Over the past six months, FormFactor’s shares (currently trading at $30.02) have posted a disappointing 8.6% loss, well below the S&P 500’s 15.7% gain. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in FormFactor, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Do We Think FormFactor Will Underperform?

Despite the more favorable entry price, we're cautious about FormFactor. Here are three reasons you should be careful with FORM and a stock we'd rather own.

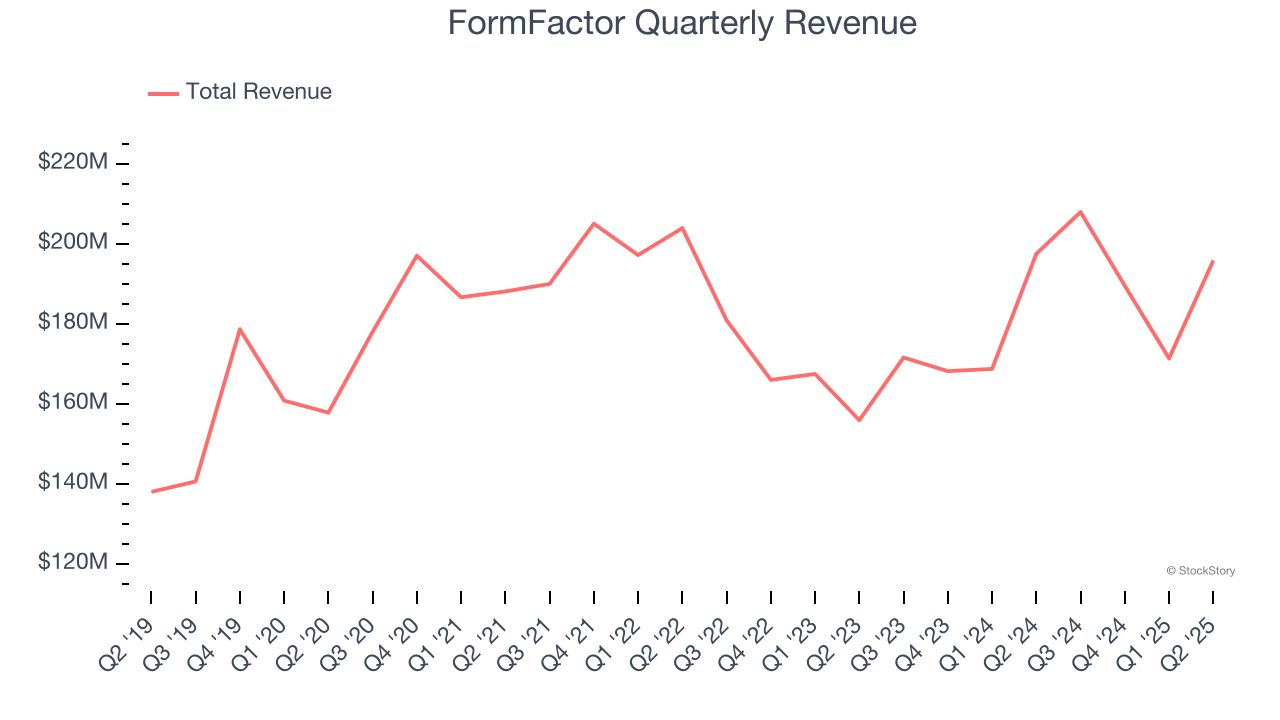

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, FormFactor’s sales grew at a sluggish 3.7% compounded annual growth rate over the last five years. This was below our standard for the semiconductor sector. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

