Fresh produce company Calavo Growers (NASDAQ: CVGW) missed Wall Street’s revenue expectations in Q2 CY2025, with sales flat year on year at $178.8 million. Its non-GAAP profit of $0.57 per share was 5.6% above analysts’ consensus estimates.

Is now the time to buy Calavo? Find out by accessing our full research report, it’s free.

Calavo (CVGW) Q2 CY2025 Highlights:

- Revenue: $178.8 million vs analyst estimates of $195.2 million (flat year on year, 8.4% miss)

- Adjusted EPS: $0.57 vs analyst estimates of $0.54 (5.6% beat)

- Adjusted EBITDA: $15.05 million vs analyst estimates of $16.07 million (8.4% margin, 6.3% miss)

- Operating Margin: 4.8%, in line with the same quarter last year

- Market Capitalization: $485.3 million

Management Commentary"Our third quarter results highlight both the challenges and the opportunities in our business," said Lee Cole, President and Chief Executive Officer of Calavo Growers,

Company Overview

A trailblazer in the avocado industry, Calavo Growers (NASDAQ: CVGW) is a pioneering California-based provider of high-quality avocados and other fresh food products.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

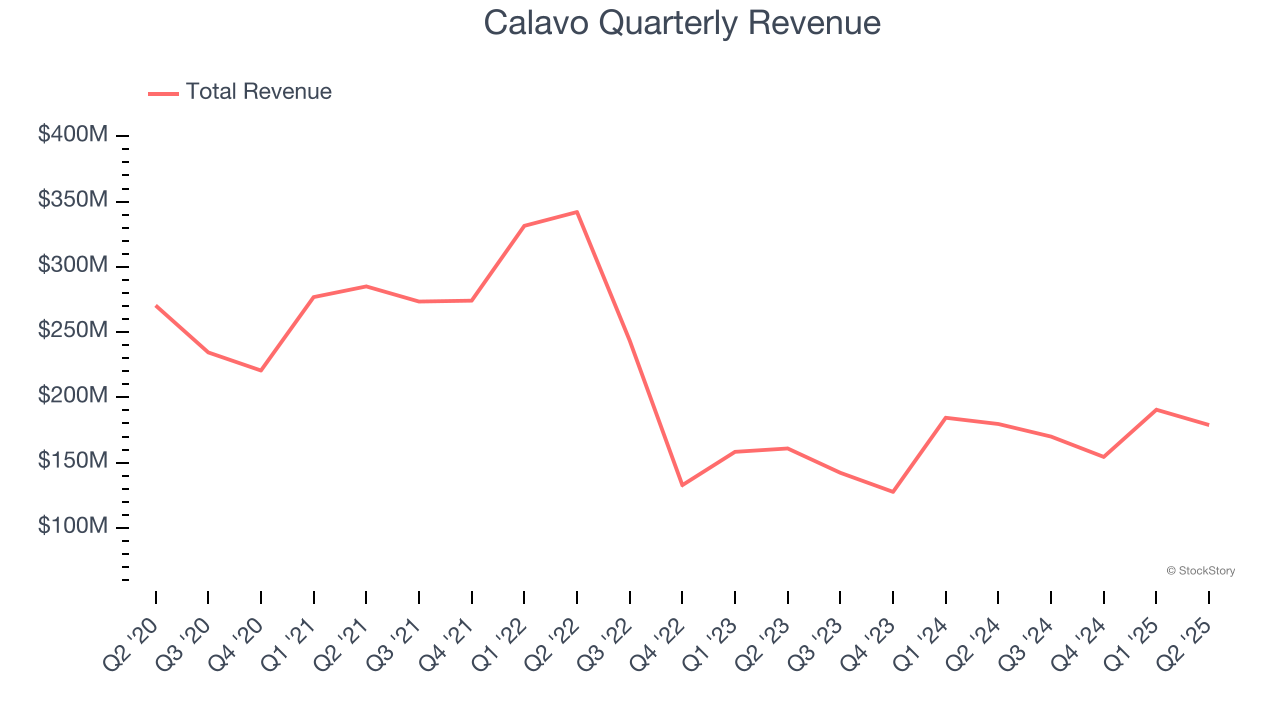

With $693.7 million in revenue over the past 12 months, Calavo is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

As you can see below, Calavo’s revenue declined by 17.2% per year over the last three years, a tough starting point for our analysis.

