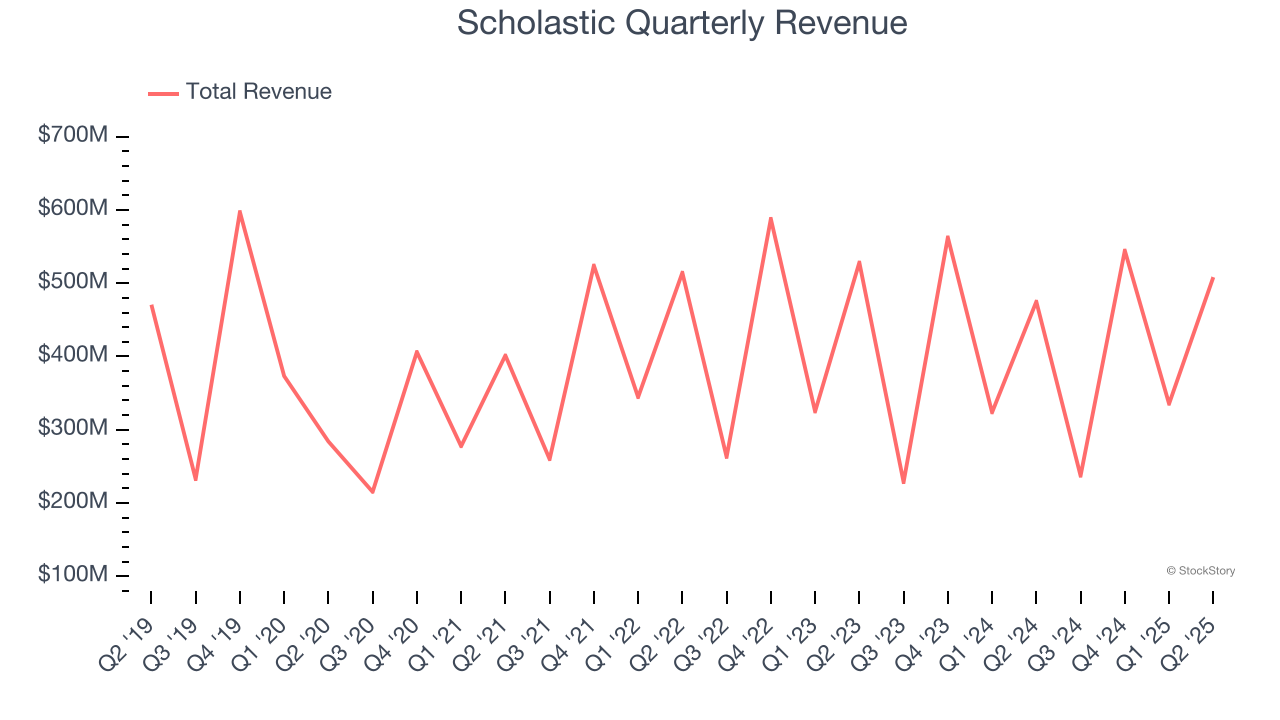

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Scholastic grew its sales at a weak 1.8% compounded annual growth rate. This fell short of our benchmarks.

2. Previous Growth Initiatives Haven’t Impressed

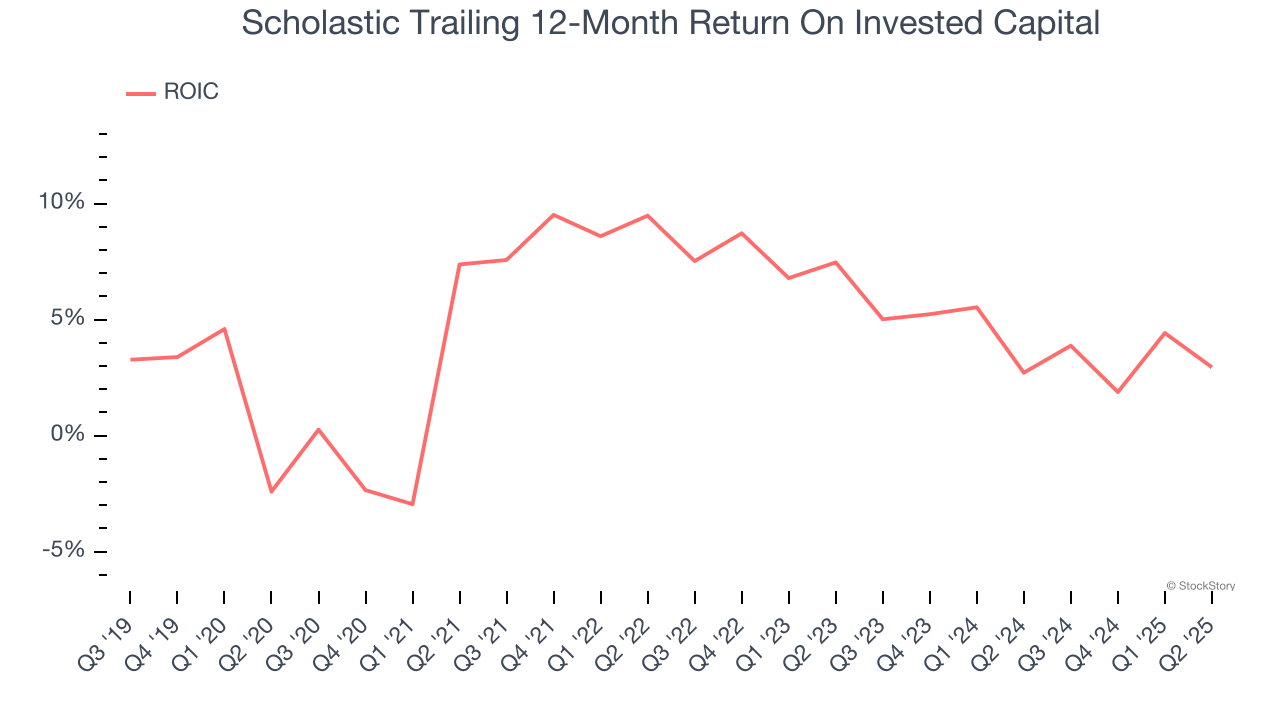

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Scholastic historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Scholastic’s ROIC has decreased over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

Scholastic doesn’t pass our quality test. With its shares topping the market in recent months, the stock trades at 11.2× forward P/E (or $25.05 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are better stocks to buy right now. We’d suggest looking at the most entrenched endpoint security platform on the market.

Stocks We Like More Than Scholastic

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.