Industrial construction and maintenance company Matrix Service (NASDAQ: MTRX) missed Wall Street’s revenue expectations in Q2 CY2025, but sales rose 14.2% year on year to $216.4 million. The company’s full-year revenue guidance of $900 million at the midpoint came in 4.8% below analysts’ estimates. Its non-GAAP loss of $0.28 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Matrix Service? Find out by accessing our full research report, it’s free.

Matrix Service (MTRX) Q2 CY2025 Highlights:

- Revenue: $216.4 million vs analyst estimates of $232.2 million (14.2% year-on-year growth, 6.8% miss)

- Adjusted EPS: -$0.28 vs analyst estimates of $0.02 (significant miss)

- Adjusted EBITDA: -$4.82 million vs analyst estimates of $2.62 million (-2.2% margin, significant miss)

- Operating Margin: -6%, down from -2.6% in the same quarter last year

- Free Cash Flow Margin: 17.8%, down from 24.1% in the same quarter last year

- Backlog: $1.38 billion at quarter end

- Market Capitalization: $406.2 million

“During the fourth quarter, we had continued momentum across multiple large projects, driving 14% year-over-year revenue growth and improved fixed cost absorption,” stated John Hewitt, President and Chief Executive Officer of Matrix Service Company.

Company Overview

Founded in Oklahoma, Matrix Service (NASDAQ: MTRX) provides engineering, fabrication, construction, and maintenance services primarily to the energy and industrial markets.

