Since September 2020, the S&P 500 has delivered a total return of 94.2%. But one standout stock has more than doubled the market - over the past five years, Ameris Bancorp has surged 203% to $74.03 per share. Its momentum hasn’t stopped as it’s also gained 30.2% in the last six months thanks to its solid quarterly results, beating the S&P by 14.7%.

Is now still a good time to buy ABCB? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free.

Why Does Ameris Bancorp Spark Debate?

Tracing its roots back to 1971 and expanding significantly through both organic growth and strategic acquisitions, Ameris Bancorp (NYSE: ABCB) is a financial holding company that provides a full range of banking services to retail and commercial customers across select markets in the southeastern United States.

Two Things to Like:

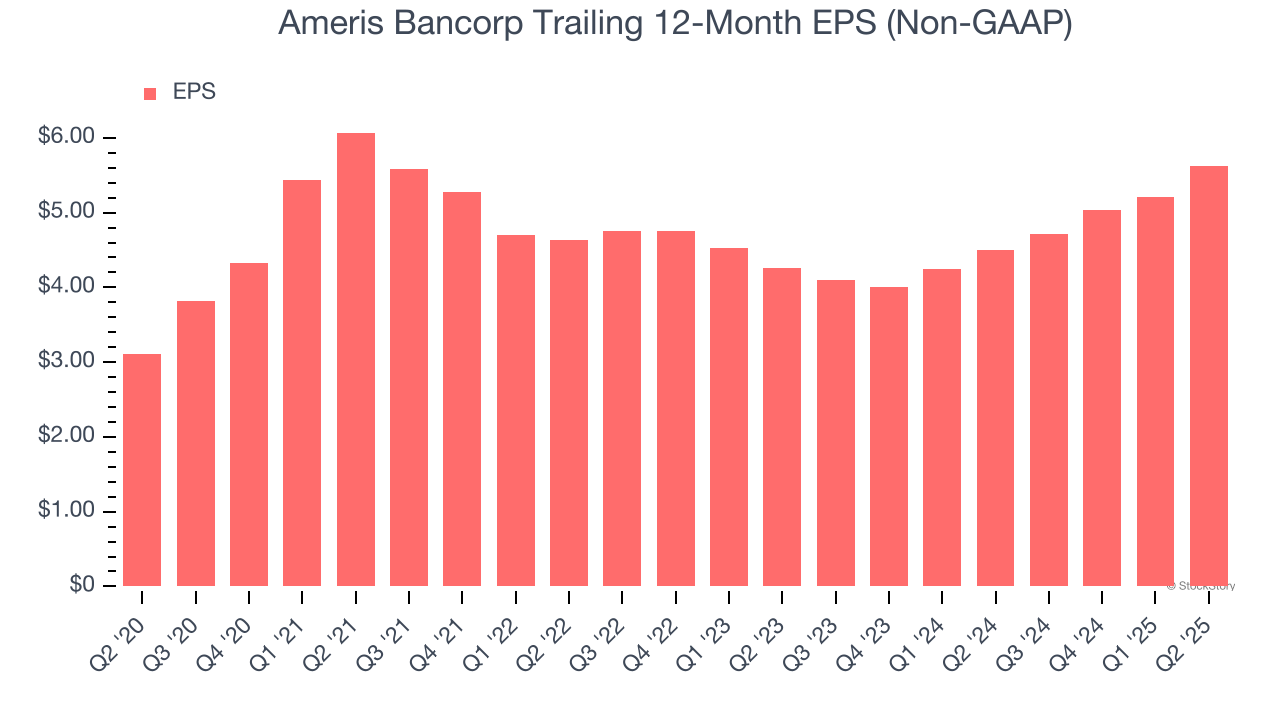

1. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Ameris Bancorp’s EPS grew at an astounding 12.6% compounded annual growth rate over the last five years, higher than its 4.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

