A company that generates cash isn’t automatically a winner. Some businesses stockpile cash but fail to reinvest wisely, limiting their ability to expand.

Cash flow is valuable, but it’s not everything - StockStory helps you identify the companies that truly put it to work. That said, here is one cash-producing company that reinvests wisely to drive long-term success and two that may face some trouble.

Two Stocks to Sell:

Middleby (MIDD)

Trailing 12-Month Free Cash Flow Margin: 15.1%

Holding a Guinness World Record for creating the world’s fastest conveyor pizza oven, Middleby (NYSE: MIDD) is a food service and equipment manufacturer.

Why Is MIDD Risky?

- Organic revenue growth fell short of our benchmarks over the past two years and implies it may need to improve its products, pricing, or go-to-market strategy

- Estimated sales growth of 2% for the next 12 months is soft and implies weaker demand

- Earnings per share lagged its peers over the last two years as they only grew by 1.2% annually

Middleby is trading at $141.14 per share, or 15.1x forward P/E. Dive into our free research report to see why there are better opportunities than MIDD.

Fidelity National Financial (FNF)

Trailing 12-Month Free Cash Flow Margin: 50.6%

Issuing more title insurance policies than any other company in the United States, Fidelity National Financial (NYSE: FNF) provides title insurance and escrow services for real estate transactions while also offering annuities and life insurance through its F&G subsidiary.

Why Are We Cautious About FNF?

- Net premiums earned remained stagnant over the last five years, indicating expansion challenges this cycle

- Expenses have increased as a percentage of revenue over the last four years as its pre-tax profit margin fell by 10.9 percentage points

- Annual earnings per share growth of 3.4% underperformed its revenue over the last five years, showing its incremental sales were less profitable

At $60.42 per share, Fidelity National Financial trades at 1.7x forward P/B. Check out our free in-depth research report to learn more about why FNF doesn’t pass our bar.

One Stock to Buy:

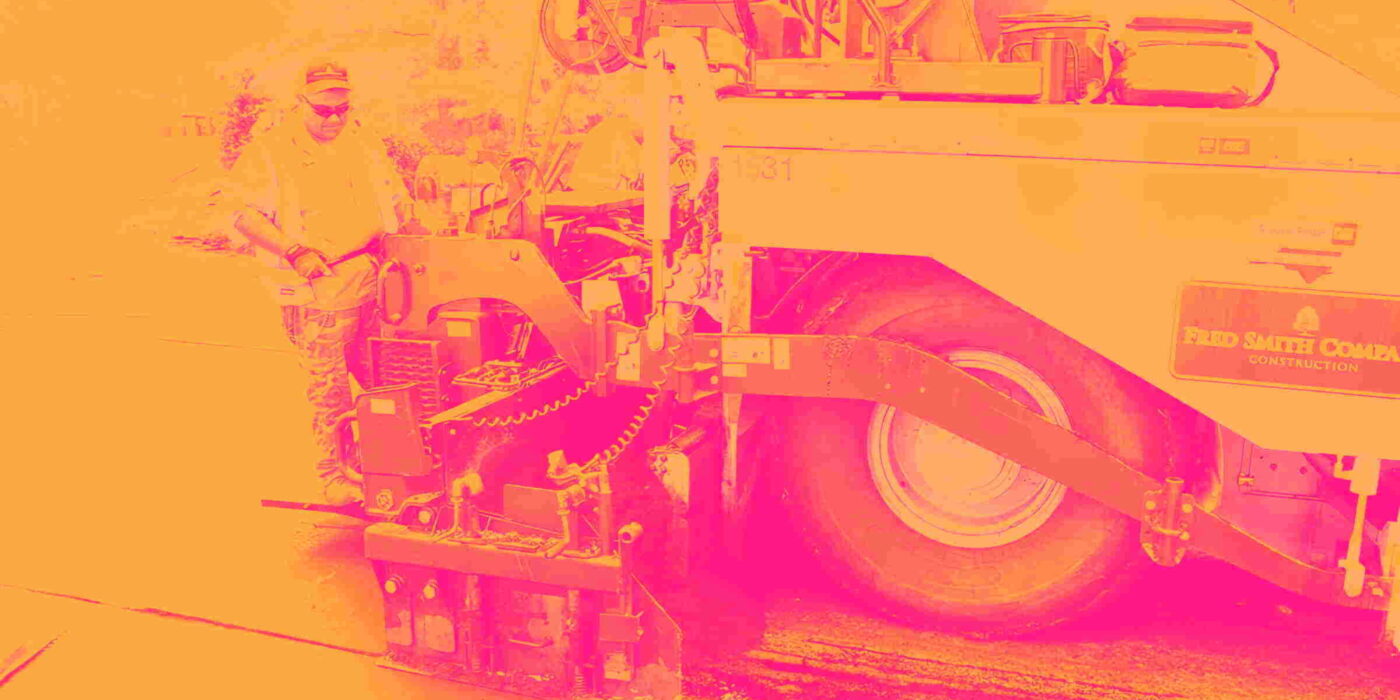

Construction Partners (ROAD)

Trailing 12-Month Free Cash Flow Margin: 6.9%

Founded in 2001, Construction Partners (NASDAQ: ROAD) is a civil infrastructure company that builds and maintains roads, highways, and other infrastructure projects.

Why Are We Bullish on ROAD?

- Core business can prosper without any help from acquisitions as its organic revenue growth averaged 9.6% over the past two years

- Incremental sales over the last two years have been highly profitable as its earnings per share increased by 70.6% annually, topping its revenue gains

- Free cash flow margin increased by 5.1 percentage points over the last five years, giving the company more capital to invest or return to shareholders

Construction Partners’s stock price of $121.99 implies a valuation ratio of 44.9x forward P/E. Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today for free. Find your next big winner with StockStory today. Find your next big winner with StockStory today

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.