Video game retailer GameStop (NYSE: GME) beat Wall Street’s revenue expectations in Q2 CY2025, with sales up 21.8% year on year to $972.2 million. Its non-GAAP profit of $0.25 per share was 61.3% above analysts’ consensus estimates.

Is now the time to buy GameStop? Find out by accessing our full research report, it’s free.

GameStop (GME) Q2 CY2025 Highlights:

- Revenue: $972.2 million vs analyst estimates of $823.2 million (21.8% year-on-year growth, 18.1% beat)

- Adjusted EPS: $0.25 vs analyst estimates of $0.16 (61.3% beat)

- Adjusted EBITDA: $75.7 million (7.8% margin, 521% year-on-year growth)

- Operating Margin: 6.8%, up from -3.6% in the same quarter last year

- Free Cash Flow Margin: 11.7%, up from 8.2% in the same quarter last year

- Market Capitalization: $10.39 billion

Company Overview

Drawing gaming fans with demo units set up with the latest releases, GameStop (NYSE: GME) sells new and used video games, consoles, and accessories, as well as pop culture merchandise.

Note that our analysis is rooted in fundamentals, not meme-stock technicals.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

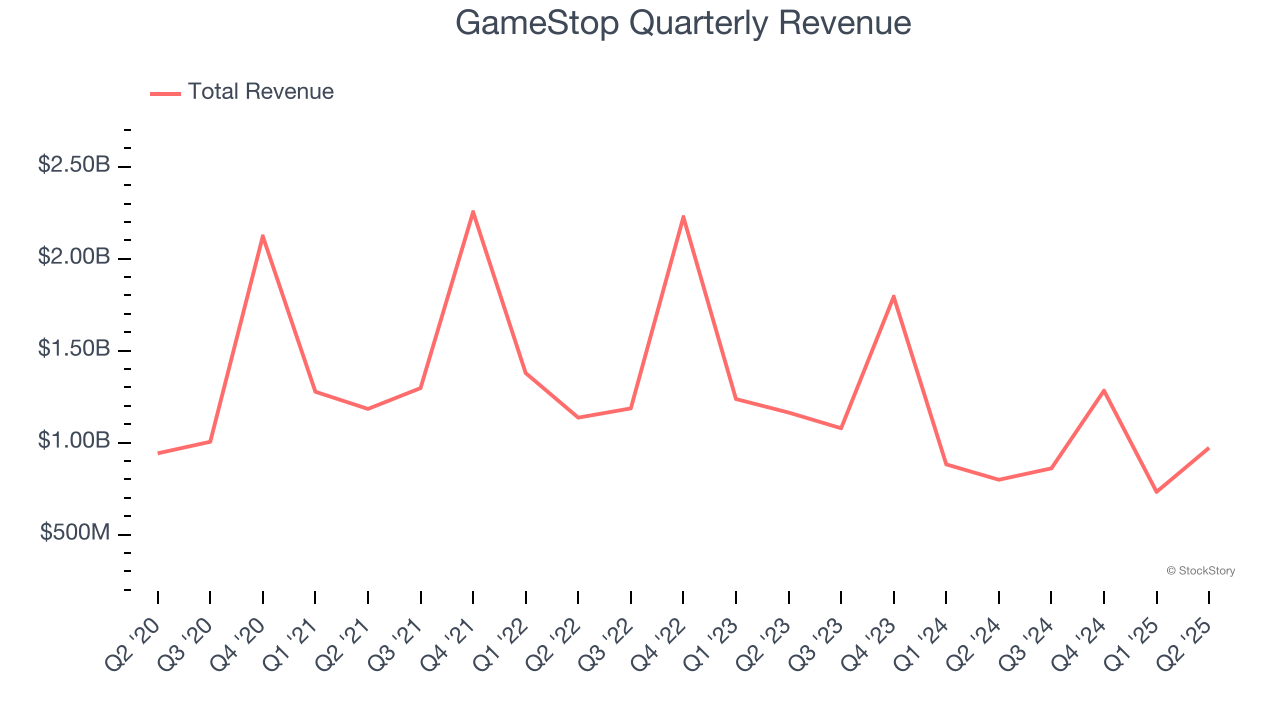

With $3.85 billion in revenue over the past 12 months, GameStop is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

As you can see below, GameStop struggled to generate demand over the last six years (we compare to 2019 to normalize for COVID-19 impacts). Its sales dropped by 11.2% annually, a rough starting point for our analysis.