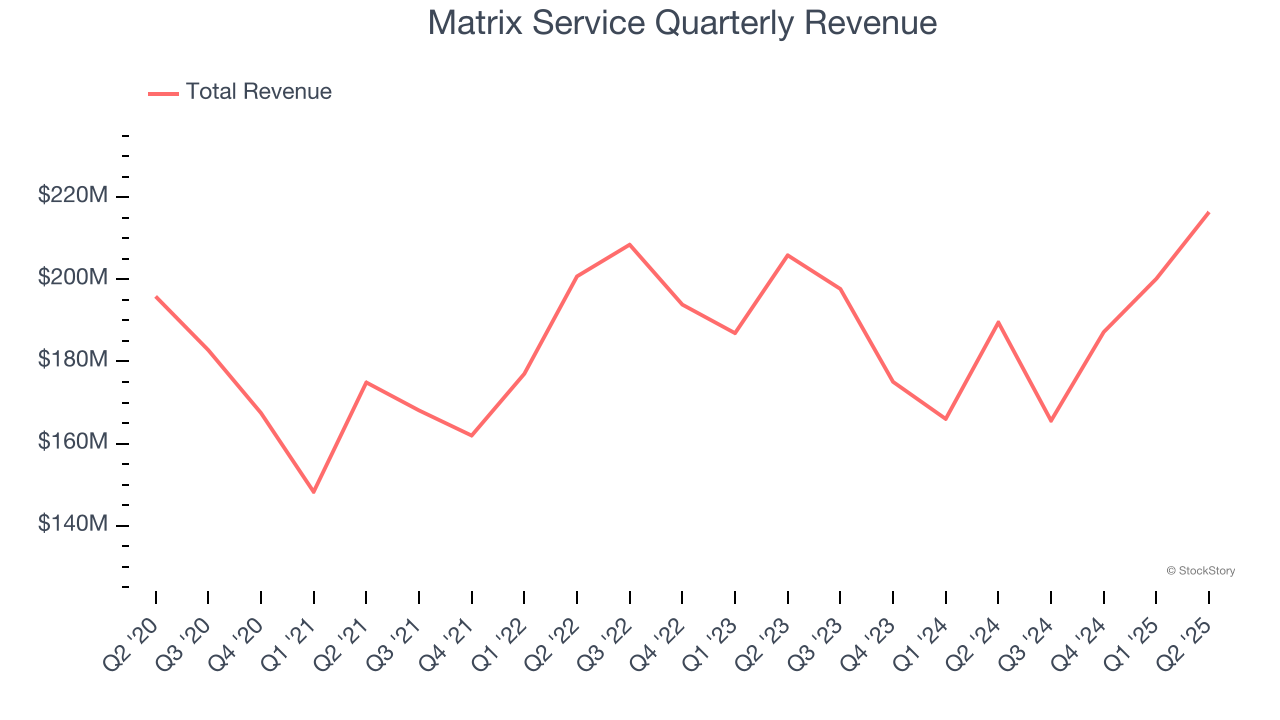

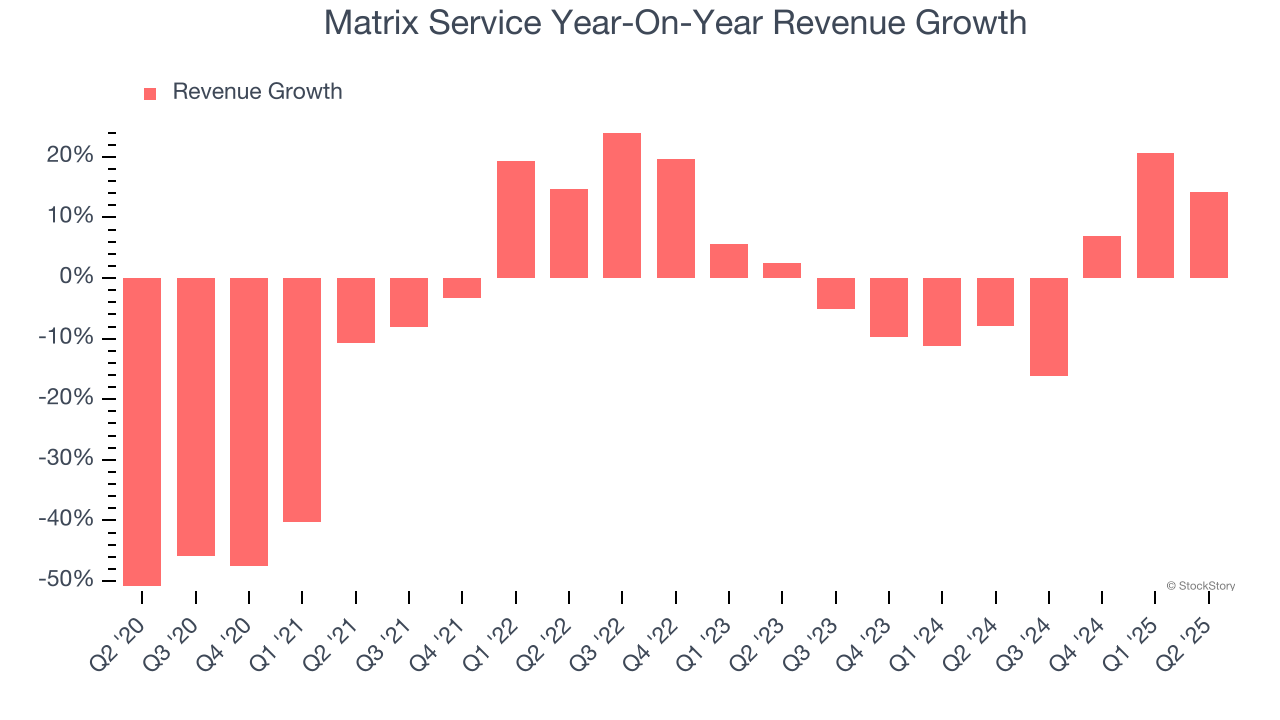

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Matrix Service’s demand was weak and its revenue declined by 6.9% per year. This wasn’t a great result and suggests it’s a low quality business.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Matrix Service’s annualized revenue declines of 1.6% over the last two years suggest its demand continued shrinking.

This quarter, Matrix Service’s revenue grew by 14.2% year on year to $216.4 million but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 22.9% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and indicates its newer products and services will catalyze better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