This quarter, Calavo missed Wall Street’s estimates and reported a rather uninspiring 0.4% year-on-year revenue decline, generating $178.8 million of revenue.

Looking ahead, sell-side analysts expect revenue to decline by 1.1% over the next 12 months. it’s hard to get excited about a company that is struggling with demand.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

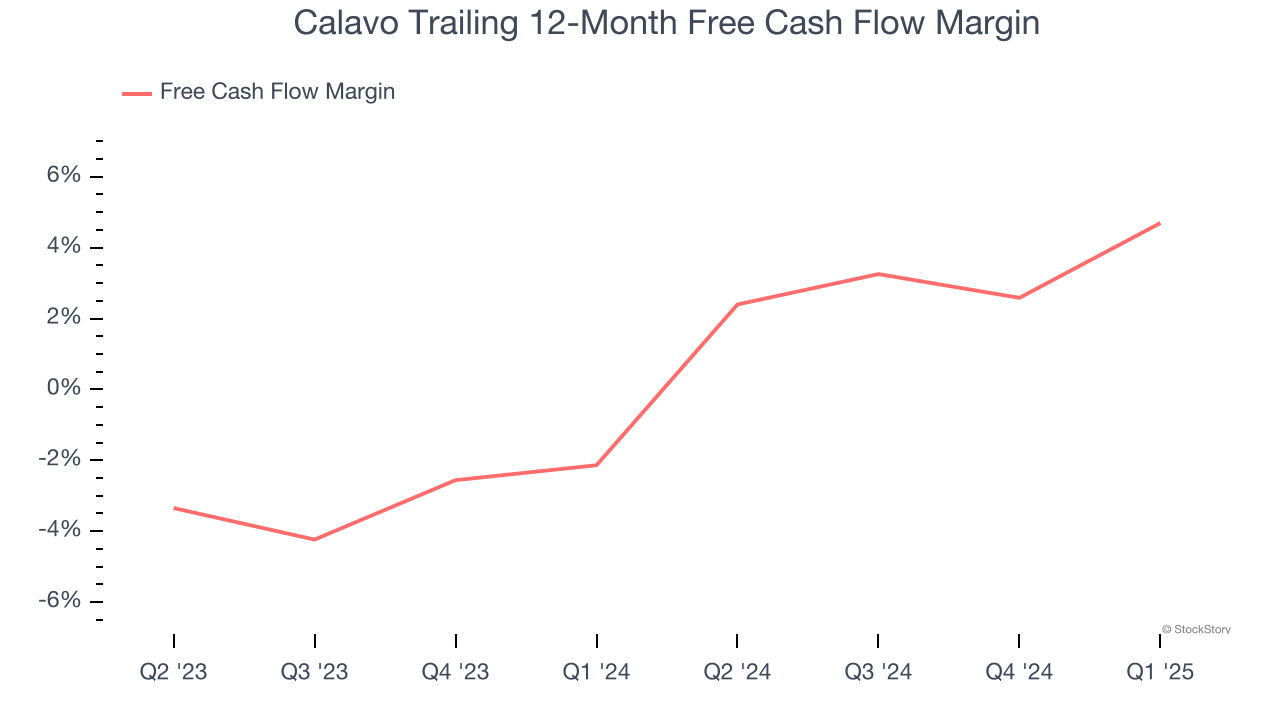

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Calavo has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.2%, subpar for a consumer staples business.

Key Takeaways from Calavo’s Q2 Results

It was good to see Calavo beat analysts’ EPS expectations this quarter. On the other hand, its revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 8.3% to $25.20 immediately after reporting.

Calavo didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.