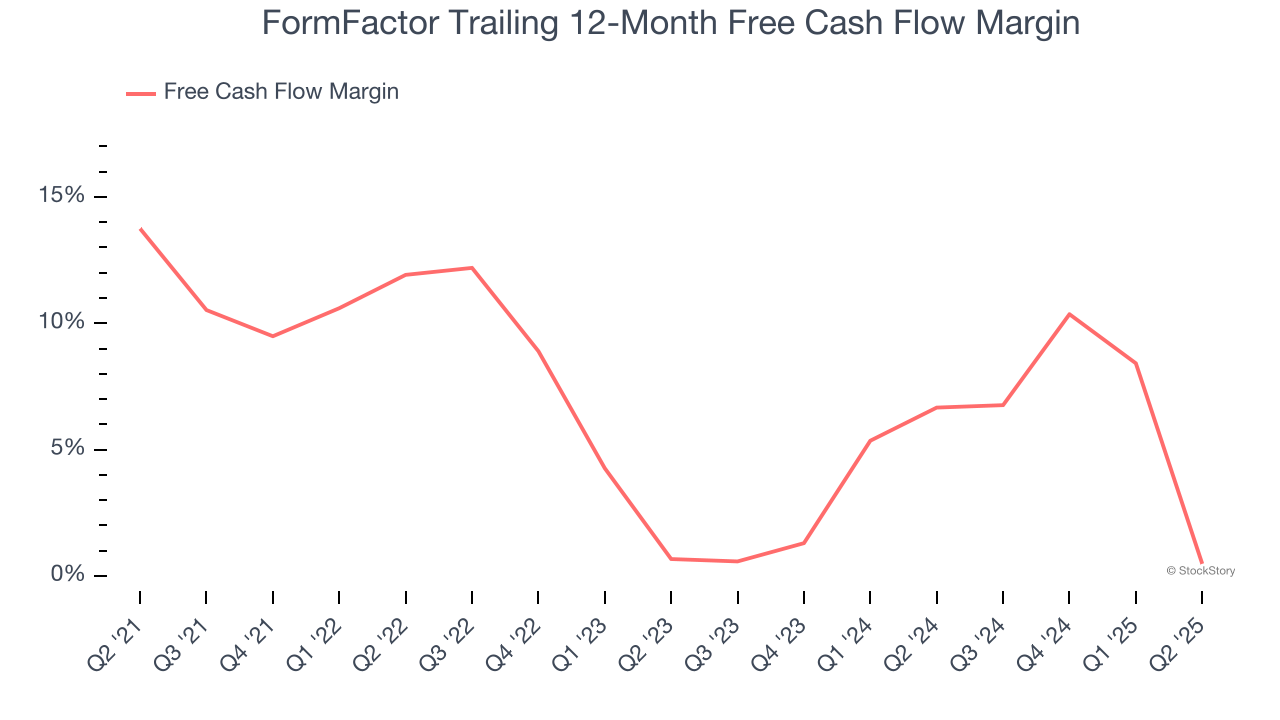

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, FormFactor’s margin dropped by 13.3 percentage points over the last five years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business. FormFactor’s free cash flow margin for the trailing 12 months was breakeven.

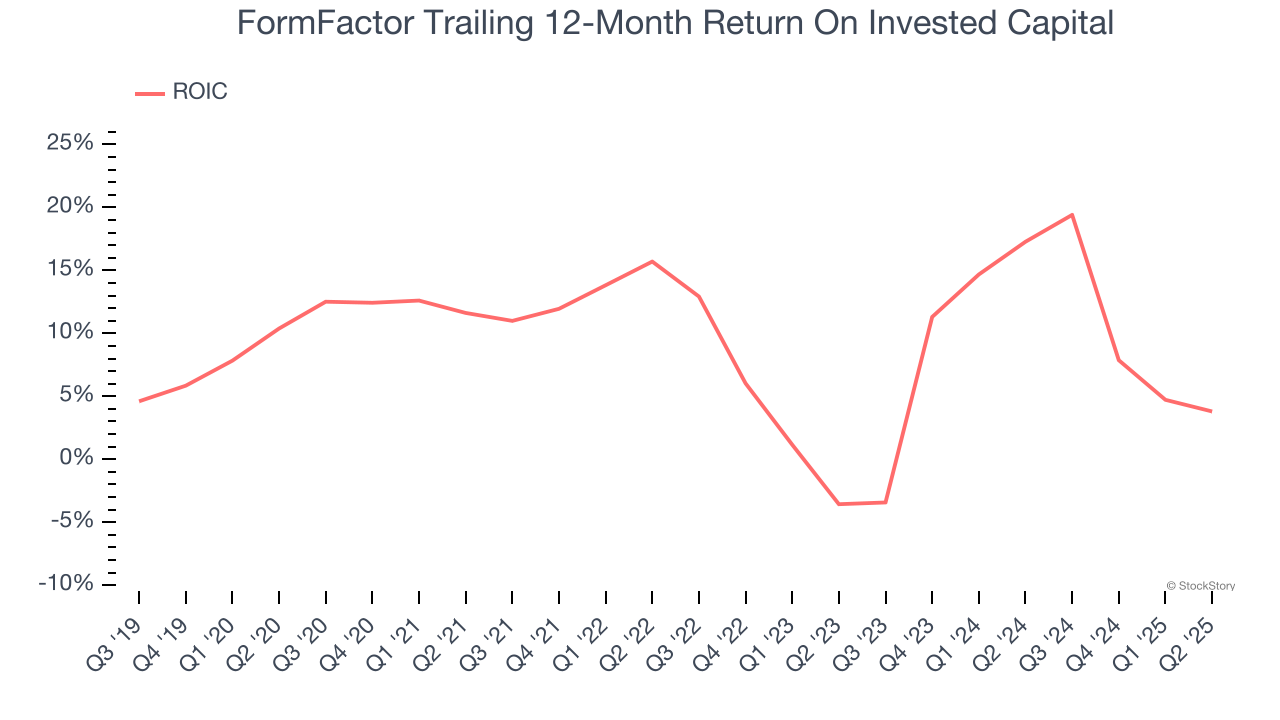

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

FormFactor historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9%, somewhat low compared to the best semiconductor companies that consistently pump out 35%+.

Final Judgment

FormFactor doesn’t pass our quality test. After the recent drawdown, the stock trades at 21.9× forward P/E (or $30.02 per share). At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere. We’d recommend looking at a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of FormFactor

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.