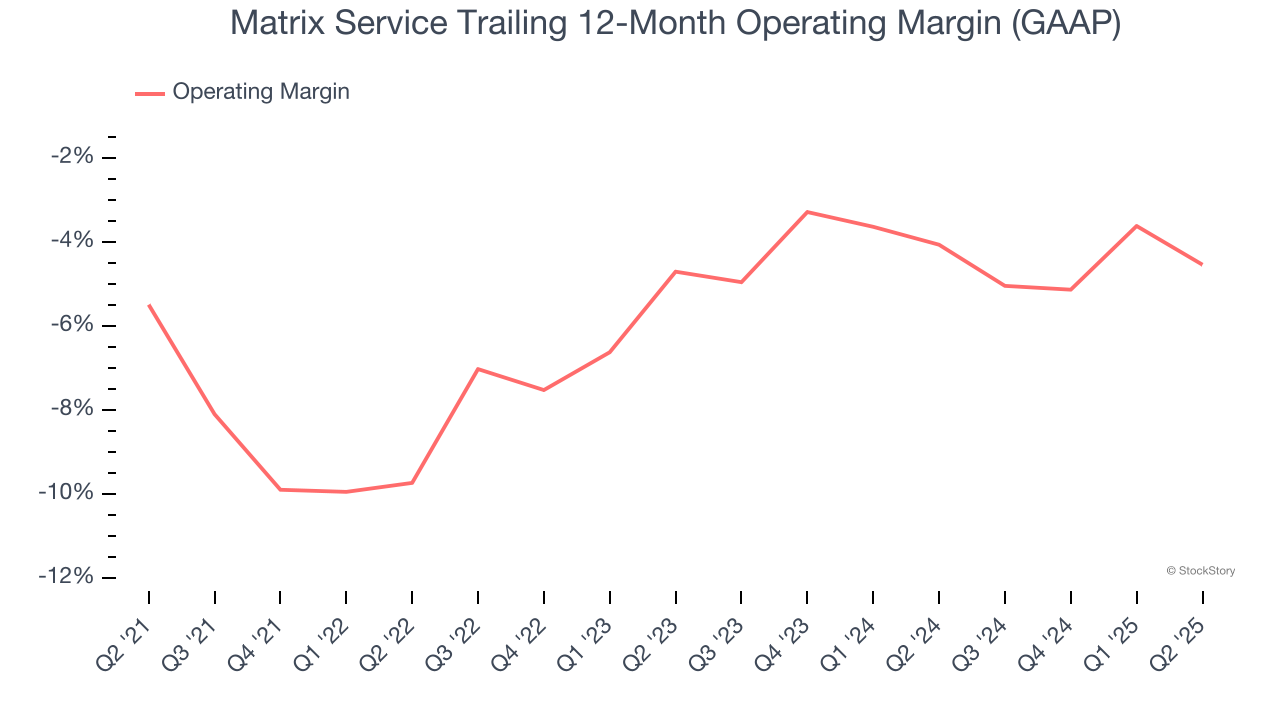

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Matrix Service’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging negative 5.7% over the last five years. Unprofitable industrials companies that fail to improve their losses or grow sales rapidly deserve extra scrutiny. For the time being, it’s unclear if Matrix Service’s business model is sustainable.

Analyzing the trend in its profitability, Matrix Service’s operating margin might fluctuated slightly but has generally stayed the same over the last five years, which doesn’t help its cause.

Matrix Service’s operating margin was negative 6% this quarter. The company's consistent lack of profits raise a flag.