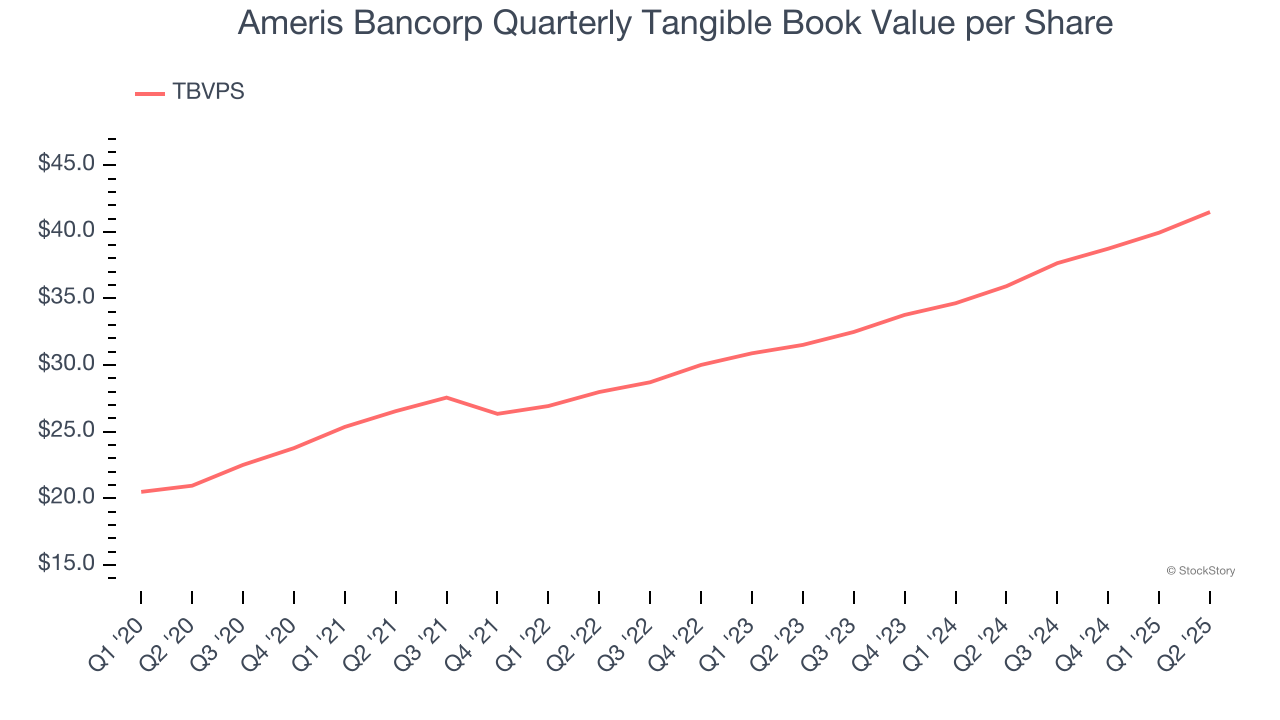

2. Growing TBVPS Reflects Strong Asset Base

For banks, tangible book value per share (TBVPS) is a crucial metric that measures the actual value of shareholders’ equity, stripping out goodwill and other intangible assets that may not be recoverable in a worst-case scenario.

Ameris Bancorp’s TBVPS increased by 14.6% annually over the last five years, and the past two years show a similar trajectory as TBVPS grew at an impressive 14.7% annual clip (from $31.52 to $41.49 per share).

One Reason to be Careful:

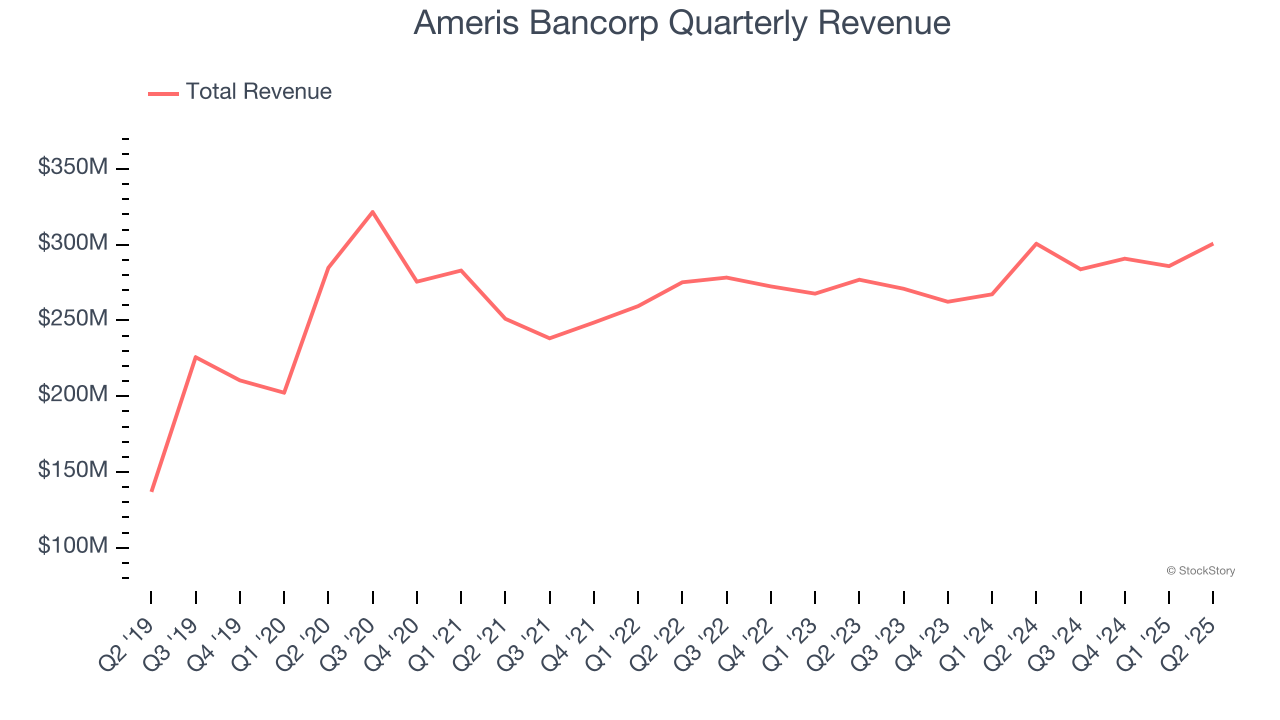

Long-Term Revenue Growth Disappoints

Net interest income and and fee-based revenue are the two pillars supporting bank earnings. The former captures profit from the gap between lending rates and deposit costs, while the latter encompasses charges for banking services, credit products, wealth management, and trading activities.

Over the last five years, Ameris Bancorp grew its revenue at a mediocre 4.7% compounded annual growth rate. This wasn’t a great result compared to the rest of the banking sector, but there are still things to like about Ameris Bancorp.

Final Judgment

Ameris Bancorp’s merits more than compensate for its flaws, and with its shares outperforming the market lately, the stock trades at 1.3× forward P/B (or $74.03 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Ameris Bancorp

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.