This quarter, GameStop reported robust year-on-year revenue growth of 21.8%, and its $972.2 million of revenue topped Wall Street estimates by 18.1%.

Looking ahead, sell-side analysts expect revenue to decline by 13.4% over the next 12 months, a slight deceleration versus the last six years. This projection doesn't excite us and indicates its products will face some demand challenges.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

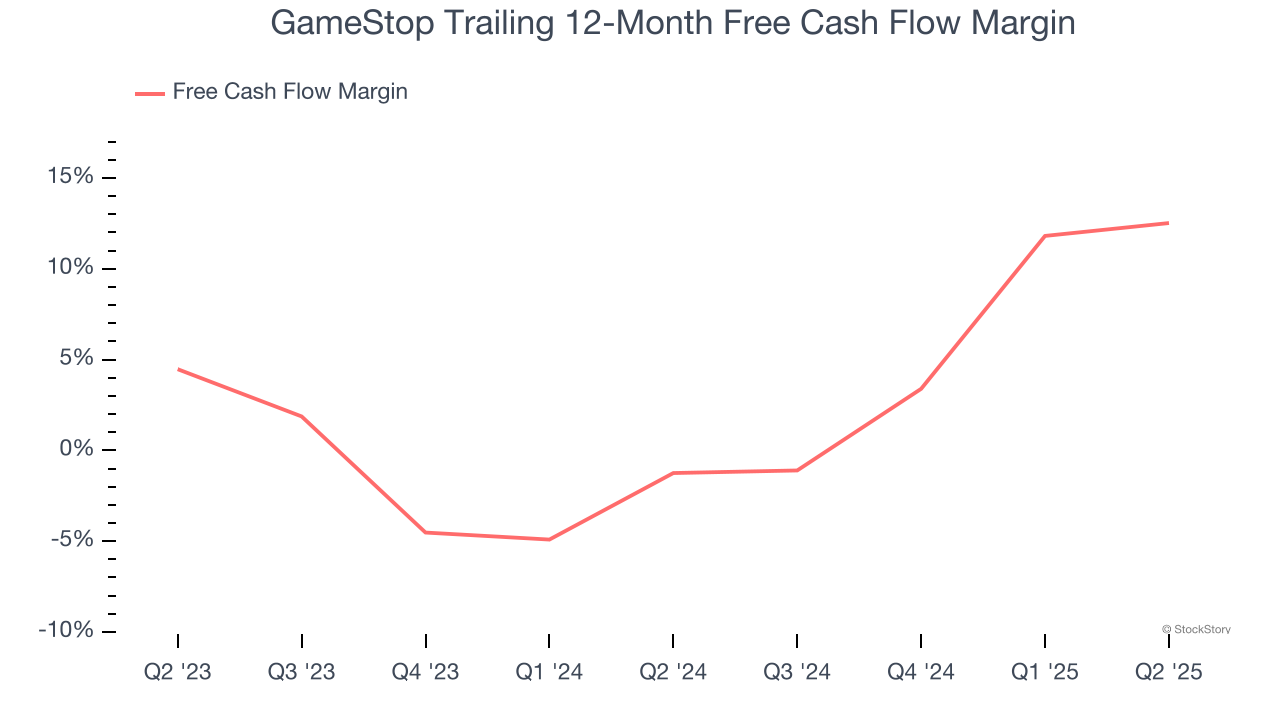

GameStop has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.1% over the last two years, better than the broader consumer retail sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that GameStop’s margin expanded by 13.8 percentage points over the last year. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

GameStop’s free cash flow clocked in at $113.3 million in Q2, equivalent to a 11.7% margin. This result was good as its margin was 3.4 percentage points higher than in the same quarter last year, building on its favorable historical trend.

Key Takeaways from GameStop’s Q2 Results

It was good to see GameStop beat analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. On the other hand, its gross margin missed. Zooming out, we think this was a solid print. The stock traded up 2.3% to $24.14 immediately following the results.

Indeed, GameStop had a rock-solid quarterly earnings result, but is this stock a good investment here? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.