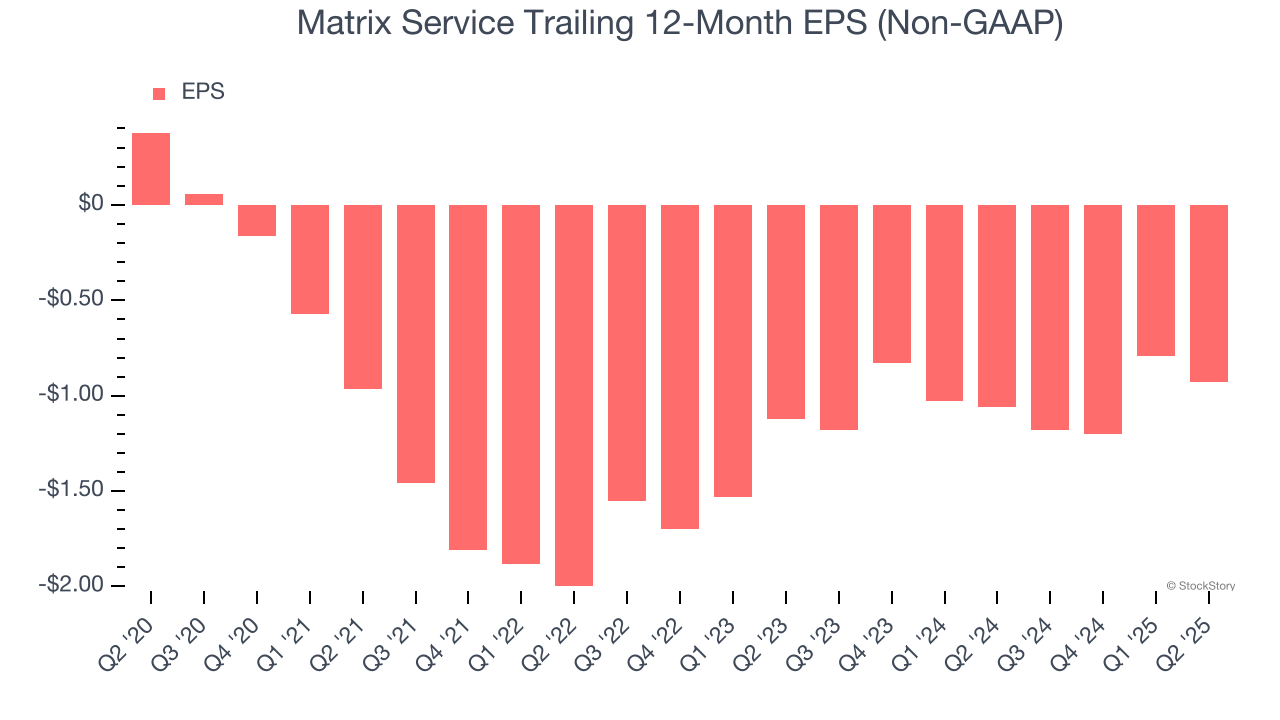

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Matrix Service, its EPS declined by 34.8% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

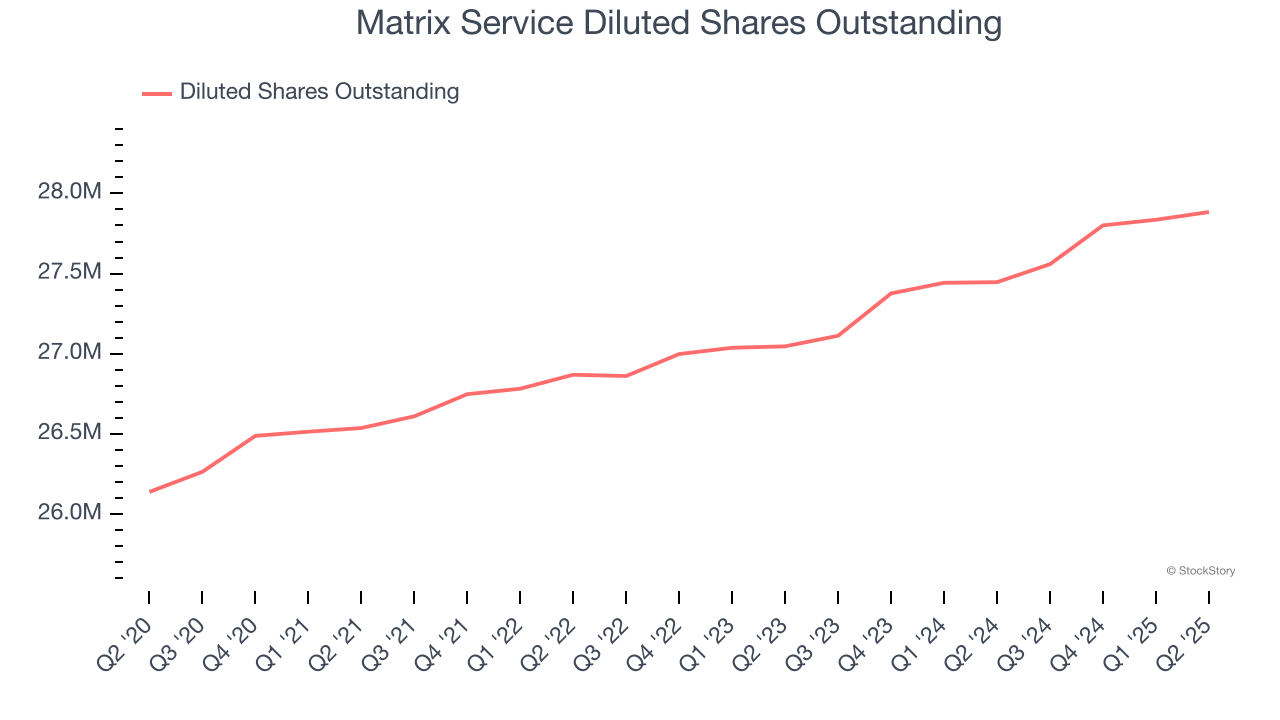

We can take a deeper look into Matrix Service’s earnings to better understand the drivers of its performance. A five-year view shows Matrix Service has diluted its shareholders, growing its share count by 6.7%. This has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Matrix Service, its two-year annual EPS growth of 8.9% was higher than its five-year trend. Its improving earnings is an encouraging data point, but a caveat is that its EPS is still in the red.

In Q2, Matrix Service reported adjusted EPS of negative $0.28, down from negative $0.14 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Matrix Service’s full-year EPS of negative $0.93 will flip to positive $0.63.

Key Takeaways from Matrix Service’s Q2 Results

We struggled to find many positives in these results. Its full-year revenue guidance missed and its revenue fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 5.1% to $13.51 immediately after reporting.

Matrix Service underperformed this quarter, but does that create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.